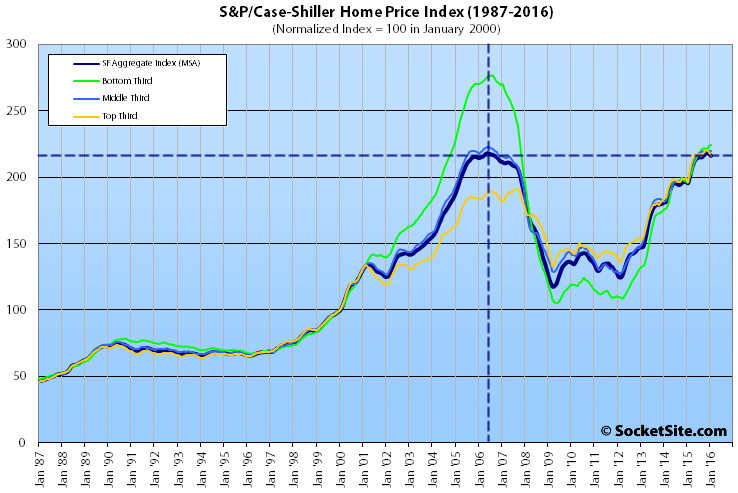

Having slipped a nominal 0.2 percent at the end of the year, the Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area dropped another 0.7 percent in January with the top tier of the market taking the biggest hit.

That being said, the overall index remains 10.5 percent higher versus the same time last year, 61 percent higher versus January 2010, and the index for condo values has hit a new all-time high.

And while the index for the top-third of the market dropped 1.5 percent in January, the middle third of the market slipped a nominal 0.1 percent and the bottom third eked out a 0.3 percent gain.

Single-family home values for the bottom third of the market in the San Francisco MSA have more than doubled since 2009 and back near December 2004 levels but remain 19 percent below their August 2006 peak.

The middle third is back to February 2006 levels but remains 1 percent below a May 2006 peak.

And while home values for the top third of the market slipped for the second month in a row from November’s all-time high, they remain 12.7 percent above the previous cycle peak recorded in August of 2007.

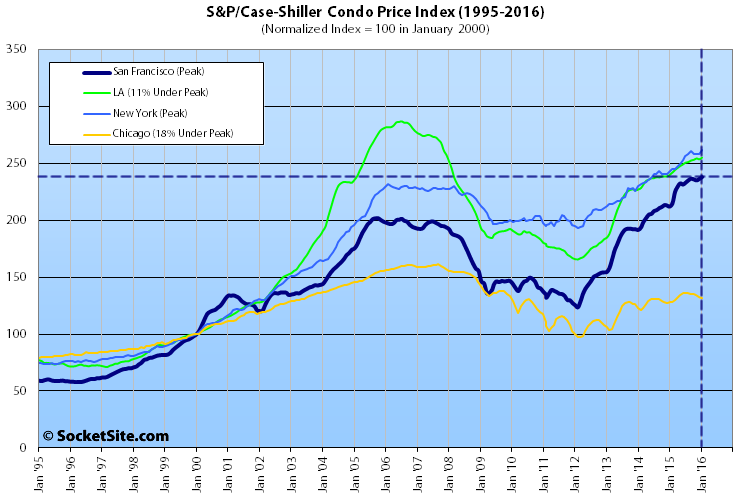

The index for San Francisco condo values gained 0.7 percent in January, hitting a new all-time high which is 12.2 percent higher versus the same time last year and 17.9 percent higher than in October 2005 (the previous cycle peak).

The index for home prices across the nation was relatively unchanged in January and remains 5.4 percent higher on a year-over-year basis but 5.0 percent below its July 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

From a 2015 Robert Schiller article in the NYT:

“Home prices have been climbing. They have risen 27 percent nationally since 2012, even more in places like San Francisco. But why worry? If you accept the efficient markets theory — and believe that real estate is an efficient market — then these prices are based on “new information,” even if you don’t know what that information is.

The problem with this kind of thinking is that the efficient markets theory is at best a half-truth, as a voluminous literature on market anomalies shows. What’s more, even that half-truth is grounded mainly in the stock market, which attracts professional investors who sometimes do make the market behave efficiently.

The housing market is another matter. It is far less rational than even the often irrational stock market, for a couple of important reasons. First, most investors find it difficult to understand how housing supply responds to changes in demand. Only a small minority of people think carefully about such things. Second, it is very hard for the minority of smart-money investors who do understand such matters to bet against bubble-level prices in real estate markets. In housing, the smart money has relatively little voice…”

If you purchased a home 3 years ago, you have a great investment on your hands. Purchasing a home now only makes sense if you are in for a long haul as prices can go down, flat, or maybe even up — you can’t sustain a 10% yoy growth indefinitely so the question is not will the growth slow, but when will it slow. In the long term prices should continue to grow steadily but prices can get rocky in the near term.

Home ownership has many benefits. Buying in this market only makes sense if it’s not viewed as an investment and you can sustain the mortgage payments for next 10 years.