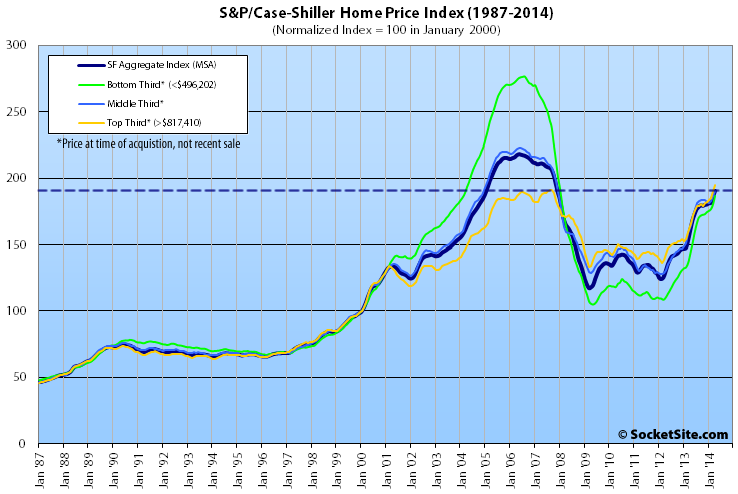

Single-family home values within the San Francisco MSA are 18.2 percent higher on a year-over-year basis and the index for the top-tier of San Francisco homes has hit an all-time high, according to the S&P/Case-Shiller Home Price Index.

That being said, while all three tiers of the market advanced and the overall San Francisco Index increased 2.3 percent from March to April, the aggregate index remains 12.6% below its May 2006 peak.

The bottom third of the market gained 3.5 percent from March to April (up 30.6 percent YOY); the middle third gained 2.2 percent from March to April (up 15.7 percent YOY); and the top third of the market (homes with an original cost basis of over $817,410) gained 2.2 percent from March to April and is up 17.2 percent year-over-year.

According to the index, single-family home values for the bottom third of the market in the San Francisco MSA are back above February 2004 levels (35 percent below an August 2006 peak); the middle third is back to December 2004 levels (16 percent below a May 2006 peak); and the top third of the market has just crossed the previous peak set in August of 2007.

Having gained 1.7 percent from March to April, condo values in the San Francisco MSA are up 16.3 percent year-over-year and have matched their October 2005 peak.

For the broader 10-City U.S. composite index, home values ticked up 1.0 percent from March to April and are 10.7 percent higher on a year-over-year basis but remain 19.0 percent below a June 2006 peak.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

So many great individual housing stories out there to support the data. High end is going crazy. 2207 Pacific condo sold in 2012 for $3.5 and just sold for $4.6 and 1450/psf. And it was perfect in 2012 but someone decided to gussy up the place even further. Really a stellar outcome for a cond with no views.

Not sure what to even make of the “bottom third”. There are hardly any properties that qualify for that metric in San Francisco at this point. Almost all of the properties that were in that range would probably now qualify in the middle tier. In the last two weeks there have been about 315 new listings on the MLS. Exactly 11 listings were under the Low Tier including only two SFHs such as the wonderful home / tenant occupied shack in the bayview @ 1206 Shafter. Or the gem at 42 West View Ave in Portola that is a stones through from 280. You can always pick up the 499 sqft condo on California street in Pacific Heights at over $1k/psf.

Of the roughly 215 homes that has closed over the same period there were 5 that would qualify in the low tier.

So, not sure what to make of the data in that tier as I’m not sure what they are including in it.

“High end is going crazy.”

Crazy. As in mad, insane, senseless, ridiculous.

“Crazy” markets end in economic disaster. But as long as someone’s making bank, “crazy” is good, right? Don’t worry, rich folks, the US Government and the working tax-payers will bail you out, yet again. Because, if we don’t prop up the assets of rich people, it would be the end of the world!

Not sure if its crazy insane. How do you bail out all cash buyers?

The same way they were last time: you use the Fed to 1. buy up all failing assets, artificially propping their value up, and 2. keep interest rates low, to re-blow the bubble.

Moral hazard? Never heard of it!

what you just wrote applies to cash purchases, how?

Because there is an implicit Fed guarantee to prop up the housing sector, despite the fact that the propping mechanisms are hollowing out the productive economy.

The market IS RIGGED.

This data is from the whole SF MSA, not just the city itself. So it includes the whole bay area.

Actually, the 5-county Metropolitan Statistical Area (MSA) is comprised of San Francisco, Marin, Contra Costa, Alameda and San Mateo counties. So basically SF, north bay, east bay, peninsula, not but south bay.

eddy,

Unfortunately that reflects a fundamental misunderstanding of how the index works.

The top tier represents the performance of the top-third of the market within the San Francisco MSA.

The top tier does NOT simply represent the performance of homes that are currently worth over $817,410. The fact that the majority of new listings in San Francisco are over that price point is irrelevant.

The index is calculated by comparing the change in value between two sales of the same home and the break points for the tiers are based on the original purchase prices for sale pairs, not the most recent sale prices.

I’ve never understood why the C-S index groups tiers based on the old sales price instead of the new sales price. The new price seems a lot more relevant and less likely cause apples and oranges to end up in the same sack.

Thanks for the reply. And, I get it. And I know I’m wrong to make the direct correlation, I guess. Every sale does represent 1 side of a 2 sided pair that has either happened or will happen in the future. And the low tier is becoming less and less relevant as an indicator with respect to “San Francisco”.

The top tier does NOT simply represent the performance of homes that are currently worth over $817,410. The fact that the majority of new listings in San Francisco are over that price point is irrelevant.

I wouldn’t go as far as to say it’s irrelevant. The question begs the point whether one can assume their home value, or SF home values in general, will have any meaningful correlation to these tiers. One could argue that the only tier of relevance to San Francisco IS the top tier since the a majority of homes list over the threshold. Again, I get that is not what is being measured nor is it its’ intended purpose.

The tiers themselves are what are largely arbitrary and irrelevant. Confusing matters further is the long standing variance from “Bottom, Middle, Top Thirds” from C/S standard “Low, Medium, High Tiers”. These could just as easily be, and more granularly, split into 4 or 5 tiers. I think it would be great to have a better view into the top fifth of the market and I’d be curious the as to the average value of homes on these tiers. But we got what we got and I think its useful information. Not sure what they are stuffing in the low tier and from where but its becoming less and less relevant.

Personally, I’m watching the low tier more as an indicator of when exactly the bubble will pop. I’d like to see more separation from the low tier. But if the low tier gets too far above the Medium and High tiers I would say run for the hills. Actually, there really is nowhere to run. Cheers.

Anybody actually paying attention or putting bids in know that housing prices are 20-35% HIGHER than all time peak prices.

Yes, in SF.

Up to 2 years ago we could easily mirror SF with the upper tier, but not anymore today. SF and other chosen few cities have gone beyond the rest of the market.

We will have to see what the little sliver house on Yukon goes for….concrete examples are always fun to kick around when these stats come out.

Wow, those guys who all told us that the bottom was going to fall out back in 2008 couldn’t have been more wrong. Sure glad I didn’t fall for their fear mongering.

the bottom did fall out. SF proper was down 30% from 2008 to 2012.

Its just that the market has been nuts now for the past 2 years with a meteoric rise from the bottom

That’s what she said. (I agree w/ Jill)

yes, SF was not immune from the fallout of the credit crisis. On one side, some people borrowed too much and didn’t get saved by higher prices. On the other side, the effects of the RE/crisis on the rest of the economy were painful, even in SF, with 10% unemployment.

But what has happened since january 2012 is nothing short of spectacular. Excess inventory was slowly churned through in 2010-2011, until it was gone in december 2011. Then everything went crazy.

You really do have to feel sorry to some extent to those in San Francisco that got caught short in the downfall. The Pacific Heights mansion @ pacific/divis that went into foreclosure and sold for 10M and is now probably worth 18M is probably the most extreme case but there are countless others.

You can never know. When I became a bull in mid-2010 I thought we’d be in for a mild rebound and maybe a return to peak value after 6-7 years, like typical market cycles. Less than 4 years later and many SF zip codes have cleared the 2007-2008 peak by 20%.

Yes. Crazy. Like a Ponzi Scheme.

Yes, I think it’s not sustainable long term. As a landlord, SF is a horrible place to invest today. That’s the sign for me that we’ve reached the crazy zone.

I don’t think it was 30% in SF proper. What evidence do you have for that? It seemed more like 20-25% to me. Quibbling perhaps, but much less than the 40+% the metro area experienced.

Actually 10-15% drop in the best cases (i.e. the mission), and 30-40% drop in the most extreme ones (over priced D10 stuff.)

Some neighborhoods, such as Cole Valley, , the Mission and Bernal heights actually even appreciated during late 2009- 2010. Taking a long view, that two and a half year downturn appears to be a blip. Tipster Beers and friends were wrong.

Tech cushioned the fall, and the market came back with a vengeance. But you cannot deny 2009-2011 were very tough years for sellers and realtors alike. I routinely saw 5 to 10% underbids on property that were already 10-20% under peak value.

they might have appreciated between 9 and 10, but 11-12 was the bottom anyway. after the drop in 09, there was a small blip in many place that traced back down in 11-12.

of course some neighborhoods fared better than others, and I dont know how to define “SF proper”. SInce the city is only 7×7 it seems fair to include it all. there were plenty of apples on this site, but the case schiller, which is not perfect, but the best measure out there, the top-tier of SF MSA which most closely resembles SF did indeed drop by 32% for condos and 25% for SFHs. see below. imn not sure if this was the lowest one. I just picked one closest to the low point.

https://socketsite.com/archives/2012/06/spcaseshiller_san_francisco_homecondo_prices_show_april.html

Yes, SF plainly saw significant price drops across the board. The low end neighborhoods in D9 and D10 started really falling in about late 2007. Most of the rest of the city started falling soon after. And the few top neighborhoods started falling after Lehman in late 2008. Nothing was linear, of course, and there were a few blips up and back down as govt incentives came and went. But basically everything bottomed in about late 2011. Big drops at the low end, 30-40%. Less severe at the higher end, about 15-20%. Inflation added another 5-10% in real losses. Been a pretty astounding upward tear across the board since early 2012. By raw dollar numbers, the top end seems like it’s led the way (“up by $1 million!”) but I think in % terms the low end has bounced back even better. Anyway, a good three-year window to buy in 2009-2011. I wouldn’t buy in SF now unless you are quite certain you’ll stay at least 12-15 years or more.

At least the city is collecting a ton in property taxes with the high assessments on new sales and the lowered assessments on peak buys handed out from 2008-2012 being reversed.

Yes, quite a few owners asked for property tax reduction in 2010 and 2011. I wonder if this lower tax is banked as part of prop 13, or can it be reversed as the market improves? It would be a Heads I win, Tails you lose situation! Prop 13 is such an idiotic law. In par with rent control.

property tax reductions are year to year.. so the lower tax is only a year.. then back to Prop 13 base.

Condo values at a new high is actually the major story as Adam correctly points out with the headline. The anecdotal evidence I’m seeing is that the gap between condos and SFH is actually as small as I’ve ever seen it in the past 10 years. I’ve not spent any time analyzing the data, but I’m seeing scores of mid to high end condos selling for what could have easily commanded a decent SFH homes. And while SFHs are indeed higher it seems the gap between the two asset classes is smaller than before. Anyone have any hard data on the spread between condos and SFHs. Not sure if it can be inferred from C/S?

To me, either condos will have to come back into alignment or SFHs still have room to pop; or they both go down and create a more normal price gap betwee n the two. Not sure.

Do you (or does anyone) have a good aggregate data indicator for looking at the discount for a TIC vs. a Condo? Is there a rule of thumb? I have found it somewhat challenging to draw these two groups out on the major consumer web sites (redfin/zillow).