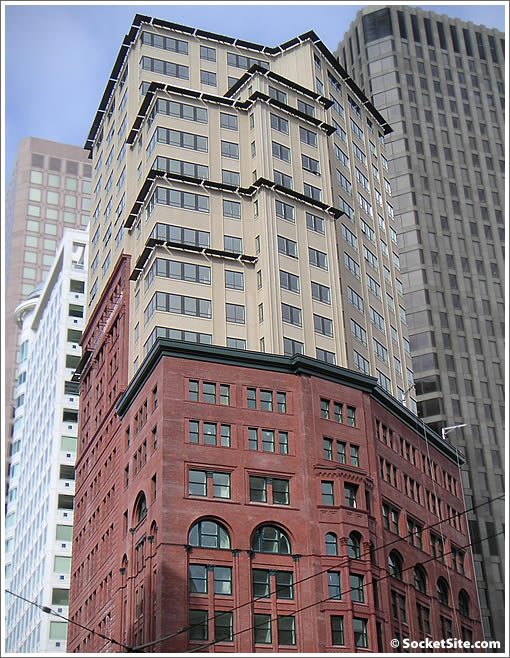

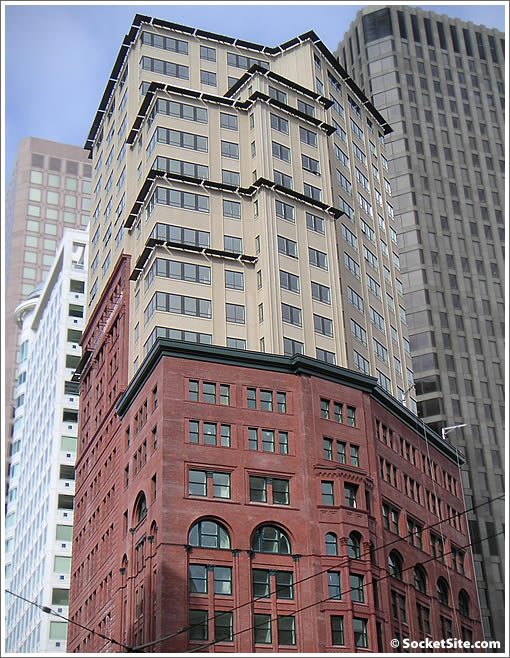

The rather ironic line from the listing for 690 Market Street #1505, a one-bedroom at San Francisco’s Ritz-Carlton Residences: “The world’s most trusted luxury brand has brought a new measure of service to one of the world’s most fascinating and engaging cities.”

While we’ll naturally agree with the “one of the world’s most fascinating and engaging cities” bit, how has this condo in the “world’s most trusted luxury brand[ed]” building performed over the past four years in San Francisco?

Purchased for $1,193,000 in 2008 by way of a $894,440 loan (25 percent down), last year 690 Market #1505 was taken back by the bank with $937,377 owed.

Today, they’re asking $699,900 for the Ritz-Carlton condo, 41 percent ($493,100) less than its purchase price in 2008 and down from a list price of $729,900 last month.

∙ Listing: 690 Market #1505 (1/1.5) 952 sqft – $699,900 [MLS]

∙ A Concerning Comp (And Empty Shell) At The Ritz-Carlton Residences [SocketSite]

The HOA dues on this puppy are just shy of $2400/month. Yes, it really is “different” here. I certainly don’t know too many people who would buy a place where their HOA dues are as high as their mortgage, so this one could sit empty for a while.

$700K seems like a good deal for a luxury 1BR in a good location. But the $2369 HOA is the zinger. Perhaps that’s why the listing photos emphasize the common areas.

We should track HOA/SalesPrice ratios. This unit could be the leader.

I think the HOA fees include property taxes. And earthquake insurance (in addition to the usual luxury condo stuff). I’d take a place at the Ritz for 699k over some ramshackle Bernal shed for 619k, as seen as another thread, any day.

41% below 2008 (which was after prices had already started to fall) is quite a hit. I’d be surprised if this did not go for around the new asking.

When I was reading this blog, I am having my chicken stew over rice for lunch. I think some of my rice & chicken went into my nose when I saw the HOA cost.

What were they thinking to have a $900,000 loan payment with $2000 HOA for a 1 bd/1.5bd??!!

What I think they were thinking, other than the fact that the building has to cover property taxes, 24-hour concierge availability, doormen and things like that, is that someone who can afford a $900k+ mortgage but can’t easily afford a $2k+ HOA dues payment is someone that they don’t want in the building. I think this is an example of what economists call signaling.

I don’t see where taxes are included in the HOA.

100% loss of the $300k downpayment. But what must really sting is having been so wrong. You just know that every bubble buyer in this building thought his “investment” woud go up at least 10% a year.

Yes, that’s right: every. single. buyer.

The HOA/price ratio is even worse with below market rate units in higher-end buildings. For example I’ve seen listed in the Watermark units with a ~250k price and $750 HOA. That would be equivalent to a $2,700 HOA for a $900k unit.

Well everything is out of whack for BMR units. They need to be dealt with as a separate category especially if you’re a mortgage underwriter.

It may only be the fractional-ownership units where HOAs include property taxes. If that is the case, these are indeed very high.

Things covered by HOAs – like insurance, maintenance, doorman, gardener, trash – don’t go down in cost just because the value of the unit tanked. Of course, the same goes for those sorts of things on an SFR where the owner pays them directly rather than through an HOA. Property taxes, however, would go down. On rent-vs-own calculators, they generally let you enter a certain percentage of the sale price for maintenance costs, and it probably makes sense to use a higher percentage than was the case a few years ago as sale prices have dropped so much, but maintenance costs have not.

other than the crazy HOA, how about that crazy floor plan??? Is that the main entry next to that crazy out kitchen? Is that supposed to be the bedroom off of the main space? Looks more like a studio than a one bedroom.

I wonder what it is like to walk from $275,000 down payment?

Looks like the property has never sold to anyone. It was owed by the developer named RC Chronicle Building and now taken back by the HSBC Mtg Corp.

[Editor’s Note: The property was transfered from R C Chronicle Building to another party in 2008.]