Single-family home values within the San Francisco MSA ticked up a nominal 0.1 percent from October to November but are running 8.9 percent higher on a year-over-year basis. And local condominium values have hit an all-time high, according to the latest S&P Case-Shiller Home Price Index.

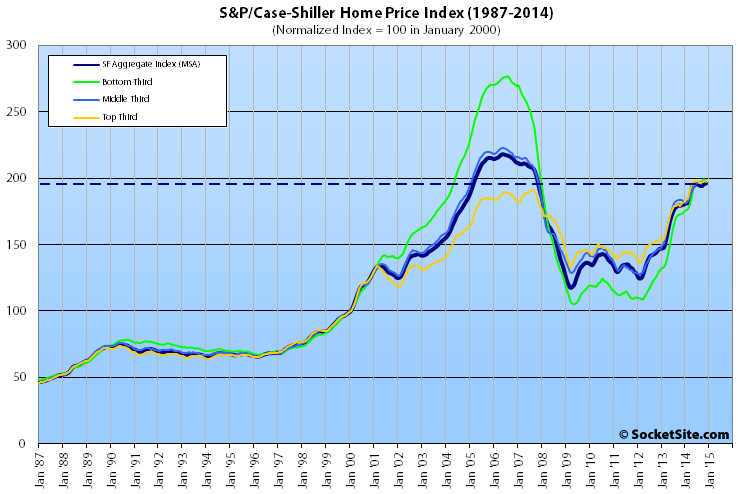

Keep in mind that while the aggregate index for San Francisco home values has gained 67 percent since early 2009, it remains 10 percent below its 2006 peak.

And while the indexes for the top two thirds of the market both gained 0.1 percent in November and are respectively running 8.1 percent and 9.4 percent higher on a year-over-year basis, the bottom third of the market fell 1.3 percent in November, the first recorded drop for the bottom tier since early 2012 and the smallest year-over-year gain (13.4 percent) since 2012 as well.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA are back below May 2004 levels (29 percent below an August 2006 peak); the middle third is back to just above February 2005 levels (11 percent below a May 2006 peak); and values for the top third of the market are 3.6 percent above their August 2007 peak, just below the all-time high reached this past June.

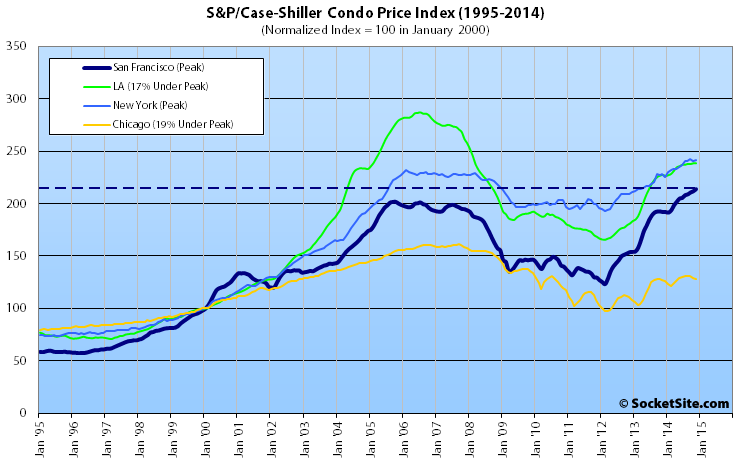

Condo values in San Francisco ticked up to a new all-time high in November, up 0.9 percent from the month before, 11.4 percent higher on a year-over-year basis, and 6.0 percent higher than at the previous cycle peak reached in October of 2005.

For the broader 10-City U.S. composite index, home values slipped 0.3 percent in November. And while the composite index is running 4.2 percent higher on a year-over-year basis, it remains 17.0 percent below its June 2006 peak and the year-over-year gain last month was the lowest since late 2012.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Not surprised condos. hit highs — they are built much closer to downtown core where the jobs are. The changing demographics in the region no longer places a priority on car ownership. There is a lot of work going into maintaining/renovating a home so I can appreciate the peace of mind of living in a condo.

I have hit my limit for the year. Three major projects within a span of ten months and within a year of a close family member’s passing is my limit. It is reminiscent of my former orthopedist who told me he discovered his limit was performing three surgeries in one day. Why?, I asked him. You don’t need the money. He just wanted to see how far he could go.

Still I have not experienced what my brethen from Seattle endured: curled up in fetal position and crying because she immediately went back to work full-time as a civil litigation attorney after giving birth to her first and only child. Signing off.