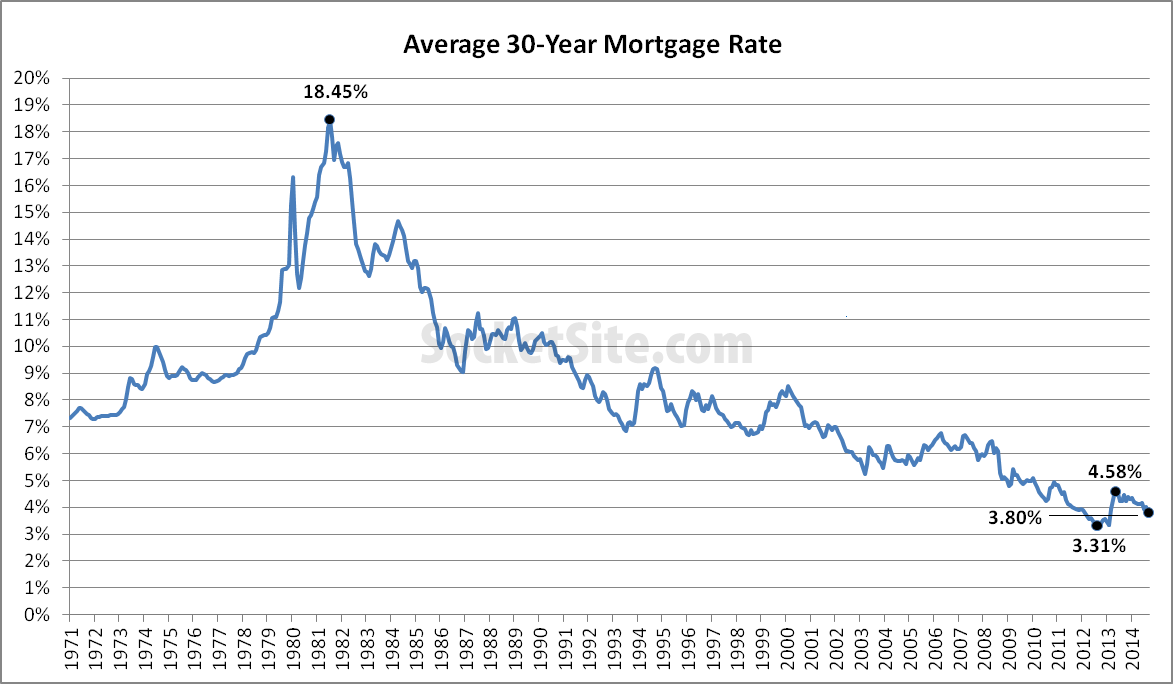

The average rate for a conforming 30-year mortgage dropped from 3.93 to 3.80 over the past week, the lowest level since May 2013 and 67 basis points below the 4.47 percent average rate at the same time last year.

That being said, with the Federal Reserve having rather clumsily reaffirmed that it’s on track to raise interest rates in the second half of 2015, the yield on the 10-year treasury ticked up around 10 basis points over the past 24 hours, a move which should lead to higher mortgage rates as well.

Averaging around 6.7 percent over the past twenty years, the 30-year rate hit a three-year high of 4.58 percent in August of 2013 and an all-time low of 3.31 percent in November of 2012.

And the analysts at Freddie Mac who had originally forecast that the 30-year rate would end the current year at “around 4.6 percent”, a forecast which was revised downward to “around 4.4 percent” in July, get a failing grade.

Yeah, this definitely was not expected by most.

This already may be old news though. 10-year treasury rates have ticked up about 15 bps since the Fed’s announcements on Tuesday. I see that Wells Fargo is advertising 4.0% on 30-yr loans now.

The rate offered by the Swiss National Bank just went negative. Strange times.

I believe the Swiss are trying to lower the value of the Swiss franc. It is crazy expensive over there – US $40 for a small pizza. $10 coffee. Even the affluent Mainland Chinese with their love of expensive Swiss time pieces are savvy enough not to buy them in Switzerland.

Does anyone know what current best rates on a jumbo 10/1 ARM interest only happen to be?

I remember those times in the early 1980’s when banks were offering 16% interest rates on savings accounts, CDs, etc. Real estate prices were extremely depressed and no one wanted to buy. Of course, I was much younger then and did not fully appreciate those times. My family didn’t even own a car so the whole oil crisis and seeing cars parked in long lines to fill up at the gas station was lost on me. Such nostalgia.

Good times to be flush with cash Beatrice. Parking money in CDs was a no-brainer, safe, consistent return, and downright simple. Nice time to be living off interest on your savings. No need for brokers either.