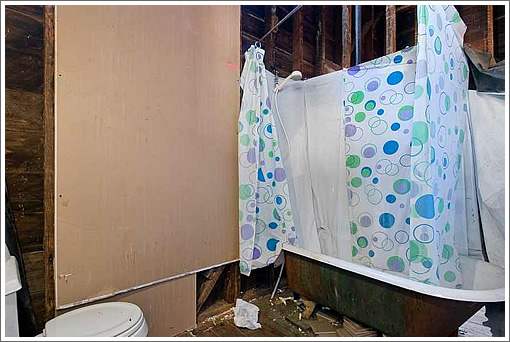

As we first wrote about the 1870’s era Victorian on a 6,000 square foot lot at 837 South Van Ness Avenue last month, “while we do see the potential for a spectacular Mission District compound, calling it a “fixer” seems a bit gracious and it’s not a project for the faint of heart (nor pocketbook).”

Having been listed for $1,395,000, the sale of 837 Van Ness Avenue closed escrow last week with a reported contract price of $1,901,000. We’ll let you know when the plans are drawn, the permits are filed, and whose pocketbook ends up financing the fixing.

Looks like the sale price reflects the dirt value of the property. Minus the difference between doing a teardown/rebuild and restoring the existing house. The city would probably approve construction of several units on this relatively large lot.

1.9 is high. Only makes sense with adding new condos on side lot. Maybe lot split and 3 condos.

There will be no teardown whatsoever. There’s recently permitted foundation work, in fact. Not to mention good bones. Get a clue.

Not everything is about maximizing land use.

If it were up to me, I’d dig a nice 40 foot swimming pool on that space. There would still be tons of footage for landscaping, garden, patio,…

Will be interesting to see how this turns out.

If the owner isn’t going to split lot and build condos then this is an insane amount to pay for this property.

I’m picturing the buyer as a rich crime boss who likes to live near the base of his operation or a famous crime novel writer who wants to observe and write about the riff rafts while sipping martini in the comfort of his crib.

Prediction: I think we’re going to see new condos in one way or another.

The inside is stripped completely of it’s original features. If a restoration was to be done properly it will cost a small fortune to return this house to its former glory.

Let me clarify Anon. I don’t think there will be a teardown here either. But a restoration or rebuild within the existing shell will likely result in lower profit compared to a teardown/rebuild. So that needs to be factored in too.

No. A teardown is moot and not a factor. Any development of the existing structure will be repair or expand or probably best and highest split into units. Seems like you don’t underatand a lot of what you weigh in on here. Have you ever done any developing? Did you view this property? Read its permitting history? If the answer is no to all of these, why try to posture like you have an idea?

It doesn’t matter whether a teardown is moot or not. The reason I mentioned teardown was to normalize costs to more easily quantified empty lot development.

Focus people. On the Future.

The Mission is changing rapidly, demographically, economically.

Look at the short evolution of Valencia St. See how lower 24th is evolving; teeming with local food restaurants and shops. Look at the great weather in this part of town. Cyclists love the flatness.

We “could” see some condos on the empty lot. I think (pretty sure) we will see this large Victorian brought back to life and fully restored. And I still think my original estimate for reno of the house will be near $1m.

My bet is that the buyer splits the lot, builds condos on the new parcel and renovates the existing house, maybe splitting it into 2-3 units if feasible with the city.

While out of place, I love that mideval looking gate!

I wonder what the previous owner was doing in there? It looks like they were attempting some renovations, but also living there. Perhaps it was squatters living there? Very strange if you look at the listing photos.

I agree with MoD that it sold for close to lot value. Even without a teardown the existing structure isn’t worth much given how much it will cost to bring it to a livable state.

I think that price is high for lot value. If both were vacany and doing 3x condos per lot, then yes. But lot splits are big brain farts in the this city (trust me, I did one) and that Vic will probably just retain its exterior and maybe wood floors. The inside will be all new and modern, jus like googlers and Fbers like it.) given those factors, this is less desirable than 2 empty lots. I think some over zealous developer got a bit too excited. I’m sure it will still make money for the dev, but it’s big and complicated. And as for foregoing developing the empty lot and putting in a pool…enjoy that million dollar pool!

It’s interesting how people try to make practical sense of things within their own budget reality.

Perhaps, the person who purchased this, shits buckets of money and thought, what a charming old house. I want it, I’ll have it.

Agree Mike. most people here commenting are so damn “practical”. To them, it’s always the bottom line, the ROI.

And that can be very boring.

Yes, maybe an eccentric billionaire bought it, but extremely unlikely.

If you have enough money to buy a $2 mil major fixer, with at least another $1 mil in reno costs, then you have enough to buy a nice house in some of the best neighborhoods in SF.

The price does not make sense without some plan to develop the lot.

^what Mike said^

It’s almost a blank slate, and it has a huge lot. 2 very big assets for people who want to make their dream home.

I am currently planning up my personal (and more modest) dream home on the French Mediterranean coast. I figured it was a 2-year project and that I would not recoup more than 50% of my remodel expenses in the equity once all is said and done. But heck, you only live once and this will be a sweet pad.

I would submit that we don’t actually know how good its bones are (unless one of us is a building inspector with access to the structure). If it’s rotted inside, there may be nothing to do but tear it down.

But I hope the beams are still solid and someone puts out the (huge) pile of cash for a complete rebuild.

The bones are good. I inspected it with my structural engineer and contractor in tow. But feel free to challenge while not knowing what you’re talking about. Lots of people do that on here.

I don’t doubt the health of the bones. It would still more profitable to build a larger new building on a blank lot. Well, unless the developer does an extra cheapo remodel. I hope that neither happens though.

There’s a LOT of facebook money floating around out there, and soon to be a TON of twitter money. Competition for SFH in the mission has been abusrd lately – and picking this house up, even at an elevated price, is not a bad risk financially IMO. If I had $3M laying around doing nothing after hitting the IPO lotto, I’d do this in a heartbeat.

And then there’s always the option of the person who wants something unique. It’s a big lot and the property is already gutted. There are many wealthy individuals in this town and not all have their eyes stuck on the potential profit number. It’s not all about business and us working stiffs have a hard time accepting this new reality.

This is not a simple project. Developers in SF have deep pockets. My guess is that this sold to a dev, not some FB noob wishing to make a statement.

“FB noob”

Some have been around for a while. They’re not all 20-somethings. Plus there are many more deep-pocketed individuals at GOOG, APPL, ORCL, MSFT, etc, etc… and their employees are probably in their 30s/40s with already 1 or 2 purchases under their belt.

I am starting such a project overseas. Upgrading the house, adding a swimming pool, landscaping. The large lot could accommodate another house at the back with street access, but I do not care for the ROI at this point. YOLO.

Wow, I would love to be able to just throw that kind of money around like this. When I buy a house, I always have to have an exit strategy and make sure it could be cash-flow positive in case the flip doesn’t work exactly as planned.

It’s not a flip. I am in my 12th purchase and 8 sales. At some point you have to do things not for the money but for yourself.

And yes, I have an exit strategy. None of my current projects can put me in the street if it turns for the worst.

The one thing that annoys me about renters, is that every month, every SINGLE month, there is a struggle to get the rent money, in full, and on time. Who lives their life like that? Renters… that’s who.

Other than that, I also enjoy accumulating and spending the profits. But the attraction of a flip is a big chunk of cash, all at once. That is ever-so-sweet when it happens.

I have been decently satisfied with all of my tenants.

I have completed a full transition to furnished/seasonal/less than 12 months rental mostly through Airbnb as well as other local specialized web sites. This is mainly to avoid the long-term tenant trap in rent controlled cities, but also to be able to cherry-pick the right tenants. And I get to live in and visit my small enterprise by rotation.

Airbnb for a few months at a time works great in SF, with all the newly transplanted tech kids and their generous relocation allowances (I love that Google cheese). Plus they’re very considerate and not the people that the SFTU will cater to.

Sorry to hear of your tenant woes Jimmy. I only got stung once when my best tenant sublet to my worst. She turned out to be a con artist. Now I know to vet every resident, even sublets.

Well, I’m not really getting “stung” so much as its a constant headache. They do all pay. In the end …

Jimmy, where in gods name are your props? Richmond? (Kidding 🙂 All my tenants are SF professionals and I’ve never had any issues with late rent. I love rentals and hate flips- you put so much effort to renovate, then have to sell it off. Besides, renovations is real work! If I’m gonna bother doing that, you bet I want to keep it for the long run. Collecting rents and dealing with (good) tenants pretty much amounts to the 4 hour work week.

lol- the point is that this property could be developed into a profitable multi unit project (while keeping the Vic.) Vanity money usually goes for a run down SFH, where you can gut/expand all you want. Why in gods name would even an idiot want to blow a $1mil lot on a side pool or kale garden. Just get an SFH with a big back yard and be done with it. If you really want space go to Napa, etc. and farm your ass off.

And I’d be careful with that air bnb shit, not legally kosher, plus your neighbors will probably hate you. I’d never do that in the city. But, I do love renting to “FB noobs” etc., as they always move on in 1-3 years anyways.

Oh yeah, I should have mentioned the keys to getting the rent on time:

1. Make sure the contract defines a late payment penalty. Define how interest will accumulate for really late payments.

2. Consistently and objectively enforce #1. You’re not being a meanie, just conducting normal business.

You probably already have #1. #2 was hard for non-professionals like myself but I found that without enforcement #1 quickly becomes meaningless. Yeah, cut them some good will slack the first time they’re late, though hold the rope taught after that.

They are SFHs on the Peninsula. Good investments in terms of capital appreciation, but the tenants themselves are always sort of iffy. “Professionals” is a word that has been greatly devalued. I should just be meaner, you’re right. The contracts only specify late fees after 15 days. Guess what, I get paid consistently 2/3rds by day 6, the rest on day 14. Ah, well, they are leaving anyway.

I was thinking of getting a building in the city, Ellis Act’ing it, and then putting the entire building up on Airbnb as furnished rentals. I’m sure I’d make a lot of friends in the neighborhood that way.

Vanity money also goes into vanity neighborhoods. This is not one, it’s got lots of drugs, bums and prostitutes.

Not to mention that $3 mill goes for a really nice house in Noe Valley. If you have that kind of cash and want a pool, buy a weekend home in Marin or Sonoma, you’ll get to enjoy the pool way more often, and won’t have to deal with crack hos on a daily.

My money is on a developer as the buyer, I’d be happy to give odds to anybody who wants to bet otherwise.

Maybe the buyer is a pimp who wants to watch his ho’s without leaving his crib?

Much more likely that the big house will be cut up into apartments and another building gets built next door with … even more apartments.

49yo hipster,

Why in gods name would even an idiot want to blow a $1mil lot on a side pool or kale garden.

Well, you would probably do it on a 100K lot. I am building a pool on a 200K Euro lot in France. Some would consider it on a 1M lot. Different scale. Different means. Zuckerberg is not rebuilding up his manse to property line, is he?

And I’d be careful with that air bnb shit, not legally kosher, plus your neighbors will probably hate you. I’d never do that in the city.

For 2+ month, you’ll have less turnover. for legality, NY only made rentals that are for less than 1 month, fyi. So far so good, but filtering candidates thru linkedin profiles and FB really helps. Also, most people want to keep their airbnb rep pristine.

2 to 6 months is typical to corporate rentals, mostly relocation while the newb settles down in his new job and starts to hunt for cheaper and more permanent housing. I got wind of the relocation policies at some of the big tech and they’re perfect for what I do.

Jimmy- OMG 15 days, practically a credit card! Definitely do 5 days. I set a 5% penalty, but have never had to enforce it. Another trick, try to hook them in on auto pay. Chase has quick pay, and it’s easy and free. Push for this stuff when negotiating, as people are most flexible then. One thing I find with rentals and tenants, inertia carries the day. Have it work in your favor.

Lol- yeah, going for 2+ month corp relocs helps a lot. Plus those guys are busy starting new jobs, not partying around with 40 ouncers. I thought you were going to rent to budget euro tourists week to week 🙂

Mike- this one isn’t a great rental play. More a flippers gig, and I can’t be bothered with that.

I was thinking of getting a building in the city, Ellis Act’ing it, and then putting the entire building up on Airbnb as furnished rentals. I’m sure I’d make a lot of friends in the neighborhood that way.

I thought about it as well. There were these 2 incredible buildings on SVN (that were mentioned this spring), with 3 humongous flats in each. 1.3M was a very decent price but the units were packed with low-paying tenants. An Ellis seemed the ONLY way, knowing that the buy-outs would be 100K+ for each unit and there would be that one bad apple with “community support” aka SFTU Equity Extortion Team ™.

I chickened out, and went over the pond to catch the market in its nadir instead.

@lol: The only wrinkle would be if one of the former tenants found their old place on airbnb, then moved in for a month… and refused to leave and tried to claim they could pay at the old rent.

However, at $200/night, they first month’s rent would probably be more than they could afford.

lol: “I am currently planning up my personal (and more modest) dream home on the French Mediterranean coast.”

lol: “I am in my 12th purchase and 8 sales. At some point you have to do things not for the money but for yourself.”

lol: “It’s not all about business and us working stiffs have a hard time accepting this new reality.”

Just because you are sore from counting all your money and patting yourself on the back doesn’t mean you are a “working stiff”. 😉

Another “wrinkle” is having activists showing up at your door and shouting your name, posting about you, etc… It has happened a few times lately notably in August in support of a Castro tenant who is getting Ellis-ed this month, or the picketing for the Lee family this week. Then your name is everywhere and your rep is cast into stone. Pour vivre heureux vivons cachés as they say in the old country.

Rillion, I still have a day job. I started from zero 16 years ago, fyi.

Well, my name is common enough (sort of like “John Smith”) that it gives me a degree of anonymity. I’ve never felt the need to hide anything … but then, there was nothing much to hide. That may change.

Only one of me in all of CA. Tough luck, I can’t go crazy like other specuvestors.

Just a little good natured ribbing lol. Few ‘working stiffs’ that I know talk about the multiple properties, how much of the year they spend in Europe, and building dream homes on the French coast. Just a little pet peeve of mine that goes back to the silliness of how people refer to their ‘class’ in america. We apparently have 1 poor person and 1 rich person and everyone else is middle class working stiff cause there is someone richer and someone poorer than them…

I searched and found that there are at least four other people in the county with my exact name (including middle name), one of whom born the same year … and that is just the ones with criminal records (some quite extensive)! There are probably others I didn’t find in public records. If anyone complains about something, I’ll just claim it was that other guy … I think it’s a foolproof plan.

So what do the missionistas on this site think 1321 S. Van Ness will sell for?

@observant neighbor:

I will guess $1.5M

@Brian, do you think the buyer will be a developer who lifts it up and adds rooms below, baths on upper level, and blows out kitchen to deck . . . or an end-user who uses it more or less as-is. As an expansion/flip I doubt it would be worthwhile unless there’s a market for $3M homes on canyon-like lots on SVN. Maybe there is–a scary thought. The building is gorgeous.

1321 S. Van Ness is not going to sell to a developer.

@observant neighbor:

I would guess closer to $1.7M

Don’t know why all of you’z is fussin about name recognition. If you Ellis elderly, you have a chance of getting on the stfu radar. Unpleasant, but it’s all legal so keep cool and I wouldn’t worry about it.

OTOH ellising a bldg and than trying to airbnb it is a recipe for a lawsuit. If you Ellis you can’t rent the shit out period (for whatever years.)

As for owning multiple props in the city, I guess it all depends on one’s personal circumstances. I know for me priority #1 was not having a job. So I achieved that about 10 years ago and it’s a blessing. But as for having an elaborate lifestyle being a “millionaire” ain’t what it used to be. Especially in this area, I know plenty of PAM’s- poor ass millionaires needing to work to pay the mortgage. My solution was to have reasonable expenses, which was helped a lot when I brought 10 years ago in the mish my own residence. I now pay a fraction of current cost to live in a hood that I really like. If I had an 80% mortgage on our place with today’s values, I’d be screwed big time. Picking your priorities is critical to astute financial planning. And a little luck never hurts as well 🙂

“recipe for a lawsuit” yeah… ok, but how many years will that take to play out? 10 years including appeals?

I think I could make the ROI work even with recurring legal fees.

If you Ellis elderly

Well, newsflash, the folks with the most outrageously low rent will be the elderly as well as the most resistant. And their lawyers will use all the tricks in the book.

I’d do the same if I were in the situation. Then again, I would have already purchased my own home.

Jimmy- city can always shut you down pronto, then a few years after legal plays out, you’re on the hook for a few hundred grand. Not the cash flow model I’d like to follow. Blatant housing lawsuits is this city can ruin a small landlord.

Lol- yes, but it’s fully legal. Just put it under an LLC to hide your name, and don’t go there during protests!

I share your pet peeve and I completely agree that it’s silly, but you have to understand it happens for political reasons.

Anyone interested can easily go out to the U.S. Census Bureau’s income tables, open up the summarized data in any commodity spreadsheet program and see that, in 2012 dollars, the third quintile’s household income mean is $51,179 (this is a national number).

If we call the middle quintile “the middle class”, that means all those below that cutoff by definition are the lower class and those in the top two quintiles (the fourth quintile’s mean is $82,098), are the upper class. It’s really not that hard to do the arithmetic.

From the L.A. Times earlier this month, Amid slow economic recovery, more Americans identify as ‘lower class’, money ‘graph:

If almost everyone thinks of themselves as “middle class”, that misapprehension obscures where the real (class) lines are drawn and hence lulls people into not noticing when their (class) interests are being trampled on.

Back in August when former Sen. Rick Santorum was going around saying that no one in America should be using from using the term “middle class” because — he claimed — that the United States has no social classes, that was a rhetorical tactic designed to bring about false consciousness, nothing more.

The evidence is growing that people aren’t buying it.

You’re right, Brahma. Mark Zuckerberg is in a meaningfully similar “class” as a family in SF or Manhattan with a household income of $83k.

So long as it helps you feel righteous.

49yo

Yeah, I could do that. But one problem is that anyone can find out who you are by doing some simple investigative work. I’ll stick to my “do no evil” principle, even though I could become much wealthier by mothballing my personal conscience. I’ve been lucky and moderately successful so far without destroying any lives (disclaimer: that I know of).

Brahma

Yes, almost everyone considers himself as middle class. At the top, it’s because of the fear of “class envy”.

I grew up in France which is the home country of this phenomenon, symbolized by the luxury tax, the neighborly hatred of someone with a better or newer car or a nicer house. It’s natural, recognizing your own envy kills your self-esteem if there’s nothing you can do about it, and you have to convert it into disdain or mild hatred or punishing policies to make this acceptable.

It’s especially visible when you are among a group that all started from the same background and one guy does better than the others. It’s cultural, and SF in many ways is a bit like France. Renter mentality is one major source of this I think.

Jimmy wrote:

Didn’t try a public records search, but just for kicks I did a quick web search on the name of the guy currently Ellis Act evicting the elderly couple from the rent-controlled Nob Hill apartment so he can flip the apartments in the building into high-value TIC units.

I even added in “San Francisco” and “building owner” and still got over sixty five hits on LinkedIn alone. So I think Jimmy’s on to something if you as a flipper have a fairly common last name and you want to get into the flip-to-TIC™ game.

If the owner of the building on Jackson has Jeff Bezos-style private security following him around in a year, well, we’ll know the plan was unsound.

Speaking of searches, the property transaction finally hit the recorders website. And the winner is… 837 SVN LLC. Financing provided by California Property Funding LLC. There are two different agents for service of process for the LLCs, but it looks like they both are from the same law firm. Anyone want to send off a check to the Secretary of State to find out the actual owners?

^ my guess: flippers. So, who cares. Flipping = temporary and short term gains, plus it’s rather boring IMO.

Lol- I didn’t bring up the Ellis act as a way of doing business, you did. It’s a non issue for me, as I intend to hold my properties, and ellising them precludes renting them for a number of years. Circumventing that law is very risky, given that any number of non profit pro tenant organizations can rat you out and sue you.

Flippers so who cares? boring? It may not be your thing but it is not boring and this site would be a lot less interesting if everybody bought and held so I think lots of the readers here care. If this place is bought by a homeowner to restore and a pool goes in behind the fence we will never get to see it restored. If a flipper bring it back out everyone can blast them for removing all the beautiful Victorian character inside this place and then the thread can devolve into a Dwellified techies and their real estate agent lapdogs have ruined SF discussion That’s not boring.

Flipping, when it works, is the closest thing to getting free money I’ve ever done. Just sign some papers, wait awhile for the remodel to get done, sign some more papers… and then tons of cash lands in your account!

That might be boring to a 49 yo hipster… but it ain’t boring to me!!

1 – Buy house

2 – ???

3 – Profit

Smells like 2005 to me 😉

This place is not a flip. A flip is a low investment (less than $50K) followed by quick turn. That means paint, landscaping, oak floor restoration, and other superficial stuff. The standard stainless and granite kitchen redo at most.

This property will require serious redevelopment. A greater risk and hopefully larger reward.

@lol, you forgot a few details but here is the general plan:

1 – Buy house (at 60% of market value)

2 – Get in a crew to dress it up — floors, walls, garden, kitchen, bathrooms etc.

3 – Sell at market value

4 – Collect profit, repeat.

Yes, with 2 pre-requisite:

1 – you have access to fixers at 60% of market value. Watch out for too many flippers hunting too few fixers.

2 – the “market” is going your way during the time you did the redo

Right now, it’s still pretty lucrative to do flips, because even though you might overpay for a fixer, the market will still go up enough to make it worthwhile.

I think we’re approaching the time when the expected market increases will not be realized and a fixer will be boring again. 30% a year (even 70+% for Oakland) is not sustainable. Better speed up those flips.

lol, I’m not a real estate bull, but I strongly suspect that the market for flips (to invoke John Maynard Keynes) can stay irrational and unsustainable for longer than you think it will.

A lot longer.

I really do wish there were a more robust market of private lenders offering shared appreciation mortgages, so there’d be a corresponding derivative market where speculators could bet on this.

In anticipation of some decline in the availability of low-priced fixers, I am already considering building a 6-unit condo development down here on the Peninsula.

I know that is uncharacteristic for me as it involves actually doing something productive but it had to happen eventually. Engineers just have this natural urge to build things.

“I really do wish there were a more robust market of private lenders offering shared appreciation mortgages, so there’d be a corresponding derivative market where speculators could bet on this.”

This sentence gave me the retard tingles.

Sparky- “then the thread can devolve into a Dwellified techies and their real estate agent lapdogs have ruined SF discussion That’s not boring.” Good point. I rather enjoy those 🙂

Regarding flips in frisco. Very few just throw paint/carpet/ikea cabs/cheap Chinese granite into a quick flip. This ain’t Phoenix, Vegas or the Central Valley on boom/bust sterioids. You’re normally talking about expansion, new concrete, steel, not to mention tenant buy outs/Ellis evictions.

I can tell you the dudes who brought last year and flipped in the mish made a killing; 1$mil+ on some deals. Rent controlled Central American tenants + Ellis + high end renovation + Google-hipsters = phat profits. But already the fixers are going for a lot more around here, and the neighborhood is up in arms, like in 1999-2000 about gentrification. The easy profits won’t last and the social and moral friction is growing by the day.

Plus flippers usually need to 1031 into another property to avoid mega taxes. And they need to keep their crews employed. So they sometimes buy lukewarm deals to meet those demands. A poor deal can equate to working hard for 1+ years and making less than $100k; loose money if the market turns. That’s not investing. That’s a hard, stressful job IMO.

Looks like this Ellis evictor is getting outed: http://missionlocal.org/2013/10/royalty-of-the-mission-art-scene-faces-eviction/

It’s going to be a bumpy RE ride in the mission, that’s for sure.

Ellis evictions are legal and exist for a reason — as a response to onerous rent control statutes. The owner has the right to “go out of business” if he so chooses. The fact that years ago, someone even had to resort to litigation just so that landlords could have the right to stop doing business, that in itself is madness.

The Evil Evictor cited above is acting within his very narrow legal rights as a property owner in SF. The true crime is that property owners have so few rights and have to resort to extreme measures like the Ellis Act in the first place.

Way back on Sep 26th, lol wrote:

No, he isn’t.

Instead, he recently paid more than $30 million in total for the four residential properties located next door and behind his own 5-bedroom pad in one of Palo Alto’s toniest neighborhoods and then leased the properties back to the existing families that live there.

^indeed.

It’s interesting he’s putting a higher price on peace of mind than self-aggrandizement. We’ll see how long this lasts.

I think he’s still in the infancy of his billionaire years. Many ultimately end up being tech pharaoh like Ellison.