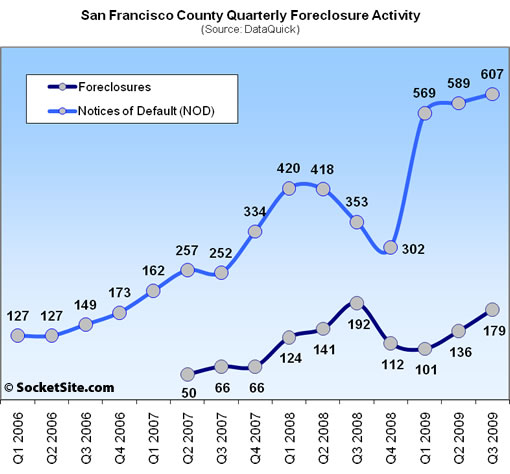

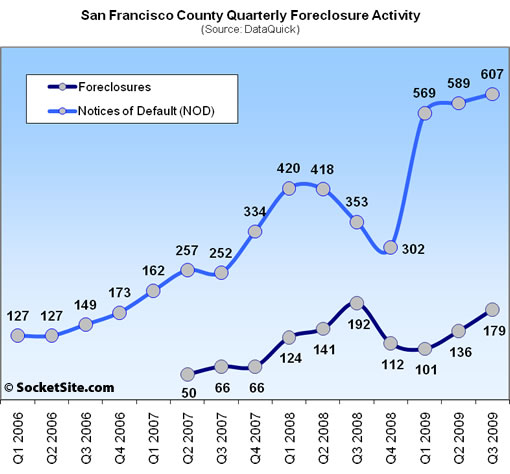

Bay Area Notices of Default (NODs) in the third quarter of 2009 rose 25.2% on a year-over-year basis, up 72.0% in San Francisco proper (from 353 to 607). NOD activity in San Francisco increased 3.1% from the second to third quarter.

Actual Bay Area foreclosures in the third quarter fell 38.3% on a year-over-year basis (from 12,093 to 7,462) with Contra Costa (down 43.9% to 2,053), Alameda (down 30.2% to 1,760) and Santa Clara (down 42.9% to 1,237) leading the way with respect to volume.

Second quarter recorded foreclosures in San Francisco totaled 179, down 6.8% on a year-over-year basis but up 31.6% (43 homes) from the second quarter 2009. Expect San Francisco foreclosures to continue to rise over the next few quarters as moratorium delayed NODs work their way through the system.

∙ California Mortgage Defaults Trend Down Again [DataQuick]

∙ Actual San Francisco Foreclosures Up 34.7% QOQ (Down 3.5% YOY) [SocketSite]

You have left Real America and entered “San Francisco Country.” 🙂

[Editor’s Note Good catch (and since corrected).]

“Expect San Francisco foreclosures to continue to rise over the next few quarters as moratorium delayed NODs work their way through the system.”

Possible, but I doubt it. At least not enough to make a material difference in the market. Our mortgage system is nationalized/zombified, with the intentional effect of delaying exactly this process. The government has artifically prevented real estate from finding an equilibrium clearing point, and I imagine it will stay this way for many years. The support will probably increase given the looming CRE problems. At least until there’s a currency crisis and other nations require higher interest rates on our debt to keep rolling it. Otherwise, I would expect the graphs to keep fidgeting sideways, but that’s about it.

Maybe, LD, but the administration appears to have hit an upper spending limit and realizes something has to give. It appears that housing price supports are going to be the first to go.

You’ll notice today that the administration released a report that it was holding onto for awhile showing that the new homeowners tax credit is the subject of many tens of thousands of fraudulent claims.

They released that report just as the legislature was taking up an extension so that the administration could start the political process of killing it off. If they weren’t interested in killing it off, they would have released it three weeks ago so that it would be forgotten by the date of the vote. Instead, it will be front and center in the debate.

They’re going to try to tank it.

http://www.nytimes.com/2009/10/23/us/politics/23housing.html?_r=1&hp

White House is just changing the flavor of the cheese – not eliminating it:

http://blogs.moneycentral.msn.com/topstocks/archive/2009/10/21/don-t-look-now-it-s-a-second-stimulus.aspx

So the YTY compare (which is effectively seasonally adjusted) shows improvement (down 6.8%). Should I read that into this data or not? Or does the ‘foreclosure curve’ not really posses a seasonal trend and its all about the Notice of Default ‘backlog’?

I hear you, tipster, and I hope you’re right. But I still think this gets renewed or replaced by some other subsidy, as OneEyedMan alludes. Trying to punish fraud in real estate is like trying to hand out speeding tickets at the Indy 500. Most politicians don’t even care anyway – they’re focused on grandstanding for C-Span and making sure they appear to be on the right side of the right issue, whichever sides/issues those may currently be.

Anyone heard of Elizabeth Warren, the bailout cop appointed by Congress? What’s she been saying lately? And is anyone listening?

Anyway, back on topic, I personally know people who are in NOD/foreclosure limbo. Tried to short sell, but the bank was unresponsive. So they’ve stopped paying and are living for free, waiting for something to happen. I’ve heard you have to be behind on payments a full year before a bank even pays attention these days. And once the foreclosure process is initiated, it can take up to another year for the place to hit market. By which time we’ll likely have government-provided 2% 50-year mortgages with principal reductions courtesy of the taxpayer.

For those interested in broader context, the ratio of NOD-to-sales in SF through 2009 is at the levels that Contra Costa and Alameda were at early/mid-2007. Incidentally, that was also when the median prices really began to fall. Of course, we’ve already had median prices start to fall in SF even without a huge number of foreclosures, so perhaps a decent fraction of the ultimate price adjustment has already taken place. Nevertheless, caveat emptor.

“homeowners tax credit”

The tax credit is nothing more than a fart in a hurricane compared to the one trillion in MBS that the Fed has purchased and government loan guarantees through fannie, freddie and fha.

If they start to pull back on those it’ll get ugly.

“government-provided 2% 50-year mortgages with principal reductions courtesy of the taxpayer.”

Now there is some tasty government cheese! Perhaps that will be a nice 2012 election year bribe, just in time for my reset! 😉

Even if foreclosures are up 31.6 % QOQ, SO WHAT?

Let’s say there are 400,000 owned homes in San Francisco.

That means only 0.15% are NOD and 0.044% are facing foreclosure. That’s simply not enough to have any type of downward pressure on prices.

Maybe 400,000 isn’t the right number, but it’s close (does anybody have the right number?) The point is, as a percentage of available inventory, the number of owners in distress situations is virtually negligible.

Even if foreclosures increased tenfold, as in 1,000%, that’s still only 0.44% – nothing.

Personally, given how much San Francisco prices have gone up in the last ten years, I’m amazed they haven’t cratered. But they haven’t. And the reason is, demand is still strong enough, and most owners are well capitalized enough to ride out the storm.

DataDude, this is a common mistake made by commenters on this site. Someone once estimated on SocketSite that there are approximately 600 homes sold per month in San Francisco County on average. These 600 sales set what market price means, and the other 399K+ homes are irrelevant to market price.

Therefore, if 179 of the 600 sold are foreclosures, then approximately 30% of the market-setting events are affected by foreclosures. That is incredibly significant.

For more detail on this, see my post on 9/21 at 4:12PM here:

https://socketsite.com/archives/2009/09/san_francisco_county_unemployment_up_to_101_percent_in.html

CORRECTION: 179 is a quarterly figure, so figure 60/month. That’s 10% of the monthly market, so it is still very significant.

Corntrolio has the point exactly right (although foreclosures were 179 for the quarter not month). There is a tipping point where the percentage of foreclosures becomes a substantial enough portion of the market that the foreclosure price becomes the market price. I don’t know what that percentage is but it is well below 50%. If foreclosures pick up at the higher end, where so few places are selling at all, this could become a big factor with only 10-odd foreclosures a month in the higher price range.

A tangential point — I check in with the new listings on redfin on Fridays and we are now at just under 300 in the last 24 hours. That is a huge number — about double the highest I’ve ever seen before even during the Spring. Anyone know what is going on?

Corntrollio – first, let me applaud your polite tone.

You make an interesting point with your 30% “foreclosures as percent of sales” (F/S) number. What do you suppose this number is in a place like Detroit or Las Vegas? Maybe 90%?

If foreclosures actually exceed sales, F/S would be > 100%, so maybe the logic of this measure isn’t quite sound.

My guess is San Francisco has one of the lowest, if not thee lowest, F/S numbers in the country. Does anybody have info on other markets? I think this is a great metric.

And the truth is, prices haven’t fallen that much here.

DataDude — I’m not sure about what the statistics are for other cities. For the 9 county Bay Area region, there were 7462 foreclosures in Q3 2009 (http://www.dqnews.com/Articles/2009/News/California/CA-Foreclosures/RRFor091020.aspx), or approximately 2487/month. There were 7879 sales in the 9 county region in September (http://www.dqnews.com/Articles/2009/News/California/Bay-Area/RRBay091015.aspx). So for the 9 county area, the ratio is 31.6%, for comparison. SF County had 536 sales in September, so approx. 60 foreclosures is 11.1%. (I didn’t round my numbers until giving the final answer)

One thing that confused me though: a foreclosure *is* a sale — i.e. it gets recorded by the bank or the new owner and then published in statistics as a recorded sale. So I don’t think F/S could be greater than 100% because all foreclosures will become recorded sales. Am I missing something?

“Personally, given how much San Francisco prices have gone up in the last ten years, I’m amazed they haven’t cratered. But they haven’t. And the reason is, demand is still strong enough, and most owners are well capitalized enough to ride out the storm.”

“DataDude” demonstrates that the only thing supporting the SF Real Estate market is faith. Here’s what the data says:

Demand is not keeping up with Supply – plenty of properties are being pulled of the market after many rounds of price reductions.

Well Capitalized Homeowners – more and more home sellers are getting NODs or going into foreclosure.

True, you will not realize a change in real estate value until you buy/sell, and yes, keeping the supply tight will keep prices from cratering. But didn’t they build a buttload of residential units around SOMA in the past few years?? DO you think all that extra capacity will not impact prices?

“Personally, given how much San Francisco prices have gone up in the last ten years, I’m amazed they haven’t cratered. But they haven’t. And the reason is, demand is still strong enough, and most owners are well capitalized enough to ride out the storm.”

“DataDude” demonstrates that the only thing supporting the SF Real Estate market is faith. Here’s what the data says:

Demand is not keeping up with Supply – plenty of properties are being pulled of the market after many rounds of price reductions.

Well Capitalized Homeowners – more and more home sellers are getting NODs or going into foreclosure.

True, you will not realize a change in real estate value until you buy/sell, and yes, keeping the supply tight will keep prices from cratering. But didn’t they build a buttload of residential units around SOMA in the past few years?? DO you think all that extra capacity will not impact prices?

Many of you are still missing the bigger picture, I think. Prices aren’t really cratering anywhere anymore because of government intervention. Foreclosures are meaningless if they’re never resold to the open market (or resold in drips and drabs over the course of 5-10 years vs. immediately).

Ask yourselves: how can mortgage rates be near record lows while foreclosures are at record highs and rising? Does this seem logical to anyone? A discussion of supply and demand here is a little bit misplaced, IMO, given that supply is being constrained while demand is being goosed by artificially low rates, FHA loans that are designed to default, and various other stimuli.

As LMRiM predicted, the government has attempted to absorb and maintain the bubble. He didn’t predict it would work. So far, it has, at least partially. As to how long this can continue…who knows?

Legacy Dude, I don’t think foreclosures are “meaningless” if they are never resold — they still show up in statistics, and it’s still clear that no one else felt the need to bid higher than the bank’s note to purchase the house.

However, you make an important point re: government intervention. Given how ridiculously low mortgage rates are and the FHA programs and all the other items you mentioned, the government is clearly working hard to keep home prices up, whether it is doing so to help out banksters or otherwise. In addition, things like allowing the GSEs to deal with “conforming jumbo” loans are propping up sales up to $729K (+ downpayment) to some extent. The Fed is still engaging in large amounts of quantitative easing as well. Until all of these extraordinary measures stop, there will still be a lot of artificial supports for housing prices.

“I don’t think foreclosures are “meaningless” if they are never resold — they still show up in statistics”

Yes, but they count as a “sale” at the loan balance. As you wrote, the implied market value is below this balance, otherwise the property would have sold directly or via short. So median prices are actually skewed upwards when a bank takes a property back, and reality won’t be reflected until the bank sells to an actual occupant. And I don’t see this happening with any sense of urgency today.

Anyone think it will, ever? A nationwide RTC-style liquidation? Puh-leeze. Newsflash for everyone: this is America. The sky will never fall as long as we can borrow more sky. Period. Our generation’s credit bubble has officially become the next generation’s debt burden. Apologies to my fellow prudent savers who were expecting a true market correction – that show has officially been cancelled. Rained out by a torrent of devalued, borrowed dollars falling from the sky.

Apologies to my fellow prudent savers who were expecting a true market correction – that show has officially been cancelled.

Try explaining that to Las Vegas, Phoenix, Detroit, LA, etc, etc…

http://4.bp.blogspot.com/_pMscxxELHEg/SsIHnIL3gAI/AAAAAAAAGcc/ebePVZ4v2CU/s1600/CaseShillerCitiesJuly2009.jpg

But don’t let facts get in the way of your reality…

“Yes, but they count as a ‘sale’ at the loan balance. As you wrote, the implied market value is below this balance, otherwise the property would have sold directly or via short. So median prices are actually skewed upwards when a bank takes a property back, and reality won’t be reflected until the bank sells to an actual occupant. And I don’t see this happening with any sense of urgency today.”

That’s not completely right. The implied market value absolutely does not have to be below the loan balance. It is entirely possible for a bidder to bid more than the first mortgage on a foreclosed house, and the excess goes towards paying any other mortgages, and if there’s any excess after that (unlikely in this market), it goes to the seller. That’s the case even if a property is not sold directly or via a short sale — it might be that the 2nd mortgage holder didn’t agree to the short, and then the 1st mortgage holder foreclosed.

When a bank takes a property back, it has to bid on that property. If there is a higher bid, the trustee sells the property to the higher bidder and what I described above happens. If there is no higher bidder, the bank holding the first mortgage usually takes it back for the value of the note.

Because there is a bidding process, you’re still setting a market value with all foreclosures. The recorded price is either the highest bid or the value of the 1st mortgage holder’s note.

@ corntrollio: Fair enough, in this respect I guess banks taking property back can move statistics accordingly. But I still don’t see any urgency in liquidating foreclosures, nor do I anticipate there to be any. I would be ecstatic to be proven wrong, though.

@J: If you read across that list of cities, you’ll notice that most of them began to decline before the credit implosion began, which I date to late summer of 2007. Miami crash began when – late ’06?

The government didn’t take over the mortgage market until last September, TARP was passed in October. So Miami, Phoenix, Vegas, etc. had already been in slow decline for at least a year at that point. Now, in 2009, Case-Shiller is showing a flattening/uptick for many of those markets. Case-Shiller is also more applicable for those markets given the homogeneity of their housing stock.

SF was behind the curve in price correction and didn’t start falling in earnest until late ’07/08. Left alone for 18 more months, we may have seen city-wide drops of 30-40% in all neighborhoods. But that didn’t happen. And it probably won’t until the stimuli go away (i.e. never).

I’ve consistently been one of the more bearish voices here, and would be thrilled to see a 40% correction in better parts of the bay area. I just don’t think it’s going to happen at this point. I’m not saying prices are going up anytime soon, mind you. But for those of us who have been waiting to buy until it made sense vs. renting….we may be waiting several years longer than expected. As in my first post above, I predict a lot of sideways gyration from here on out, but that’s about it.

Hey, there’s no hurry to buy if prices are in slow decline but still too high and rents are dropping too…

My take is that only so much propping can be done and foreclosures are movin’ on up. And inventory may be understated but, even the stated amount, is near record highs…

Late ’08, not ’07 is when SF shifted.

LA, Detroit, Phoenix, Vegas — Oh. I get it. We’re playing which of these things is not like the other thing.

Well of course none of them are in RealSF…

Are any of them in Samecommentbot City? But seriously tho. Bad one. Detroit and LA are the same. Crummy.

And it is just a coincidence that 15 major metro areas have recently seen > 20% declines?

No, I wouldn’t call it a coincidence. Linking unlike cities is not a worthwhile thing to do, though. LA is somewhat like here. People going around writing 20% under asking offers aren’t getting much traction. Detroit is a dying city. Phoenix and Vegas are sprawls. Think what you want tho.

No, I wouldn’t call it a coincidence. Linking unlike cities is not a worthwhile thing to do, though. LA is somewhat like here. People going around writing 20% under asking offers aren’t getting much traction. Detroit is a dying city. Phoenix and Vegas are sprawls. Think what you want tho.

The common link is that they all reached their price peak at the same time because of loose lending practices and higher levels of employment, SF included:

http://4.bp.blogspot.com/_pMscxxELHEg/Sj7FkxcQmVI/AAAAAAAAFmE/F90K3I1fSfU/s1600/RealSanFrancisco.jpg

Or would you site some organic cause for SF to appreciate at historically high rates leading up to 2006 that JUST HAPPENED to coincide with a non-related bubble?

That’s not true. SF’s price peak and, for one, Las Vegas’s price peak are probably offset by at least two years.

Organic cause(s)? I have my theories.

GOOG, AAPL, ORCL, …

obviously, easy money is a giant part of the story but so are dollars shifting in and out of the stock market, especially dollars generated by employee stock.

the google reprice in March has created $1.86B (that’s billion) in new employee wealth so far. 7.6M deeply underwater options re-issued at a $308.57 strike.

Case Shiller for SF(no misleading median BS):

http://2.bp.blogspot.com/_pMscxxELHEg/SnTLa6vwP5I/AAAAAAAAF-U/n1qoSBpVA9M/s1600/TierMaySF.jpg

Nominal peak was in 2006.

GOOG, AAPL, ORCL, …

All I’m gonna say about that is that even the tech boom didn’t create the same level of house value appreciation…

Case Shiller doesn’t evaluate “SF.”

And the tech boom was over before anybody started making money via the internet.

“And the tech boom was over before anybody started making money via the internet.”

Indeed, during the tech boom people made their money the old fashioned way … ripping off investors.

Diemos, I’m curious if your outlook has changed at all recently. Are you still predicting 40% down across the board by 2012? I just can’t see it anymore, barring a currency/debt crisis or similar event.

Indeed, during the tech boom people made their money the old fashioned way … ripping off investors.

That is true for a lot of the fly-by-nights — webvan, etoys, pets.com, and a long list of others. But Cisco, Oracle, Sun, IBM, HP, and others made scads of real money during the dot-com boom. So did SF consultants, lawyers, web designers, and a host of tangential players. J’s point is a valid one. The 1997-2001 SF housing bubble was driven by a mass infusion of real money, yet even that did not cause prices like we saw later on (except in very select areas — mostly on the Peninsula but also in Pac Heights). The 2003-2007 bubble was created by loose lending and was widespread. We’re unwinding both of those bubbles now, but we won’t unwind the first one 100% specifically because it was not entirely a “bubble.”

The 2003-2007 bubble was created by loose lending and was widespread. We’re unwinding both of those bubbles now, but we won’t unwind the first one 100% specifically because it was not entirely a “bubble.”

And a lot of Bay Area companies made enormous amounts of “real money” during this period too.

Enormous compared to 1997-2001? No.

“the google reprice in March has created $1.86B (that’s billion) in new employee wealth so far. 7.6M deeply underwater options re-issued at a $308.57 strike.”

@steve

Can you speak on the GOOG option repricing and when they start vesting?

Is it a common 4 year plan with 25% vested after one year and then montly vesting of ~2%?

If so, that would imply another possible $450M+ cash infusion in March ’10. A large chunk of that money could go back into Bay Area real estate.

Of course, not all that money is going to Bay Area people and those here may have no taste for real estate, but there could be several hundered folks with and extra $250k in their pocket looking for “deals”

Enormous compared to 1997-2001? No.

Making money? Yes. Burning money? No.

“Can you speak on the GOOG option repricing and when they start vesting?”

My impression was that they gave share for share of repriced options, which is strange, because employers often offer less than 1:1 when they reprice, so that you actually have to think about whether you want to reprice or not. Investors like when employers offer less than 1:1 too, because it means that they would be diluted by fewer stock options.

In any case, instead of fewer options, the only downside was that vesting was 1 year later than normal. I’d assume most people are on a 4 year vesting schedule — pretty typical. Don’t know if it’s 25%/year or 25% for the first then monthly.

As you said, though, plenty of GOOG folks in NY too. And they probably won’t all sell at once, either.

I seem to remember reading (maybe up to a year ago in the NYT) that the average Google employee being hired at the time of the article had around 685 options. As of today, the stock is up around $245 from the $308-ish reprice, so that’d be around $168K. Not bad.

They must have had a lot of employees with high strike prices, because approximately 75% of their employees took the deal. In the same NYT article, I think the stats said that around half of Google employees at the time of the article had been there for less than 1 year, and that the average grant price was around $485. The peak was above $700, so a lot of the folks were close to the same position then that they are in now.

Counting Chickens. Hatch.

As opposed to your scorched earth for tech pontifications? Imminent doom for the SF housing market, what, two and half years ago? I’ll take those unhatched chickens to market a million times over. Didn’t you say Google was over?

Really Anonn, didn’t you grew up in small town Ohio?? How did YOU become an expert in large urban areas with THAT kind of backround? L.A. is NOT like Detroit, and in fact as has been discussed on this site before, the greater L.A. area has a far greater average urban density than here. Furthermore, as wealthy as the Bay Area is, the huge population numbers of the Southland mean that the rich areas are really rich and really huge. Instead of two blocks of outer Broadway, try whole neighborhoods of homes that still sell for well over 20 million and are purchased with cash. Having lived in London, Chicago and L.A., I find San Francisco provincialism quite bizarre.

What I find must funny about people like Anonn, is they move here to a neighborhood that is really just another small town like they grew up in (Bernal, Potrero, Noe, etc.) and after 10 years they think they are BoHo urban hipsters because they have a San Francisco mailing address. Chicago and New York are what many keep comparing the Bay Area to, but I think the comparison with Boston or another 2nd level city is far more accurate.

Huh? I was the one who called the other guy out for comparing LA to Detroit. Put your drink down and read what was said again, Mr. Provincialist in non-provincialist’s clothes. I happen to like LA a lot. I’m not one to compare cities. I realize SF proper is rather small potatoes on a global scale.

It seems as if you know one thing about me. Good for you. It’s been much longer than 10 years by now. So there, now you know two things.

Also Thomas Edison, the Wright Brothers, Ulysses S. Grant, Neil Armstrong, Paul Newman, Jack Nicklaus, Arthur Schlesinger, Clark Gable, Johnny Appleseed, Chrissie Hynde, Harriet Beecher Stowe Bootsie Collins, Kennesaw Mountain Landis, Toni Morrison, Hart Crane, Guided by Voices, Dave Grohl, Devo, Pere Ubu, The Ohio Players, Nine Inch Nails, John Glenn, William McKinley, heck something like eight presidents, Cy Young, Bobby Knight and Lebron James all had something in common. Can you guess what that is?

RE: GOOG repriced options. As of now, it is a paper gain of around $168K for the “average” employee, the first 25% of which will be vesting no earlier than Q2 2010, on which they will owe the better part of 50% in taxes, because nobody’s buying to hold at a $300 strike price. So, that’s only a $20K windfall per average employee on first vesting, and $5K per quarter thereafter, not enough to do much other than making some restaurants happy.

What it may do, however, is make the already well-off Googlers even more so, as those who have been around longer and have more senior positions will naturally have larger grants being repriced. If someone’s a Director or higher, and has been around for a few years, one might be looking at having a few/several thousand options per year repriced, and then we could be talking downpayment money.

They effectively re-priced back to October ’05 levels. Does anybody know if they re-priced already vested but unexercised options? If they did, that could open a mini-flood for higher-level employees on the first extended vest. Even so, that’s not going to be that many people.

Oh yeah. Speilberg, Mancini, Hope, Pete Rose, Branch Rickey, Jesse Owens, Sherwood Anderson, um, Halle Berry, Annie Oakley, Zane Grey … to answer my own question, these are all utterly worthless Americans from the great state of Ohio. I mean, who needed that Edison character? What a hayseed. Those Wright brothers? What a couple of rubes.

Oh yeah. Dean Martin. What a loser.

“L.A. area has a far greater average urban density than here.”

No, it doesn’t.

http://www.architects.org/emplibrary/C6_b.pdf

Are parts of LA totally full of rich people, dwarfing San Francisco’s per capita rich people total? Sure.

But so what? “Anonn, you’re from Ohio, so I’m gonna say blah blah blah about — mistaken point, mistaken facts — blah.”

You’re very worldly, you are. LOL.

Proud Ohioan signing off.

Nothing wrong with Ohio Anonn, just pointing out that San Francisco is a very small fish in a very large ocean. As someone who grew up in the city and Marin, I was educated from an early age to hate all things L.A. and the constant drumbeat of S.F. being the “best place on earth” (former station i.d. used on CBS5 I think, back in 90’s) was getting quite old. After moving to my first position in London, L.A., followed by Chicago, I found when I returned to San Francisco that it was not nearly as important or pretty as it thinks it is. The city I spent years wishing to return to seemed very provincial, dirty, but still charming (Though who wants to be called charming?).

I also apologize in that in re-reading the thread, you were not the one who was comparing L.A. to Detroit. As for density, the city density of San Francisco is FAR greater than L.A., but the regional urban density of the Bay Area is far less dense than metro L.A. I think Brutus had posted this surprising fact in the past here? The Bay Area has as much sprawl to worry about as Orange County or Phoenix.

Anonn, if I ever sell my home in the Marina, you are getting the listing, since you do have a true passion for S.F. and real estate, and it is at times informative and also entertaining. Cheers.

Enormous compared to 1997-2001? No.

Making money? Yes. Burning money? No.

Anyways, the point is, much more money was made in that earlier period, yet prices didn’t sky rocket at the same rate. So it is clear that bad lending practices are what drove the prices up this time.

“I’m curious if your outlook has changed at all recently.”

Man does not live by snark alone so I guess it’s time for a serious post.

Where are we? Where are we going?

The subprime dominated markets topped out and began to implode in 2006 leading to the demise of many subprime loan originators and a wave of foreclosures that have induced a significant correction in those markets. There are plenty of place in California, Nevada and Florida where prices are 30-40% of their peak value.

With credit tightening, the flow of funds into the real economy from mortgage equity withdrawl peaked and began to decine. At the same time our manufactured goods trade deficit also peaked and began to decline as Joe 6-pack no longer had the funds to support his consumption.

As the size of the losses on these loans began to be clear we got the first rumbling of trouble in the financial system. The commercial credit spreads between private and government debt began to spike up in summer 07 and we saw the beginning of adhoc lending programs from the Fed. Once it became clear that AIG would not have the cash to honor their credit default swaps we got the major crisis of fall 08. Without intervention we would have seen the entire financial system implode at this point in an orgy of cascading cross linked defaults. However, the Fed came to the rescue by exchanging cash for assets at par value. Something that should have come as no surprise to anyone who had listened to Bernanke’s famous helicopter speech. With the rescinding of mark-to-market accounting rules financial firms were now free to pretend that their assets were worth whatever they needed to be worth in order for the firm to go on pretending that they were solvent.

So today we have a financial system that is insolvent under any realistic valuation of their assets. However with the Fed willing to lend cash for dud assets and no one interested in enforcing honest accounting our financial system has now been zombified. While the banks are insolvent the spread between their loan book and their cost of funds insures positive cash flow. This should be being used to write off their dud loans but instead we’re treated to the spectacle of bankers paying themselves massive bonuses out of those flows.

There is currently no significant private mortgage market in the country. Only loans that can be sold off to government agencies are being made. Right now every sale or re-fi that takes place has the potential to move a liability from

a private balance sheet to the government. The primary motivation for all actions to “support” the housing market are to facilitate this transfer of liabilities to the government. As this progresses there will be less and less motivation to “support” the housing market. Currently housing is being supported on the supply side by foreclosure moratoriums and banks just plain old not foreclosing. On the demand side the support comes from low interest rates from Fed intervention and having FHA become the new subprime. This massive intervention seems to have stabilized the housing market for the moment but I wouldn’t say that the market correction has been canceled, more like it’s on hiatus.

Where to from here?

Inflation? Joe 6-pack has been cut off from MEW, total wage compensation is falling, credit cards are being paid back, unemployment is high. The likelihood of a 70s style wage-price spiral is essentially zero under those circumstances. There’s just no cash flow to create inflation.

Hyper-inflation? A self-fulfilling prophecy where people lose faith in a currency as a store of value, begin frantically trying to exchange them for real assets and thus drive the value of the currency to zero. Joe 6-pack is not going to create a hyperinflation because he doesn’t have any cash to get rid of. Who is sitting on a big pile of cash and should be nervous about it’s value? Foreign central banks especially china. So far they are more interested in maintaining their exchange rate in order to support their exporters and are still accumulating dollars.

Deflation? So far the real economy and the markets have been supported by the willingness of foreigners to loan money to the US and the US is currently projecting trillion dollar deficits as far as the eye can see. Eventually they will tire of this game and stop their lending, but when? That’s the question. They have to decide to reorient their economies from exports to domestic consumption. When they do we’ll see another round of economic contraction as either interest rates rise or deficit spending gets cut back or a fall in the dollar increases the cost of globally traded commodities.

So my prediction is still for a fall in house prices. The question now is how long will foreign governments go on propping up the US at the expense of their own well being. It’s become a nail-biter as to whether this will happen by my “sell by” date of Jan 1 2012. If not, then I shall just have to accept your brickbats for my failed prediction with quiet dignity and grace.

Anyways, the point is, much more money was made in that earlier period, yet prices didn’t sky rocket at the same rate.

I’m not convinced that either part of that statement is true. First the weak disagreemnt. The dot com legacy made bankers, VCs and LPs piles of money. The VCs were almost all local; the bankers were split between SF and NYC; the LPs are everywhere. Many founders and early employees also made fortunes (and more at big companyies like PSFT, SEBL) but paper fortunes were also lost via lockup rules and exercise and hold. I don’t have a sense if that manic period created more or less area wealth than the 2003-2008 tech expansion. But, given the Atherton thread, I’m open to believing that the dot com boom was bigger, hence the weak disagreement.

Now the more significant issue. The 99-00 runup was substantial. See the prestige index:

http://www.firstrepublic.com/lend/residential/prestigeindex/sanfrancisco.html

Thanks Diemos. I agree with your outlook, notably your penultimate paragraph above. I think we may see some pressure on rates as things stabilize globally, prompting some money to leave treasuries. Probably not enough to move the needle, though. It seems the reckoning is delayed barring another major schizm. Up next: FDIC and FHA bailouts.

Y’all are forgetting the ultimate bailout: war with China. Preferably wiping out huge amounts of their industrial infrastructure and restoring us to global supremacy.

Or (more likely) widespread civil disobedience or civil war within China. Not impossible.

Now the more significant issue. The 99-00 runup was substantial. See the prestige index:

http://www.firstrepublic.com/lend/residential/prestigeindex/sanfrancisco.html

Is that just median prices of homes valued at $1M+ by 1994? That is a pretty small fraction of the market, and probably not too relevant to anyone here. At least with Case Shiller, you can see a tracking of specific home values at different price points, and not worry about changes in mix having an impact on the results:

http://2.bp.blogspot.com/_pMscxxELHEg/SnTLa6vwP5I/AAAAAAAAF-U/n1qoSBpVA9M/s1600/TierMaySF.jpg

http://www.nytimes.com/2009/10/25/business/economy/25gret.html?pagewanted=1&_r=1

A federal bankruptcy judge wiped out the debt on the home mortgage for lack of standing cause they could not produce evidence of who owned the note. It will be interesting to see if more people in bankruptcy start tying to fight mortgage lenders by using this case as precident. Also something to see what happens on appeal.

I noticed it pointed out in the article that the bank overcharged interest… anyone know what to do if a bank has done the same but won’t pay back what they owe you? I have been going around and around with one of the larger banks regarding such but am getting the run around.. I don’t want to pay money to hire counsel necessarily.

Diemos is too pessimistic by about one third. Here is the WSJ article back in August, which already needs revision downward, as the deficit this year will be $1.4T, not $1.5 (or the $1.8T projected initially):

http://online.wsj.com/article/SB125119686015756517.html

(go through google news to get past the pay wall)

We will have to cut spending to afford the wave of boomers retiring though. Perhaps we could cut our expenditure on overseas wars.

This weeks Economist is all about the relationship between China and the US and while each side is deeply suspicious of the other, we still both need each other. As the Chinese consumer begins to spend more, this will improve the US economy, not weaken it. We should be able to export more, or at least import less and build more at home.

We will have to find another way to finance our deficit though, this is true. It looks like it will stabilize at about 80% of GDP, which is not a particularly high level, compared to other large industrial economies.