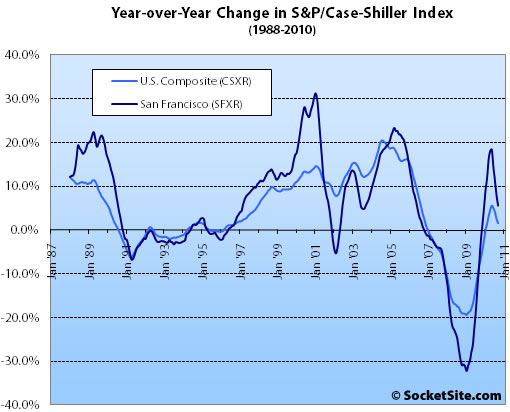

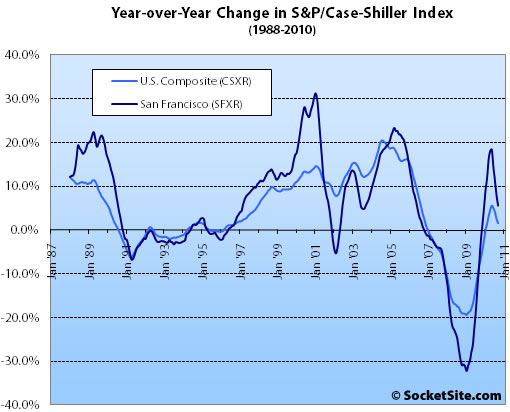

According to the September 2010 S&P/Case-Shiller Home Price Index, single-family home prices in the San Francisco MSA fell 0.9% from August ’10 to September ’10, down 35.2% from a peak in May 2006 and up 5.5% year-over-year (YOY) versus a 14.3% YOY gain reported in June, an 11.2% gain reported in July, and 7.8% in August.

For the broader 10-City composite (CSXR), home values fell 0.5% from August to September, down 28.7% from a June 2006 peak as the year-over-year gain slipped to 1.6%.

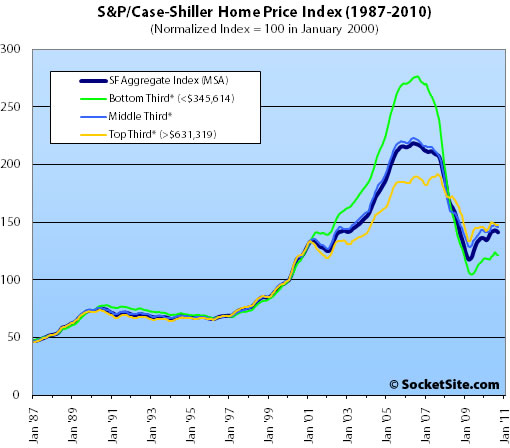

For the second time in seven months prices fell on a month-over-month basis for the bottom two price tiers for San Francisco MSA single-family homes.

The bottom third (under $345,614 at the time of acquisition) fell 0.6% from August to September (up 7.1% YOY); the middle third fell 0.5% from August to September (up 4.6% YOY); and the top third (over $631,319 at the time of acquisition) was unchanged (up 2.1% YOY).

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA returned to October 2000 levels having fallen 56% from a peak in August 2006, the middle third is back to March 2003 levels having fallen 35% from a peak in May 2006, and the top third remains just below April 2004 levels having fallen 23% from a peak in August 2007.

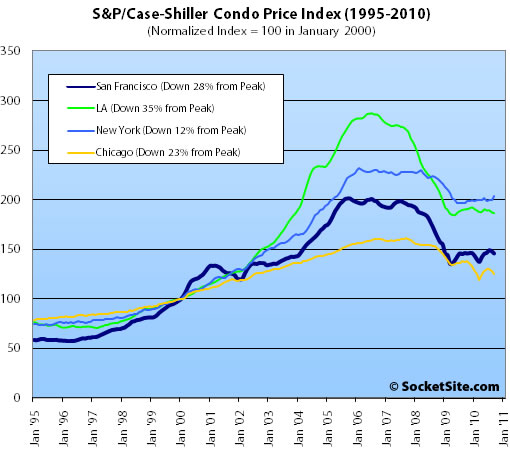

Condo values in the San Francisco MSA fell 1.5% from August ’10 to September ’10 for a nominal 0.3% gain on a year-over-year basis (down 27.6% from December 2005).

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

∙ Broad-based Declines in Home Prices in the 3rd Quarter of 2010 [Standard & Poor’s]

∙ Case-Shiller Says…San Francisco MSA Falls Across All Tiers In August [SocketSite]

I don’t post much these days, and I also find myself reading this site much less often, but I had to comment on this headline. The CS index was only UP 6% year over year versus being UP 8% last month, but the “slide continues”.

Wow, that’s a pretty negative read on things….half empty indeed 😉

Volume followed by price. Nothing surprising there. The bounce was a compound of a normal dead cat bounce and people going after Guv cheese. These 8K or 18K of incentives look like those 2 Lbs of turkey we all still have in our stomachs. It sure felt like a good idea at the time.

On the bright side, the economy is starting to recover, unemployment is a bit lower. It’s a buyers market and it will be for the next 2-3 years if nothing major spoils the recovery. I loaded up on one unit already. Next one will probably come next summer when the crazies are gone, and hopefully at a lower price than today.

Fair point, Lance, but the index has been sliding since May. Don’t worry, the CS index runs a few months behind and with the continuing slide (the post-giveaway crash is just starting to show up) we’ll soon see declines measured on a YOY basis as well.

November’s sales figures are looking like yet another big YOY volume decline, while inventory remains far higher YOY.

lance,

If you look at the YoY chart, sure the numbers do not look so grim. What all of this means though is 1) that the market has lost some of the past year’s bounce and 2) that the bounce hasn’t transformed into a virtuous bull circle as was probably hoped by a part of the audience.

We’re in for a controlled and protracted unwind with the background of never ending bailouts and monetization of bad debt. Paint drying of grass growing as tipster always says.

I think inflation will come in a trickle-down fashion, with the enriched few/emerging poor making the middle class poorer by gobbling up resources and making them harder and harder to get. Incomes will lag but follow and therefore create inflation in the medium term.

For me this means the current market is a buy as long as numbers make sense on today’s rent-vs-buy numbers. I’d pass on anything that the Google/Apple/Netflix-gotta-have-it-at-any-price-crowd wants. These guys are delusional when it comes to pricing. It’s called wealth redistribution.

I think that it was ex-SFer who uses the paint drying on a painting of grass growing analogy. Lets embellish it one level further : Like watching a made-for-TV mini series about the paint drying on a painting of grass growing.

I think that the executive summary has been the same for at least a year : deals are getting better though there’s no rush or worry about another price surge in the near future. Still some dumb money out there mating with overpriced bling properties.

ex-SFer it is. I don’t see these guys posting much lately. Post-gobbler-day nap I presume. Or maybe they’re waiting for the paint fumes to completely dissolve away.

PDGG is ex sf-er’s very accurate call.

Again, I will ask where are all the one year apples up 6%. That has to be the AVERAGE. For every home down 6%, another one has to be up 12%.

I’m not seeing that anywhere. I didn’t see it at 8% and I don’t see it at 6%. 90% of the one year or so apples I see are down.

And don’t get me started on that peak at +18% YOY. +18%? On average? Really?

just to nit pick, it would have to be an up of +18% for every down of -6%:

+18 + -6 = 12

12/2 = 6 avg

“And don’t get me started on that peak at +18% YOY. +18%? On average? Really?”

As I’ve mentioned on prior threads, the Morgan Stanley breakdown of organic sales vs. short sales/REO shed a lot of light on this.

For some perspective, this is the second highest Aug-Sept drop on record. Bested only by 2008 where the Aug-Sept drop was a whopping 3.9%. This is rating pretty high on my ugly meter. In the early nineties downturn, the worst Aug-Sept drop was .28% in 1990 and 1994.

^ Winter. Bloodbath.

^Tipster, you’re going to be sorely disappointed. Just wait..

I find that I am both surprised and not surprised at these report metrics every time. A part of me finds it hard to believe we’re not falling faster/harder and at the same time encouraged by the resiliency of the market. I’m no longer anticipating the major bust (as I think we’ve seen the biggest % drops from Peak) but I do think we are going to see some more declines cross the board. Many observers are waiting for Rent versus Buy metrics to come back into alignment, but I think that is a fools game here in SF, NYC, and other major metro markets. Especially in SF where rent is controlled and housing supply is limited.

“Bloodbath” might be too strong, but sales have been extremely slow the last couple months and that has continued into November. Meanwhile there is no shortage of listings. And recent “apples” show continuing price declines, as one would expect from increased inventory and declining sales. There is certainly nothing in the economic front to indicate that will reverse anytime soon. Lending continues to tighten (and we’ve seen the bottom on rates, although they’ll stay low). And CW has now swung 180 degrees with the consensus that is there is no benefit to buying now because prices will be lower later.

A couple of closings from today:

Down 54% from 2006

http://www.redfin.com/CA/San-Francisco/528-Lisbon-St-94112/home/1821897

Just under the 1999 price

http://www.redfin.com/CA/San-Francisco/90-Clarendon-Ave-94114/home/1351554

Tipster might be disappointed in the pace of further price declines, but not the trend itself. Maybe not a bloodbath, but lots more wealth destruction for 2003-2010 buyers. If I were even thinking about buying, I’d tie up all my downpayment cash in a 1-year CD and sign a 1-year lease to avoid an expensive mistake.

bloodbath and watching paint dry are not synonymous, FYI

I’d tie up all my downpayment cash in a 1-year CD and sign a 1-year lease to avoid an expensive mistake.

Classic.

I think the 90 Clarendon feels like a good buy. There are some deals. Not clear if something like this could / would go much lower IMO. That house probably has some incredible views!

@ A.T: Inventory is not rising and offers are not decreasing. Actually the opposite in the last week. 142 offers accepted in SF last week, highest week since April and well above the 6 month average of 104. Sales absorption (% of listings in contract) at 6.4% last week or highest in last 6 months and well above 6 month average of 4.5%. Number of new listings at 114 which is the 2nd lowest week in the last 6 months. Number of active listings has dropped below the 6 month average of 2,330 to 2,212. Data source http://www.helenazaludova.com/?p=400

Yes, of course listings are dropping right now as it is the end of November. That’s just seasonality. Comparisons with the last 6 months don’t mean a thing. Inventory is way up over last year (and recent years) as it has been for many months. And sales – that is closings, what matters – are way down compared to last year (and recent years).

Look at the last chart in the link you posted: “Listings Actively For Sale: slowly declining.” That’s the key. Inventory remains high, even in this slowest part of the year.

My current forecast is I believe prices will bump along +/- 5% or so until the next Presidential election. I don’t see a significant drop happening in “real” SF RE, i.e. D7/8 including parts of D5. I do see further retraction in the “tower” condo market in D9 as I believe this was oversold and overpriced during the bubble anyway. Rest of SF is a don’t care for me personally. No bloodbath or even slow unwinding IMO. Now if sh*t hits the fan in Korea, all bets are off.

Now if sh*t hits the fan in Korea, all bets are off.

War has historically been good for the economy. D9 Condos and condos in general as a result are likely to be a bloodbath. I actually think TICs are a good measure of the condo market in SF right now. Wish I had time to study that further.

eddy wrote:

Well. I guess that means that the war we’ve had going on in South Central Asia for the last nine years and the war we’ve had going on since 2003 that we’re trying to wind down in Mesopotamia are indicators that the economy is going like gangbusters right now.

Dow 36,000 here we come!

I wouldn’t worry too much about the recent events in Korea escalating any time soon. What happened there is that Kim Jong Il is getting ready to step down really soon and needs to make sure his successor is as ruthless and cold hearted as the prior regime. So he set up a situation where Junior had to push the button, kill a few foreigners, and put the RoK on full alert. Junior passed that test. His prior tests probably included authorizing torture and execution of a few of his own countrymen, something we’ll never hear about unless some DPRK whistleblower leaks the evidence.

A test of nerves? Or maybe just a gangland maneuver to put blood on the hands of a new recruit so he couldn’t easily sell out and make peace with the south and the rest of the world

Like Brahma says, if you’re worried about the effects of war keep your eyes on the current conflicts in Iraq and Afghanistan.

War is hell but the deep water that the economy is treading in has a far bigger effect on CS numbers.

I’ve said this every winter for several years, but I really try not to make too much of winter data. The volumes are just so low that they may not have much statistical significance. I always enjoy looking at these graphs every winter, but I just don’t know how predictive they are.

clearly, comparisons to 2009 are dicey given the amount of govt intervention that was present last year that has expired now (FTHB credit, Fed purchases of MBS and Treasuries, etc)… although QE2 is up and running now.

These poor results we currently see today were known to be in the cards for some time. In fact, I’m pretty sure I wrote about this sometime back this last summer when some posters were trumpeting the 18% yoy gain statistics.

Way back in the summer important leading indicators (such as mortgage purchase applications, etc) heralded that we would see a significant slowdown in the fall. this is finally showing up in the CS data set now. it took this long because CS data sets are based on 3 months averages in order to smooth volatile data. but this means the data is somewhat backwards looking.

based on those same forward looking data sets, we are likely to see a few near zero or perhaps even negative YOY home price data sets around January although this is not 100% certain.

the biggest question going forward is basically whether or not the economy/employment picture will improve, and whether or not the world banking system can remain liquid/solvent.

too much depends on politics, and politics is rapidly shifting right now. Thus, I will continue to abstain from making any bold predictions, although I will maintain my now 3 year old prediction that housing will continue to face considerable headwinds until at least Dec 2011. Given the tea leaves that I look at, it looks to be probably further out than that.

as lol said for me above, this is indeed like watching a painting dry on a painting of grass growing.

If you guys think these wars had nothing to do with our current situation, thing again.

The unleashing of the credit monster originated in the 2001-2002 downturn: 1 – the dot-com burst. 2 – The attacks of 9/11 and subsequent need/want to wage wars.

The dot-com burst should have been let run its course: destroying some undue wealth and let it propagate into the economy like the 1990-1992 crisis which led to the 1991-1996 sluggish real estate market where good deals abunded.

But because of 9/11, we couldn’t afford to have a deeper recession than we had already had. If you have deficits and unemployment, it’s very hard to convince people you have to go to (2) war(s). Brakes were put on the correction by opening the spigot of easy and plentiful credit associated with no real oversight. Growth would pay for the war(s), and it did in part, but it was fake growth.

Of course, all of this was done by shoving more debt on everyone’s balance sheets.

For $1 needed for the wars, we created $5 of consumer debt that created $.50 of growth. That’s roughly the proportion.

Bushies wanted financing for the wars to be as painless as can be because they knew that levying new taxes would have prevented a second term in 2004. Heck, they even gave tax cuts to everyone!

Now whoever is in charge now doesn’t know how to break it to the public: we need more taxes to pay for the bailouts + years of deferred maintenance + unjustified tax cuts.

But they won’t give it straight to us. Nope, they want to appease us with… tax cuts! Yeah!

this wasn’t just a 2001+ phenomenon. prices in sf and much of the immediate bay area pretty much doubled from 1997 to 2001. 4 years. i have a colleague who paid 400K for a 1400sf new SOMA condo in 1997 and sold it 4 years later for well over 800K. and a cousin who bought a mill valley house that also doubled. all before things ‘took off’!

i believe i posted here some time ago about a 60 minutes segment i saw in washington dc in 1999 or 2000 (just before moving here) about the out of control re prices in the bay area. i remember an interview with an indian guy who was about to spend like $300+K (gasp!) for an old 3 bdrm 1 bath home in fremont that needed work. my numbers may be off but things were already out of control.

is it totally crazy to think we may still have quite a ways to go? i don’t know.

and something else. i believe perceptions are starting to shift in the bay area. this is purely anecdotal of course but since the downturn began and until this year, i have been amazed at how the underlying perception of many (most?) people still seemed to be that you simply had to have bay area estate and it was just a matter of time until things really took off again. i’m sensing a real shift on the part of colleagues, friends and relatives in just the last 6 months or so. what might the impact be if perceptions about real estate truly change dramatically and many people feel as certain that it’s a bad investment (even as your own shelter) as felt before that you couldn’t go wrong?

on the other hand, if my observations are correct i suppose it could be taken as a contrarian indicator that we’re at the bottom.

and what’s gonna happen to prices when interest rates start going up? or maybe they’ll stay here for years to come?

as darren’s mother used to say, i have a sick headache.

Median reversion is more inevitable than negative.

I predict that when the three lines cross again, with the bottom tier median growing faster than the top tier, we will finally be in another real estate bull cycle. This won’t be for a while though.

Most of the run-up from 96 to 2001 was due to gentrification, with household incomes in San Francisco going from below the regional mean to above. This was combined with a normal real estate bull market, which California has one of every decade or so. I think that most of these gains are enduring.

The 2003-2007 runup was a credit bubble, which is still unwinding. But these things take a while, as everyone is now finally starting to realize, even the most vociferous of bears.

Mark, I agree with your general premise that the quality of commentary here has waned a bit (oh for the days when fluj/anon and lmrim/satchel would have at it with insight, information, and flair); but “negativity” is in the eye of the beholder. Many ss posters appear to believe they are are being positive, even optimistic, by cheering down prices, trashing realtor practices and mocking individual listings. For a market to be healthy, they argue, prices must return to some equilibrium with rental values. They hope perhaps even to impact the market by dissuading wavering would-be buyers with their certainties about next year’s prices (“wait till next year”; “this winter, a bloodbath”). Hence, the resulting spin on every factoid that is selected for comment. Depressingly predictable perhaps, but for me the polemic is still mildly entertaining and the information still sometimes useful.

Agreed 100% with NVJ. The runup towards 2001 was greatly justified by economic/population shift, even if some of it was the result of another bubble.

About negativity, I agree that perma-bears are showing their true colors. 1996 will not come back, unfortunately for some of us with leftover dry powder. I think prices will stabilize at around 2001-2003 prices adjusted for inflation. We’re not too far off today, except for a few emotional buys.

I lived next to a house that traded hands three times between 1995 and 2004. This was a decent house in good condition in North Berkeley.

In 1995, it sold for 325,000. I don’t recall the asking price.

In 2000, it was placed on the market for 525,000, but sold for 753,000. A 130% increase in 5 years. This was before the bubble.

In 2004, it was placed on the market (I don’t recall the price), and sold for 812,000. This was peak bubble territory, yet the price increase barely covered the cost of the sale.

At the peak of the bubble in the area, which was in 2007, it was probably worth 950,000, and is likely now worth around 850,000 (a similar house across the street with a more usable yard was a no sale at $850,000 or so after several months on the market).

The run up in the late 90’s, early 00’s was driven by dot com money, which were then kept up by great financing deals and mob psychology. The average monthly payment being taken on today I am sure is lower than in 2000 due to interest rates. Looking at sales price is interesting but the more important number is the monthly cost being committed to, which is what people are comparing to rent. I bet it is as low now in real terms as it was in 1995.

My family just purchased a house for about 10% less than it sold for 2 years ago. That price was probably double what it would have sold for in 1997. But that was 13 years ago, and taking interest rates into account it is probably only slightly higher, but with higher incomes in the area it probably isn’t so different. Our monthly payment is about 15% more than renting an equivalent house – yet as in many parts of the bay area, there is no equivalent house to rent due to the variety of the housing stock in size, quality, and desirability.

It’s interesting to see the majority of the appreciation was over by 2000.

the biggest question going forward is basically whether or not the economy/employment picture will improve, and whether or not the world banking system can remain liquid/solvent. — exSFer

I think it’s pretty clear at this point that our government will not let the banking sector fail and will do everything in its power to get the economy / employment going again. There is a tech bubble raging right now and make no mistake that SF/Silicon Valley is at the heart of things.

The 2003-2007 runup was a credit bubble, which is still unwinding. — NVJ

Often lost in the bursting bubble analogy is that along with the bubble effect, there is still healthy growth. So although yes, there was a bubble from 2003-2008/9 there was also real economic growth and gentrification. Sure Noe Valley blew up, but it’s not going back to its former working middle class roots / prices, ever.

The same is true now, IMO, that we are in the midst of a new social driven tech bubble and the amount of activity / growth / investment (cough: google/groupon, twitter, FB, etc, zynga, apple, HP, Yahoo, etc…) is astounding. These firms literally cannot find people to hire at any price. Feel free to ignore this reality and pretend that our economy is crashing and burning. I don’t see it. Restaurants are still packed. Hotels are boooked, Fisherman Wharf, Union Square/Westfeld still brewing with tourists and locals. And the government is hard at work trying to quantitatively ease our situation and will do so for as long as it takes.

Not calling bottom, not saying SFRE is going up up up, just saying that if you can find a deal out there and you think you are 5-7+ years stable you could build a solid case for buying a home in one of SFs Prime neighborhoods where there will be more downside protection. There are deals out there trading at the 2001-2003 price ranges. I think those are good deals and could prove good returns versus renting over the next 5-10 years.

PS: suck-it-site, by Mark is very funny. The few random posts of humor and insight make it worth the visit for me.

“(oh for the days when fluj/anon and lmrim/satchel would have at it with insight, information, and flair)”

I wasn’t around for most of that unfortunately, but I come across it in old posts, and there was some good back and forth there on occasion (although fluj is fluj and still is). There are always going to be the stupid complainers like Mark who contribute nothing to the site and probably never have other than a “there’s no bubble” comment back in 2006-2007 in the early days of this site and make a drive-by insult here in 2010 because they have never had anything substantive to say.

There is still plenty of good commentary going on here if you look for it and lots of current market news and substantive content in the posts. There are certainly people who complain that the only apples that are shown here are negative ones, but those people almost always fail to show positive apples that they claim are everywhere, so I never understand those comments.

I assume most of the people like Mark are either bubble buyers or real estate agents without business. Yes, folks, we’ve replaced bitter renters with bitter buyers. Cheers! 🙂

“1996 will not come back”

That part is obvious, actually. 1996 was the bottom of the last bubble and likely overshot par values.

The dual Bay Area bubbles in the last 10 years definitely complicate the analysis. I generally like to think of the last two recessions as the same recession with a suckers’ bull market in the middle. If you look at stock market charts, it looks like we never actually recovered from the dot-com bust, but instead used debt to hide the fact that we never recovered. It worked for a few years, but we never overcame the structural problems by hiding them with debt. Now we have to deal with the structural problems and deal with a the remains of a credit bubble.

These firms literally cannot find people to hire at any price.

Didn’t HP just announce layoffs for about 10,000 people? And a few large companies do not make the economy. Facebook is looking at moving into the campus that was formerly occupied by Sun. Those Sun people lost their jobs and Facebook is simply replacing some of them.

I have several businesses that deal with Silicon Valley organizations of all sizes. I haven’t seen any bubble. A handful of companies doing very well, which is always the case, but most of the companies we are dealing with are still cutting back/downsizing/going under. Sunnyvale class A office vacancy rate is 42.5% as of September.

Some tech bubble when nearly half the space in the center of silicon valley is vacant! Definitely getting a bit better, and a few firms seem to be doing well, which is always the case and was the case in the great depression by the way, but nowhere near a bubble.

You realtors are all alike: good times are always right around the corner so people should buy NOW and at a premium price. The inventory this season was at an all time high, number of sales at an all time low, mortgage rates have been rising, and the conventional wisdom is that prices will continue to fall. That means prices will fall dramatically.

A handful of tech firms doing well will not make up for the thousands who are struggling. Sorry to burst your bubble, it’s the only bubble those of us who live and breathe silicon valley are experiencing.

What I am seeing is a few startups on absolute shoestring budgets. Companies who would have gotten $10M and burned through it in two years now get $700K and it lasts them 5 years. They used to hire 50, now they stay at 5. They work from home or coffee shops. Pay is abysmal, but stock options are there for 5 years from now. The money is not sloshing around like it was. Probably won’t for awhile.

The good news is that the 99 weeks of unemployment is ending, so the unemployed are going to start taking jobs at whatever salaries they can find. That is what we need to start rebuilding: when wages fall, jobs return.

Tech Bubble? Only in the dreams of realtors. Those of us in Silicon Valley haven’t seen any evidence of it.

“could prove good returns versus renting over the next 5-10 years. ”

Oh good, more people telling others that short-term holding is a good thing.

May be completely off-topic (or may be not, as this might affect SF prices):

What do you think of eliminating mortgage interest tax deduction? Wouldn’t it affect SF prices more than other localities?

“What do you think of eliminating mortgage interest tax deduction? Wouldn’t it affect SF prices more than other localities?”

I think it will be difficult to eliminate it politically for one thing. It would be a great change to our tax regime if this deduction were eliminated or reduced, but it’s largely seen as sacred, so I’m not holding my breath.

The mortgage interest deduction does affect SF more than other places for two reasons: 1) people make more income here than in many other cities, so more income is being sheltered and at a higher tax rate, and 2) people’s houses are worth more here, and higher loan values create more potential to shelter. However, there is a cap to the mortgage interest, so houses here have a reduced benefit if they have a greater than $1M loan.

Right now, the mortgage interest deduction serves to artificially raise housing prices. Thus, you would see housing prices drop over time to un-incorporate the deduction if the mortgage interest deduction were eliminated or reduced because people could not afford monthly payments as high as before.

AT posted: “but the index has been sliding since May”

In the interest of accuracy, here is the NSA index since April.

April 2010 139.77

May 2010 142.16

June 2010 142.55

July 2010 143.23

August 2010 142.83

September 2010 141.54

The YOY percentage *increases* are decreasing vs. 2009 gains.

Not arguing your overall point, mind you, just correcting the statement.

Where is Marina Girl? My nominee for funniest posts.

BernalDweller, also, don’t forget that Case-Shiller data is rolling three months, so the index could have been sliding on a monthly basis since June.

Still, I think the Morgan Stanley breakdown is more instructive than the general index, as I’ve mentioned many times, which shows organic sales have been down YOY since May:

https://socketsite.com/archives/2010/08/mix_pshaw_whos_ever_heard_of_such_a_ridiculous_thing.html

fyi, I was “ed” in the above post.the “dy’ got cutoff?? But certainly not a realtor and certainly not encouraging anyone to buy at a premium. I even said as much.

@tipster, the HP layoffs were in June and it was 9000 and in the same report they indicated they were hiring 6000 so the net loss was 3k. Article ref in name link. I expect Palm acquisition will result in some layoffs as well due to redundancy, but those are employable people. Your observations about small funding just shows that technology development and deployment is more efficient. Those skills are in demand and the bay area is the center of the universe. The established companies are fighting for those resources.

I forgot to add salesforce to the list of high growth companies in our backyard dying for talent. Like I said above, feel free to ignore the fact that some of the highest growth companies in history are all right here.

The same is true now, IMO, that we are in the midst of a new social driven tech bubble and the amount of activity / growth / investment (cough: google/groupon, twitter, FB, etc, zynga, apple, HP, Yahoo, etc…) is astounding. These firms literally cannot find people to hire at any price.

just an FYI: Yahoo is rumored to be laying off right now. Reports are up to 20% of workforce, but my contacts have said it’s going to be more in the 7-10% range. obviously many of those layoffs will be in non-bay area locales, however it will affect the bay area Yahoo employees too.

they certainly aren’t struggling to hire right now.

http://techcrunch.com/2010/11/30/yahoo-layoffs/

as for google:

that ship of riches sailed long ago.

Don’t get me wrong, many people got enormously rich years ago at Google (my family included), but not many people recently

That’s one reason why they are raising salaries 10% or so… because stock options aren’t worth anywhere near what they used to be.

The great tech hope these days obviously is Facebook.

Twitter is overhyped.

Will be impossible to eliminate the mortgage interest deduction.

FAR more likely the max deductible would get stepped back: $800K in year one, $700K in year two, down to something like $400-500K.

FAR more likely the max deductible would get stepped back: $800K in year one, $700K in year two, down to something like $400-500K.

Agreed. I think they will just leave it alone. Too many politicians with $1M loans. 🙂

BernalDweller,

I was looking at the seasonally adjusted CSI numbers:

April 2010 142.32

May 2010 142.82

June 2010 141.99

July 2010 140.86

August 2010 138.68

September 2010 138.57

I.e. sliding since May.

Still more late data entry to flow in but the November MLS sales look to be down substantially from last year. Currently:

SFRs

2010: 155

2009: 205

condos/TICs

2010: 132

2009: 220

More inventory + fewer sales = lower prices, every time. As I’ve oft-noted, I don’t think SF prices will go back to nominal 1996 levels, but they will certainly be lower a year from now than they are today given the trends and the fact that these things do not reverse on a dime.

The value of a commodity is inversely related to supply and directly related to demand.

Housing, like all products, is a commodity.

Interest expense deduction will be reduced and eventually eliminated since it will be voted upon as a package. Why should renters subsidize the lifesytle of home owners?

“Why should renters subsidize the lifestyle of home owners?”

They shouldn’t. But since most people are homeowners, this is the way it is. I would not bet on the mortgage deduction changing materially — maybe for second homes but not the primary home.

I’m a homeowner and think the mortgage interest deduction should be eliminated, possibly by phasing it out over 10-15 years.

Existing housing will decline in lockstep so the major impact will be to make new houses smaller and land cheaper. Those are the only ways for the builder to deliver a cheaper home. Builders are not thrilled since their highest margin comes on volume – of the house. Small and large houses all require the expensive stuff like kitchens and baths, but adding pure volume is dirt cheap. Land sold for development will also be cheaper then before.

Going back to looking at house prices over the years, the $750,000 purchase in 2000 I discussed is the same net cost per month to a 20% down buyer as a 900,000 home today. Since the 750,000 home is worth 800,000 (per notoriously inaccurate Zillow) today, it’s actually cheaper then 10 years ago – not even accounting for the 20% inflation that has occured since then. In constant dollar terms, the house is 20% cheaper to own on a monthly basis, despite the higher price in today’s dollars.

“In constant dollar terms, the house is 20% cheaper to own on a monthly basis, despite the higher price in today’s dollars.”

That said, lower prices and higher interest rates are much better for people across the board. It makes refinancing that much more powerful and allows people to more easily pay down their loans. Low rates with corresponding high prices is bad for the long-term.

The low rates also are ironically part of the reason the home loan market is frozen up. Why would anyone buy a risky mortgage-backed bond with a low interest rate when you know that interest rates have to rise? Any bond created at such a low rate is going to get slaughtered when interest rates go up.

well yes, of course you want to buy at low price/high interest rate; there is a property tax benefit as well.

But sometimes your family can’t wait for the macroeconomic stars to align. Your kids are there and are busting out of their shared room (3 kids in one room!). Just sayin’ that in terms of monthly commitment, people are paying less than 10 years ago, even through nominal prices look really high. I would love to buy at a 20% interest rate…but I may be dead before then, and we need space now.

“…sometimes your family can’t wait for the macroeconomic stars to align…”

You can rent and keep the money you save for a down payment in case the stars ever do align and landlords stop subsidizing renters in SF.

@mark1332: Strictly speaking real estate is not a commodity. Only one Hearst Castle that I know of…

Sure, economic theory still applies, but we are not talking pork bellies here. The home you live in has personal utility, and therefore, the buyer’s and seller’s behavior is quite different than how a strictly financial investor behaves trading commodities. Certainly makes RE more interesting IMO as well. Also, that is why you will see REOs trade at different values. Banks don’t get the personal utility.

“The home you live in has personal utility, and therefore, the buyer’s and seller’s behavior is quite different than how a strictly financial investor behaves trading commodities.”

If you’re saying home buyers are more irrational than stock buyers, I don’t know whether to agree or disagree with that. 🙂 Both exhibit herd mentality quite often and make other miscalculations too.

Pork bellies and bushels of corn certainly have personal utility — you can eat them!

The “market of one” notion of real estate is a realtor’s fallacy. While there may only be one Hearst Castle, there are tens of thousands of 1, 2, 3, and 4BR homes in SF. Greater supply (listings) and lower demand (sales) drives the prices down on them, and they are like any other commodity in this sense. There are exceptional situations, just like with corn (see how much you could get a starving man to pay for your bushel of corn), but the existence of exceptions does not change the rule. Heck, even if someone wanted to buy Hearst Castle, if there were a suitable castle available somewhere else at a better price, the buyer would but the alternative castle.

@A.T.: Ever tried to eat an unprocessed bushel of corn…

Anyway, sorry, but Real Estate is not a commodity. Look up any accepted definition in economics…Let me give you Wikipedias: “A commodity is a good for which there is demand, but which is supplied without qualitative differentiation across a market. Commodities are often substances that come out of the earth and maintain roughly a universal price.[1] A commodity is fungible, that is, equivalent no matter who produces it. Examples are petroleum, notebook paper, milk, and copper.[2] The price of copper is universal, and fluctuates daily based on global supply and demand. Stereo systems, on the other hand, have many aspects of product differentiation, such as the brand, the user interface, the perceived quality etc. And, the more valuable a stereo is perceived to be, the more it will cost.”

As I said, supply and demand and economic theories still apply, but not in the sense of commodity trading.

“Ever tried to eat an unprocessed bushel of corn…”

Well, yes! Mind you, not a whole bushel at once. But you simply shuck the ears and steam them. Then you can eat away.

All I said was “Greater supply (listings) and lower demand (sales) drives the prices down on them, and they [homes] are like any other commodity in this sense.” While homes may not be “fungible” in the literal sense, for any one there are many, many substitutes available, so no home is a product market of one, nor is SF a geographic market in and of itself. If a substitute is available at a better price, the buyer will buy that one. Both the home at issue and all available substitutes have the same personal utility you mention.

Totally getting off topic, but a bushel of corn is for dry feed corn that pigs and cows eat. Not too appetizing for humans. Marko1332 said RE was a commodity, it is not nor does RE trade like a commodity. That is all I said and this fact will still be true tomorrow just as it is true today. This thread has run its course for me so I am done here.

Merchant built houses in tract communities are largely commodities. Individual houses in developed areas built by different builders, with different views, different streets in a city grid, etc, are certainly NOT commodities. I scoured our area for years looking at houses, and of the several hundred offered for sale per year, perhaps 200 had the basic bedroom count we wanted, 20 were worth visiting, and 2 were worth trying to buy. We made about 5 offers in 3 years. And the house we bought has features that no other house in the area has. It’s not a commodity.

djt, you made offers on 5 houses. Clearly the one house you bought was not the only one in the world you would ever buy, regardless of how unique its features may be. No house is a market all by itself, and the pricing of potential substitutes puts downward pressure on prices where there are lots of sellers and few buyers, like we have today. That’s all I’m saying.

Real estate lies somewhere between “one of a kind” and a true interchangeable commodity. No properties whether they be the Hearst Castle or a Levittown tract home econobox lie at either extreme. Homes are distributed across quite a range along the unique—commodity axis.

Today on SocketSite we have the Callister house which is unique though whomever bought that house would have been happy with dozens of other comparables in the city. At the other end of the range is that Beacon 2BR unit for which there are probably hundreds of similar replacements some of which are in the same building and are nearly indistinguishable from unit #624.

So you’re all somewhat right here.

(FWIW, my experience was almost identical to djt’s)

An eat in kitchen that can seat 5 is great until you see one that can seat 10 at the same price and square footage due to better use of space.

And a 300 square foot garage for hobbies looks great until you find the one house in the city with an 1100 square foot garage (in a dense urban area, very unusual).

The four we did not get turned out to be far inferior to the one we did. We would have been happy in the others. But we are ecstatic now.

J wrote:

Well, being able to “rent and keep the money you save for a down payment” totally depends on how high your household income is and how much of that you’re paying in rent.

The reason you sometimes see home ownership (really: the mortgage payments) referred to in the financial press as “forced saving” is because for some households, particularly those just above the area median, paying rent is stopping them from saving up an amount that would add up to a down payment in any reasonable amount of time.

Buying a place (in normal times where real estate price levels aren’t falling year over year) allows them to direct the amount they’d normally be using to line the pockets of their landlord toward equity. A better bet for your example family, if they didn’t have a lot of excess household income would be this, from House hunters are too scared to buy despite low prices, from earlier today:

The story doesn’t say how long this took them, but building up a twenty percent down payment can take someone not making six figures a long time if they’re paying rent. Think about it this way: Every rent payment you make is increasing the asset account on someone else’s balance sheet.

It kinda irks me to see financial advisers recommending a forced savings plan(especially one with such high transaction costs). How about telling people to show a little discipline??? He says it may just match inflation, how about TIPs then???

If someone can’t save anything after paying rent, they really can’t afford to purchase the same kind of house they are renting unless the total cost is lower, even without a down payment.

There’s no way I would try to buy in SF on less than a 6 figure income while raising a family, unless prices were much lower. Not if I ever wanted to retire.

I can understand how a financial adviser can push someone towards a mortgage. It teaches you budgeting, gives you an extra motivation at work, in short gives you a glimpse into the financial grown-up world with the possibility of growing from there. Next is IRA/401(k) and stuff.

But in high priced areas, having a mortgage just for the sake of building equity through principal payments is not a sound financial decision. High transaction/resale cost amount to 5 to 7 years of principal payments on a typical 30-Y mortgage. The math doesn’t add up short term.

Now if you buy at or near a trough it’s a totally different story. Like between now and 2013, I think. In that case equity usually builds much faster through appreciation than mortgage payments. Inflation can also make a mortgage work in your favor 2 ways. 1 – Your payments represent less and less of your salary, 2 – your property (usually) gains in dollar amount while the mortgage doesn’t. Your house didn’t only protected you against cold and rain, but also helped you protect your future. Now all you need is stay clear of those HELOCs!

More listings than sales this week, according to redfin. 78 to 76. Shocking for this time of year.

Sellers just continue to pour into the market, hoping against hope they can get out before the collapse.

More listings than sales this week, according to redfin. 78 to 76. Shocking for this time of year.

Actually, MLS shows 79 sales to 68 listings.

Redfin shows 81 listings and 77 sales (both of SFRs/Condos/townhouses) in the last week. Whatever — inventory remains well above last year and sales remain well below.

I am shocked by the indiscriminate use of “shocking” on this site.

The prestige index is up for Q3:

http://www.firstrepublic.com/lend/residential/prestigeindex/sanfrancisco.html

Down almost 1% from 447.10 last quarter to 443.52, and down almost 17% from the peak of 533.17 in Q3 2007. This quarter’s number is within 1% of December 2004 and is about 7% above the Q2 2001 peak.