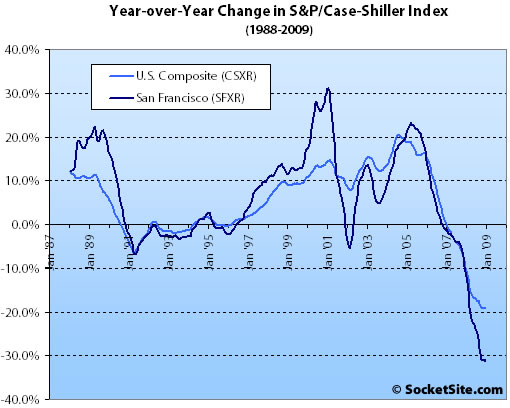

According to the January 2009 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 4.4% from December ’08 to January ’09 and fell 32.4% year-over-year. For the broader 10-City composite (CSXR), year-over-year price growth is down 19.4% (having fallen 2.5% from December).

The three worst performing cities, in terms of annual declines, continue to be from the Sunbelt, each reporting negative returns in excess of 30%. Phoenix was down 35.0%, Las Vegas declined 32.5% and San Francisco fell 32.4%. Dallas, Denver and Cleveland faired the best in terms of annual declines down 4.9%, 5.1% and 5.2%, respectively.

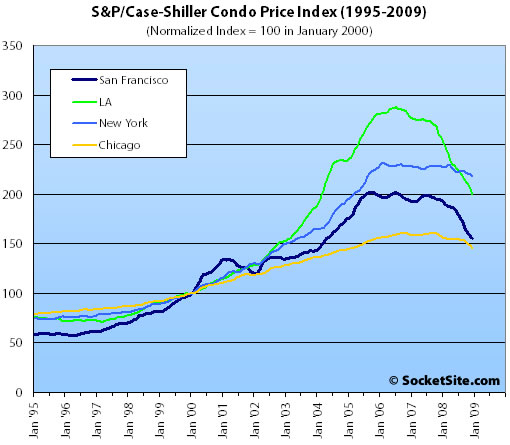

Condo values in the San Francisco MSA accelerated their decline falling 5.4% from December ’08 to January ’09, down 19.8% on a year-over-year basis and down 27.2% from an October 2005 high.

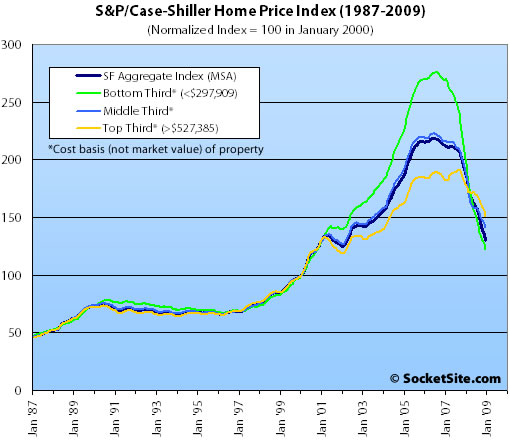

San Francisco MSA single-family home prices fell across all three price tiers.

The bottom third (under $297,909 at the time of acquisition) fell 4.7% from December to January (down 39.2% YOY); the middle third fell 2.9% from December to January (down 24.8% YOY); and the top third (over $527,385 at the time of acquisition) fell 4.2% from December to January (down 17.9% YOY).

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA have retreated to August 2000 levels having fallen 58% from a peak in August 2006, the middle third has returned to May 2002 levels having fallen 39% from a peak in May 2006, and the top third has fallen to February 2004 levels having fallen 25% from a peak in August 2007.

The standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

∙ The New Year Didn’t Change the Downward Spiral of Residential Real Estate [S&P]

∙ December S&P/Case-Shiller: San Francisco MSA Ends ’08 Down 31% [SocketSite]

What a wonderful set of graphs!

Hooray! Looking at the graphs we seem to have reached a bottom in the housing market.

Well.

At least our rate of decline seems to have bottomed at 30%/year.

Top Tier is now $527,385. Too bad we do not have 3-tiers granularity within the top tier.

The decoupling between the tiers is pretty dramatic. You can clearly see the effects of easy sub-prime financing starting in 2001. The lower tier separated from the rest, chasing up high prices from the 2 first tiers. Now that the gold mine has been depleted the bottom tier falls harder and faster.

Does this mean the bottom tier is now undervalued? Or is the top tier is still overvalued? These graphs are surprising even to the uberbears. I wouldn’t discount a dramatic overshoot on all tiers.

Look at Los Angeles, geez.

Hate to own something 10M over there, at least based on what I watch on the Real Housewives of Orange County.

I’ll throw out some guesses here as to the extent of final correction.

In nominal terms:

Bottom third – 75-85% complete

Middle third – 40-50% complete

Top third (and all of The Real SF) – 25-35% complete

In real (inflation adjusted terms) I bet that none of us reading this will live long enough to see the real valuations in the SF Bay Area that prevailed 2004-06.

Congrats to those who sold out at the peak and reduced their bubble equity to gold, t-bonds, cash or even a palace in a more sensible part of the US (or were otherwise able to navigate these back to back bubbles with their converted value intact). It was a once in a lifetime opportunity.

The impact of the crash on the “tiers” is pretty interesting. In the release of the August 2007 index (the SF top tier peak), a sale needed to have a cost basis of >$851k to get into the top tier and the bottom tier went up to $612k. In January ’09 you only needed to be >$527k to get into the top tier and the bottom tier tops at $298k. So a $600k basis only put you into the bottom third 18 months ago but now puts you into the top third. I’ve been predicting for a while that the top tier will surpass the lower ones down, but this downward “tier creep” may be masking that phenomenon.

LRMIM,

Can you suggest a nominal value for me for downtown condos in terms of price psf?

I know they are not at all homogenous, but I’m wondering what $ I’ll be able to justify to my tax assessor.

Seems like prices are all over the place in SOMA, Barbary coast, etc.

What I am wondering this beautiful morning is that as this unwinding rolls, will there eventually be large scale foreclosures in the “real” sf.

Would I be wrong to say that most on this site would bet against foreclosures coming to their neighborhood?

Rents are falling, jobs are disappearing, equities are disappearing… will all really continue to take their lumps for years to come?

jessep,

Can you suggest a nominal value for me for downtown condos in terms of price psf?

Not really. I think the housing stock is pretty heterogeneous everywhere in SF, even in SOMA where there are clearly big differences in micro-neighborhood, high rise vs. loft, 1/1 shoebox vs view 3/3 penthouse, Millenium vs. Palms. etc. But as for a possible nominal bottom valuation, I’d suggest thinking in terms of 50-60% off the original peak wishing prices of developers there (not saying of course that many purchasers didn’t negotiate better deals). Tell the assessor I said so 😉

I would bet against foreclosures and price declines in my neighborhood (westside San Bruno) except that they are happening all around us right now…

Outbid so far on all my candidate houses & apartments that are in East Oakland/San Leandro. Cash flow investors are all over these areas.

I think we’re at the bottom here.

Middle & higher end houses still have a bit to drop. Montclair is coming down. Alameda is too. Berkeley’s still too elevated. These places will drop in 2010-2011 as the option ARMs recast, as I suspect these places were the prime areas for “prime” loans that were limited doc/option loans etc. Subprime’s already been torched as we see and at the bottom.

All tiers will be retreating to roughly 1997-1998 metrics over time either through price drops or inflation. This seems to correlate with LiRM % decreases noted above.

Articles are all over the net today about a new DB report discussing potential housing busts with NYC topping the list. SF was not on the list, but that doesn’t mean we’re immune.

I would think that you could get at least 10% knocked off from your latest assessment… assuming you bought after 2004.

will all really continue to take their lumps for years to come?

Yes. Considering that many many people drank the koolaid (making rational choice difficult b/c they have internalized the purchase decision as a measure of self worth) and have $$ tied up in large downpayments (rolling bubble equity in larger “move up purchases”), I’d bet that a very large percentage of The Real SF will fully absorb all the declines coming.

In addition, anecdotally we’re all aware of the phenomenon of parents pulling cash out of inflated properties in order to help their kids get on the housing ladder. In effect, these multigenerational housegamblers have doubled down on their bets. This dynamic should make rational economic decisions pretty tough (and make for some uncomfortable holiday dinners in future years ;)).

Although people are looking for “capitulation”, it won’t happen that way IMO in stable areas with relatively high income/financial resources. But in any event, because buyers set the marginal price of any good (not sellers), volumes will remain low as buyers slowly realize what is happening in the “better” areas. Besides, there are not enough liferafts on the Titanic. Most will ride the ship down to the bottom 😉

The “key housing indicators” S&P releases simultaneously with the CS index is worth a look:

http://www2.standardandpoors.com/spf/pdf/index/2009-03_Residential_Real_Estate_Indicators.pdf

Granted, this is national summary info and not SF MSA. But it shows a rapidly growing trend in prime mortgage delinquencies — up from 3.24% to 5.06% from Q4 ’07 to Q4 ’08, with prime foreclosures also up 50% (from .41% to .63% of loans). I agree with David that the worst is yet to come for the top and middle — couple more years at least before we hit bottom. But it also looks like the subprime and low end crash still has legs and is not over — slowing declines are still declines.

chuckle-

Anecdotally, I own in the ‘real’ SF, and while crime rates are increasing, neither anyone in our household, building, or next door neighbors has yet to be laid off, though the contractor above us is having a harder time finding work. Maybe SF is lagging the broader economy again, but it feels like, to me, that we’re not taking it as hard as the rest of the country. So, assuming that home buyers in my neighborhood are well capitalized (a big assumption, but most of the stuff around here is fractionalized TIC loans and 1-2 million dollar homes) foreclosures will be light. In places like Pac Heights, I expect the rate to be even lower.

However, I still expect a foreclosure here and there. I also expect prices to come down significantly, especially on TICs which become dramatically less appealing when more condos and SFHs are become affordable. And, if jobs continue to be lost, eventually it will hit everyone.

Trip,

agreed about the “tier creep” most probably distorting these figures, hence my comment about the need for more granularity. There is still something very real about the shifting of tiers. If a house at the edge of the top tier was selling at 851K in 8/2007, it might be selling at 700K or 750K or most likely is asking 851K today and is not selling!

A very interesting statistical oddity yet to come:

If the volume on the current bottom tier goes down due to depletion of the current oversupply, then the tiers will be really messed up. If more than 1/2 of sales are of distressed property and these sales go away, then the effect on prices will be huge. What will matter then will be the overall BA.

Hm, just asked Nina Hatvany and she thinks I can only get 15% off. I’ll have to look at comps.

Do I own in the real SF?

Jackson Square? No one ever talks about it so I’m not really sure.

This is all so odd to me because all my neighbors are remodeling everything under the impression that they can resell later for higher values. My neighbor in PH1 is an MD at iShares and is tearing the place completely apart after paying north of 2.6M for it.

rr, there are plenty of higher-end layoffs in SF. My wife and I are big-firm attorneys. The legal industry is currently a total bloodbath. Two of SF’s largest firms collapsed at the end of last year. The other two largest firms have each laid off 10-20% of their associates. Finance is also a bloodbath at the associate levels — layoffs and 70% cuts to bonuses. Once these roll through and deplete savings, you might not see mass foreclosures in “good” areas, but you should see forced selling and thus the beginning of a return to rational valuation. No more of this nonsense where someone lists a property for a year asking for 10% more than they paid in 2006. Current prices are still wildly irrational.

regarding comments that prices will drop to ’97-’98 prices, what kind of PSF prices are we talking about for a SOMA condo, particularly the new ones that were built in the past few years.

Asking prices in SOMA seem all over the place, in terms of calendar year price. some are asking for new highs, while others are back to 2004 prices. i am tempted to put in an offer for one that’s asking year 2004 price, but i wonder how big of a loss i’d be taking if the price then dropped back to ’97 valuations.

I agree with anon. While the number of listings in my price range and neighbourhoods are the highest I’ve ever seen, open houses show them to be very overpriced properties in not great locations, needing lots of work. NPR had a segment last week on sticky markets – increased number of houses on the market, but not the bargains that potential buyers now expect given all the news. So few sales and increased inventory. Seems to me the result is inevitable. I just wish it would happen sooner rather than later.

Giving some more thought to the foreclosures in desirable areas issue, lets say we’re at the end of 2009 and prices are 20% off peak.

At that point, people most vulnerable to foreclosure will be the ones that bought in (lets say) 2005,2006, 2007.

Lets say 5% of the people that bought in these peak years fall in foreclosure in 2010. This can add up to 15% of the sales in 2010 from foreclosures. Actually, more like 25-30% when you consider that sales have declined considerably from the peak years.

Of course, a lot of speculation on my part.

So if LMRiM’s call for 50-60% down in Soma is reasonably accurate, and to try to answer the questions posed by condoshopper and jessep, I’d guess that Soma will bottom somewhere around $400 to $500 per square foot. This would be around 50-60% off of the $1,000 benchmark that many of the luxury highrises asked for (and got) around the peak. With current Soma resales around $700-$750 per square foot, looks like we’re about halfway there.

Congrats to those who sold out at the peak and reduced their bubble equity to gold, t-bonds, cash or even a palace in a more sensible part of the US (or were otherwise able to navigate these back to back bubbles with their converted value intact). It was a once in a lifetime opportunity.

Not to worry, there will be other bubbles to “invest” in. That’s a guarantee!!

@condoshopper: I paid (as did most others in my building) $406 sf in 2001 for a newly built SOMA box (never was comfortable calling it a “loft”!) Sold it in 2005 for $650 sf. Depending on quality of the development, finishes, etc., I think Chuckie’s range is about right.

Chuckie wrote:

> What I am wondering this beautiful morning is that as this

> unwinding rolls, will there eventually be large scale

> foreclosures in the “real” sf.

My wife and I both went to Grammer School, High School, Undergrad and Grad School in the Bay Area so we know quite a few people.

As a real estate guy (with access to title company data) I have been looking to see what everyone we know has paid for homes and condos.

There are a lot of kids who got a ton of cash from Mom & Dad, but there are also a ton of kids (including many of my sisters single female friends) who never saved a penny but were able to buy ~$1mm condos (in PH & RH) with 80/20 loans.

Almost all the 80/20 loans had a “neg am/IO” or “pick your payment” 1st TDs and almost all the people that got 80/20 loans have gross income of less than the fully amortized DS.

I’ve noticed that it has been getting a lot hard to borrow from the “Bank of Mom & Dad” since unlike a few years ago the “Bank Managers” are not sure that real estate “will always go up” (like many were when they gave the down payment and co-signed a few years ago)…

Not to worry, there will be other bubbles to “invest” in. That’s a guarantee!!

I hope so! I’d love to get back on that gravy train again…

I don’t doubt they are out there, but, again, anecdotally, I’m not seeing them. (yet?) Based on your comments, I am wondering if some industries are entirely skewered, some are coming out relatively fine, and some (like the aforementioned contractor) are seeing something like the average. My neighborhood doesn’t have a high number of bankers or lawyers. It tends to be one tier below that, for lack of a better explanation.

What confounds things a bit is that many people who live in my neighborhood work outside the city down on the peninsula, and many of the higher-end jobs disappearing in the city may have been filled by people who lived outside of it.

Do I own in the real SF?

Jackson Square? No one ever talks about it so I’m not really sure.

According to my data, (combining Redfin and Trulia) there is one multi-million dollar condo for sale and a million dollar NOD. REO ratio of 1… hanging by a thread 🙂

I love predictions of percentage falloff by people who don’t even know what the units are like they’re talking about. Oh, 50% dropoffs! This was derived using my tried and true “WHAT A GRM SHOULD BE” calculator TM, and ignoring historic GRM rates a k a flat return to 1995-1996, sans appreciation or inflation. And then other people talk about it, and it builds as it always will, being a certian substance which runs downstream. Congratulations for being taken “seriously.”

RE: Industry specific layoffs + “Real SF” – Think that’s it safe to say that professional services in general are getting crush. Law firms, ad agencies, i-banks, strategy consultancies, etc are all getting smoked as discretionary spending on professional services is shrinking.

Generally speaking – all of those industries pay well, and when people drop from $150k+ (in many cases, lots of pluses) to

I found a really funny post from a little over a year ago. It’s pretty funny in light of all the digits spilled on here lately about “accountability”. Free burrito for anyone guessing the identity of “kenny” back then 😉

By kenny on Jan 3, 2008 | Reply

None of those gloom and doomers on Socketsite are going to stick around and admit error come spring. Many, many parts (most?) of the country have been getting clobbered for over two years now. We’re doing just fine here, you know? The socketsite bears area always on about the Sunset getting hit and whatnot. It hasn’t. I just searched the Outher Sunset. There were six fewer SFR sales in 2007 than 2006, and guess what? Higher median. It’s pretty hard to stomach at times. I don’t know why I keep going there. I’m like the old guys in the balcony on the Muppet Show.

http://thefrontsteps.com/2008/01/03/manhattan-is-a-bit-like-san-francisco-on-steroids/

Sound like anyone we know, lol?

Oh, you mean last spring 2008, when the market hadn’t yet shifted? Yeah. There certainly was no chorus of “I was very wrong. Sorry for my constant stream of arch and condescending language” on here.

You = “fair value” = 1996 = nobody can tell you different.

And it’s funny. Because it’s merely your gut feeling and you’ve actually got nothing. How many SOMA condos have you ever even visited, LMRiM? I’m thinking zero.

LMRiM,

Why would you dig that up? May this be a good lesson: you did the crime (of poking the fluj), now you’ll have to do the time (of facing his ire). I’m outta here.

LOL, you’re right SFS. I saw the language between you and Der Foolj (that was subseqently deleted by the editor) and perhaps you saw my “outta here” (also deleted) and Trip’s (still on I think). I know it’s petty – he’s such a moron and we shouldn’t lower ourselves, but as St. Augustine wrote, “Lord make me chaste, but not just yet”.

It’s kind of hard watching this anonn person have a complete mental breakdown on socketsite.

he’s such a moron and we shouldn’t lower ourselves

And… you just did.

Nothing I’ve written has been deleted today so far. Guess you flew off the handle mistakenly? What, people can’t change their names on here? Fluj became a lightning rod for dilettante axe grinders like you some time ago. I definitely tinkered with a few name changes.

Bug again kudos for getting like six or seven frequent posters to think you’re worthwhile to talk SF r.e. with. Because you don’t know anything except the formula you invented that I laid out, above. Oh. And how to look up tax records for properties in a city you don’t live in and ostensibly never care to.

I know, SFS, I know. No more “poking the fluj”. I promise 😉

It is sad that rather than give reasons “why” someone thinks that SF real estate will not revert to a historic median GRM (like it did every other time real estate heated up) that they just post that anyone living in Marin [couldn’t] know anything about SF real estate…

[Editor’s Note: And with that, back to the numbers at hand…]

FormeraptBroker,

The guy doesn’t use historic GRMs. He ignores them. His methodology is that he picks a moment in time pre-bubble, does not allow for appreciation, or inflation, and backs into it with what he thinks a GRM “should” be. Your infantile snap-bear criticism of my challenge was duly noted.

thx Dude and BD for the input on my inquiry.

In real (inflation adjusted terms) I bet that none of us reading this will live long enough to see the real valuations in the SF Bay Area that prevailed 2004-06.

Hmmm…..

SF peaked out at ~200% of January 2000 normalized 100 index. Let’s just call it “200” and date it back to Summer 2005.

I assume this index retraces back to that normalized 100 index level of January 2000 in five more years, or 2014. That represents an additional 33% (nominal) decline ahead of us. I assume that will constitute “the bottom.” (I know we likely disagree on that, but that’s okay. I’m playing the sucker for your wager anyway 😉 ….)

I’m 42 years old. I’m going to live into my mid-80s. Let’s call it 85 (my living father’s current age). I’ll be 85 in 2052. That is 38 years after “the bottom” I am assuming.

From my assumed 100 index low to the 200% top requires an effective doubling, and implies an average real rate of return beginning in 2014 of under 2%. (A CAGR of 1.85% over 38 years will get you a real doubling.)

I didn’t inflation-adjust the time between the Summer 2005 high and 2014 low. Let’s assign that 9 year period an inflation discount of… 2%/year, which compounds out to an additional 19.5% that has to be returned on a real basis.

If you compound 2.1% for 38 years off the assumed 2014 low, you can pick up that additional 20% of inflation between Summer 2005 and the 2014 low.

The graph in the link below shows real median household income increased from $35,379 in 1967 to $46,326 in 2005, or over 38 years (conveniently, the same period of time I was dealing with above). That’s an increase of only 30%. I assume a relationship exists between median income and median home prices.

http://en.wikipedia.org/wiki/File:Household_income_65_to_05.png

That historical 30% gain between 1967-2005 is four-fold smaller than the 120% real gain I calculated as necessary above.

Ergo, I decline your wager….

Years 1996, 1997, and 1998 all got mentioned. This is very likely to be the pattern seen at the bottom where overcorrection happens first and brings about 1996 prices, then the revived market bobs back up to 1998 prices which were a notch higher.

This gives us just a little time to attempt to clean up the worst practices that led to this. Additional disclosure requirements might expose toxic loans and fraud sooner, possibly even right up front, while costing very little. Layers of new rules and enforcers shouldn’t be necessary, just a well chosen nudge. Treating assessments like surveys could be enough to clean up that tar pit. At the least all kind of options like this need to be discussed.

There is a mixed bag, I’m still amazed at what some units are going for. A 30% drop from 2006 means nothing to a condo bought years ago that can still get $1,000,000 in 2009.

I think you guys need to ease up. The fact of the matter is a Stanford prof. and MD couple bought fluj’s flip. Period. The cold water hitting the face will eventually (I believe) be the fact that 70%+ of all home loans in the Bay Area circa 2005 were Option/IO ARMs; I’m willing to bet some of those were in “real SF”. Others don’t think so…

Can anyone comment if Stanford professors have always chosen to live in Ess Eff? Is this evidence of ‘The Shift’ (higher-end jobs disappearing in the city [being] filled by people who lived outside of it)?

As a side note, I just discovered my significant other went to school with one of fluj’s buyers. This is getting weird.

Nice way to add some numbers to the intuition, Debtpocalypse (btw, we’re almost exactly the same age!).

I’m not surprised you’d decline my bet. I don’t disagree with your numbers of course, but I’d even go further that over a very long period (e.g., your ~40 year period following the nominal bottom) I have the sense that real returns in CA (and SF generally) will be slightly negative for two reasons.

First, every region enjoys its place in the sun. No one could argue that post-WWII CA has been extraordinarily blessed. It might continue its outperformance, but mean reversion from these levels could be a killer, and would be the odds-on bet.

Second, as government grows, increasing its control over – and demands for resources from – the productive economy, less value will be available to devote to unproductive resources like residential real estate, leading to a lower share of value there relative to other parts of the economy (which are assumed to correlate with the generalized price and/or wage inflation that we are using to calculate real returns). If I had to pick a region for outperformance based just on this idea, I’d go with Washington, D.C. (Obviously, there will be all sorts of things that influence relative regional performance of real estate prices, and concentration of wealth/power in Washington DC would just be one factor).

Sorry to get off the topic of bagging on people for their prior real estate predictions…

I wanted to comment on the economic decline and which groups are affected. Some sources talk about the medical field being unaffected, but this just isn’t true. I’m finishing my specialty training in 2 months, and i can tell you that all of the specialty fellows, GI, Cardiology, Nephrology, Pulmonary, etc… are having trouble finding jobs. The graduating residents are running into the same thing. The larger employers, like the Univ of California system and Kaiser, have implemented hiring freezes in a lot of their departments. This applies to support staff as well (nurses, resp therapists, etc), not just MD’s. The smaller private groups seem to be doing the same, just not announced “official” freezes. A lot of the older docs are also not retiring to make up for all the money they’ve lost recently in their 401k’s. This increased physician “supply” is also dampening the overall salaries as well.

Its kind of disappointing to go thru 4 yrs of college, 4 yrs of med school, and 7 years of residency/fellowship, have 250k in school loans, and then come out to this lousy environment. I guess we’re all gonna suffer together.

[Editor’s Note: We’ve moved the medical discussion to: A Plugged-In Perspective On The Local Economics Of Medicine.]

“Can anyone comment if Stanford professors have always chosen to live in Ess Eff?”

My father-in-law is a professor at Stanford medical school (he’s a psychiatrist and also has a private practice). Can’t say if Stanford profs have ALWAYS chosen to live in SF, but my F-I-L bought his SF house over 40 years ago.

That historical 30% gain between 1967-2005 is four-fold smaller than the 120% real gain I calculated as necessary above. Ergo, I decline your wager….

don’t forget the incredible demographics shift that happened (baby boom). this led to a relatively unprecedented number of people that all grew up, bought their first houses, then their second houses during the same time periods.

Baby boom economics plays a huge role in our economy. it’s ONE reason why you saw such massive appreciation in equities and RE.

as they start to retire, they will likely become net sellers of RE and equities (to fund their retirements)… unless we change immigration patterns, there are not really enough Gen X and Y people to take up the slack.

not only that, but our economy faces considerable headwind during that time due to unfunded liabilities due to the entitlement programs, as well as the massive amount of debt our govt is amassing.

our country will look very different (demographics and tax wise) in 20 years compared to today.

it is unlikely that it will be favorable in general to RE appreciation, barring massive allowed immigration.

“The fact of the matter is a Stanford prof. and MD couple bought fluj’s flip.”

Two years ago, that same couple would be buying a hell of a lot nicer property than the modest home in a very modest neighborhood they bought this month.

“Two years ago, that same couple would be buying a hell of a lot nicer property than the modest home in a very modest neighborhood they bought this month. ”

Good grief you one sickening toadie. You never set foot in there, loser. And you’re quite wrong by the way.

I would like to ask all information about this property to be swiped off of here. It is not the proper place. I did not bring it up. You all constantly go there.

is there a off-topic button somewhere?!

Back to LMRiM’s post about very long term real estate trends-

San Francisco (and the Bay Area) has shown a remarkable ability to remake itself as national trends change. However, at the current time, I see a lot of forces trying to freeze San Francisco like a big 7×7 museum (in many more way than one). If those people are successful, I think we’re looking at a long term decline in appeal.

However, at the moment, many many young people adore San Francisco, both nationally and internationally (based on my anecdotal experience of telling people where I’m from), and it’s getting more desirable as prices begin to return to earth. Combining that with the proximity to three giants of academic research (Stanford, UCSF, Cal) who will keep creating new jobs and new industries makes me feel optimistic about our prospects.

That doesn’t mean real estate won’t decline in real terms, but, like the recent Atlantic article, I think SF will continue to be attractive, perhaps more so coming out of the huge shift in lifestyle I see occurring due to the economic implosion and death of easy credit for a long time.

… post-WWII CA has been extraordinarily blessed. It might continue its outperformance, but mean reversion from these levels could be a killer, and would be the odds-on bet. …

This is missing two very big trends. First, technology industries have created the greatest sustained boom in modern history and are still pushing ahead while being stronger in the SF Bay Area than anywhere else. Secondly, the population continues to move toward the largest combined metro areas. These hives of consistently above average growth experience many problems like frequently overheated housing markets and high taxes, but such areas also consistently draw more workers.

There is always an exodus of sorts in progress from any overheated urban area, but that is typically driven more by people moving along or not being able to make it. In the most productive industries tax burdens have little relevance. The relevant questions have to do with capacity for pushing the boundaries. Genuine innovations are extremely profitable, and even commodity software typically has margins of around 30-40% which is roughly quadruple the 8% or so margins that most other markets have.

I’m not ‘in the loop’ with regard to the flipped house, but now, getting more on topic, Stanford profs (especially if they are MDs) have access to large (even by SF standards), very low interest loans, depending on when they were hired and their level of Professorship. They are far from the only Bay Area employer that subsidizes home purchases for higher level employees – again, part of the bubblenomics of the region and part of the reason why correction will take so long.

Which brings me to my question, and one that I think is most certainly on topic. I’m of the belief that the ‘real SF’ wherever it may be, has about 25-30% further to fall in nominal terms. I’m also of the belief that this will take 5-7 more years, with better than half of the decline coming in the next 12-18 months. Finally, I believe that in real terms prices will not come back to 2006 peak levels for >50 years.

If you take the vast leap of faith with me that I am going to be correct, and you were able to afford the purchase of up to a one million dollar home at this exact moment (20% down, 6% 30 yr fixed, HHI = 400k, stable), would you make the home purchase now? In 12-18 month? in 5-7 years? Or never?

I have been surprised by how many people I have posed this question to have simply said – ‘ if we find a house we like, we’ll buy it, even if it drops in value and we are fully aware this will happen.’ Seems crazy to me, but knifecatchers are everywhere, even when they are fully aware that the blade has no handle.

You thoughts?

EBGuy:

You should be aware that Stanford faculty qualify for subsidized housing. Specifically, the university will pay for a substantial portion of the house on the condition that they receive most of the capital gains when it is sold.

Of course, in this case, it is likely that there will be capital losses rather than capital gains. I don’t know what happens at that point…does the university take the majority losses or the faculty member? I don’t know all the details of the program because I’m not a faculty member at Stanford but rather at, uh, the other top-5 research university located in the Bay Area…

Mole Man,

I hear your argument regarding tech. I just don’t think that the computer science-driven and (more recently) internet-driven tech growth is a huge deal in the overall evolution of the world economy. Sure, perhaps it has kept us growing at reasonable growth rates (actually lower than in the 19th century and even pre-1970, though, btw), but I don’t see that it has been any category change from the general progression of human ingenuity that exploded from the Enlightenment (again, most recently).

Almost certainly you disagree, and that’s cool. I’ve posted this link before, but if you didn’t see it, it’s worth reading the first few paragraphs from this year 2000 piece (the latter paragraphs are technical and probably not very relevant):

http://www.efficientfrontier.com/ef/702/2percent.htm

“I’m of the belief that a luxury automobile has about 25-30% further to fall in nominal terms. I’m also of the belief that this will take 12-18 months, with better than half of the decline coming in the next 2 months. Finally, I believe that in real terms prices will not come back to 2006 peak levels for >50 years.

If you take the vast leap of faith with me that I am going to be correct, and you were able to afford the purchase of up to a one million dollar Bugatti at this exact moment (20% down, 6% 30 yr fixed, HHI = 400k, stable), would you make the car purchase now? In 12-18 month? in 5-7 years? Or never?

I have been surprised by how many people I have posed this question to have simply said – ‘ if we find a car we like, we’ll buy it, even if it drops in value and we are fully aware this will happen.’ Seems crazy to me, but knifecatchers are everywhere, even when they are fully aware that the blade has no handle.

Your thoughts?”

>>> My thought is that million-dollar houses are a consumption item just like million-dollar cars.

You could drive a Honda & rent. Or not (if you can afford it).

Jimmy – somewhat true, but do they give 6% 30 year loans of 800k for million dollar cars?

“Seems crazy to me, but knifecatchers are everywhere, even when they are fully aware that the blade has no handle.

You thoughts?”

I think of this as neutralizing the stupid money. Each knife catcher takes themselves out of the competition, unable to bid on another home for many years. In the bubble years it worked the opposite direction as appreciation and leverage allowed homebuyers to become mini RE moguls. Moguls loaded with stupid money.

What I don’t know is whether there are more knives than catchers. The future direction of prices are tied to that ratio.

Plenty of car loans at 6%

I used the million-dollar car as an extreme example but you could say the same thing about a $150k car. Lots of people finance those, they are a consumption item and they are all destined for the neo-cubism of the car crusher someday.

Just like how all those quaint $2.5M Victorians are going to collapse some day and be trucked away and dumped somewhere in a landfill in Oakland.

Jimmy, you sound cynical.

This is San Francisco, we don’t use landfills but giant compost heaps.

jessep — You mean the Tenderloin?

Unfortunately its already full of crap …

I am not seeing a price decline for condos priced 500-700k.

They are still selling around asking and within a few months

There is no such thing as a bottom Tier in SF BTW. There is nothing on the market for less than 400k

RogerRabbit, just go to redfin and look at the “solds” for the last 3 months in SF. Shows 147 such sales (about 1/4 are some odd transaction — e.g. for $1000). Some are hovels, I’m sure, and none are Pac Heights 4BR houses. But there are decent places in the under $400k range. Still way overpriced, IMHO, compared to comparable rentals, and still falling fast, but there are a lot of places being sold all over town for 40% less than they would have gone for two years ago. (To contrast, redfin only shows 26 places selling for > $1.5M in the last three months).

Those charts are painful.

Mole man @4:39 is spot on.

People (e.g. Lmrim) who dismiss this really should challenge themselves and read Richard Florida’s book, ‘who’s your city’ (goog his web site). socio-economic trends bourne from technological advancements are effecting the entire planet, and some areas, such as SF bay, significantly.

I can speak as a former small biz owner (after bailing out of high tech/w-2 land in 1999, i ran a corporate art consltancy, travelling world wide to collect art from developing nations, and exhibiting it in large bay area corps): the Internet, a laptop and an inkjet printer allowed me to effectively market my services to top 50 US corps. I would not have been able to do so, and more importantly, the prevailing business culture, would have precluded my success 20 years ago. In other words, small business became profoundly empowered with the advent of technology. It has allowed many others to do what they love and monetize it. Since then I have evolved from doing what I love to just being (while managing my rental properties). And again technology has played a hand there too. Now I can (almost) ditch the laptop for the $230 iPod touch I am using right now to manage my rental and development business.

And needless to say, all large business have been transformed as well via computing and the Internet. The world is a different place due to computers and the Internet. Cel phones are also huge, transformative in the developing world IMO. In 2004 I was in east Africa and Kampala (uganda’s Capitol) was bursting with business activity. I have also seen the radical changes technology inspired in south east Asia. From my first trip to Vietnam 94, Cambodia 97, I can hardly recognize their capitols on my most recent trips.

One cannot under estimate what computing, Internet and cel phone technology has done to our world in the last 20+ years. And if anything, this has pushed the most business opportunities, the best jobs and consequently the most personal wealth into specific metro regions globally. And I contend that SF and the bay area are at the epicenter of this phenomena (and it’s not going away anytime soon). The bay area (and especially SF) housing market is not going to deflate over the next 5-10 years. If anything, future technological developments will put more upwards pressure on bay area housing, which serve as a counterweight to the present economic challenges. And to chronic pessimists who think that this economic crisis will linger like a depression, just imagine how bad it will be for people and areas outside of major metropolitans.

@45yo hipster:

Ah, but it’s neither black nor white. While the influence of technology in the Bay Area will certainly keep us from being Detroit, the impact of tight credit is also constraining real estate right now, and for the foreseeable future, limiting loans to the proportion of buyers requiring credit. Also, the maturation of the tech industry means that wages (in the broad sense, including options, bonuses, etc) are constrained. And then there is the relationship to the rental market. If rents don’t fall appreciably, this will serve to put a floor under real estate prices. However, if jobs tank further, and rents fall, then this further erodes the value of real estate.

I do agree with you that in tough times, people don’t move to Detroit, they move to where the jobs are, and right now, the Bay Area is relatively better situated than many areas. The rub is precisely where all of these influences lead us, and I don’t think any of us, including LMRiM or anybody else, quite knows where we will land. We all have our theories, and that’s why SocketSite gets the hits it does :{)

45 yo hipster,

What makes you think technological development will stay in areas like the Bay Area? What makes you think the Bay Area has a real moat?

LMRIM has said many times that if there is bailout, we will end up in Great Depression 2.

There are so many bailouts since then.

On March 31, 2009 4:47 PM, polip wrote:

Interestingly, a new Deutsche Bank research report looks at markets that potentially have the hardest fall, taking into account employment levels, affordability, etc. and finds that the San Francisco MSA isn’t even in the top twenty markets in terms of projected price declines, and the number 20 area (The central coast: San Luis Obispo) is projected to decline less than 21%.

Since the MSA isn’t limited to ‘real SF’, I don’t think I’d bet that the ‘real SF’ will face a decline of more than 21%.

Don’t get me wrong, I’m enthusiastically in favor of lower real estate prices and believe that SF real estate is still at crazily high levels, but I just don’t think I’d project a 25-30% decline inside of seven years.

I dont think the bay area has a “moat” but it has something more in the nature of a magnet in several knowledge based areas of innovation. the critical mass argument is valid. there have been lots of opportunities for it to flatten out and diffuse but it has not happened. florida model is more right than friedman.

anyway, my prediction is that San Francisco RE prices will normalize when they reach the long term CAGR of around 5% per year/ past 35 years. This means we have around 15% correction to go and it takes 1-2 more years.

Sf will recover faster than CA or US.

There is no such thing as a bottom Tier in SF BTW. There is nothing on the market for less than 400k

RogerRabbit,

A quick MLS check pulled 49 SFHs and 158 condo/TICs. In any case, the sub-400K does exist in SF. Just say you have high standards, we’ll understand.

[lolcat’s note: And with that, back to the numbers at hand…]

let me be more clear. i’m countering what Lmrim @ 4:53 was saying “I don’t see that it (tech) has been any category changer from the general progression of human ingenuity…”

1. technology makes the whole world more efficient, and will continue to do so. hence, the productive economy continues to grow, as large corps down to small business become more efficient. add to that the 5+ billion “other” people, and you definitely have a game changer.

2. in essence, the richard florida vs. thomas friedman argument. these massive socio-economic trends will benefit SPECIFIC metro areas immensly.

do you all remember the late 90’s world is flat mantra? it was front page on the economist, i.e. how a telecommuter in montana will have the same capabilities as a palo alto resident. i too brought off on that. and how wrong it was! it made sense intellectually, but in reality people still gravitate to areas of similiar ilk. we’re social creatures, and sure people can telecommute, but what about the start up engineer who needs peer review? or the connections to get the venture capitalist’s ear? that’s local baby!

the reality is, most tech firms (and the best start ups) still reside in the bay area. silicon valley has decidedly not been reproduced anywhere else. not boston, seattle, bangalore, or tel aviv. yes, yes, significant tech firms exisit in all those places, and other places too, but the concentration is still the bay area- and by a wide margin. and the same also goes for bio tech- the majority of firms are here. and we’re leaders in alt energy too.

these realities will continue to put pressure on housing. and a boutique city like SF is the crown jewel, where alot of the wealthy seek to reside (or have a pied-a-terre.) sociological norms changed too in favor of SF- witness more families living in the city, the goog/ebay/etc. shuttles. the limited geography and lack of expansion add to the pressure. of course SF median income is way lower than prime marin and silicon valley towns, as many SF housing units feature long term renters and a plethora of public and private non profits own properties housing the gamut of people in need. all in all the number of properties suitable for even upper-mid income in SF is quite stunted. these all put pressure on SF housing prices.

so unless we enter a GD2, which is not probable by any means, the above socio-economic factors will continue just liake they have in the 20+ past years. this is not some fantastical bubble, it’s based on critical socio-economic factors that effect the whole world, and specific metro areas in particular.

45yo hipster, I’m getting flashbacks to the tech stock bubble a decade ago. Lots of plausible-sounding reasons back then to justify lofty stock valuations: “The New Economy.” “B2B will be an XX trillion dollar market.” “The internet changes everything.” The interesting part is that the arguments weren’t necessarily all that wrong in the sense that high tech has changed the world a lot in the last decade. However, that doesn’t mean that that tech stock prices didn’t get ahead of themselves. Yes, cell phones have made a huge difference all over the world, but if you bought the Sprint PCS tracking stock a decade ago, you are probably quite a bit under water. Or consider fundamentally good local tech companies like Intel, Cisco, Oracle, eBay, and Yahoo. They are all down 70 percent, give or take 15 percent or so, from their peak values, not so much because they are bad companies, but because the peak values were too lofty.

So the point is that one could have a very high opinion about real estate in SF based on the technology angle (as well as all the other standard arguments) and still believe prices could drop significantly just because of previous values having been way too high.

“so unless we enter a GD2, which is not probable by any means”

Actually it’s pretty much inevitable unless the government takes some specific steps to counteract the contraction in the money supply from the credit crunch. And no, bailing out the banks won’t do it. There just aren’t enough worthy projects and people to lend to.

It’s not going to matter what they try at this point, diemos. It’s already baked in. (BUut GD2 is not going to look exactly like GD1, of course. Many more safety nets today mean that the USG will become even more totalitarian in its attempt to steal assets from the productive sector to reallocate.)

Perhaps a “debt financed money drop” would work to avoid it. That is, a huge and across the board tax cut financed by Treasurys (for instance, eliminating ALL income and corporate taxes for 2 years and then committing to a flat tax going forward), but the USG would have to cut spending some major percentage (maybe 20-25%??) in order to prevent a dislocation of the currency/bond markets. It would be very risky, and I doubt the current adminstration’s wall street masters would allow it.

Anyway, a debt financed money drop is not going to happen. So, it’s going to turn into a free for all, as competing interests vie with each other to steal as much for themselves from the value that the USG is stealing from the productive economy (either through direct taxation, indirect taxation like carbon “tax and trade”, and monetary inflation).

It should be a good environment for traders. I hope 😉

“BUut GD2 is not going to look exactly like GD1, of course.”

Yup. If someone is waiting to see sepia toned men in trench coats selling apples for 5 cents they’re going to be waiting a long time.

“Perhaps a “debt financed money drop” would work to avoid it.”

Almost right. Print! Print like the wind!

“in order to prevent a dislocation of the currency/bond markets.”

Screw ’em. We need to collapse the currency to stop the migration of the real economy out of the country and give the foreign bond holders their haircut anyway.

“So, it’s going to turn into a free for all”

Which is why I advocate handouts directly to individually divided equally among all legal adults.

“for instance, eliminating ALL income and corporate taxes for 2 years and then committing to a flat tax going forward”

a fall back plan that I like is to set the social security tax rate to zero and pay current benefits with printed up money until the money supply stabilizes. That would increase the money supply and put it in the hands of people who would spend it.

I’m really not sure about macro events, it just seems like there are too many factors manipulating the money supply. I think it’s almost a certainty that taxes will go up and so will inflation.

Entitlement spending is going to really be something interesting: with Medicare & Social Security now having much more importance than 2 years ago because of what’s happened.

BTW: What’s worse than paying for overpriced SF real estate?

Buying AIG stock 😉 Just ask Hank Greenberg who was functionally destroyed (lost 2Bish).

“This is ludicrous.”

No it’s not.

will tech help the Bay Area’s economy? of course. Will it be enough to weather a recession that is at least the worst in 70 years and possibly the worst since the late 1800’s? No. will it be enough in the face of a state that is in dire financial stress (California) and a country that may face a currency crisis (US)? Nope.

SF will do better than other places, but will still get hammered by the world economy. Just as SF Real Estate appreciated with everywhere else in the world, it will depreciate with everywhere else in the world.

the likelihood that any RE market recovers significantly anytime soon (5-10 years) in real dollars (inflation adjusted) is extremely low.

“so unless we enter a GD2, which is not probable by any means”

not sure I agree here. the situation is very dire right now. it is clearly the worse recession since the great depression. It can be easily argued that this is worse than the Great Depression (if you compare where we are 14 months into recession to the first 14 months of the GD). and we still show little to no signs of improvement.

think about the fact that the Federal Govt, the Federal Reserve Bank, Treasury, and other world governments have taken measures that have NEVER been done before. why do you think that is? They didn’t do these things for any other recession.

For some time I’ve spoken about how recession was inevitable, and that it would likely be a bad one. Looking at macroeconomic data is not encouraging. Outside of govt intervention, the capital markets are still not functioning.

Govt intervention has its limits (which our govt will soon discover) and thus it is highly important to implement that intervention wisely. I am saddened to say that our government has done the exact wrong things IMO. (you can google my old posts where I thought Obama and his team headed by VOLCKER would implement different strategies).

we are propping up insolvent banks (Citi, BofA) using immense taxpayer dollars. These banks waste our money as they are insolvent, not illiquid. worse, keeping them in zombie state puts pressure on other banks (nobody knows who is solvent and who is insolvent) and their special govt handouts can be used to undercut healthy competition, crippling the healthy banks.

we are propping up AIG to shovel billions of dollars to the insolvent banks again (Citi, BofA, even probably Goldman Sachs), making their bad bets good.

but it comes at enormous cost. nearing 12-13 Trillion dollars. the numbers are so big that they lose context to the human mind. this helps a little (look how little 1 Million is!)

http://www.pagetutor.com/trillion/index.html

and yet the capital markets are no better. So we go begging to the world economies for their aid. it will not happen for many political reasons.

It looks like France will walk out, and Germany has no interest in helping us. Russia and China are asking for a different Reserve currency. In other words, there is OPEN challenge to the US as the dominant world player. The US enjoys tremendous advantage due to the fact that it is the reserve currency, most of which is that we can borrow our debts IN US DOLLARS. Imagine if we were borrowing in Chinese Yuan or in Russian Rubles? Or borrowing in gold.

depression is not inevitable, but it is also not improbable. it is a very real concern. If you aren’t preparing for a POSSIBLE depression then you aren’t paying attention to the world economy, or you are a gambler.

During the 1990s, Japan printed money, conducted money drops, and marched the debt/GDP value up & up in the face of its debtpocalypse.

How’d that work out?

Two decades from their equity top, and here they are, still fighting deflation.

Diemos is right – those looking for apple-sellers in trench-coats have missed the beginning of this Depression, as it carves out its unique contours & history.

Hard(er) times remain ahead….

“During the 1990s, Japan printed money, conducted money drops, and marched the debt/GDP value up & up in the face of its debtpocalypse.”

It worked just fine. I was in Japan with some co-workers and one of them was holding forth with what a disaster Japan’s deflation had been. As I looked around at the bustling restaurants, gleaming new infrastructure, happy well dressed people I said, “If this is a disaster, can I have some? Why does their disaster look better than our success?”

If you define success as rising asset prices then Japan’s policies were a disaster.

If you define success as citizens who can feed, clothe and house themselves, it was a raging success.

Yes, diemos, but there was no currency collapse in Japan. Just the opposite, in fact.

A currency dislocation in the US would not be pretty. I spent a little time in Russia in the mid 90s and Southeast Asia in the lead-up and aftermath of the ASEAN crisis. Not a pretty picture. From what I heard, Argentina 2001 was no picnic either 😉

Currency dislocation is an entirely different world when you run massive c/a deficits. That’s why I’m still betting against the hyperinflationists (hedging a bit, though, with gold and at some point this year some real estate).

diemos:

I would be pleased to get the Japanese scenario (10-20 years of stagnation)

the problem that we run into is that Japan stagnated while the rest of world did well. Thus Japan could debase its currency and export to the rest of world.

secondly, of course, Japan was a creditor nation filled with savers. The US is a debtor nation without savers. (so the Japanese faced no currency crisis… the debt could be and was bought by the Japanese themselves)

I think the US would be in far better position if the theoretical “decoupling” would have happened (there was no possibility of decoupling except in Wall Street’s heads).

or if we had higher domestic savings.

thus I see Japan’s lost decade as a best-case scenario for us.

I fear an Argentine or Russian currency crises.

if it does come (or major inflation, the so called POOM) then that is the time to jump out of the US Dollar as fast as possible and buy any hard asset that you possibly can (commodities, gold, Real Estate, etc).

despite what people claim (including LMRiM and polip, both eloquent and smart but naive IMO), the fed will NOT be able (or willing) to mop up the liquidity when the party starts raging again. it will be a repeat of every other time, most recently in 2001-2003 when they held rates too low too long, and then couldn’t see the obvious RE bubble forming, until 2007 when that bubble was popping.

they still called the obvious bubble “froth” as late as 2005-6.

and by the Maestro’s (greenspan) own admission, it is impossible to foresee a bubble until it’s already happened

thus they will blow and blow and blow until a bubble comes along. and then they will coddle that bubble and say it’s “innovative” and “increases productivity” and give the bubble all sorts of platitudes. they will give all sorts of rationalizations as to why the bubble makes sense. and then they will be surprised when that bubble pops too.

luckily(?) that is still a ways off. we still have monetary disinflation (and massive credit deflation) and will for some time (probably years). and the more they shovel money into the insolvent banks, the further it pushes the POOM back (since that money just goes to money heaven anyway).

so maybe LMRiM and polip are right and I underestimate the geniuses at the Fed. maybe this is all just a master plan to keep the peons working through deflation. I’d feel better about the masters of the universe being able to keep a lid on this if the US had a savings rate though.

Diemos/Lmrim- whoohaa horsie…aren’t you guys unhinging just a tad here? The recently announced treasury plan of creating a co-op public/private asset purchase plan is the best thing I have heard from Washington in awhile. This could be successful. It’s stupid to mark to market now and kill the banks. A fund that will take and hold the bad loans at least has a chance of recovering value in the future. We all know that some of that ‘bad’ debt will recover as the market trtiyns eventually. Right now the negative psychological aspects are over whelming any other rational option. With this asset fund, at least there is a chance of some future market based asset recovery.

Didn’t Milton Friedman call fiscal policy “the idiot in the shower”….That’s how I feel we are right now

Thus Japan could debase its currency and export to the rest of world.

Wait a minute. When did Japan debase its currency? I was trading it throughout much of the 90s and I must have missed this! USD/JPY started out the 90s in the 140-150 range, and steadily strengthened through 94 or so, reaching around 80. (JPY strengthens when the USD buys fewer of them.) This was a period of some dollar weakness, though, so on a trade weighted basis, JPY did not appreciate so much, but it did appreciate, not debase!

As the USD strengthened dramatically into the latter half of the 1990s, the JPY weakened slightly against the USD, and there was a brief spike up to the 140 range in the 1998 crisis – exactly where it started the 1990s! Again, on a trade weighted basis, JPY probably strengthened a bit through this whole period, owing to the outsize relative strength of USD versus ROW (rest of world).

After the ASEAN/Russia crises passed, JPY again resumed a trend strengthening against USD, spending much of the 2000s in the 100-120 range. It’s trading around 95-100 these days (down from the low 90 range a few months ago), again stronger against the USD than it was at the beginning of its 90s lost decade.

The idea that Japan debased its currency is a myth. (They probably would have wanted to, though ;)) Markets are way too big for governments to manipulate long term. JPY has been strengthening against the USD (and trade weighted against Asia) for decades on a trend basis (I don’t have the data handy, but I think USD/JPY was in excess of 300 for most of the 70s, and was certainly over 200 for much of the 1980s).

The fact that JPY strengthened so dramatically during Japan’s credit deflation is one reason why I was moderately bullish the USD all last year when everyone seemed to be talking about imminent dollar collapse.

LMRiM:

you are technically correct depending on time scales.

The Yen appreciated mightily in the 1980’s due to the Plaza Accord.

however, I am specifically speaking about the time from 1998-2005 when they initiated both ZIRP and also Quantitative easing (which is what we are now doing by the way).

during that time the Yen went from 80 to 134.

is it your contention that ZIRP plus QE was not partial cause of Yen currency debasement? and that this was not the goal of the BOJ?

seems hard to believe.

by the way:

Yen’s trading stronger against the USD right now because we are debasing our currency with ZIRP and QE. It traded stronger against the USD in much of the 2000’s because we were debasing our currency then too. (we were at 1%, remember?)

I’ve already spoken about how I anticipate coordinated global currency devaluations. you’re seeing it right here between the USD and JPY

the Japanese have already blown their wad. Now it’s our turn. what else are they going to do? they’re already at ZIRP… so they’ll stay strong until they restart QE again. or until we stop QE/ZIRP.

if we were to stop QE/ZIRP you’d see the JPY plummet in value. If they were to announce massive QE again you’d see it plummet in value as well. If we were to increase QE you’d see JPY rocket up in value.

QE/ZIRP was a clear attempt by BOJ to debase their currency.

The recently announced treasury plan of creating a co-op public/private asset purchase plan is the best thing I have heard from Washington in awhile.

When the far left and far right agree on something – tread carefully. Economists on the far left and far right have denounced the PPIP as folly, and for good reason. It is outright theft which does not solve the problems of the financial system, rewards the wrong parties, and does little to truly shore up balance sheets of the weakest (who happen to be the biggest). It will also take way too long to implement, and due to the absence of requirement for participation (i.e. banks can withdraw if the auction prices are not as high as they would like – a reserve option on Ebay), will not address those assets that are severely distressed (and for good reason – insolvency would be laid plain).

The far right has cried for failure and subsequent mop up. The far left has called for nationalization. Both have the effect of creating the good bank we need. My idealogical stripes favor the former solution, but it is a little late for that now, so heck, I’d be in favor of outright nationalization at this point. Anything but the path we have chosen – because it is ugly.

ex SF-er,

I agree with you on the benefit Japan received from US (and world) growth in the 90s, which partially offset its credit deflation and sustained flat- to weak-growth. But you’re all washed up on USD/JPY! I remember vividly (because I was squeezed out of the position 🙁 ) being short the 125 USD/JPY calls in 1998! USD/JPY was not trading anywhere near 80 in 1998 – more like 100-120 range before the USD spiked on the ASEAN/Russia crises.

Believe me, JPY strengthened throughout the 80s, and continued strengthening on a trend basis through most of the 90s. There was a dramatic strengthening in the early stages of the Japan crisis (through about 93 or 94) as JPY was repatriated and panic set in as the Japan asset bubble came unhinged and Japan turned from moderate CPI-type inflation in the late 80s/early 90s to mild CPI-type inflation in 93 or so (sound familiar??). JPY finished the 1990s against the USD about 50% stronger than where it started (roughly 100 vs 150, or .0067 JPY/USD vs. .0100 JPY/USD), and is almost exactly right there again in 2009 (actually a tiny bit stronger than where it closed out the 2000s).

Remember, exports were not really a huge deal for Japan (increasingly important throughout the 2000s, though) because the share of trade in the Japanese economy was never too big (less even than in the US, but now somewhat more – roughly 15-20% of GDP, up from maybe 10% in the 1990s).

You can dig around here for historical rates of currencies (it’s a little cumbersome):

http://www.oanda.com/convert/fxhistory‘

About the Plaza (and Louvre) Accords, they were just meaningless governmental dog and pony shows IMO. The markets go where they want based on fundamentals, but short term and at inflection points these meaningless statements sometimes seem to be the catalyst.

Re: toxic asset purchases, I’d like to hear from the more financially knowledgeable on the problem it’s trying to solve and the theory behind its operation. I’ve heard two conflicting descriptions in the media:

1) The problem is that no one is buying anything (the market is “broken”, whatever that means) and the solution is for the government to act as a buyer of last resort, paying below the value of the asset, in order to create liquidity – kind of like a market maker, if I understand this correctly. Since there will be a buyer now no matter what, speculators and then investors will return to the market, knowing they can always get some cash back out, even if the price is lower than they’d like. Eventually the taxpayers will make a profit (since they paid below the long-term value determined objectively by finance experts), and the current owners of these assets can determine their market value. Everybody’s happy (unless you had unrealistic expectations for your asset).

OR

2) The problem is that no investors are willing to pay what these assets are valued at on the banks’ books, and trading them (and thus marking them to market) will cause a catastrophic collapse in the banking system as everyone tries to raise capital at once. The government acts as a buyer simply as an alternative to direct subsidies of the banks, and they deliberately pay more than the securities appear to be worth (either according to the market or some valuation model).

I had initially heard that 1) was true, which sounded kind of OK to me, but now it’s sounding more like 2) is the reality, which seems economically unsound in a lot of ways. Why aren’t we at least making the common shareholders eat some of these losses?

2, Po Hill Jeff. Definitely 2.

The common shareholders are eating (and have eaten) plenty of pain. The USG is trying to protect the bondholders of all these banks. These guys are all going to get 100% on the dollar (at least that is the plan – no more Lehmans). It’s pure theft from the taxpayer to reward the bondholders, who are the people pulling the strings of the politicians.

Hussman has done a good job talking about this in his recent weekly market commentaries (especially March 9, March 23 and March 30 (long wrap-up).

http://www.hussmanfunds.com/weeklyMarketComment.html

I’d start reading there. Hussman is good and balanced (former Stanford prof I think, now pretty successful money manager). I disagree a bit with him on his inflation outlook, but he’s always a good read.

Po Hill Jeff:

the answer is clearly 2. I think most everybody agrees on that.

Geithner’s most recent plan was somewhat more palatable to a few people because it has private oranizations “bidding” on the price instead of the government just dictating a price. it seems less “communist” (even though it’s worse than communism)

====

LMRiM:

I guess we’ll have to just disagree here. I think we’re just talking around each other anyway. i’m sure you were stopped out of positions many times. you’re a trader. I’m not speaking about trading, but overall general trends of currency manipulation by the Japanese govt.

Perhaps I should use the word currency manipulation instead of debasement?

BOJ was manipulating its currency using ZIRP and QE, but was at times overrun due to external factors? perhaps that statement is more palatable to you?

(I will remind you that the Yen was at 80 in 1995, and then fell to 134 by the time QE/ZIRP were in full force, only to rise again with the US 1% policy.)

regardless, you seem to be taking the overall exchange rate and using that to argue that Japan wasn’t attempting currency debasement… but that argument is weak since you and I both know that the USD/JPY exchange rate is about BOTH US and JAPANESE factors. You seem to be ignoring the USD aspect in the JPY fluctuations.

I guess I’ll word it another way:

how does Quantitative Easing paired with ZIRP not debase a currency? if it does not, then why don’t we all just do it all the time?

About the Plaza (and Louvre) Accords, they were just meaningless governmental dog and pony shows IMO.

Perhaps. But up until the Plaza Accords the dollar was very strong relative to the Yen with no end in sight. within 2 years of the Plaza Accord the dollar declined 50% vs the yen.

Many felt that it went too far. Thus the Louvre accord. afterwards the dollar depreciation halted somewhat.

dog and pony shows clearly can affect the market.

Po hill- I think #1 has a chance of working too. It’s not a binary works/fails outcome though. It’s clear that the market value Of a significant amount of home mortgages are undervalued. There are bad loans out there, but the overall percent is still small compared to performing ones. But the market has shut down/panicked, and is incapable of acting rationally by looking at normalized longer term values. An analogy is the current unemployment rate. Most people, 90%, have jobs. But if everyone thinks they will loose their jobs tomorrow, the perceived unemployment rate is effectively much higher.

The joint public-private fund is the lesser of evils, IMO, certainly preferable to creating guaranteed chaos by killing the banks. Just how will that scenario play out without being very destructive to all citizens?

The Japanese yen thing is becoming a bit of a yawner guys…perhaps we can resurrect the plight of doctors again 🙂

Or better yet, why don’t you comment on my socio-economic theory, a la the Florida study?

ex-sfer, you mention that Japan had savings. I don’t know the right sources but I had heard that US had negative savings, and now up to 5%. This shift from spending to savings is part of our problem. These are from commentators on the networks so not sure if the 5% savings rate for America since December is accurate, but if it is, what do you see happening since your analysis had a negative savings rates as part of your premise? Just curious as most of macro-economics is over my head. Thanks.

A Great chart for personal savings rate for the last 50 years:

http://1.bp.blogspot.com/_pMscxxELHEg/SczUDXip4hI/AAAAAAAAE54/4vjbWnPzUU0/s1600-h/PersonalSavingFeb2009.jpg

And the accompanying article here:

http://www.calculatedriskblog.com/2009/03/february-pce-and-personal-saving-rate.html

The USG is trying to protect the bondholders of all these banks.

Which, I guess, brings us back to the elephant in the room (CDSes — ex-SFers favorite topic).

It’s stupid to mark to market now and kill the banks.

There is a theory that the stress tests and the toxic asset public/private auction will determine who gets shut down by the government later this year as denying insolvency will be a bit harder. As someone pointed out, you’d be hard pressed to find even gov’t bureaucrats saying “Let’s wait two years before we sort this out” (Japan syndrome).

Great chart, Fronzi (you guys are so much better than I am at finding these things).

From memory (almost certain it’s correct, though), Japan started its “lost decade” following its asset bubble burst with a 10% personal savings ratio. They spent this down to about 0% by the early 2000s, so Japan was able to maintain its relatively comfortable lifestyle (as diemos alludes to) in part by shifting towards consumption.

We are in a tougher place. We need desperately to increase savings to support the debt bubble we’ve created, but we are entering the deleveraging process with negative savings rates (just turning positive after the first stage of the debt collapse). Strap in, b/c no one really knows how this is going to spin out!

The Japanese yen thing is becoming a bit of a yawner guys

Agreed.

Po hill- I think #1 has a chance of working too.

I disagree here, at least that the PPIP can function the way that Po Hill elucidated in his #1. The structure of the PPIP was done specifically to encourage “overbidding”. it also seems to have been specifically structured to allow/encourage “cheating”

I could (and often have) blather on, but instead I’ll just point you to these two posts. the commentary in the post is equally (if not more) enlightening.

Basically, SOMEONE has to lose money on these loans/securities. The money is already lost, we just haven’t accounted for it yet. That money thus must come from the bank, the private investor, or the government.

Due to the set up (12:1 leverage with the Private investor putting up only a small fraction) the loser will most likely be the govt. remember, the losses HAVE to eventually be accounted for…

although it is true that some of the loans on the banks books do have intrinsic value, some of the securities do not… thus even with low default rates some securities are worth ZERO

https://self-evident.org/?p=502

and

https://self-evident.org/?p=504

About indebtedness, What this near-0 savings rate means from a more practical standpoint is that for every reasonable saver you had someone using debt to make ends meet. For every person paying off principal on his mortgage you had a fool (LMRiM will call him wise) withdrawing “equity”.

There’s no room for unemployment, for retirement, for health problems. The fools have literally “consumed” their own future and the Gov’t is now trying to present the bill to the savers.

Thanks everyone for your comments. I guess if the plan is to loan taxpayer money to investors, with losses guaranteed, I need to figure out how to become one of those investors 🙂

Sorry if this has been addressed already, but from an investment standpoint would a real estate purchase in LA be reasonable. Almost everyone agrees that SF has a ways to go, but has LA reached numbers close to bottom? Also, a majority seem to think that the market will not turn up in SF for a long time. Does anyone think that the market in LA will turn around sooner? How does this compare to the areas right outside “real” SF?

About indebtedness, What this near-0 savings rate means from a more practical standpoint is that for every reasonable saver you had someone using debt to make ends meet.

That is always the case — who else would fund the saver, if not the debtor? It’s just an accounting identity. Well, there is the caveat of printing money, but without this, one man’s cash flow surplus is always another man’s deficit. This is especially visible when looking at household, corporate, and government surpluses/deficits — it always nets out to zero (well, exports also are an actor).

High household savings in the post WW2 era were funded by massive government deficits, both declining until the recent blow-up; the current explosion of government deficits has started funding an increase of private savings. It doesn’t just go in one direction, though: during the mid 90s – mid 2000s, household deficits were funded increased corporate surpluses. Money flows are fun to watch 🙂

The fools have literally “consumed” their own future and the Gov’t is now trying to present the bill to the savers.

I agree that on an individual level, it is possible to over-promise future income streams, although a simple bankruptcy can remedy the over-promise.

However, in aggregate, it is impossible to consume the future, just as you cannot send goods back into the past. Each generation consumes exactly the goods produced by it, which is why I’m not worried about social security.

Over-consumption (which must be the same as over-production) is really just “over-payment”. People over-paid for houses, and savers over-paid for housing securities. When this over-payment was publicly recognized, values began to fall. The government is now trying to re-inflate the value of the financial assets that the savers purchased. Very little is being done to bailout homeowners. In the current environment, massive deficit spending (and some printing) is funding savers, not the other way around.

Good analysis Robert.

Let me pat you on the back.

Doesn’t inflation help everyone who’s a debtor whether a homeowner or joe schmoe?

In the current environment, massive deficit spending (and some printing) is funding savers, not the other way around.

isn’t this the other way around, i.e. the savers are funding the deficit spending? any money spent must have been previously saved (unless the govt just prints some).

@alex,

Nice marketing. Drop a completely worthless statement to the thread, but make sure your website gets promoted in your link, on a site you’ve been making cracks about for their bearish coverage of RE. Of course this all comes after someone posted a link on your site showing that your bullish housing predictions for 2008 (in Jan 08) were a complete 180 from reality (Which you deleted after the fact based on the follow up comments). If you disagree so much with the bearish sentiment on this site, make your objections known here and defend your future forecasts, such as the one you made in Jan 2008:

“Our predictions are for a nice healthy market fueled by pent up demand, low inventory, and plenty of qualified buyers, who are now faced with even less inventory than before.”

If you really want to contribute to the discussion, dropping four words and your website link won’t suffice.

@alex,

One last thing. Could you explain your “Buyer’s Market” call that you’ve been making for the last 2 months on thefrontsteps.com? We need some parity on this overly bearish SF RE site.

If you could include more than 4 words, that would be great… Thanks.

Jorge,

Very true. Someone is trying to capture a bit of audience in the “Bear Cave”. I always take every incursion like that with a grain of salt. This one is just what it is, but others are just non-constructive.