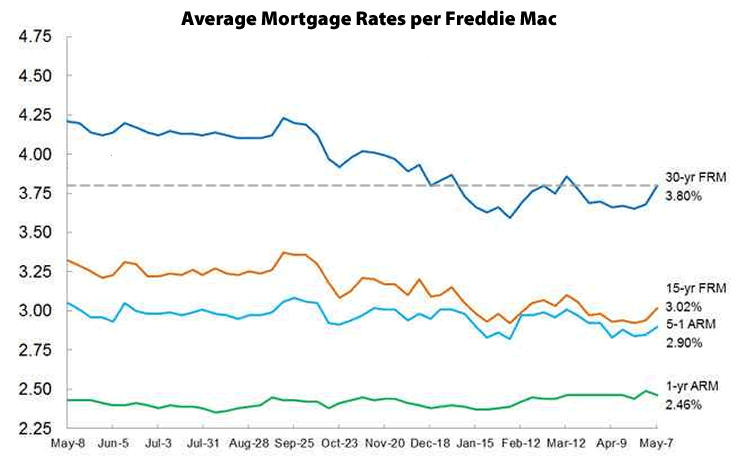

The average rate for a conforming 30-year mortgage increased 12 basis points over the past week to 3.80 percent, up 21 basis point from a 3.59 percent 21-month low in February but 41 basis points below the 4.21 percent average rate at the same time last year.

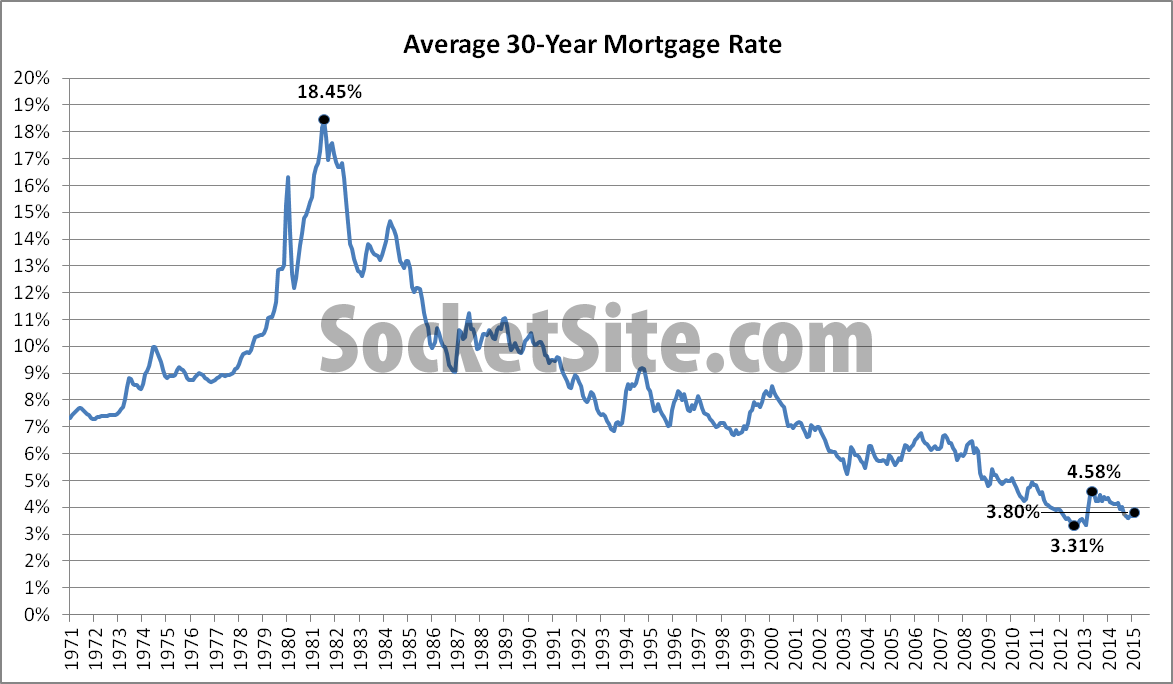

The 30-year rate, which hit an all-time low of 3.31 percent in November 2012, and a three-year high of 4.58 percent in August 2013, has averaged roughly 6.7 percent over the past twenty years.

I wonder if this spurs even more demand to buy. We don’t need more demand as prices have far surpassed 2006-2007 peak levels by 30%+ in many areas. What do you guys think? Rush to buy?

No impact yet. Let’s see if rates break out of the 3.6 – 4% band. If they go into the mid-4s or 5s, that will have an impact.

I think it will be politically popular for the rich and poor to keep rates low. Between Greece/EU and Russia/Oil and a choppy, regionalized US economy, I think rates will stay low until Clinton gets into office.

18-24 months before cooling effect is felt.