Eleven years ago the two bedroom and three bath townhouse known as 655 5th Street #9 sold for $781,000 down in SoMa. Seven years and a thousand or two new neighborhood condos later, the 1,774 square foot unit sold for $1,018,000 in 2007 by way of an $814,400 first and a second for $152,700.

Yes, this was yet another case of only 5 percent down in the “it’s different here” San Francisco and with “only” $50,900 in equity at risk. Lo and behold, this past November Wells Fargo foreclosed on the first with no bidders at $746,547.

Yesterday the property was listed for sale on the open market for $777,900, a sale at which would be just below its year 2000 price, “only” 24 percent ($240,100) below 2007.

∙ Listing: 655 5th Street #9 (2/3) 1,774 sqft – $777,900 [MLS]

∙ 30 Percent Down Or Interest Rates Up As Proposed By Wells Fargo [SocketSite]

1,774 square feet and not a single photo can make that apparent? They could have at least taken a photo from the kitchen…

It seems like this is probably on the bottom level since it has an exterior entrance. Otherwise, I wouldn’t mind buying something like this…but not at this price.

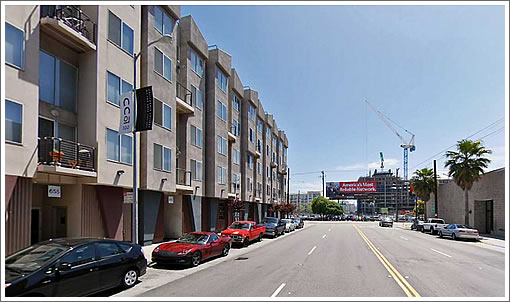

I lived in that building many years ago, terrible neighborhood for petty crime and the HOA was full of miserable human beings. No way I would pay 777k for that place. It is across from the train station and it is very loud when you have your windows open in summer.

it is different here. this is the exact same product they build in san jose or atlanta or (fill in the blank)yet this POS still costs more as REO than most places in the world.

this will always be so instantly replicable that it never makes sense to buy it unless its way cheaper than renting…imo

#20 is contingent as a short sale after several months at a price below its Feb, 2000 price, for around the same ppsft as this one.

So we’re firmly into 1999 pricing now. And the nicer homes that were worth twice as much as these are still worth twice as much of a lesser amount.

This is a complete bloodbath, and it’s just getting started. The foreclosures are starting to ramp up like they did in Sacramento when prices collapsed, and initial jobless claims are trending back up. The state is laying off workers by the hundreds and many businesses continue to suffer. Not at all a market in which anyone should expect anything but substantial further real estate price declines.

“it is different here.”

No way would anyone anywhere else (except maybe NY) have paid over 1 million for a place like this! This is why SF bubble buyers are losing far more, in dollars if not (yet) in percentage terms, than buyers just about anywhere else.

“never makes sense to buy it unless its way cheaper than renting”

anonee is right!

It’s a mystery to me how someone could pay over 1,000,000 for this place in this crappy location of the city – oh wait, it has granite counter tops.

On the 781k 2000 price, I must admit I’m stunned by that. I guess the dot-com money sloshing around went into crazier purchases than I had remembered (at least the banks were even bigger suckers in 2007). I’m starting to buy into tipster’s camp that at least for some areas we’re going to fall back further than I had thought. Anyone who pays more than about $425k for this place is looking at a substantial loss.

The location has issues, but has been getting better fast. Several buildings in the area that used to be only used for homeless camps now have busy tenants. For people who work in South Beach and may have customers in the South Bay this is an ideal location.

For me the biggest problem is the construction. These may be big, but they are seriously ugly. This kind of timber framed construction is cheap and practical, but not especially robust or durable. To top it off these were framed in the pouring rain, though to the extent that might have caused complications everything should probably, hopefully be sorted out by now. These are the antithesis of an industrial conversion.

“So we’re firmly into 1999 pricing now. And the nicer homes that were worth twice as much as these are still worth twice as much of a lesser amount. ”

sure tipples, over reach all you want. so where are the 2-4unit buildings in d5 and d6 that used to go for $500k-$700k back in 2000? since we are so “firmly into 1999 pricing now” it should not

be hard to find some examples right??

Tipster,

Post after post, day after day, your negativity is unbearable.

…and yet the market falls. Replace “negativity” with “dead on accuracy” and add “for us Realtors and developers” in your sentence, and we’ll be able to agree

Oh no!

It’s the return of the dreaded nattering nabobs of negativity. If we’d all just join our hands, close our eyes and hum kumbaya we could get home prices back into the stratosphere in no time.

um diemos,

the fact that product like this is still trying to fetch prices like this shows us that prices, though down alot, are still in the stratosphere.

and tipples, where are my 2-4 unit buildings at 1999 prices??

Tipster,

Please keep up the good work. I have followed your comments for many years now. You, and your fellow thinkers at Socketsite, helped inspire me long ago to make a wise financial decision, one for which I am very grateful, one that allowed me to profit handsomely. More importantly, wisdom such as yours prevented me from finding myself stuck in a condo that I didn’t really love. And yet, my real estate broker, mortgage broker, neighbors, and many of my friends insisted I should not sell because I would never be able to get back into the SF real estate market. Your analysis has been spot on for years now. Thank you.

You’re welcome.

As for anonrealtor’s d5/6 buildings, they are on their way: they are being bought by one last set of suckers so the bankers can get the down payment money. Happy selliing!

anonee, try:

http://www.redfin.com/CA/San-Francisco/55-Cotter-St-94112/home/917104

16% below 2003 sale price

or

http://www.redfin.com/CA/San-Francisco/2578-Sutter-St-94115/home/1959223

44% below 2006 sale price

Right at 1999 prices? Maybe, maybe not exactly, but right about there. Lots of others if you’ll just look. I’m sure you’ll find something wrong with these or any other examples, just as I’m sure I’d find something wrong with your hypothetical $500k 1999 D5 multi-unit buy.

so a.t., those are your examples? where the hell is south of alemany? nice find on sutter directly across the street from the projects.

“Lots of others if you’ll just look”.

actually i actively look. pretty much everyday when i’m in town. maybe you and tipples can dig up something? as i noted i am interested in d5(ex glen park and noe) and d6.

i think we will eventually see some crappy stuff getting puked up but from where i sit there still seems to be a strong bid for 2-4unit buildings in real sf.

“still seems to be a strong bid for 2-4unit buildings in real sf.”

Does that mean you’re conceding the point on 1-unit buildings, or is this just when you change the subject?

hardly sfr,

here’s a good example^^. this POS is REO and they still want over $700k for it.

well whaddya know, 1674-1678 Fulton

San Francisco, CA 94117

Price: $679,900. no parking and long term tenants but that’s cheaper than we’ve seen in a long time.

UPDATE: 14 Percent Below Its Year 2000 Price And Offers Anytime.

Another interesting thing to note is that 1674-1678 Fulton, which paco mentioned, is down another $40K to $639,900, but is still on the market. It’s down from a $753K sale in 2004, which was cashed out to a $1,231,162 foreclosure in 2009.

Pretty smart business if you ask me — the property certainly didn’t pencil out at $753K in 2004, so taking $400K+ out of the property helped make a certain bad investment into something positive.

What do people think this will go for?