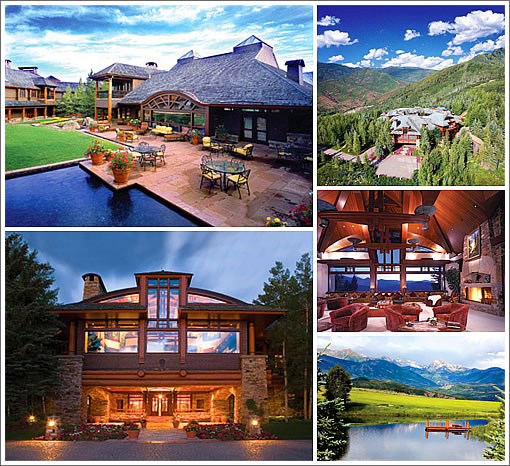

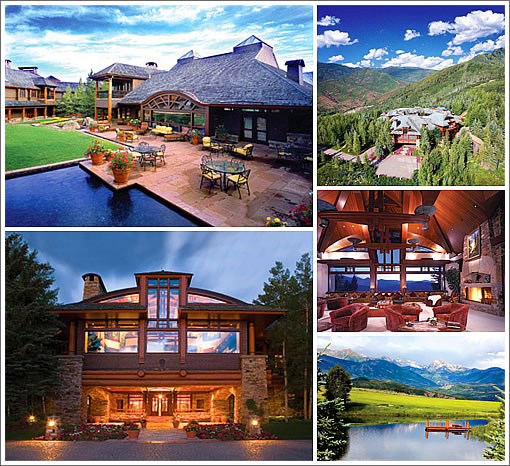

Hedge fund manager John Paulson has purchased the 90-acre Hala Ranch in Aspen, Colorado along with a separate 38-acre parcel in a deal valued at $49 million.

Built by Saudi Prince Bandar bin Sultan, Hala Ranch includes a 56,000- square-foot main house and hit the market in 2006 priced at $135 million.

While $49 million isn’t chump change, it is peanuts compared to the billions Paulson made betting against housing in 2007. Damn those bitter housing bears.

∙ Paulson Buys Saudi Prince’s Ranch in $49 Million Deal [bloomberg.com]

∙ Hala Ranch Slideshow – $135,000,000 [wsj.com]

From March of this year in the WSJ, Some Good News for Paulson:

Even if he keeps losing money (which I don’t have any reason to believe will happen), he’s still got enough liquidity to live like a Saudi Prince for the rest of his life even if he closed Paulson & Co. this year. That carried-interest loophole for financial types can work wonders at large values for AUM.

“John Paulson bought Hala Ranch, a 90-acre and a separate site in the town for $49 million. The ranch, built by the prince about 20 years ago”

It was obviously overpriced. Seems like the Saudi Prince made out on this deal.

This looks like Ahwahnee hotel. Let’s seize it and turn it into a lodge for common people.

Why is this guy paying 15% on his income while the rest of us pay 30%+?

He’s paying 15% because he’s smarter about his tax strategy. You can do the same.

Lol, don’t you think people who run businesses deserve to pay less tax? Don’t they take the risk and provide job opportunities for others?

On a related note, do you think it’s fair for one person to pay 75k in income tax (on 250k in earnings) but another to pay 750M (on 4B in income)? How is that fair? Why should one pay 10000X more tax than another?

Soccermom could definitely invite some friends over for wine at that pad.

Longtail, you have a LOT of homework to do.

read up!

Can someone really in the know (prove it before you comment) explain where the $20 billion in profit came from? Did it ultimately come from the feds giving banks money that then paid out on the insurance that Paulson bought against defaults?

From whose pockets did the $20 billion come from?

Even if you accept just for the sake of argument the Objectivist dogma that “people who run businesses deserve to pay less tax” because “they take the risk and provide job opportunities for others”, it’s still a logical leap to say that someone running a hedge fund “provides job opportunities for others” commensurate with the difference in taxes paid relative to other types of businesspeople.

Someone like Elon Musk is not engaged in the same kind of business enterprise as John Paulson.

Is it “fair” that Safeway charges both me and Warren Buffet the same price for their groceries?

Fair = I want more money for my pet government programs.

“On a related note, do you think it’s fair for one person to pay 75k in income tax (on 250k in earnings) but another to pay 750M (on 4B in income)? How is that fair?”

Yep. The guy making 4B receives a WAY bigger benefit from the services the US Guv provides, from protecting the high seas so commerce is smooth, to regulating the financial markets so they are efficient, to building highways and airports so goods can travel, to protecting our borders and policing our streets so that citizens are safe and productive and spend/save money rather than having it stolen by thieves, to educating the populace so that they are productive workers and consumers.

Let’s consider the alternative: determine the lowest $ of taxes the poorest citizen can pay (that would be ZERO) and assess the same to everyone in the name of “fairness.” Yay, we all pay zero taxes, and that will create a sound and safe government and society!

http://www.youtube.com/watch?v=OvzePsDYv7k

Uh…I don’t know about “obviously overpriced”. If it were, wouldn’t you expect someone who is “obviously” financially savvy to drive a hard bargain when negotiating the sales price?

Why do I say that? Because I read this in Vanity Fair a while back (on dead trees); Hamptons Overdrive: While much of America worries about foreclosure, John Paulson, who made $3.7 billion shorting subprime mortgages, has plunked down $41.3 million for a Southampton estate.

Emphasis added. I guess you can take this story two ways.

Either Paulson is one of those price-insensitive “wales” you overhear real estate agents talking about at the coffee shop that falls in love with a property and will pay asking to get it, regardless of the overall circumstances, where in this case “asking” is what Propp paid in 2007 plus transfer tax.

Or Paulson was a shrewd negotiator that took into account the fact that Propp was in no position to play the part of the patient investor and wait until the market recovered while maintaining a mansion with a household staff (read: servants like in Downton Abbey just fewer of them) and thus negotiated a favorable price, considering that Propp wanted $12M-15M just for the two accessory lots, to take the entire property off Propp’s hands, at a 14% discount off the pre-2007 sale asking.

I don’t think the more likely scenario is “obvious”.

I choose to look at the fact that it was listed for 135m and sold for 49m. This seems to me a case of obvious overpricing. All of the is tounge in cheek as there are only a handful of buyers in the world for this “home”.

“All of the is tounge in cheek as there are only a handful of buyers in the world for this “home”.”

Precisely 1% of the buying population to be exact.

Maybe 1% of 1%. There’s no way that three million American’s could afford this place. Well maybe if they pooled their funds they could.

Milkshake: I agree with you that there is no way the top 1% of the U.S. income and/or wealth distribution could bid on this place. But, you seem to have missed the part about “…handful of buyers in the world…”

OK, then make that 1% of 1% of 1% considering most of the world lives below the American idea of poverty.

According to Wiki there’s 93,100 people in the world with more than $30mm.

So .0014% of the world population has more than $30mm. And you need a lot more than that to buy this place.