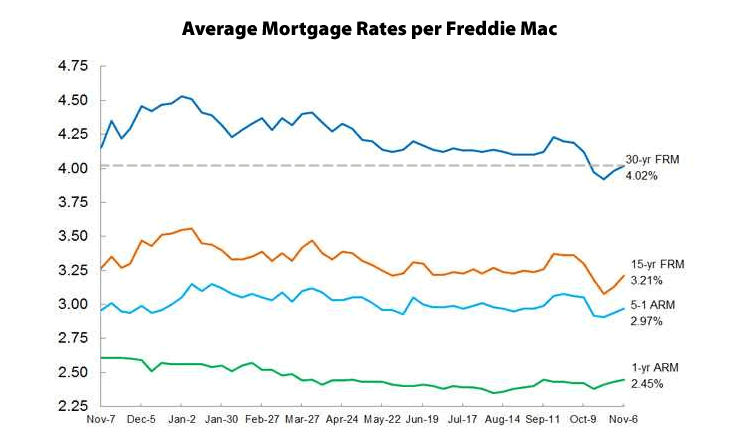

The average rate for a conforming 30-year fixed-rate mortgage has ticked up from 3.92 to 4.02 percent over the past two weeks but remains 14 basis points below the 4.16 percent rate at the same time last year.

As we noted two weeks ago, with unemployment claims at their lowest point in 14 years and the yield on the 10-year Treasury on the move, the dip in mortgage rates is likely over for the time being.

Having averaged around 6.7 percent over the past twenty years, the 30-year rate hit a three-year high of 4.58 percent in August 2013 and an all-time low of 3.31 percent in November 2012.

we might not get back to the average of 6.7% in our lifetimes. don’t be surprised if rates go back under 4% again in the near future, and stay under 5% for YEARS to come. the private sector still carries so much debt, that any rise in interest rates will hurt the economy. the catch-22 is that low interest rates allow the private sector to maintain its debt levels, and even increase it, which means we’re going to be debt-heavy for years to come, so interest rates must stay low. only an over-heated economy, with rising wages and inflation will change this. we are getting that here in the bay area, but we’re the exception.

A high private sector debt level increases interest rates; it doesn’t keep them low. Basic supply and demand. The driving forces behind currently low interest rates are a high availability of funds to lend (i.e. a high supply), low inflation (lenders demand higher interest rates when inflation is higher), and fed policies (injecting tons of free or cheap cash into the banks — see factor #1).

I agree this is unlikely to change for quite a while, but some shock (like the Repubs taking the white house and keeping Congress in 2016) could result in a quick rise in rates. As for mortgages, if I were buying now, I’d go with a fixed rate loan if I was pretty certain I’d stay for more than 7 years. Less than that, go with an ARM.

Is your crystal ball so very crystalline from your vantage point in the Everglades?

Many variable influence interest rates, and of course lending rates are different from other interest-bearing securities. Besides credit risk, one huge determinant is monetary policy. I think hangemhi was suggesting that the fed would consider private exposure when formulating policy. As you already know, the fed can manipulate supply and demand irrespective of private sector debt.

It’s more correct to suggest that excessive public sector debt places upward pressure on interest rates, since the government will need to issue bonds. This makes your second point about repubs counterintuitive, since they are more mindful of public debt.

Repubs tend to cut taxes, but not spending, and thereby drive up deficits and debt. An upward force on interest rates. And they tend to do other things, like start wars, that also increase debt.

You are correct that the fed will continue to use the tools they have to keep rates down.