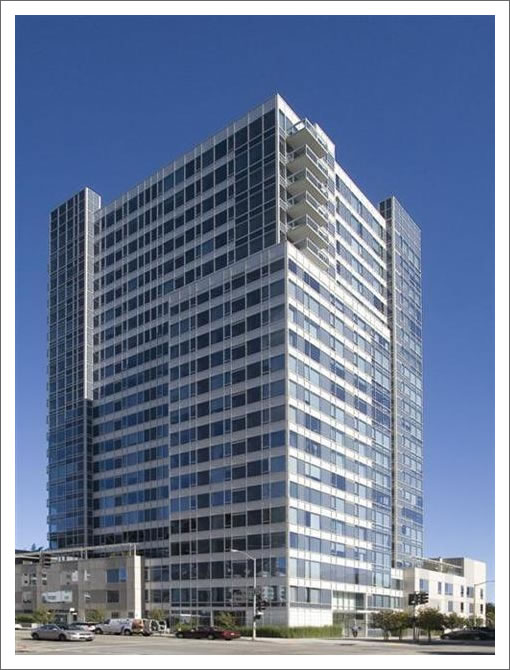

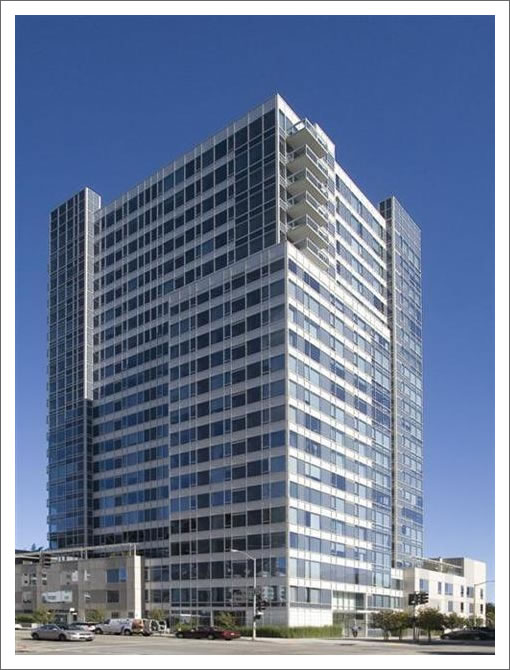

Of 83 new listings in San Francisco over the past week, 30 (36%) are either bank owned (16) or seeking a short sale (14). One such listing is for Watermark (501 Beale) #1D.

Purchased for $725,000 in January 2007 but then bought back by the bank this past August, the 831 square foot one-bedroom with parking was listed for $495,000 yesterday.

And according to public records, 501 Beale #1D was refinanced in July of 2007 with a variable rate loan for $780,000. Is it yet another “anomalous” data point to be?

∙ Listing: 501 Beale #1D (1/1) 831 sqft – $495,000 [MLS]

∙ A Higher Watermark Than Some Expected…Only 23% Under ’06 Price [SocketSite]

∙ A Pair Of Bank-Owned Penthouses Atop The Watermark (501 Beale) [SocketSite]

The coalition of the willing.

Wow, that unit at the Watermark is depressing. I didn’t realize they developed townhouse apts around the base. Good idea generally, but doesn’t seem to work in this case.

The pics of 501 Beale #1D suck.

I just can’t visualize the layout. I guess they need a wider lens and about an hour of decluttering effort…

Those listing photos give me the impression that the occupant isn’t motivated. Just guessing.

interesting metric. I wonder if it will hold once the selling season starts again (after super bowl weekend)

related, anyone know the number of listings thanksgiving week last year and the year before?

It’s also sad that 4 of the pics for #1D aren’t even of the unit itself (first the building, then the building’s entrance, then the 1D lettering above the door to the unit, and the last photo is the crappy view of the street outside the unit).

it’s not just the unit that’s bad. it is poorly on display. their crap is all over the place. it tells me the agent wasn’t much involved or interested.

I have always felt SF was a year behind OC and SD in this process. OC/SD had this same type of spike in REO / bank owned a 1.5 years ago (speaking of 1 mile within the coast so not inland empire sub prime but so cal prime). Now prices in OC /SD are 40% below the peak for what I will call B+ areas, 30% for the A areas and the A areas still falling. The block we lived on in OC (less than a mile from the beach – B+ area) now has 3 REO / in foreclosure process. One block, prime neighborhood, about 20 homes max, 3 in trouble.

Looking at foreclosures.com (I have a subscription) I see many new listings in my SF neighborhood — similar to the level I saw in OC/SD about 1.5 years ago — that was when OC / SD broke. I also see many for sale listings that were posted about 2 months ago now receiving NOD’s.

So the question is how many SF people are under water and of those how many have no option and of those who can afford to pay, how many will decide not to pay? I don’t think it will take a lot of theset two groups to cause a major hurt in entire the SF market. Those not in trouble will have no choice but to compete with those in trouble and the banks will have a hard time ignoring the in trouble sale comps.

And take a look at for rent on craigs list. I can safely say the current inventory is very close to the inventory I saw when I had to look for a place in the spring / summer of 08 (so peak rental time, summer, has the same inventory as lowest rental listing time, Dec). And this time (we are looking in case we have to move) 100% of the listings I called called me back and 40% were sitting empty and at least 50% were already willing to bargain on the rent. When I looked in the summer of 08, I was lucky if 70% called me back and instead of bargaining, people tried to raise their rent over the listing price. Times have changed.

Redfin shows a rental amount of $2300 per month.

http://www.redfin.com/CA/San-Francisco/501-Beale-St-94105/unit-1D/home/8191061

Propertyshark shows the owners address in Santa Monica.

http://www.propertyshark.com/mason/san_francisco/Reports2/showsection.html?propkey=45274905

HOA is $706 a month. If the place sells at the beat down price of $495K and the place continues to rent for $2300 per month, the proud new owner will enjoy a cap rate of about 2.5%.

The pics have really turned me off. The $700 HOA doesn’t help either.

Oh yeah, screw that high HOA fee!

Nice exterior pic. 😉

Coincidence I’m sure, but this dovetails nicely with the cnn article citing 35% of all morgatages in CA as underwater.

Ohhhhhhh, duh! There is a tenant in there now, no wonder it looks like crap.

From the listing:

“Please DO NOT Distrub Tenants. Tenants are cooperative and will allow showings with advance notice.”

First time poster here. I was surfing the nets and I came across an archived thread from nearly two years ago to the day. It’s hilarious how the kool-aid drinkers are all being proven wrong. SF RE is crashing! Hilarious! Foreclosures up, short sales are up, and many of your homes look like dumps! In SF you think it’s OK to pay all your money to the mortgage and have none left over to maintain the place! The archived thread I stumbled upon was about Chicago. Basically the same salaries yet RE is 1/4 the price – and still crashing in the higher ‘prime’ neighborhoods! Yeah the median might be inching up but the deals (as compared to SF) are amazing if you’re coming with CA locust money! I live in Chicago and I’m firmly of the opinion that RE has got another 15% – 20% to drop in Chicago.

“Of 83 new listings in San Francisco over the past week, 30 (36%) are either bank owned (16) or seeking a short sale (14)”

Ouch!

The list price for the bank-owned 501 Beale (Watermark) #1D has been reduced 10% from $495,000 to $446,738. Once again, purchased for $725,000 in January 2007.

Hmmm…. 40% off at the current sales price. Just a little further.

I don’t understand the gripe about prices on socketsite. I recently moved from NYC, and there is always demand for housing in a quality city, with NYC and SF at the top of the list (in that order).

I agree prices were way too high in 2006/2007, with prices for a 2/2 being upwards of $800k-900k+, and 1/1 being in the $600k area.

In my estimation a 2/2 (and lets say 1000k sq ft) should go for around $600k-$700k and a 1/1 (and lets say 800 sq ft) should for around $450-550k. At those prices they are affordable to own.

In fact, there are 2/2’s available at BLU, 829 Folsom, Palms, at those prices, just check the MLS,

Where I think there will be further depreciation are the smaller 1/1s and 2/2s at the high end buildings like Infinity and ORH, because a couple of blocks away that is what the prices are at the buildings I mentioned. And I think its better to own a good unit in a reasonable location, than a crappy unit in a great location.

The list price for the bank-owned 501 Beale (Watermark) #1D has been reduced another 5% from $446,738 to $424,401 and the listing now notes, “Unit will be VACANT on 2/1/10.”

Once again, purchased for $725,000 in January 2007.

Looks like it’s now available for rent @ $2,600:

http://sfbay.craigslist.org/sfc/apa/1788316213.html

Ok, so this did sell in April for 402K. As noted above, it was rented for $2300 and it appears the new owners think they can get $2600.

http://www.redfin.com/CA/San-Francisco/501-Beale-St-94105/unit-1D/home/8191061

[Editor’s Note: Another Bank-Owned Watermark Apple Falls Into Our Cart.]

Sold for $725, then $402?

Sarcasm: Where are those people predicting 50% haircuts! This was “only” 44%!

LOL!!