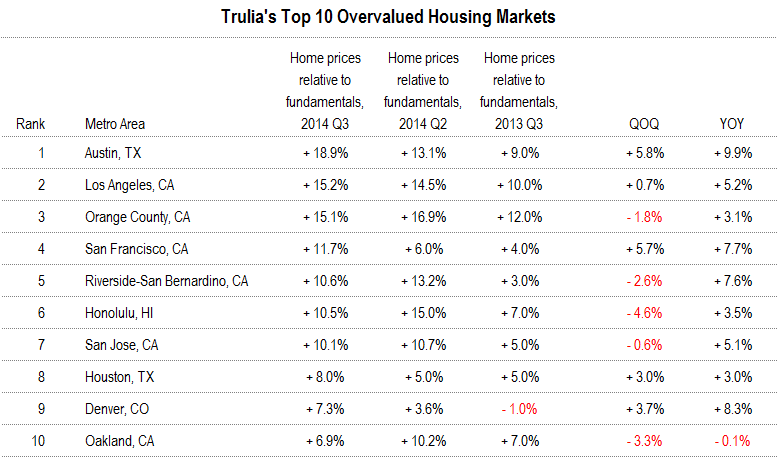

Based on ratios of home prices, incomes and rents, San Francisco, San Jose and Oakland all made Trulia’s latest top-ten list of the most “overvalued” housing markets in the U.S., ranking fourth, seventh and tenth respectively.

While Austin, Texas topped Trulia’s list of the most overvalued metro areas with home prices 19 percent overvalued relative to incomes and rents, San Francisco wasn’t too far behind at 12 percent higher than Trulia suggests the fundamentals alone should support.

That’s an increase of 6 percentage points for both Austin and San Francisco over the past quarter, second only to West Palm Beach, Florida with an 8 point gain, and versus an average 1 percentage point drop over the past quarter for the largest 100 metro areas in the U.S.

Deemed 4 percent overvalued in the third quarter of 2013, Trulia’s measure of San Francisco’s overvaluation has increased 8 percentage points over the past year while Trulia’s measure of asking prices for homes in the area has increased a little over 11 percent over the same period of time.

And in the words of Trulia:

“One test of whether it’s time to sound the bubble alarm is whether prices are rising faster in markets that are already overvalued. Price gains in overvalued markets are a sign that we’re headed for danger, while price gains in undervalued markets are probably just a sign of getting back toward normal.”

Trulia deems the San Jose housing market to be 10 percent overvalued, up from 5 percent in the third quarter of 2013 but down from 11 percent in the second quarter of 2014, while home prices in Oakland are currently 7 percent overvalued according to Trulia, down from 10 percent last quarter and unchanged year-over-year.

Keep an eye on the stock market and the bay area tracking stocks. Doubt we’ll see much downward pressure on home prices until the markets drop significantly and for a sustained period of time. So long as people “feel” wealthy and prosperous; and the supply of quality homes remains low – home prices will remain steady.

This recent housing run caught me by surprise and convinced me once and for all that there is a perpetual value distortion field surrounding top tier city residential stock. Perhaps we’ll see a 10-15% drop in values and it may very well be warranted; but I don’t think the bears are going to be rewarded. And shorting SF real estate has been a lot harder than going long.

Kathy Fetke, who I follow, has been saying the Bay Area is over-valued. For 10 months now she has said that. Folks are bidding prices up too much and she has warned Bay Area buyers to be careful. ITA.

It may be over-valued, but I don’t think you can reach this conclusion from Trulia’s analysis. For example, if they take average income as a basis, then in SF they are also including people with tiny incomes who can only afford to stay in the city due to rent control. Implicitly Trulia is trying to estimate affordability for people buying real estate, which, due to rent control, is not the typical resident and, therefore, using simple unadjusted average income is incorrect. Relative valuation only makes sense once market distortions, of which SF has several, have been taken into account.

This is correct and blows a bit of a hole in the validity of the whole analysis being presented here. Peer review (even at some low level) would help give a bit of credibility to these off-the-cuff outputs being churned out to increase clicks.

Not to mention that Trulia’s analysis doesn’t account for all those who buy or rent in East Bay but earn their salaries in SF. That will surely skew the ratio relative to the ‘fundamentals’.

yep, in all honesty, they should just be looking at upper quartile of income. no one in lower 75% is buying, unless they have a large inheritance

Trulia = zero credibility in economic forecasting. About as good as those lame zillow estimates. waste.of.time.

And another thing. Sure, I can also forecast that SF RE is over priced and will go down in value, temporarily, at some point. Who cares? It’s like a broken clock is right at telling time twice a day analogy. What about the other 23 hours, 59 minutes and 58 seconds?

rent control benefits lots of people – some of which have extremely high incomes. There are also lots of lower income people that have owned homes here for years (for example, three separate households on my block have owned their homes for 30 years +)

This study may be flawed, but there are lots of reasons that the average income is what it is and I wouldn’t blame it on rent control.

Rent control benefits greedy middle aged people. They have been in the same apartment for 20+ years and drive up the rents for mostly younger people, just starting out in life.

Better the unsightly OLDS be forced into Tracy, or onto the streets, to allow for the more deserving Twitter employees to get cheaper housing!

There is logic in this. Seriously. If you have been “working” for 20+ years, and still can’t get yourself into a nicer place (because rent-controlled units are not maintained), you are indeed unsightly.

I (and the US culture) would rather invest in promises (young people), rather than proven lackluster cases (olds who couldn’t move on).

Prop 13 benefits greedy middle aged people. They have been in the same house for 20+ years and drive up purchase prices for mostly younger people, just starting out in life.

if those darn greedy people would just pay more tax

Yeah and Prop 13 does that for the entire state of CA.

You want to make housing in CA affordable and get the state’s fiscal health in order, repeal Prop 13.

+1

more taxes for you would be great, but working people are paying too much

A couple weeks ago I overheard a young guy on the L train talking about how his uncle from China pretty much bought an entire block in the Sunset in less than a decade. A lot of foreign investors buying up like crazy (and paying cash) in hot markets, including the city by the bay. Combine that with insanely high tech wages and there you go. Eventually, people will be so priced out that they will leave the area completely since commuting by vehicle will become prohibitive on many levels and our transit systems are pathetic.

And yet SF’s population is still increasing. Which means there are more people moving in than moving out.

Sure they’re not the same people. But SF is not emptying itself, that’s for sure.

It’s probably best to think of valuations in terms of price/rent ratios–an idea promoted by this very site during the last bubble. The nearest substitute for owning is renting, so the price of one is unlikely to stray from the other for very long–and has not, historically. Ratios of 15:1 are typical for ordinary housing, though the ratio may go up somewhat at the upper end, where there’s a greater ownership premium (ownership being a luxury good).

By this token, SF does not seem wildly overvalued now. We have a renovated 1 BR in-law which we just considered selling or renting. Its current sale value is about 16x current annual rent, right in line with the historic average. The one thing that makes me nervous about this type of analysis is that SF rents are artificially volatile b/c of rent control. There’s a decent chance that current rents will fall as new supply comes on line, and they fall a lot during recessions. And if current rents substantially overstate “normal” rents, then the market is indeed overvalued.

I don’t think rents will fall a lot during next downturn. During the great recession my mission rental only dropped 10%. I don’t think most others dropped by more than 10-25% max citywide. And of course it’s now way past that. It recovers in 2 years. By 2010, business as usual 🙂

@SFrentier–are you pals with any landlords who were in the business circa 1999/2000? It’s my understanding that rents fell by about 50%.

FWIWA, in the Mission you were buffered by gentrification–the neighborhood continued to improve even during the Great Recession (which was pretty minor in the Bay Area regardless).

And the great recovery in rents you experienced was no doubt due in substantial part to the Great Supply Restriction known as rent control.

1- I saw no 50% rent drops in 99/2000.

2- yup, mission had gentrification as a tailwind, so mine only dropped 10%.

3- rent control has been in SF since 79, and yes, it increases marginal rents.

The only places I see potentially large rent drops is in new “luxury” buildings where they are getting $5000 and up for a 2 BR. With more new rentals coming online especially in soma and south beach, those units may get a haircut. But I’d only worry at the high end. I have nice, but more bread and butter units. They are practical rentals, even for tech workers. Who wants to blow $5000-7000 on a frickin rental??

There were a few occasions where some people paid way way too much for a room. Like $1500 a friend of mine [paid] in 2000. The going rate in 2002 for a room was close to 800. Of course we have gone much higher today. I see people sharing 2/2s for 2300+ each today. The private bath makes all the difference.

SF is so cheap compared to manhattan. And jobs and income seem higher in SF!

I will use a very unscientific method to determine the next substantial correction. The US in having quite the recovery. One sign of this recovery is the deficit. We were used to a Trillion Dollar Deficit until 2012. The deficit is shrinking so rapidly that we might break even in 2015 and even have a surplus in 2016!!! But rules of real economics hate surpluses and something will stop this too-good-to-be-true scenario.

The pattern of this recovery is similar to 1994-2000. A “jobless recovery” followed by a surprisingly strong growth.

In my opinion 2016 is the year the next recession will hit.

The Congressional Budget Office said Tuesday that higher tax revenues and restrained spending will produce smaller budget deficits in the next few years, but after 2015 deficits will start rising again. That will happen because federal spending will grow more quickly than the economy will.