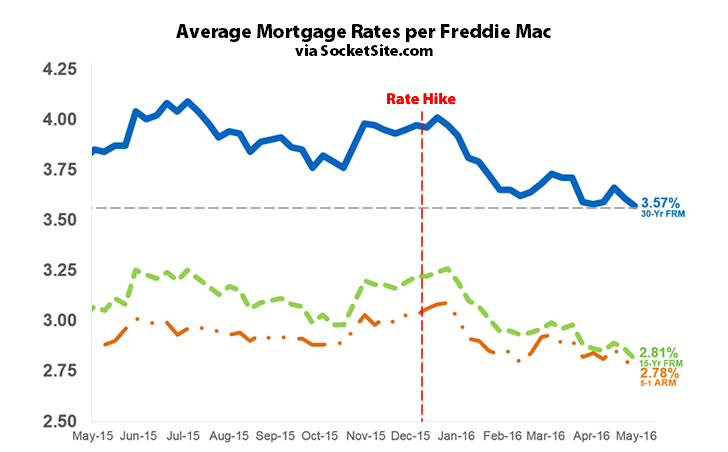

The average rate for a benchmark 30-year mortgage has dropped to 3.57 percent, the lowest rate in three years and 40 basis points below the 3.97 percent rate in place prior to the Fed’s first rate hike in December.

The current rate is 28 basis points below the 3.85 percent average rate recorded at the same time last year. And while good news for those in the market for a mortgage, keep in mind that the drop in rates has been driven by disappointing economic indicators, such as employment, and the Fed having retreated from its previously bullish plans for four rate hikes this year.

And in fact, the probability of the Fed instituting another rate hike by the end of the year has dropped to 56 percent.

I have a feeling interest rates will not rise in any significant way for years to come…

There won’t be a rate hike. Look at tech stocks, in the toilet, retail earnings have been pathetic as well. Apple at 52 week lows and back to summer 2014 prices. And a rate hike sends China, Japan, and Europe into a currency tizzy, puts downward pressure on commodities/emerging markets, and hurts the national debt. They’d rather squeeze the American consumer with stagflation and send us into the next recession.