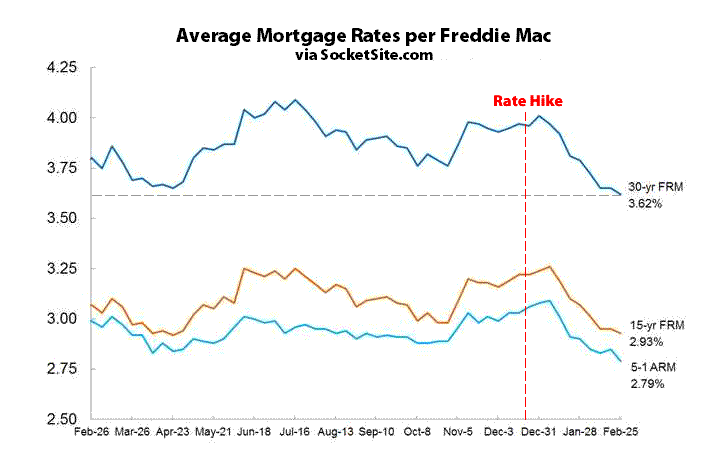

The average rate for a benchmark 30-year loan dropped to 3.62 percent over the past week and is within 3 basis points (0.03) of its lowest rate since mid-2013 as concerns about a global slowdown and market weakness continue to drive the 10-year Treasury yield down.

The average 30-year mortgage rate is now 35 basis points below the 3.97 percent rate in place prior to the Fed’s first rate hike in December and the probability of a second rate hike by The Fed next month sits at just over 8 percent according to the futures market, which shouldn’t catch any plugged-in readers by surprise.

Also, the 30 Year German Government bond is trading at 0.83% and Japanese 30 years are trading at 0.84%, with our US Treasury 30 years at 2.58%.

In other words, call off the hawks, the market could take rates lower before we go higher…