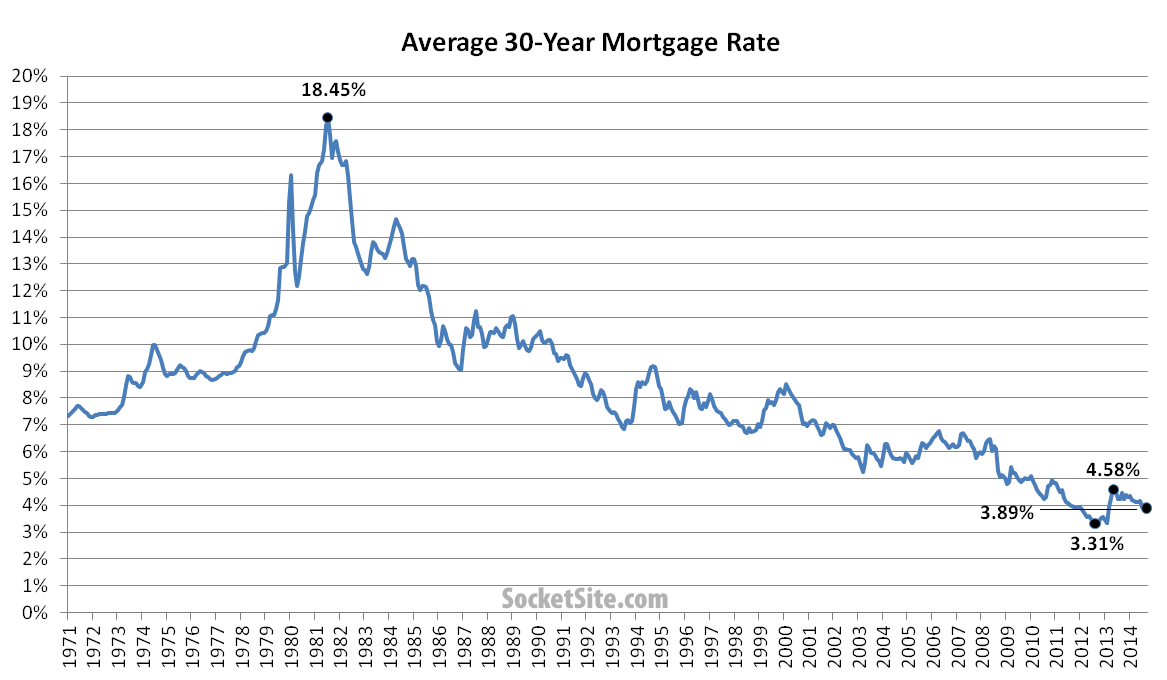

Having ticked up to just over 4 percent last month, the average rate for a conforming 30-year fixed-rate mortgage has dropped to 3.89 percent, the lowest level since May 2013 and 57 basis points below the 4.46 percent rate at the same time last year.

Averaging around 6.7 percent over the past twenty years, the 30-year rate hit a three-year high of 4.58 percent in August 2013 and an all-time low of 3.31 percent in November 2012.

But Freddie Mac said they would be 4.6%(!)

Where is the Alt-arm tsunami I was promised.

That hit in about 2008-2010. There were a lot of foreclosures. Pretty easy to find lots of articles about it.

subprime yes, in SF, Alt-A foreclosures didn’t move the needle

Nah, tons of Alt-A mortgages in SF than went sour in SF, just like everywhere else. Stated income, high-LTV, neg-am, etc. Just google a bit if you don’t remember all this or weren’t paying attention than. Wasn’t that long ago.

The fed kept a lot of neg-ams from doing what they were slated to do, actually. If you want to look at where subprime really hit SF it hit in the southeast part of town where yes, stated, and subprime were more prevalent. You are lumping numerous scenarios together and then trying to say I wasn’t paying attention. Why? Each of those played out in differently.

True that districts 9 and 10 got slammed with foreclosures, more than the rest of the city. But those weren’t all subprimes but also included tons of Alt-A loans. They certainly moved the needle here and elsewhere. People with neg-ams in particular got slammed, and foreclosed, because prices dropped so much that they had negative equity in spades.

You’re confusing adjustable rate mortgages, which were used in all classes of loans from prime on down, with Alt-A.

No, I’m not. Now you’re parsing your own incorrect comment and trying to come back. Not having that.

Yeah, you got them mixed up. It is a common mistake because people throw out terms like subprime, ARM, and Alt-A interchangeably without really understanding the distinctions. The media did this all through the mortgage crisis. Alt-A is not the same as adjustable rate. You can start with Wikipedia and go from there to learn about it all. This stuff is not that difficult.

You lumped them together JR “Bob” Dobbs. Not I.