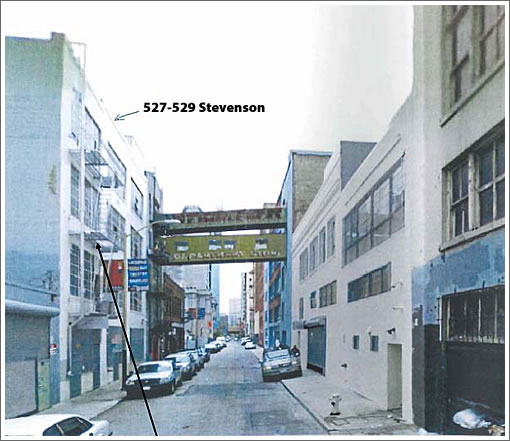

Currently vacant, as proposed the 42,600 square foot former garment manufacturing building at 527-529 Stevenson between 6th and 7th Streets will be converted to a mixed-use building with 67 residential units, eight tandem off-street parking spaces (currently four individual), and a 210 square foot ground floor commercial space.

A few of the “issues and other considerations” associated with the project per Planning:

The project proposes a dwelling unit mix of 48 studio units with lofts and 19 one-bedroom units with lofts. The studio units range in size from 250 square feet to 380 square feet in area. One‐bedroom units are either 440 square feet or 550 square feet in area. The project does not provide any units that are two‐bedroom or larger. The Planning Code does not require a specific unit mix in this area. The lack of family sized units is acceptable for this project as the location of the project, a small back street in an area of industrial and warehousing uses, is less desirable for family housing. However, the area is expected to increase employment in the technology sector and is a suitable location for housing young professionals.

The project features both one bedroom and studio apartments and provides 10 affordable dwelling units on‐site. The one‐bedroom apartments comprise 30% of the total units in the project but represent only 20% of the affordable units provided. The project should provide a minimum of 30% one‐bedroom affordable housing units for a total of three such units.

The project provides a Code complying number of bicycle parking spaces. However, 10 of the bicycle parking spaces are within the inner courtyard area and are not convenient to the building entrances and exits. The bicycle parking spaces should relocated as necessary to improve convenience for building residents and guests.

That being said, the Planning Department recommends the Planning Commission approve the project (with a few conditions) based on the following rational:

The project provides new housing in the Mid-Market area and provides an alternative to the Residential Hotels in the area.

The project develops a new commercial space providing business and employment opportunities for local entrepreneurs and area residents.

The project will provide 10 new affordable housing units on-site.

The project meets all applicable requirements of the Planning Code except for the dwelling unit exposure requirement of Section 140 from which a Variance has been requested, and…

The project is desirable for, and compatible with the surrounding neighborhood.

UPDATE: Floor plans for a few of the smaller units as proposed:

∙ 527-529 Stevenson Street Determination of Compliance And Plans [sfplanning.org]

This is a loser. Artists that make lots of noise and have no money live in industrial areas. Young people who work in “industry” – internet software – romanticize industry and think living within an industrial zone is cool. It was for a short time in the dotcom bubble – look how cool business is, and I live surrounded by businesses! It isn’t, and people buying these types of places are making a mistake.

Sounds like Cubix 2.0 … and we all know how that ended (bankruptcy).

This doesn’t sound at all like Cubix. That development had only studios, only a handful of which had storage lofts, they were all much smaller than 380 sqft, and there were no one bedroom units.

The idea that disintegration improves communities is unproven. There is great demand for residential units near commercial opportunities, and these units can take a lot of pressure off transportation infrastructure.

One of the biggest drivers of this are social factors. The kind of right-thinking people who think urban living makes no sense are forced to live elsewhere. As a result life without these snobs is that much better. There is a price to be payed in terms of inconvenience and noise and so on, but it can be worth it to have a life that makes it easy to get work done and not have to worry that you neighbors will be freaking out over any aspect of your lives that they haven’t already seen on television sitcoms.

Make sure we preserve the metal bridge next door before it falls down. Great reminder of the area’s industrial era while the area is being turn into office and residence.

I have to say this does sound a lot like Cubix to me. However, I don’t think Cubix or this project are a bad idea, Cubix was just poorly priced.

If they can price them correctly, for fresh out of college graduates just starting out with little for down payments and ‘starting’ salaries, they will be fine.

Of course the trick is getting that to actually pencil out for the developer (good luck with that).

Agree with badlydrawnbear….issue isn’t product, it is price.

That said, projects like this make more sense as rentals rather than condos, because very few people want to stay long enough to make the transaction costs make sense, and we can no longer rely on the “starter home” concept. Nothing in the application that talks about condo units, btw, and it appears to me that the intent is to rent these.

It’s not the best neighbourhood to be in anytime of day. I follow bluoz.com with the on-the-ground coverage around the Mid-Market area. It’s quite sad and entertaining sometimes.

This is an important development in the right location- the area has to have more market rate housing options given the overbalance of social service housing. Mid-market will never be viable without a more balanced community. More like this, please. Separately, I’m not quite understanding how one lives in 250sf, but small is trendy — so they may have something going on.

Nice way to store overstocked hipsters until they grow a brain.

What in the world does “we can no longer rely on the ‘starter home’ concept” mean, exactly? That one can’t buy a home, ever, because one can never afford to buy a home as an entree into the home marketplace?

Does that mean all workers, including the ones who work at dot comes and who earn substantially more than the area household income median can’t buy a home until the company they work for has a Linked-In level IPO and their vested stock options become worth enough that they can buy a million dollar SFH?

I don’t have a study handy to prove this and if someone has one please post a comment, but just from being in the area and being informed since the crash in 2000, The hard fact that market fundamentalists never talk about is that most, if not the overwhelming majority of dot com workers will never cash out their stock options for more than a 30% gain, much less the amount required to buy a home such as 526 Duncan.

UPDATE: In reference to a reader’s comment, floor plans for a few of the smaller units have been added above. Keep in mind the sleeping loft space isn’t counted in the official square footage referenced by planning.

I know of buildings in that alley that house illegal lofts subdivided into rental rooms.

Don’t reference Cubix for comparisons here.

Look at the Book Concern Building.

Same hood. Same idea.

https://socketsite.com/archives/2006/07/book_concern_bu_1.html

“The hard fact that market fundamentalists never talk about is that most, if not the overwhelming majority of dot com workers will never cash out their stock options for more than a 30% gain, ”

I’d prefer “advocate of the benefits of markets” rather then “free market fundamentalist”, but I’ll point out that I in fact did write a number of posts pointing out that typical option payouts are far far less then boosters would have you believe.

When I see some argument like the recent “take the number of options and divide by the number of employees” this is so off base, that I’m pretty sure that the person making this argument has no real connection or involvement with tech, nor actually do I think that the target audience is anyone involved in tech, since they would see right through this as well. (In fact if you just had good common sense and awareness of income distribution in the US you would probably end up doubting the statement above) If you substitute the word “wealth” for “tech” in the above you’d see a similar pattern as well.

So does it really seem like this is some grand conspiracy of fascist hard market fundamentalist bankers or just salesmen talking garbage to make sales??

It is cute for 1 person. What is the fair price to rent? or to sell?

The Book Concern was initially conceived as student housing- it’s across the street from Hastings. Like Cubix, a great idea, flawed business plan.

Seems like Cubix was new construction, no? Whereas the Book Concern Building was a conversion, so I agree with rubber_chicken that the latter building is a more apt comparison.

As far as rocco’s flawed business plans diagnosis, this has bothered me for a long time when it comes to condos and lofts, etc. Doesn’t the bank making these kinds of loans have a team of seasoned, in-the-trenches analysts who have had a bit of formal training in managerial and cost accounting going over these business plans with a find tooth comb before making the loan? What are these people getting six figure salaries for, exactly? Is this rocket science?

@ Brahma – What I meant by the “can’t rely on the “starter home” concept” is that the idea that was sold in residential real estate for many years was get in to whatever you can afford, ride the equity train, trade up, repeat.

That truism ceased being true a while ago (and was always oversold by the industry, and really depended on great market timing). I’m not saying it will never return, but with current economic conditions and demographics, it’s certainly not currently wise to think that way. Currently if you buy a little shoebox you might get stuck with it for a very long time.

I wasn’t trying to be provocative. Sorry if my shorthand set you off.

These will do well as rentals– there certainly is demand right now.

curmudgeon, when you put it that way, I actually think you’re right in the context of this project and I shouldn’t have lept to respond. Of course, a lot depends on the selling price of the completed units.

I still like the idea of making units available for buying that are not priced into the stratosphere for people who want a place to live and aren’t betting on appreciation. One approach to that is to bring small units to market for a low headline price, even if that price works out to be large on a per ft.² basis.

To address Wai Yip Tung’s question, units at the aforementioned Book Concern Building are asking for < $200K right now, so if they price these units at a level substantially less than that in accordingly deflated year 2012 dollars (or whatever year the developer finishes them), buyers would still have to hold on to them for a while, but perhaps equity appreciation isn’t completely out of the question.

On the other hand, the Book Concern Building doesn’t have parking, this project will, so I’m sure that the developers will probably be asking a premium for these. Say in the mid-300,000s, and that’s a guess.

No stairs shown in any of the floor plans.

How are you supposed to get to the ‘bedroom’?

There is a flat little rectangle shown at each of the mezzanine walls in both the upper-level and lower-level floor plans and I have a sinking feeling that this represents a ladder.

Well…. at least anybody you bring home from clubbing on Saturday night gets a fitness test before you hop into bed with them…

“There is a flat little rectangle shown at each of the mezzanine walls in both the upper-level and lower-level floor plans and I have a sinking feeling that this represents a ladder.”

Yep.

And when you get up there, the sleeping loft ceiling height is only about 4 feet.

I appraised a property across the street (Stevenson) a few years back. For the security the owner kept BIG dogs, along with razor wire around the perimeter. He got mugged as a matter of course. I wish them luck on this one.

Those floorplans aren’t drawn to the same scale. The top plan seems larger than it really is compared to the other two.

———–

I agree with Wai Yip Tung that the passageway spanning the alley should be preserved. Incorporate it into the space of the adjacent loft: it would be a fun feature even with the tilt and could attract a higher price. I don’t even want to think about what sort of building codes apply to a legacy warehouse elevated passageway though.

the passageway is assoicated with the building to the west and is not a part of this project.

Up and coming neighborhood for the true pioneers in the Bay Area. Will definitely begin the area’s gentrification.

Got this notice the other day at work: CVS will begin construction on a new store at the corner of Market and 7th Streets in August 2012. The check cashing outlet, barbershop, and restaurant will close.

Just realized, I should provide some calculation for my comment ^^^^^

Section A-A on Sheet A-8 in the Planning Dept. Submittal (linked above)

13′-0″ floor to floor subtract 1′-6″ floor structure = 11′-6″ floor to ceiling

11′-6″ subtract 7′-6″ (7′ min. bathroom ceiling height + 6″ for loft floor) = 4′-0″

Hey Wanda at 1:46:

What do you care? Or are you just a fink, a rat? Are you appalled that some artists have the effrontery to try to survive in a city where are all of their work and living facilities have been taken over by by zealous greedy developers and turned into sham loft boxes for yuppie programmers who think they are really edgy artists?

We own a studio unit in the Book Concern Building; paid $273k, and it is now worth under $200k, which is the Assessor’s valuation for the current tax year. But … we find it a great pied-a-terre – ultra-convenient for the opera, symphony, etc., and for public transportation (the inbound 5 Fulton trolleybus now stops in front of the building). I think we are the only owners using the unit as a pied-a-terre, but we have not regrets at buying, only buying at the wrong time, so we will have to hold the property quite a while to get a return on our investment (we paid cash, and so are just swallowing the hypothetical loss – had we taken a loan I would have felt quite differently).

UPDATE: Fewer Units And A New Façade For 527-529 Stevenson As Proposed.