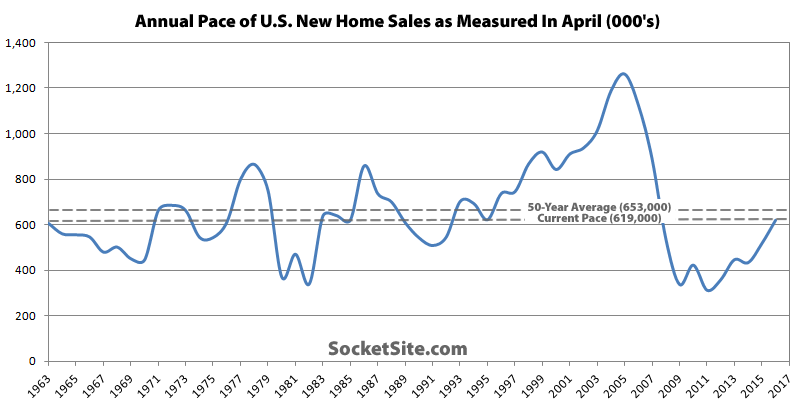

Having slipped a revised 1.3 percent in March, the pace of new single-family home sales in the U.S. surged 16.6 percent in April to an annual rate of 619,000 sales and is now running 23.8 percent higher versus the same time last year (523,000), up from 8.4 percent higher on a year-over-year basis in March.

The current is pace is within 5.2 percent of the long-term average rate for this time of the year (653,000). The pace as measured in April peaked at 1,260,000 in 2005.

In terms of inventory, the number of new single-family homes for sale across the county is now 243,000, down 0.4 percent from the month before but 17.4 percent higher versus the same time last year.

And having dropped 23.6 percent from February to March, the pace of new single-family home sales in the West rebounded 18.8 percent in April to an annual rate of 152,000, 23.6 percent higher versus the same time last year.

My guess, from visiting other cities, is that this is being driven by high rents. Even the slowest cities have now seen double digit rent increases since the bust.

This helps too.

And, per the BLS, every county in California had a decrease in unemployment rates between March ’15 and March ’16.

As well as easing lending standards for residential mortgages.

All of these are more geographically broad observations than our local SF-outlier case, of course.

And things like Quicken’s Rocket Loans are probably helping too: “Push button, get mortgage.”

The rise of non-bank/non-traditional lending (Quicken Loans, SoFi, Prosper, Lending Club…) is a very interesting thing to keep an eye on.

Quicken Loans in particular I believe has had a very precipitous rise in loan volume.

One also wonders how these non-traditional lenders are being regulated vis-à-vis the banks.

For better (or worse, though I think mostly better) Quicken sells primarily Fannie / Freddie loans, with a small mix of Jumbos (that have tighter guidelines than Fannie/Freddie)

“Push button, get mortgage” is purely marketing – they’re just advertising their online platform to deliver documents (uploading paystubs and bank statements to their website) and track your loan online

I think that they are now one of the biggest low down FHA lenders. And they’re currently being sued by the government for defrauding taxpayers due to the loans they originate.

Could be true, could be overzealous prosecutors fighting the last war. But worth watching how this plays out. Lots of junk got sold to FF during the last bubble. I think banks are under a lot of pressure to catch problems at origination. Thes new lenders are trying to grow rapidly which can incentivize a lot of sloppiness.

Yay, I just scored a low paying service job, I’ll run out and buy a house just as prices are reaching a new unaffordable high, because I’m so tired of living with my parents!

This is good news economy-wise on the national front. New homes typically lead us out of a recession (good-paying construction jobs, spending on appliances, furniture) as pent up demand becomes unleashed after a downturn. But, of course, the Great Recession was driven by the home-bubble bursting, leaving a vast overhang of extra homes. Thus, new homes were not needed, and this economic spark was missing. Looks like we’re finally close to absorbing that overhang after 8 long years, so we can get the new home economic machine going again.

I see nothing but positive news here; home building and it’s associated industries are a major part of the economy. I am also glad that none of these new homes are being built in the good parts of the Peninsula where all my houses are located. Prices in one neighborhood I own in are now crossing $1,000 psf. That price point used to be reserved for high-end homes; now it is just middle class worker housing.

Jimmy, I’m assuming you maxed out on Fannie/Freddie mortgages? Will Fannie and Freddie Need Another Bailout?

We’re crossing $800/sq.ft over here thanks to Ess Eff housing refugees…

How’s the widget factory going these days?

WSJ clickbait headline: “Will Fannie and Freddie Need Another Bailout?”

From the article: “The companies have about $258 billion in remaining bailout money to draw on—a credit line that calms mortgage-backed securities investors.”*

Answer to headline question: No.

*nb: they needed a $187.5 billion bailout after the last, catastrophic housing crash

Your quote, and the article, aren’t saying that the won’t need more bailout money. Just that they have a large “credit line” from the Treasury so that if another bailout is needed there would theoretically already be a framework for it.

Nobody needs a bailout when home prices are rising. The real question is how are Fannie and Freddie exposed to a possible dip in housing prices. And are these derivatives that are currently causing losses to FF a market based sign of weakness in their portfolios or merely some irrational market movement or hedging error.

Widgets are doing fine.

Jimmy, it’s only positive in the short term for the rent seeking class. Because home prices continue to outpace middle class worker incomes, people have little money left over for other expenditures, which will crush the economy.

And like EBGuy said, your gains will once again become socialized risk for the taxpayer. First time buyers accounted for 58.8% of primary owner-occupied home purchase mortgages with a government guarantee, up 18% from last year. 70 percent of first-time buyer mortgages in April 2016 had a combined loan-to-value (CLTV) ratio of 95 percent or higher and 97 percent had a 30-year term. Slightly more than one-fifth of first-time buyer loans in April had a FICO score of below 660, which is the traditional definition of subprime mortgages, and nearly 30 percent of them had total debt-to-income ratios higher than 43 percent—the limit set by the Qualified Mortgage rule.

Sacramento is the future for people who want a more normal economy. I have lots of friends there working for Intel and Oracle admittedly not in the sexier Bay Area roles, but with real jobs and nice homes and good schools in Folsom, Roseville, and Sacramento. The growth will continue to get squeezed into other semi-local areas.

@soccermom–I echo that sentiment, but the non-sexy jobs leaving the Bay Area are no longer stopping in Sac’to, they’re heading over to Reno. And when you consider the regulatory environment, tax advantages, hire/fire rules in NV vs CA, I think Reno is the next (biggest little) boomtown over the next decade as companies like Tesla who need manufacturing relatively close but NO WAY are going to employ hundreds of blue collar workers in CA set up shop. Plus, the housing dollar still goes very far in Reno and there are actually some pretty great houses in solid neighborhoods there…places even an SF transplant could consider home easily.

What’s a house you like in Reno? (Like a link to a listing that has good value.)

I get all of the sadness of Las Vegas when I go to Reno, mitigated only by proximity to Tahoe.

Sacramento is getting more like Portland. Gradually, gradually. Midtown is where it’s at.

Midtown and East Sac are phenomenal neighborhoods with good restaurants, a walkable street life and interesting and varied architecture. The problem with Sac is that outside of the core, it can be miles and miles of dreary suburbia. However, if one is inclined to stay within the same neighborhood it’s a great alternative to the Bay Area.

I would generally agree, but that’s a fairly broad brush. There are plenty of neighborhoods between dreary suburbia and midtown/East Sac. Oak Park along Broadway has transformed radically since the crash. Land Park offers quiet tree lined streets within a legitimate flat 10-15 minute bike ride from downtown. Even downtown between the Capitol and the river is filling in rapidly. Little Vietnam has great cheap food off Stockton Blvd. The Japanese bakeries etc. off of Freeport. Tremendous choices, not just in midtown.

We are in agreement. I would include Land Park, Oak Park, Curtis Park, etc. in the “core”. And downtown has tremendous potential. Lot’s of great buildings in need of some TLC.

@SM– to answer your question, here’s a nicely done home in a solidly upscale Reno neighborhood…7,800sqft on 1.2 acres, $2.5mm (about the average SFR price in Noe these days). You could almost imagine this quality of workmanship passing for a new listing in Blackhawk/Alamo (at about 3x the price).

And FWIW, I’ll take the worst areas/blight Reno has to offer over the worst SF has to offer (e.g. Market b/w 6th and 12th; Civic Center; Tenderloin; Hunters/Bayview, etc.). At least Reno is merely sad and not truly dangerous / defacatory (is that a word??)

It looks like a nice house, but is sort of different from the point I was trying to make about choosing a different city for a more “sensible” (read lower) cost of living. Sacramento will offer a nice-ish house in the 300K-500K range.

@ Sabbie, how do you tie in your view with the fact that US household debt to GDP ratio has been falling steadily from 98% in 2009 to just under 80% in 2016? Check out the graph on the St Louis Fed site.

How much of the debt to GDP ratio decrease was due to an increase in GDP. And how much of that GDP increase flowed through to middle class pocketbooks…

Not sure what you’re asking, but household debt had gotten out of control during the housing bubble, we’re only back to about 2003 levels. It’s a good thing that it’s coming down. Again I do not think the current bubble is in private debt but corporate debt.

Speak of the devil, great article on this topic in today’s WSJ. Like he says, there’s no reason to worry, until there is, so don’t skip the last four paragraphs!