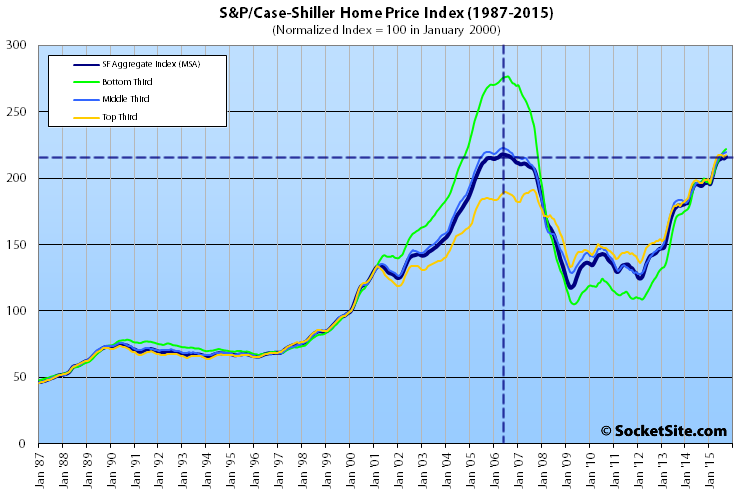

Having slipped in August, the aggregate Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area ticked up 0.6 percent in September and is within 0.9 percent of its 2006 all-time high. The index has gained 60 percent since January of 2010 and is running 11.2 percent higher versus the same time last year.

The index for the bottom third of the market gained 0.6 percent in September (up 12.1 percent, year-over-year), the index for middle third of the market ticked up 0.3 percent in September (up 11.9 percent YOY), and the index for the top third of the San Francisco market gained 0.5 percent in September, reversing a two-month slide, and has gained 10.6 percent over the past year.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA have more than doubled since 2009 and are back to November 2004 levels (20 percent below an August 2006 peak); the middle third is back to February 2006 levels (1 percent below a May 2006 peak); and home values for the top third of the market are 13.5 percent above the previous cycle peak recorded in August of 2007, just below the all-time high set this past June.

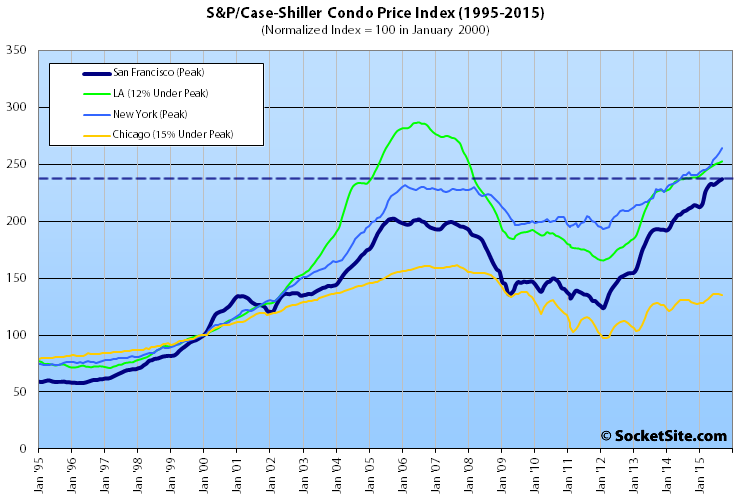

At the same time, San Francisco condo values ticked up 0.7 percent in September to an all-time high, up 12.2 percent over the past year and 17.2 percent higher than in October 2005 (the previous cycle peak).

The index for home prices across the nation gained 0.2 percent in September and is running 4.9 percent higher on a year-over-year basis but remains 4.9 percent below a July 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).