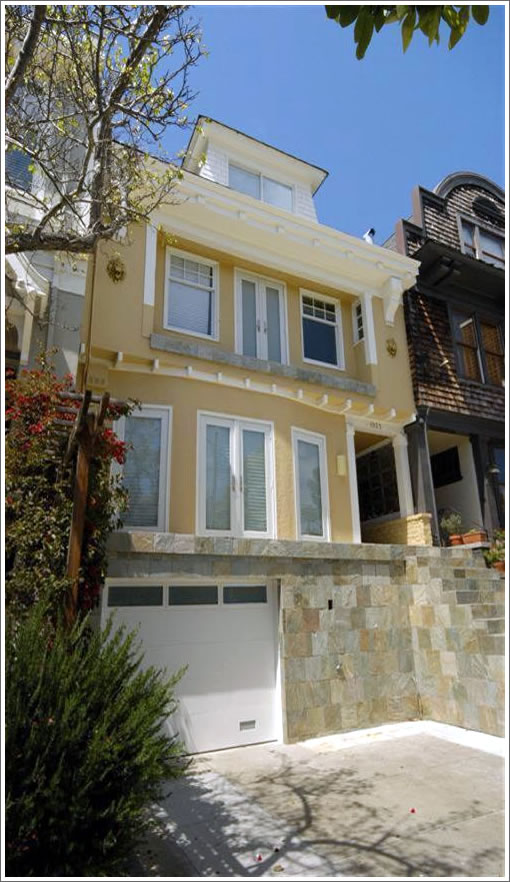

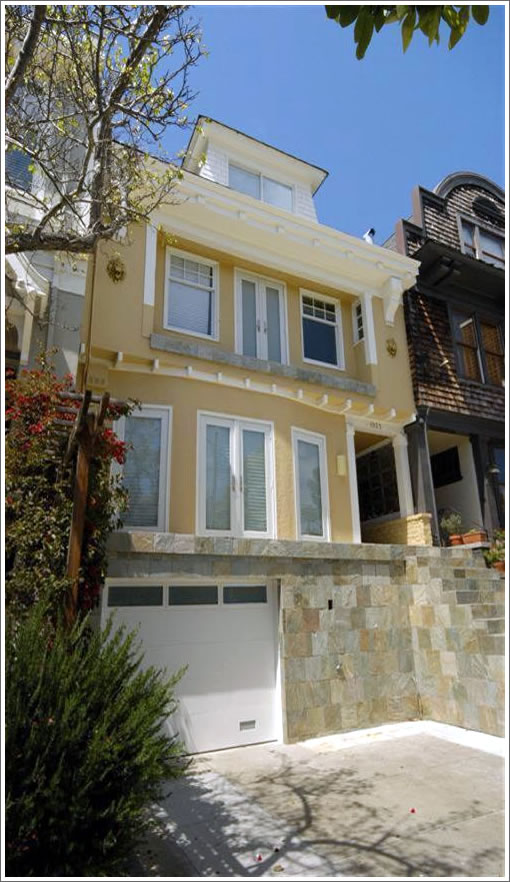

It’s a successful foreclosure flip for fifteeen twenty-two (1522) Lake. Think financing.

Purchased on the courthouse steps a month ago for $1,305,500, the quick re-sale of the “unfinished” (i.e., stripped) single-family Lake Street home closed escrow on 1/7/10 with a reported contract price of $1,700,000 ($50,000 under asking).

∙ Latest San Francisco Listing Euphemism: “Unfinished” Versus Stripped [SocketSite]

So the most recent sellers did not even restore the stripped features ? Wow, that $400k gain is quite a windfall for doing nothing other than taking on the financing and market risks !

Don’t fall off the stairs going into your new home. That’s quite the flip.

How do I find out about their courthouse step auctions?

I know of another one. 4 units in the portola district. Purchased 2 years or so ago for $1.25 mil. Brought at auction this summer for an astounding $500k. Flipped for $770k w/o any additional work. Even at $770k it had an 8.5 grm! Heck, I wanted it at 8.5, and was trying to get them to carry the first. But no go, another buyer came in all cash. Hard to find such a good grm in SF, especially for 4 units.

Congrats to the flipper and the new homeowner. I think they both did well.

Shame to the former homeowners. When I walked through this house, all I could think of was, “I bet I would have loved this home pre-renovation.”

I am glad someone loved it….

this sale does show the difficulty of using foreclosures as pure comps.

that does not mean we should ignore foreclosures, especially if they make up a large part of the market. but it does remind all that one must take the distressed condition into account when trying to use the foreclosure sale as a barometer of the overall housing market.

I am personally not surprised to see this. High risk often means high reward, or high failure. this person took a big risk and it paid off handsomely.

“this sale does show the difficulty of using foreclosures as pure comps.”

I would have said that it shows how sensitive price is to availability of financing.

No loans = huge price drop.

I intend to use this strategy as part of Operation “Craptastic shack”, requiring a stripped kitchen so that I don’t have to bid against straw buyers with FHA funny money.

There were loans.

This house had major issues not just from the cruddy remodel. It was built weird in the first place.

Exactly the same house.

When a cash offer is required its price is 1.3,

a few days later bought with financing for 1.7.

But of course your ideology that values are determined by micro doesn’t allow you to accept that. If you accepted that loan availability can have that big of an effect on price then you might have to see that recent values were nothing but a crazy loan generated bubble. 😉

nice apple 😉

Anonn…

How were there loans on this purchase? The seller was looking for a cash buyer. And, I was told that banks aren’t going to give a loan on a home without the essentials (think toilet and kitchen). To top it all off, the permits taken out for the renovation were never closed. And, when I toured it, some agent pointed out that the staircase leading from the second floor to the third floor was CLEARLY NOT up to code…

Don’t tell me what I was thinking, pal. I thought you meant the previous sale when it was bought for 2.2 or whatever. As far as the foreclosure sale, several people I know complained about it not being posted to the general public. Of course the removal of loans can have an effect upon price. What did the foreclosure speculators care? A 1.7M sale and they netted 300K or so. If you want to take this bank/foreclosure driven transaction and use it to say, “crazy loans generated a bubble” go ahead. But somebody bought it at 1.7 knowing that it still needs another 500K or more to be any good.

The offer accepted when I spoke to the realtor was non-contingent private financing. They wanted an all cash quick close, but I think someone bought it with a private loan. Half cash, half private, or something. It merely took a little longer but it was the same as all cash, really, because a bank wouldn’t have touched this nowaday for the reasons mentioned. Other than that, the stairs were screwy. The thresholds were all short. I was in there with a 6’3 client and he had like a millimeter to spare. Doors opened to nothing. The kitchen was in the wrong place, and tragic. The downstairs needed excavation because the rooms were 6′ tall or so. The backyard was a postage stamp. The upstairs needed dormers or a deck, or both, badly. On and on. But if the person who bought it wants to do all that work and keep it they’ll probably wind up with a 2.5M house for 2.2M.

No loans for the new buyer.

You sure, Paul? Maybe the first offer backed out then.

Hmmm… Then perhaps our dear editor should expand on his cryptic comment, “Think financing.”

Yeah, well, you should reel in the causality lines regardless.

“Exactly the same house.

When a cash offer is required its price is 1.3,

a few days later bought with financing for 1.7.”

“No loans for the new buyer.”

Seems like since bank owned doesn’t matter, auction doesn’t matter, it’s all comps. etc. Then I read this as THE MARKET IS UP HUGE. All of D1 is seeing gains of 30%.

4 offers, 3 cash.

As soon as the auction was over (the next day) I lowballed $1.5 mil cash for a client. I was on it the whole time. My guy waffled, and it hit MLS.

I new about it before the auction, saw it get auctioned for $1.3051 mil (3 bidders).

I am, or my assistant Page are at the auctions almost everyday.

San Francisco is difficult and complex, but other counties, these deals happen every day.

What was the story with the auction? Do you mind divulging? I heard several complaints.

@Paul: if you knew about the auction and were on it the whole time why did you have your client offer $1.5M cash the day AFTER it sold for $1.3? Why didn’t you have your client offer $1.31M or $1.4M or $1.45M at the time of the auction?

Would you have earned a commission if your client would have bought it the next day at $1.5M? Would you have earned a commission if your client would have bought it for $200K less the day before?

What’s going on? I thought the best parts of SF would never see the auction block?

Did you really think that, and if so, why?

Because we were informed by purportedly reliable sources that SF buyers did not use exotic loans, they all put down large down payments from family money or other sources, and SF prices would not fall and have not fallen so nobody is underwater.

Yeah, you like to say hyperbolic things. I get that.

But what does any of that have do with this Lake street property?

Did you really think that, and if so, why?

I’ll take that as a “no part of SF is immune to foreclosures”. Thank you very much. Option ARMs Reset will be a lot of fun in the next 3 years.

“Thank you very much. Option ARMs Reset will be a lot of fun in the next 3 years.”

Speaking of which, surprised and anon, I can’t imagine any of the prime jumbo mortgages that are increasingly becoming delinquent are in SF. We simply just don’t have those here.

http://www.businessinsider.com/jumbo-rmbs-defaults-triple-california-florida-and-new-york-lead-the-way-2010-1

Prime jumbo RMBS 60+ days delinquencies for these states at December 2009 compared to December 2008, and their approximate share of the $388 billion market, are as follows:

–California: 10.8%, up from 3.5% (44% share)

The market seems to have entered a new phase as investors are showing up (and buying) at the SFH auctions. The property at 471 Duncan (1,458 sq.ft.) was last refinanced with WaMu in 2007; a group of three LLCs bought it at auction for $736k on December 16.

hahah. Diemos comes back and says something in this thread. Shameless.

Really. What about this backstory makes you guys want to talk about ARM resets and the like?

Wow, EBGuy, the tax value of 471 Duncan was under $300K. The prior owner must have been incredibly irresponsible with the cashouts.

@ MKM,

He couldn’t get his sh*t together despite my pleas. I offered to lend him the balance, but he waffled. It’s scary to throwdown $1.3 mil without even looking. He was just not ready. He wanted to see it first. Can’t blame him. If we got into the mix, who knows where it would have ended, probably $1.5 mil.

I just point out the deals and give an opinion as to market value, spot pricing.

As for payment, yes I have a buyer’s agreement in place for the auctions and afterwards the MLS offered a commission.

If you want to go to the auctions you need cash and need to have done your homewrok prior. If you want to go with me, we can sign the buyer’s agreement and go.

Paul

Wow, EBGuy, the tax value of 471 Duncan was under $300K. The prior owner must have been incredibly irresponsible with the cashouts.

It was either an elderly couple (one of the owners was 65+) who needed the money for expenses or was taken advantage of (or a little of both). Mortgage previous to WaMu was with World Savings.

“Thank you very much. Option ARMs Reset will be a lot of fun in the next 3 years.”

Beware the 2.9% payment!!!!!!!!

2.9% reset? Smoking crack aren’t we? From neg arm to full arm will be painful. You can try to go IO, IF, a big IF you can prove your income. Hey, good luck on that. 2006 it is not.

It’s the end of free money for most folks. Big Daddy will soon ask you to pay for the dope he he used to give you or free. You got hooked, you thought you were rich. You’ll be a debt slave. That was the goal from day one.

Man. Do you have an ARM? Sparky does. I do. What do you know that people who have them don’t? And, um, why are you talking that talk in this thread again? What does it have to do with the Lake st. property?

There’s never a wrong time to talk about Option ARMs, but be of good cheer, I promise that 718 days from now you’ll never hear me talk about it again.

Nice you got an ARM and your little buddy too. 2.9% for how long? Tick-tock-tick-tock. Hey, the market will be back before rates go up!

Why do you answer out of-turn? That Sparky guy came back on the Option-ARM bait with regular ARM talk. That was a faint attempt to get anything replied to mitigate this fact:

Option-ARM resets will generate massive foreclosures for 2005-2007 bubble idiots with negative equity on their real income. That’ll be fun to watch.

The you come back for little buddy who said a boo-boo.

Unlike those with whom he fraternizes, sparky-b is a pretty smart guy. He’s just tweaking the bears. He knows that the interest reset on option ARMs is a relatively minor part of the problem. It is the fully amortizing recast that is breaking, and will break, the camel’s back for many of those who used this type of loan. And there is no way out of it with a refi because those buyers are so far underwater.

I didn’t speak for myself because I didn’t see this since I posted. Option ARM has some of the best rates going, mine is 2.9% full amortized. I have paid the full amount since I got it, and the full amount is currently way less than the original minimum. Mine already recast, I know this only becuase there are only 2 option now, full amortized and 15 year, instead of the original 5. Also, even before the recast I notice that the minimum number was removed since it had become lower than the interest only. So yes, tick tock, but in the mean time I am still paying my old amount(close to the 15), I put 20% down, and had some great years at work. I could refinance but it wouldn’t be worth it.

Will there be a recast problem for those who put nothing down in 2007 and paid the minimum, of course. But, that’s not all of those loans by a long short. There are lots of people like me, and lots who already sold, and because the rates are so low the recast amount won’t be as bad as lots of people think.

Oh and “little buddy”, I’m over 6′ what are you?

Yeah diemos. Great call on the 1.35 cash 1.7M loan. You really know what you’re talking about. What does this house have to do with option ARM’s again?

sparky-b – good for you for taking a prudent payment strategy. I don’t doubt at all that there are many others with attitudes like you (myself for example). But the real question is “how many relied on the minimum neg-am payment”. It only takes a small fraction of sellers to affect the market and there may be enough people who have painted themselves into a corner to trigger an avalanche.

Out of turn? LOL. What does this property have to do with option ARMs? What do you know about any bank, any bank at all, and its programs aimed at option ARMs? Honestly. Spouting SS CW as if it’s critical thinking, in a thread that has nothing to do with option ARMs is clownish.

yes it is clearly sparky-b’s fault that the prior posters keep saying “reset” when they mean “recast”. Seriously people stop saying resets are going to be a problem. Until we actually see interest rates go up everyone who has one pretty much would love to see a reset as the interest rate would reset to a lower rate. Now recasts are another matter but should not be confused with resets.

home now has its rails up. looks good.

Another foreclosure flip @ 2035 Greenwich St

http://www.redfin.com/CA/San-Francisco/2035-Greenwich-St-94123/home/562098