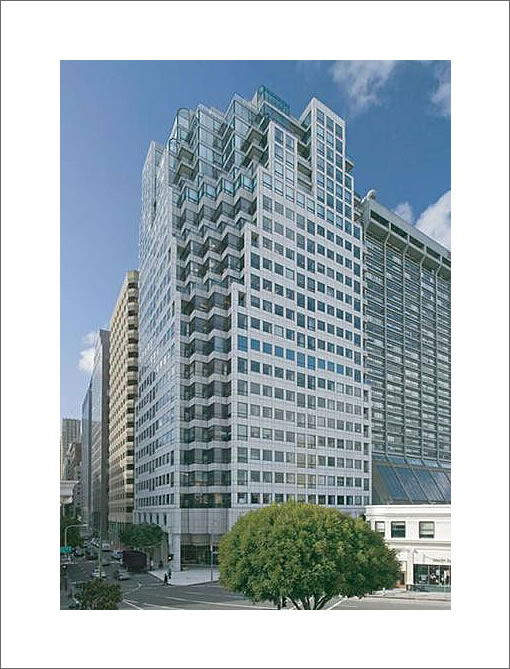

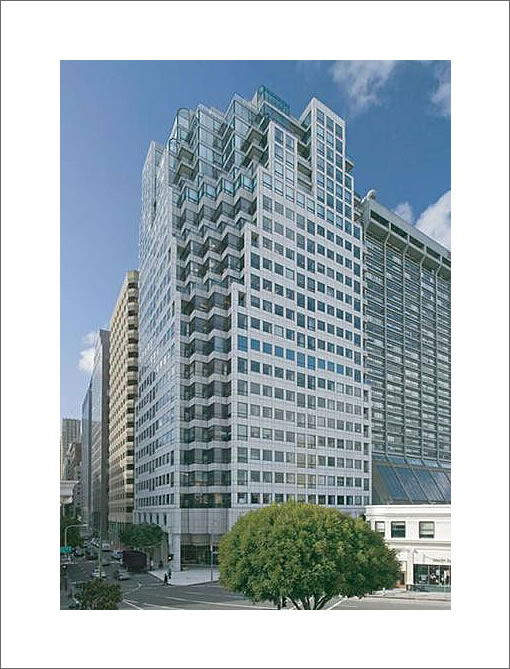

One San Francisco’s original luxury high-rise buildings, only 33 residential units were built atop 611 Washington (perhaps the pool on the 21st floor now makes more sense). As units 2101 and 2102 were merged into one, however, there are now only 32.

The 2,624 square foot #2402 is one of those thirty-two. Once listed for $4,595,000 (it’s been on and off the MLS four times since 2008), 611 Washington #2402 was being shopped off the MLS at $3,995,000 last month, and has just been re-listed at $3,595,000.

And yes, industry reports will reflect “one day” on the market.

∙ Listing: 611 Washington #2402 (2/2.5) 2,624 sqft – $3,595,000 [MLS]

thank you for continuing to beat the drum on deceitful industry statistics! someone has to.

nice condo too. i think the former coach of the g.s. warriors used to live here.

The industry reports will reflect accurately that this property has only been on the market one day at this price.

I don’t know what the big deal is about the DOM number. If someone lists their 500 square foot condo for $50 million, it’s going to stay on the market at that price for eternity — but so what? All that tells you is that a 500 sf condo isn’t going to sell for $50 million. If the asking price is then reduced to $200,000 and sells in a day, and it’s reported as selling in a day — that seems to me a truthful reflection of the facts.

The final sale price is the data we really need to know — how many days it takes to get to close? Not that important, especially now, when essentially everything is for sale whether it’s on the MLS or not.

“how many days it takes to get to close? Not that important, especially now”

For reals? If it’s actually not important, then why would you care? Why do the de-list/re-list?

You don’t think it’s valuable information in the aggregate as to how long it takes properties to sell and what kind of real price cuts people are making? I mean, we’re talking about juked stats here — all this BS “sold at asking in one week” stuff is a side issue in some ways.

DOM has meaning from a negotiation standpoint. If you don’t know a property has been sitting on the market you don’t know how willing the seller might be to negotiate. Maybe it doesn’t matter. Maybe it does. Of course, the buyer’s real estate agent should be able to pull the history on the property.

“All that tells you is that a 500 sf condo isn’t going to sell for $50 million.”

That seems like a really bizarre case and not even close to what we have seen in real life. I get your point, but “real DOM” does give an indication of the gap between the seller’s perceptions and reality and as a buyer I find that information useful. I’ll continue to seek real DOM numbers and have given up on SFAR to supply accurate information.

“Not that important, especially now, when essentially everything is for sale whether it’s on the MLS or not.”

huh ? you’ve got to be kidding here. Or you considering the flipside of the seller asking $50m as a buyer offering $50M on an unlisted property. That’s just fantasy.

So a full accounting of DOM doesn’t matter?

I suppose it’s no wonder the Used House Salespersons around here have so much success working over naive buyers.

On a different note, anyone who wants a condo at the Montgomery Washington tower better ask about all the litigation over construction defects. Those nice curved skylights tend to leak like a sieve!!! And, from what I’ve heard, that building had numerous defects issues when it was first constructed. Maybe they’ve all been addressed, but buyer beware on this one.

On a different note, anyone who wants a condo at the Montgomery Washington tower better ask about all the litigation over construction defects. Those nice curved skylights tend to leak like a sieve!!! And, from what I’ve heard, that building had numerous defects issues when it was first constructed. Maybe they’ve all been addressed, but buyer beware on this one.

What a trip! I remember landscaping that pool on the 21st… or was it the 26th?… floor back in the 80’s (when it was known as 655 Montgomery).

I agree with blahblahblah and others: Triple kudos to Socketsite “for continuing to beat the drum on deceitful industry statistics.”

It’s Econ 101 that for markets to be efficient, there’s an assumption of perfect information on the part of buyers and sellers. This kind of manipulation/deceit in my view is a deliberate effort by seller agents to distort information and create inefficiencies in the price-finding negotiation process in favor of the seller.

It goes without saying that, in this kind of market with these kinds of players and this kind of information manipulation, it’s especially important to stay “plugged-in” via Socketsite (and other non-industry information sources).

honestly, no one cares about these stats as much as people on socketsite. any decent (not even good, just decent) agent will know if a property was previously listed and convey that information to the buyer. ultimately what matters is the price paid. period. is a property worth less because it sold for $2M in 1 day or 100 days? I didnt think so. same story for your constant drum beating (some might call it whining) about % of list price/sale price. what matters is the sale price.

“honestly, no one cares about these stats as much as people on socketsite.”

Don’t be ridiculous — anyone buying a house or selling a house cares. All of this data helps evaluate the marketplace — whether prices are falling or rising and the speed of the rise or fall, whether asking prices are reasonable, whether places are selling quickly, etc. Again, I challenge you to tell us why agents try to manipulate this data if it’s not important.

anon$random, you miss the point. The misleading DOM stats for property X aren’t going to affect buyers of property X — they’ll research its individual history.

However, they do distort aggregate stats — where you don’t get to look into every single property’s sales and listing history to get true DOM, % of asking statis — which are used to tout the relative health on the market.

And it’s not a great defense of any practice to say “well nobody’s going to believe it anyways.” You’re not convincing me it’s above board with that argument.

$3,595,000 to live in an office building 3 blocks away from the North Beach strip clubs, – Only In San Francisco

YIKES…What dreadful decor. Nevermind…..anyone

who pays $1870/mo HOA AND $650/mo for parking won’t care!

It’s not that nobody cares about these data, it’s that nobody in their right mind would accept a realtor’s word. We know that they lie, we know that they conspire amongst themselves to deceive buyers.

We care very much how long a property sits unsold and obviously take this into consideration when making an offer. It’s just that we would never rely on a realtor for information about this – or any other fact that is critical to a RE transaction.

This is an example of how RE agents have destroyed their own reputation and earned themselves the scorn of buyers.

RE agents should be paid by the hour for what they actually do – which may be a lot or very little of actual value.

2502 now on for 3.995. Updated condition, but no atrium window, it looks like it was used as a corporate meeting facility.

$2K HOA

http://www.redfin.com/CA/San-Francisco/611-Washington-St-94111/unit-2502/home/544996