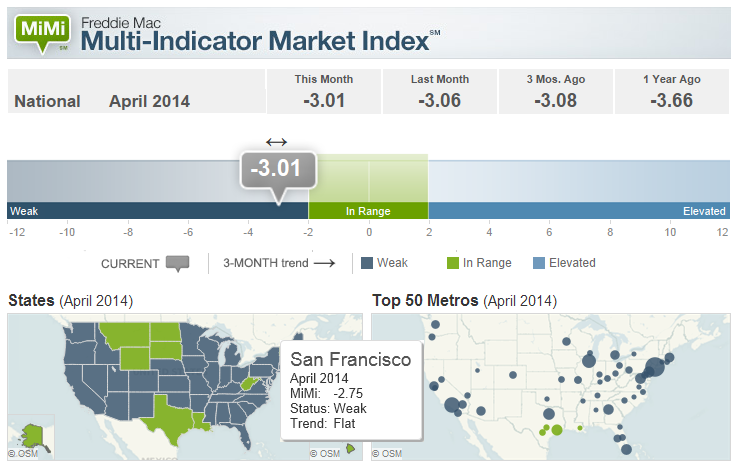

According to Freddie Mac’s “Multi-Indicator Market Index,” the U.S. housing market remains weak despite improving employment, declining delinquencies, attractive mortgage rates and home price gains, but conditions have improved year-over-year.

Of the top 50 metropolitan areas in the U.S., only San Antonio, Houston, Austin, and New Orleans were considered to be stable markets.

Ranked in 14th place, the San Francisco housing market, which includes Oakland and Hayward, was characterized as “weak and flat,” weighed down by declining mortgage activity and a higher than average proportion of homeowners who remain seriously delinquent on their home loans.

The calculations for Freddie Mac’s index are based on conforming loan activity for single-family homes, however, and do not take all-cash sales or jumbo home loan activity into consideration. And in effect, San Francisco is being penalized in the rankings for being expensive and in-demand by investors or individuals with access to cash.

Freddie Mac also recently surveyed Californians and can report that almost no one speaks Spanish. Freddie Mac does not include anyone from Mexico or Central America in their surveys.

Freddie Mac recently surveyed the food at McDonalds and found every item to be healthy. Freddie Mac ordered a salad with no dressing.

I guess the market for single-family homes in San Francisco less than $625,500 would be “weak and flat”.

Freddie Mac employs some of the smartest people in market economics. Maybe they’ll recommend bolstering the “weak” SF market by extending credit to subprime borrowers. However, until that happens, I’m thinking of moving from SF into their “stable” markets, probably Houston or New Orleans.

Now we know what happens to the drugs confiscated by the Feds.

It is quite painful isn’t it to realize government is wasting your money like a cheap hooker with your credit card, no? If you want to move away, go where the 1% are. They are much smarter than you or me. And they can afford to pay for the $800 call girl and not eat spam.

the overall conforming health of the mortgage market in SF/Oakland/Hayward is weak, which is what the survey is designed to measure. 14th out of the top 50 isn’t that low, but is technically below “green” or within the target range for health metrics.

only 4 cities measured in the green, so don’t feel bad. San Jose and Los Angeles are also expensive and have appreciation and cash buyers, but still had fewer delinquencies per capita than SF, so that’s why they ranked higher. it’s just one of many measurements of local housing markets.