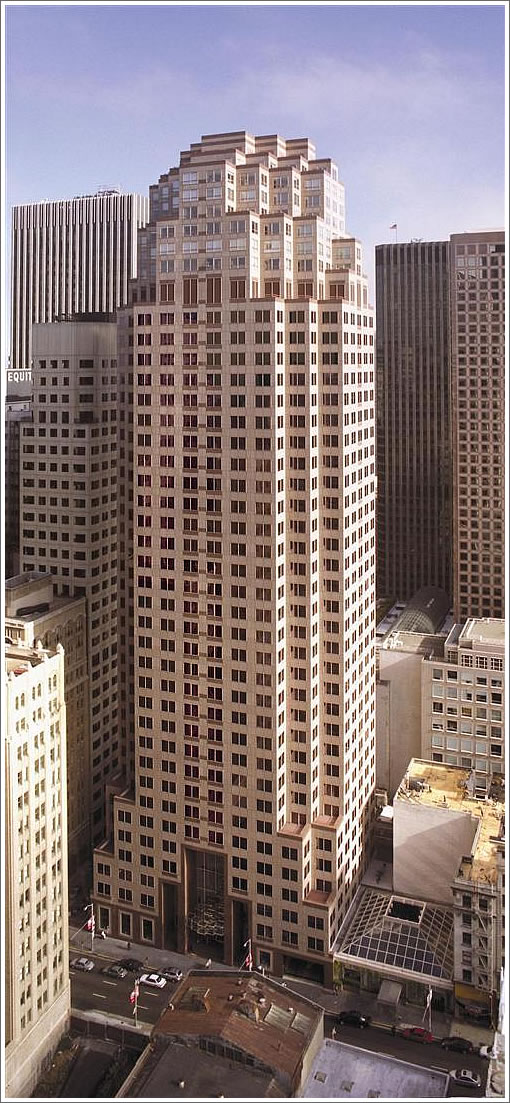

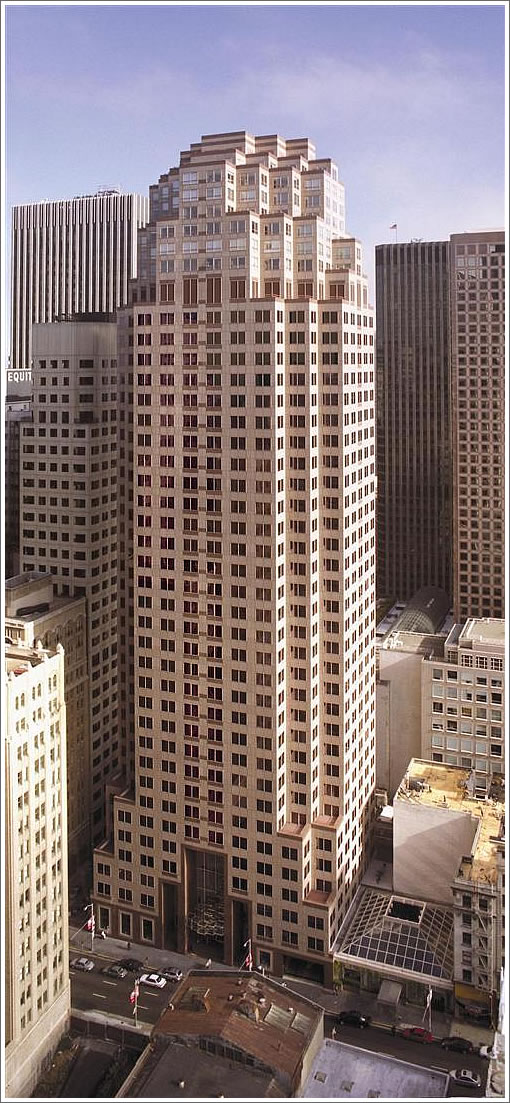

As expected, with $233,784,407 owed on the property, 333 Bush Street was taken back by lender Brookfield Properties. The building was bought for $281 million in 2007.

Also as reported by the San Francisco Business Times, Morgan Stanley is in the process of handing One Post, 201 California, Foundry Square 1, 60 Spear and 188 Embarcadero back to Apollo Global Management. All five were acquired in 2007 as well.

∙ 333 Bush: Bought For $281M In 2007 But Now Going Back To The Bank [SocketSite]

∙ Brookfield Properties forecloses on 333 Bush in S.F. [Business Times]

∙ Morgan Stanley to give back San Francisco buildings [Business Times]

This signals a huge re-set in the commercial market. There are very like more give backs to lenders on the way.

Consequences of this might be larger but less severe than the resi meltdown — large owners (funds) will simply write down their losses and move on as it is mostly OPM. The OP — all the pension funds, etc. will have to reconcile the billions they have lost with their own payout obligations, and this will take years and is certainly still in a state of denial.

We have already seen a larger reduction in value in SF commercial (down 50%) than in SF resi (down 30%) and the comml process is not over yet.

It just doesnt ruin people lives the way the resi collapse has. Heres hoping it doesnt lead to a next wave of bank writedowns that they forgot to account for last year.

The future for CRE in SF is bleak because of local factors and external trends.

Much of the spec space taken during the boom was by the finance and legal industry. Those have been wiped out and that has really hurt SF. The lack of job growth for the indefinite future in SF (and generally California) is likely to push CRE prices down even further in the city.

If that wasn’t enough, there is a damper being put on the need for commercial office space because of the internet and tele-commuting. This affects the whole country which is why recovery of CRE (and retail) will be subdued.

Its a double whammy for cities like SF that are stagnant.

Realitically how long will it take to fill all the empty space? A decade, two, more?

Will some of the downtown office towers try to re-invent themselves as residential towers – especially as CRE remains bust for an extended period in SF?

And what of the 100 story office tower that was supposed to be the crown jewel of the HSR center on Mission Street? I can’t see this ever being built so what will that do to the once grandiose plans for the area? Doesn’t it all hinge on that tower? And how will this affect the City government revenue stream? All those fees and taxes the city was counting on gouging out of developers/residential buyers in SOMA are drying up fast.

Its seems inevitable that the future in the next 10 to 20 years for CRE in SF will be bleak. bleak

Telecommuting does not obviate for office space. I work from home and, as you may tell from my being an active participant here, I would be more productive in an office.

“Telecommuting does not obviate for office space. I work from home and, as you may tell from my being an active participant here, I would be more productive in an office”

I absolutely disagree about the internet/telecommuting and its long-term impact on demand for office space.

A pertinent observation from Charles Smith (OfTwoMinds):

“There’s even more trouble on the horizon. The wave of creative destruction unleashed by the Internet has yet to envelop commercial office space – but it will. Just as online shopping has decimated retail sectors such as bookstores, the Web is busy revolutionizing white collar work, the mainstay of office towers and business parks. Real work can now be done remotely at a home office, cafe or anywhere but a cubicle at headquarters, and the cost advantages of this flexibility will not be going away. Yes, there are still powerful reasons to meet in person, but there are equally powerful reasons to downsize travel and office costs permanently.”

This is not to say demand for CRE is goiong away. It is to say that the huge demand we saw in the past and the explosive growth of office buildings and office parks will not be seen again in anywhere near what occured previously.

For a city in decline as a business and jobs center as San Francisco is, this will be an additional factor that, IMO, may preclude any future real recovery in the CRE market in SF.

I hear Elisa Stephens (Academy of Art) is going to lose some buildings too, she can’t keep up with payments. Interesting!!!