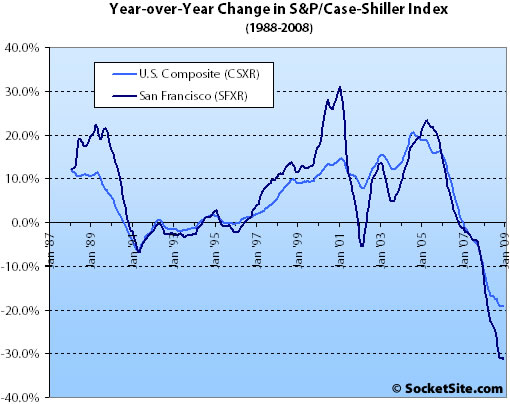

According to the December 2008 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 3.8% from November ’08 to December ’08 and fell 31.2% year-over-year. For the broader 10-City composite (CSXR), year-over-year price growth is down 19.2% (having fallen 2.3% from November).

The seven worst performing cities in terms of year-over-year declines continue to be from the Sunbelt, reporting negative returns in excess of 20%. Phoenix was down 34.0%, Las Vegas reported -33.0% and San Francisco fell 31.2%. Denver, Dallas, Cleveland and Boston faired the best in terms of annual declines down 4.0%, 4.3%, 6.1% and 7.0%, respectively.

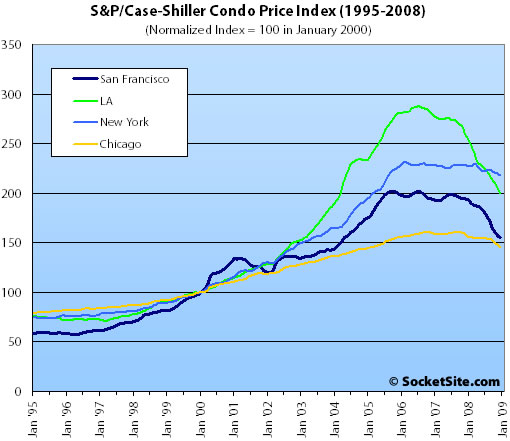

Condo values in the San Francisco MSA also continued their decline falling 1.3% from November ’08 to December ’08, down 19.8% on a year-over-year basis and down 23.0% from an October 2005 high.

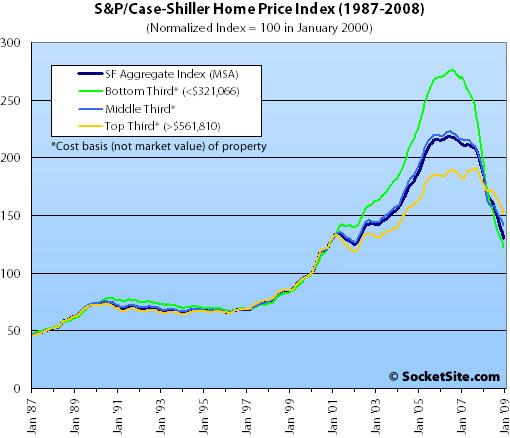

San Francisco MSA single-family home prices fell across all three price tiers.

The bottom third (under $321,066 at the time of acquisition) fell 3.8% from November to December (down 39.0% YOY); the middle third fell 2.5% from November to December (down 25.8% YOY); and the top third (over $561,810 at the time of acquisition) fell 3.4% from November to December (down 15.8% YOY).

According to the Index, single-family home values for the bottom third of the market in the San Francisco MSA have retreated to October 2000 levels, the middle third has returned to June 2002 levels, and the top third has fallen to April 2004 levels.

The standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA) and are imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best).

∙ Home Price Declines Closed Out 2008 with Record Lows [S&P]

∙ November S&P/Case-Shiller: San Francisco MSA Down, Rate Levels [SocketSite]

Minus 3.4% MoM for the top tier? This thing is moving really fast. Not many knife catchers on the market I guess.

75 here we come!

maybe then i’ll be able to find a house for my family and stop renting. until then, i’ll enjoy watching on the sidelines

Interesting to watch what is happening with the top tier of homes (down 16% YoY) vs. the bottom tier (down 31% YoY). Do they have to converge given that jumbo mortgages are hard to come by? Or will the more expensive homes fare better at the end of this cycle? views?

This confirms what Shiller was saying yesterday on Tech Ticker: SF and LA were bubble markets with a lot of see-saw action.

http://finance.yahoo.com/tech-ticker/article/190712/Shiller-House-Prices-Still-Way-Too-High?tickers=^gspc,^dji,hd,kbh,tol,ctx,xhb

See how SF had a very big price run-up from 1996-2000 — dot-com years — far larger than other cities? So our 2000 “norm” at 100 is inflated compared to other regions.

Just playing, I “normed” the SF numbers at 100 for January 1997 rather than January 2000. Makes the picture a little different and shows how easy it would be to fall much further than we have already. Using this base date, we were at 145.4 in January 2000 and the peak for the SF MSA was May ’06 at 317.5. We were back to 189.2 by December ’08. SF not only still has a lot of credit bubble popping to go but also a fair amount of dot-com bubble popping. The odds look overwhelming that we will go back to pre-2000 price levels, and I’d bet we go back even further to 1997 or 1998. I.e my bet (guess) is that we have further drops of 30%-40% from these December levels (high end of that range for higher-priced units as they are lagging the lower end by about 6 months).

I think the higher end will compress even more toward the mid and low range prices given that large loans exceeding standard conforming limits will be very tough to come by for a long time (forever?).

The last few years witnessed the birth of a mainstream loan balance over $500k which is waaay too much money to borrow for all but the wealthiest households. I think the days of borrowing $800k+ on sub $300k incomes will be a historic anomaly. The high end will be stickier on the downside though (as we have seen) since those households likely have more savings, more extended family resources, and somewhat higher paying jobs (for now) and will be able to hold out longer before selling. I know plenty of people who are in a serious cash flow bind but will likely have 12-18 months of dry powder before they will start getting really desperate. Buyers will be even more reluctant to catch the falling knife, and from what I have seen on the financing end, it will require some serious financial gymnastics to get any loan at all!

Once a segment of this group starts capitulating it will be “there goes the neighborhood” and prices will go through the floor.

Wow, all that talk of the lines “meeting at 160 and that will be the bottom” seems so long ago – just a faint echo now – and it really wasn’t that long ago.

This part of the unwind of the bubble is not as much fun for market junkies like me as the “turn” in psychology that was taking place in the first half of 2008. I bet it’s going to be a pretty slow grind down from here on out, but I suspect that the upper tiers (including The Real SF) will start overtaking the lowest in terms of rate of decline. There should be a little more 2009 decline action in The Real SF than in the Bay Area overall I bet. It’s hard to imagine otherwise.

Most of the decline so far has taken place independent of the real economy. Housing started falling well before the overall economy did, and I think that the recession actually slowed the decline in The Real SF from what it otherwise would have been. (Just where would we be now on the indices if Fed Funds were still at 5%+, the conforming limits had not been unconscionably raised – unconscionable because it suckered in a whole new group of victims into sacrificing their wealth, and the siren song of endless bailouts had not held out hope for the hapless borrowers and lenders stuck in mispriced assets?)

I think it is inevitable that we go back below 100 on the overall SF index, and that the Bay Area essentially unwinds all housing values back to around 1997-99 (on average – of course there will be individual outcomes that are higher or lower).

Overall, though, this unwind is great news for the Bay Area. Lower housing prices are desperately needed for medium-term economic viability of the area. Also, these declines are good for individual homweowners because they will make the homeowners now consciously plan for a future that will not include imaginary wealth from housing that in any case was never going to be there.

SFBanker,

But the top tier is well below conforming limits? The loan on a $582K purchase is $466K.

Historically 4.5x house cost/income is $130K per year. All but the wealthiest? Two income?

[Editor’s Note: Once again, do keep in mind that the Case-Shiller price tiers are based on the cost basis rather than current market value of the property sale pairs in question.]

I know this has been mentioned before, but I have been thinking about CS in terms of neighborhoods that saw dramatic price inflation in the last 10 or so years.

When I moved here in 1997 I looked at some nice small SFRs in Noe Valley which were around $300-330K (not fixers). I don’t remember the addresses, so it’s possible that this wasn’t “real Noe”, but I know that it would have been impossible to buy the same place in 2007 for less than 700K.

My point is that if the earlier buyers sell in this poor market their sales would be reported as an uptick to the bottom-third segment, whereas if the later buyers were to sell it is probable that their sale would be reported as a down tick to the top-third.

If most underwater recent buyers choose to hold out but the long time holders are selling at prices that are still way below last years pricing (but up from their original price) could we see a leveling off in the bottom third while the top third continues to decline?

Does this make sense or am I misunderstanding the data?

what really hits it home for me is watching the price boundary that starts the ‘top tier’. Less than a year ago it was well above $700k.

Also, these declines are good for individual homweowners because they will make the homeowners now consciously plan for a future that will not include imaginary wealth from housing that in any case was never going to be there.

This is the most twisted logic I have seen from you so far. People with neg equity are stuck for many years to come unless they simply walk away. This will require a whole lot of savings to fill this hole, imho.

But the message behind this is true: people have to save more because there is simply no miracle to save them come retirement. The destination is clear, but the path to get there is a bit less encouraging…

Also, these declines are good for individual homweowners because they will make the homeowners now consciously plan for a future that will not include imaginary wealth from housing that in any case was never going to be there.

I think that logic is spot on. Consider how many regular people were planning on retiring to the good life in a cheaper locale with the proceeds from their housing “wealth” – and with no other real savings (save 401k’s – also not turning out as planned). This whole delusion is over. Time to figure something else out.

I think this economy is just hitting the top tier. I think those prices will have a significant drop starting this spring.

SFS – The neg-equity people have a “get out of jail free” card – just walk away. No big deal, they get to rent a place cheaper than what they are paying and can save more. New homebuyers can now make a more rational choice as to housing costs, as they are now becoming less likely to view the house s a means to obtain free money from the inflation gods. Existing homeowners with substantial equity in their homes can now make a rational choice: sell now and book the “profits” or judge that the value of remaining in the home outweighs the carrying costs + likely decline. Really, everyone benefits. The key is that the imagined future based on inflated housing wealth was always just that – imaginary.

I remember talking with an older guy (late 50s) in 2003 or 04. He knew I had been in financial services and was always asking about financial things. When we were talking one time, we got to talking about retirement assets. He literally “patted” the fence of his SFR and said that this “baby” was his retirement plan, lol. We need to strive to avoid creating another generation like that IMO. (Nice guy, though, just not very bright.)

The worst case would be the Japanese style recession/deflation. With market to go another 25% to the historic norm, it could slowly slide 2-3%/year from now on for the next 10 years. That’ll continue to clog the banking system, the economy remain mired in recession, rents falling. The right thing would be to let the housing market fall freely as quickly as possible so that we can start recovering sooner than later. Unfortunately, I’m seeing an effort to artificially prop up the housing market by Congress and Obama administration, thanks to NAR lobby and home owners interests.

A fall in in housing/rental prices should put more money in people’s hands which should stimulate the economy. I am all for free falling housing market, but then again I rent.

I’m still amazed that NYC is faring this well given the huge losses in high-paying jobs there (second chart). I guess folks there will let the 2nd and 3rd homes in Florida and the Hamptons go before they stop paying on the UWS flat. But even their cash reserves can’t be unlimited.

Hey, ya’all are forgetting about inflation. The “W” recovery. In 2-4 years the gov is going to start printing money big time. The massive bailout+housing plans+treasury/fed manipulations are certain to cause significant inflation. And that is going to have a real, and significant bearing on real asset prices when the second leg of the W come around.

I don’t disagree that in the next year or so housing will decline, but come 2-4 years, inflation is going to change everyones reality. Inflation is another game changer that needs to be thrown into this mix.

45YOH, if inflation does kick in, I agree that will be a game changer. However, because this would be accompanied by higher interest rates, the short-term effect would be to accelerate housing price declines as borrowing costs rise. It is only after that kick wears off that prices will start to rise (in now less valuable dollars). So those buying real estate now won’t get quite the inflation hedge one might expect.

LRMiM – I am a little surprised you think that we will see a slow slog down from here. The way it looks to me with the low sales volume and pent up supply, that we are going to be at an inflection point sometime within the next 6 months. Either there are a lot of owners testing the market to see if they can get out now, but will remain in their homes and not sell them if they don’t get something around a 2005/6 price, or they are going to have to adjust to the new market reality quickly as the spring inventory comes online.

I just see so many people who bought their places after 2005 and are putting them on the market for more than what they paid, it seems there is going to have to be a pretty serious capitulation soon. Can you elaborate on how you see a slow grind down?

Nice slope, but that data reflects fear and, to a lesser extent, qualification standards being harder to meet.

The jobs being lost won’t hit that graph until later this year. The job losses were just starting in December. It’s not like people lose their jobs and immediately sell their homes. But the businss situation in the bay area can only charitably be described as ‘dire’ and so we’ll see jobs contracting hit the graph later this year. Same for NYC.

The top tier won’t be immune. Anyone could get a loan for any amount they wanted. A lot of people in that tier are barely scraping by as it is.

Imagine if you went into a comma in early 2008 and just came out and read the news; and looked at your overall wealth portfolio. I’m surprised there isn’t more panic in the markets. These numbers are disastrous and if you believe CS, and at this point why wouldn’t you, we’re only half way there on housing. DOW/S&P literally decimated along with trillions in wealth. Epic.

RE: “I’m still amazed that NYC is faring this well given the huge losses in high-paying jobs there (second chart). I guess folks there will let the 2nd and 3rd homes in Florida and the Hamptons go before they stop paying on the UWS flat. But even their cash reserves can’t be unlimited.”

If you’re speaking specifically about Manhattan, the market landscape is different because of the high percentage of homes that are co-ops. The high-risk buyers most likely to be underwater or in default now wouldn’t have qualified for co-op purchases. The newer condo buildings in Manhattan are indeed experiencing the same effects of the downturn, which are more visible in other NYC boroughs and the rest of the country.

Guys,

Let’s be a little bit sophisticated in our analysis here, and not act as though the continued fall of home prices exist in a vacuum without any consideration for other asset classes.

For people like me, who bought their home too early (August 2008), it was still a great move, because I cashed out all my stock to do it (which has since fallen 50% in value). I paid a high downpayment, so my leverage factor was not as bad as it might have been for some.

Now, is it possible that *some* people who buy real estate derive their cash from dollars stored in their mattress? Maybe. But for the other 99% of us, we transferred assets from stocks and bonds in order to finance that downpayment.

So feel free to sit there with grins on your face, laughing at the fact that home prices have fallen 2.3% in the last month. What has the S&P done in that same time?

The word “capitulation” only apply when people are forced to sell. Like (Sorta) NewBuyer said, a lot more people put 20% down or more than what is typically shown on here. Remember, the environment was competitive. The buyer with 30% down was countered. If within a few percentage points of the leading candidate who only had 10% to put down and the rest financed? This happened all the time. Plus, the government is doing all it can to obviate wholescale loan resets.

Now, if you have to sell, for whatever life reason, you have to sell. Capitulation though? I think most people who put down big bucks planned to stay a while.

HappyRenter is correct about past Noe Valley prices. Homes in Noe Valley did not consistently go for over $400k until the net boom started going in earnest around 1998-1999, and at that time those prices were considered oddly high. Project forward from there plus inflation as a potential rough estimate of a bottom and we have a long way to go. Much of that will be up front, but even with low inflation it only takes a few years of stagnant prices to remove a large chunk of value.

(Sorta)NewBuyer,

One issue, unless my coffee hasn’t kicked in yet, is that your losses are leveraged. I.e., if you put 20% down (rare) and your house drops 20%, you’ve lost 100% of your investment. Add in financing/interest and taxes+maintenance and a well diversified portfolio (stocks, gold, etc.) turned out to be a much better way to go.

“Homes in Noe Valley did not consistently go for over $400k until the net boom started going in earnest around 1998-1999,”

Homes? I think you mean 2 br 1 ba flats, right?

Also, and sorry to keep beating a dead horse, but Noe Valley underwent a sea change in its demographic makeup over the last decade.

LMRiM,

Do not discount 2 very important factors: Denial and Pride. These will make sure this market goes through a very long and painful reality check. We can always hope for a quick one, but the mass of the fools who bought in 2004-2008 (2009?) are likely to try and “suck it up”.

For data at the very high end of the market, you should look at the First Republic Prestige Home Index. It is produced by Case/Shiller and uses the same methodology as the national index but filtered for houses over $1MM.

http://www.firstrepublic.com/lend/residential/prestigeindex/sanfrancisco.html

In the over $1MM range, SF is down 3.1% Y/Y and 1.8% down over Q3 2008

“But for the other 99% of us, we transferred assets from stocks and bonds in order to finance that downpayment.”

I had a third of my down payment money in stocks, which has been halved now. I think i’m still in better shape than if i had bought, when taking into account leverage on the real estate side, and the absurd carry costs.

That’s a great point about the stock market, though. Real estate, today, is a great way to destroy wealth slowly, over time, rather than have it bouncing around in the stock market.

but the mass of the fools who bought in 2004-2008 (2009?) are likely to try and “suck it up”.

“Suck it up” eh? You mean live in the properties they admired enough to purchase with large down payments, and plans to stay a long while?

Now that most of your neg-am and alt-a reset arrows are gone, many of you are down to job loss, and job loss only, for “capitulation” trigger. Fair enough. That was always gonna be the one. Tipster went on record the other day saying that this recession would be worse than dot bomb. That’s definitely in contrast with everything I’ve read.

“Do not discount 2 very important factors: Denial and Pride. These will make sure this market goes through a very long and painful reality check. We can always hope for a quick one, but the mass of the fools who bought in 2004-2008 (2009?) are likely to try and “suck it up”.”

True if they were buying for “investment” purposes, but don’t forget that a good number of folks bought homes for the long haul, especially if they bought a bigger place because of kids. Those folks aren’t going anywhere anytime soon unless they lose their jobs, and although unemployment is sure to rise, we’re talking general worse case scenario of what, 10% up from the current 6% or so?

@ anonn, as you said above:

>>I think most people who put down big bucks planned to stay a while.

The problem is that The Plan, for probably 80% of your big money plunkers, also included having a job and steady-ish housing prices going forward. It’s the little things that’ll get you.

…And yet there are fools in “real SF” pocket listing their places for 40%+ over 2002 prices. Does anyone else get these listings from their brokers and just laugh? One just arrived today, apparently from a parallel universe.

“Now that most of your neg-am and alt-a reset arrows are gone”

Says who? Those recasts haven’t hit yet and when they do, people will look to refinance. No problemo there, except when they get the appraisal, they’ll realize just how far under water they are, and that’s when the problems start. If there is one thing everyone on this forum has learned, it is the ability for a homeowner to deny reality and believe that their place is “special”. That will be the first time reality hits them in the face and they realize how many hundreds of thousands of dollars under they are, and how difficult it will be to qualify.

Interest rates ARE low, but it isn’t going to bail them out. And people realizing they are under water is the biggest problem for keeping the suckers paying: it’s why Fannie and Freddie have floated the idea of no appraisal loans: the appraisals are what is causing people to walk away. Until then, people keep paying.

“many of you are down to job loss, and job loss only, for “capitulation” trigger. Fair enough.”

You are forgetting demographics. All those baby boomers are retiring and they NEED that money from their homes to live on, because, as others have pointed out, for many people, it’s all they have. That would have been a lot of sellers, bust or no bust.

And job losses in Silicon Valley are going to be horrific. I don’t have a good handle on SF jobs, but I have an amazing handle on south bay jobs and I can tell you that disaster is the only word for it. And it will be worse than dot bomb because it is so widespread. Dot com hit the bay area hard, but there were lots of businesses that served the remainder of the economy, which was fine in the bust. Not so this time. And web 2.0 and biotech are all getting hit just as hard.

The greater economy was always bigger than the dot com economy. Even here. I don’t remember the federal reserve and treasury bailing out *anyone* in dot bomb days. AIG and General Motors are absolutely sinking. Tell me how that’s not much worse than pets.com going under.

Folks, sellers don’t set market prices. Buyers do.

So just because people are in it for the long haul, and don’t plan to sell soon, doesn’t mean their property is holding value. Prices can and will still fall. They’ll fall to what buyers are willing to pay.

So if you don’t want to sell today at a loss, then hold onto it for 10 more years to try and break even. Plenty of other properties will trade in the meantime to evidence the declines, and the eventual rebound.

But you can’t annul bad decisions by refusing to acknowledge them (although it’s clearly what our government is intent on doing).

“But for the other 99% of us, we transferred assets from stocks and bonds in order to finance that downpayment.”

We covered this on another thread. Most people that wrote in are keeping their down payments and emergency funds in CD’s and other non-volatile investments. Sheeple like me follow the conventional wisdom that stocks are good for longer-term investments only, not for money that should be liquid.

I agree with anonn that many people will stay in their homes even if they are under water. I do have some friends that may have to sell, but also have plenty who love their homes and didn’t buy above their means.

The stats in Noe get messed up by those huge Dwell remodels. I’d be curious to know what a nice 2/1 SFR sold for in 1997 and 2004. The kind that were selling for $1M to $1.1M in 2007, that is.

@deflujional

“Now that most of your neg-am and alt-a reset arrows are gone, many of you are down to job loss, and job loss only, for “capitulation” trigger. Fair enough. That was always gonna be the one. Tipster went on record the other day saying that this recession would be worse than dot bomb. That’s definitely in contrast with everything I’ve read.”

Please cite where you get your market analysis. I can’t locate one reputable economist who shares this opinion with you.

About the (perhaps) absence of seller capitulation, it’s just too bad that in every market, at every time, 100% of the time, it’s buyers who set prices, not stubborn sellers. I agree with SFS that there will be a lot of resistance by sellers, and that will moderate the pace of the decline (the hint will be continued low volume numbers).

@ Bunk – reluctance to take losses, and seller “anchoring” to past values is what will make this a longer slog than it needs to be. In the end, SF Bay Area residents – even residents of The Real SF – are just average people. Nothing special, and they’ll make the same amateur mistakes that all average people do at inflection points in markets.

Also, I think we may see some slowing in the rate of change for the overall SF MSA for a few additional reasons (although the upper tiers should perform relatively worse):

1) Even Case Shiller suffers from selection bias. Paired purchase and sale requires the sale. At the margins, people who can resist “taking a loss” (a misconception, because of course they have already absorbed the economic loss) will hold out, leading to a systematic bias in favor of sales data in which the buyer “underpaid” years ago to the detriment of all those “overpaids” who drop out of the data set. Over long periods of time, of course, this selection bias washes out of the data.

2) In view of the income of the Bay Area and the low interest rate environment that is likely to continue for a while, the lower end Bay Area properties and tiers are now closer to “fair value” than the upper end. This should moderate and “lean against” the tide of price declines for these assets.

3) Even with these moderating influences, I still think the overvaluation was so great and the bubble so large that we will maintain a significant downward trajectory. It just that 2% monthly declines at the high end, and 1% monthly declines overall will feel like a “slog” compared with what is going on right now (just picking some plausible numbers, not a specific prediction). The cumulative destruction though by mid-2010 should be pretty awesome to behold nonetheless.

BTW, the idea that the “government” is working against this, etc., put forward above by some posters is silly. This thing is so large that the USG is powerless to change the final outcome, except perhaps to change the rate of decline and certainly to make the final bottom much lower than it otherwise would have been. (Actually, I really think it has all been a political show for the sheeple. These guys know what’s going to happen, and they always have.)

“Says who? Those recasts haven’t hit yet and when they do, people will look to refinance.”

But you’re wrong about that. Those recasts ARE hitting, and they’ve been hitting all year and will continue to do so throughout the spring. Mine did. Several of my clients’ did. My brother’s did. My sister’s did. Guess what though? They’re resetting lower.

@ Dude,

“So just because people are in it for the long haul, and don’t plan to sell soon, doesn’t mean their property is holding value.”

I didn’t say that. I spoke against “capitulation.” And in my opinion the fact that certain houses and condos even now are selling at ~2006 levels is a big spoke in the eye of “capitulation.”

Jake,

a good number of folks bought homes for the long haul

Yes, but I know at least 3 friends who entered the market in 2006-2007 with condos/smallish houses for their first kids with the idea of moving up once #2 is on the way. Their timeline was buy today, sell in 2-3 years and move up. They’ll probably stay put and really “suck it up” in a place a bit too small for them. But not a really big deal as long as they can afford the payments. But this following “move up” transition will remove some pressure from the 1M-1.5M range.

“Please cite where you get your market analysis. I can’t locate one reputable economist who shares this opinion with you”

Oh, one guy was cited on this very website recently. Lots of us saw it and there was some healthy dialog around it. He is a pretty well read and well respected bearish economist. Can’t remember who it was tho. Don’t care to lift a finger doing anything for you when you address me in that manner either.

“Let’s be a little bit sophisticated in our analysis here, and not act as though the continued fall of home prices exist in a vacuum without any consideration for other asset classes.

For people like me, who bought their home too early (August 2008), it was still a great move, because I cashed out all my stock to do it (which has since fallen 50% in value). I paid a high downpayment, so my leverage factor was not as bad as it might have been for some.

Now, is it possible that *some* people who buy real estate derive their cash from dollars stored in their mattress? Maybe. But for the other 99% of us, we transferred assets from stocks and bonds in order to finance that downpayment.

So feel free to sit there with grins on your face, laughing at the fact that home prices have fallen 2.3% in the last month. What has the S&P done in that same time?”

NewBuyer, You just lost 100% of the assets you transferred to your downpayment vs. 40% that you would’ve lost with those same assets in the market since Aug.

When you lose 20% in home value then you lose your downpayment or 100% of your investment. The ret of the home was never yours to lose

how is that a good thing?

you would’ve been better off leaving your money in the S & P

They’ll probably stay put and really “suck it up” in a place a bit too small for them. But not a really big deal as long as they can afford the payments. But this following “move up” transition will remove some pressure from the 1M-1.5M range.

Agreed, the flat appreciation bettors will not be able to move up. They should have perhaps hired a better realtor.

@fluj

“Oh, one guy was cited on this very website recently. Lots of us saw it and there was some healthy dialog around it. He is a pretty well read and well respected bearish economist. Can’t remember who it was tho. Don’t care to lift a finger doing anything for you when you address me in that manner either.”

Convincing stuff as always. You never seem to disappoint.

“The worst case would be the Japanese style recession/deflation.”

No. The “Japanese Case” doesn’t even share the same timezone with “the worst case.”

Regarding expectations, the value destruction began on the geographic and financial periphery (i.e., new community ‘burbs & subprime), and will continue to march relentlessly on the core (i.e., Real SF & jumbo prime) like a liberating army.

I expect +$1 million homes in the East Bay (i.e., Lamorinda, Berkeley Hills, and even Piedmont) to take the bulk of the hit this season – sales will be few & far between, and those who do manage to sell will have gotten out ahead of the pack with 10% to 20% discounts over stale market medians to get listings down under seven-figures.

Real SF will stagger through this season, more or less with a credible “plausible deniability” storyline. It’s real moment on the markdown chopping block will come in the 2010 season.

We know that the collapse of subprime starves the middle-market of upgraders… which in turns starves the higher end of middle-market upgraders.

Same thing is afoot geographically, with the most distant suburbs having collapsed first, placing pricing pressure on the interior suburban ring.

Oh somebody will come up with it, Jorge. Hang tight. Sorry you missed it the first time around. I forgot the guy’s name is all. And if I may, excellent cynicism tinged with a bit of the personal. You do not disappoint either.

For the record, I also gave some personal anecdotal evidence. Do you dispute that loans are resetting lower right now? If you do dispute that, why? Any personal experience?

It isn’t only about rate-recasting, for some perhaps to a “lower” rate.

For the interest-only crowd, it’s also about having to begin the amortization of the loan principal, which for some has been postponed two to five years, requiring amortization over a more compressed time frame.

That’s the source of monthly expense distress.

OK, Jorge. (That rhymed.)

Nobody has said that, eh? Sure they haven’t pal.

One cursory search found me this. Not the guy I referred to, and it’s from last year:

http://www.bloomberg.com/apps/news?pid=20601039&refer=columnist_berry&sid=ajRTMlVVsvVY

Rates are even lower now. The feds have worked to prevent massive resets from happening. They were not active enough to tackle sub-prime. Witness D10 in our own beloved San Francisco. But they’re trying not to make the same mistake twice.

“it’s also about having to begin the amortization of the loan principal, which for some has been postponed two to five years, requiring amortization over a more compressed time frame.”

That’s one sort of loan. Another would be if the amortization is tied to a specific amount. Given that with the latter sort of loans I/O is now relatively close to neg/am, or even less, then that’s diffused as well. As to your point, there are other USG initiatives afoot including 729.5 superconforming, principal reductions, rate reductions, foreclosure delegation, etc. We’ll see. Go ahead and argue whether it will work or not. But come on. Don’t sit there and say the USG isn’t trying, or that rates are not resetting lower.

I wouldn’t worry about inflation any time soon. The mortgage rate anticipates future inflation, and, given the current rate, the market obviously isn’t expecting one. Deflation poses greater and growing risk, according to Bernanke. (Falling housing/rent/income). Beside, all that money printing will only amount to a fraction of the money evaporated from RE and banking losses. Bottom line: I’ll be staying out of the market longer than I planned previously.

@Fluj

I’m referring to the dot com era comparison to the housing bubble. Loan types are almost irrelevant at this point when global wealth destruction is expected to exceed $50 Trillion.

Oh, and a link from the esteemed John Berry admitting he didn’t see the US falling into recession in 2008, let alone the worst financial crisis in 70 years.

http://www.bloomberg.com/apps/news?pid=20601039&sid=a1ntyfKvlGzE&refer=columnist_berry

Good stuff.

fluj, what does any of this really do except trap people in depreciating assets, as LMRiM has mentioned several times? Does it raise rents and incite sidelined buyers into the market? Does it raise incomes and create jobs? Does it re-start appreciation?

Additionally, the Chronicle recently had an article postulating that 90% of the bay area would not even be helped by the contemplated programs:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/02/23/MN4R1621N4.DTL&hw=bay+area+homeowners&sn=001&sc=1000

Then there’s Shiller, co-creator of this index, who said yesterday that home prices are still too high based on fair value:

http://finance.yahoo.com/tech-ticker/article/190712/Shiller-House-Prices-Still-Way-Too-High?tickers=%5Egspc,%5Edji,hd,kbh,tol,ctx,xhb

More importantly, how is the government going to finance all these programs? Massive debt. Doesn’t that push treasury rates up, and most other rates along with them?

“Don’t sit there and say the USG isn’t trying, or that rates are not resetting lower.”

Fair enough. Note that I did not challenge you on the rate resetting issue – beyond attempting to specify that a lower rate does not dictate a lower monthly expense.

For your part, don’t sit there assuming that the short-end of the yield curve will remain dead on the mat, or that the long end will persist with 3- and 2-handles. The Treasury auction supply calendar is, to say the least, “heady.”

Yes, our public creditors in Asia may step in and purchase up the whole offering for the next year or two. Then again, they may not.

And to cycle back to the Japanese case, I’m afraid we do not possess enormous stores of domestic savings with which to finance enormous public deficits, as the Japanese did at the outset of the 1990s.

Which means to my estimation that Asia doesn’t really have to sell any of its current store of U.S. denominated public debt to trigger an increase in rates. They only need choose not to add to that store.

Because there is a paucity of private domestic savings and related demand to absorb the difference.

Yes, the USG is definitely trying to help the poor bleeding sheeple with our tax money, creating artificially low rates.

But this is a “whack-a-mole” game and the Fed only has one hammer while 10 moles are popping their heads at a time.

It’s only a question of time before the market reclaims what it’s due. The welfare homeowners will have to pay up the principal eventually, and that day is gonna be ugly…

“what does any of this really do except trap people in depreciating assets, as LMRiM has mentioned several times? Does it raise rents and incite sidelined buyers into the market? Does it raise incomes and create jobs? Does it re-start appreciation?”

The point is to stave off depreciation as well as they can. Rents, incomes, and jobs are dependent upon the local economy. Appreciation too.

Two months ago was probably a good time to buy in one city. And that would be Washington DC.

“I’m referring to the dot com era comparison to the housing bubble. Loan types are almost irrelevant at this point when global wealth destruction is expected to exceed $50 Trillion. ”

OK. In that light I’m referring to the local economy, specific to a point Tipster made the other day. He said tech will be hurt worse by this, this time, than tech was hurt by dot bomb. I dispute that based upon numerous articles I’ve read. Do I need to do another search? My intent was clear. If you didn’t get your panties in a bunch every time you see my name maybe we could communicate.

Have no fear, the futures market says this will all be over by this fall (Nov 09). Hang in there, only another 15% down to go (and one guess as to which tier will be doing the “heavy lifing” — I’m with Debtpocalypse on this one).

“He said tech will be hurt worse by this, this time, than tech was hurt by dot bomb. I dispute that based upon numerous articles I’ve read.”

anonn or anyone else,

As a self interested tech employee, I would be very interested in reading articles like this if anyone has a link. My general feeling from the ominous way people have been talking, is that the current environment would hurt us more than the dot bomb did.

According to ABAG, the Bay Area job market will be terrible in 2009 and weak in 2010, but the losses won’t be as bad as they were during the dot-com collapse. Having said that, ABAG forecasts tend to be “irrationally exuberant” but for what it’s worth you can find the article here:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2009/01/30/BUVH15JLQL.DTL&hw=abag&sn=001&sc=1000

“But for the other 99% of us, we transferred assets from stocks and bonds in order to finance that downpayment.”

I had 100% of my downpayment in money markets for the last five years, and still do. Most people I know did the same. Your 99% figure is not realistic in my circles.

The rate of decline on the low end of the market cannot continue on the current trajectory. It is far too steep and is simply unsustainable. I believe it will flatten out soon.

“It is far too steep and is simply unsustainable. I believe it will flatten out soon.”

Yes! As long as soon = 2011. 😉

Grim stuff.

Although the SFH index isbecoming more and more irrelevant to SF itsself as sales pick up in other areas and fall in SF.

SF is what? 5% of the SFH index? certainly no more than 10%.

It tis strange the way that the tiers have been changing since they were first broken out in Sep07. Is this due to reduced sales volume?

Houses that were considered to be in the lower-third in Sep 2007 would now be considered upper-third properties

Upper 1/3 > Lower 1/3

That’s really interesting data, HappyRenter. I hadn’t focused on that aspect of changing price tier breakpoints.

I think (as you imply) for any data set (which consists of 3 months’ rolling average of matched purchase/sale data points) they just split them arbitrarily into 3 tiers based on selling price. They then track back the purchase price that is associated with the lower bound sale for each of the tiers and adjust the initial price that they publish.

Now that I read that, it doesn’t make too much sense 🙂 Better to go to the source. Check page 18ff here:

http://www2.standardandpoors.com/spf/pdf/index/SP_CS_Home_Price_Indices_Methodology_Web.pdf

The bottom tier will start to flatten in the next six months look at the chart.You may be right about 2010-2011 for the top tier.

I looked at many houses in Noe Valley in 1995, with a budget of $400k, so I know what $400k could buy in Noe in 1995. You could buy a decent 2/1 in Noe (often with room to expand downstairs) for under $400k, or a 3/2 fixer. There were some nice 3/2s in the $450-$600k range in Noe, but they weren’t fixed up like the high end Noe houses today.

The reason the top-third is down less than the bottom-third is mostly the result of the following: the problem wasn’t so much an inflation in home values as much as a reduction in the cost of, and qualifications to borrow, money. At the very high end, lenders still performed due diligence on borrowers: even in 2007, there were no/few 100% LTV $3 million no-doc loans. Also, a greater percentage of people entering into multi-million dollar loans understood things like LIBOR and how it can vary overtime, so the price setting buyer at that level was more aware of risk and therefore _marginally_ less crazy.

More lameness from DC:

“Some borrowers presumably knew what they were getting into,” Bernanke said before the House Financial Services Committee. “But from a public policy point of view, the large amount of foreclosures are detrimental not just to the borrower and lender but to the broader system.”

“In many of these situations we have to trade off the moral hazard issue against the greater good,” he added.

In short, dear taxpayers, BOHICA.

Dan-I concurr. I also looked in noe valley back in ’94, and saw numerous sfr’a for ~ $450k. We ended up getting a deal on a duplex (cheapest house on the block thing) for $385k. My tic portion was $160k. Sold it in 05 for $705k. Maybe it will go back to $160 by 2010 or 2011, a 77% decline. Remember, we’re in an emormus asset bubble, an economic decline equivalent to the GD. I think alot of smart people here will be able to buy similiar properties in noe for ’95-97 prices. And the poor chaps who brought in 05-08 will need to wait 20 yrs to regain their deposits. Yup.

On the relative strength of the NY market to date, NY Times article today reports that the hangover has now begun there in earnest and NY is starting to crash hard. Nowhere is immune.

http://www.nytimes.com/2009/02/26/realestate/26condo.html?_r=1&ref=nyregion

Case Schiller rates NYC the best market in the US. SF one of the five worst. Yet San Diego is rated as a top five because of its rate of deceleration. Meanwhile, San Francisco has the second best deceleration rate, and is still in the lowest five.

http://finance.yahoo.com/real-estate/article/106645/10-Best-and-10-Worst-US-Housing-Markets

So what does this all mean?

Not much, because of MSAs’ mix. (At least they acknowledge that in the article.)

FWIW, to size up the extent of this current bubble, a cool little interface from USA Today to display the % of people in debt more than 4X income county by county:

http://www.usatoday.com/money/economy/housing/2009-02-24-bigloans_N.htm

Use the slider to compare 2000 with 2007.

Wow, love that map and slider. Of course I think you mis-state exactly what it is showing. It isn’t showing the “% of people in debt more than 4x income”, it is showing the percent of mortgages given out that year to people in excess of 4x income. So the 2007 map is showing only loans given out in 2007, if someone borrowed 4x income in 2006 it isn’t reflected in the map.

From the article that accompanies the map:

“In 2007, the most recent year for which statistics are available, banks and other lenders gave out nearly 419,000 mortgages to buyers borrowing at least four times their annual income, sums that were unheard of less than a decade ago.

An examination of federal lending-disclosure reports show that amounts to 9% of all borrowers in 2007, a rate higher than at the peak of the U.S. housing boom.”

The data being displayed on the map is for each individual year, it is not for all borrowers, just borrowers from that year.

First thing I did after seeing that was calculate to see if I was one of those 9% or not since I got my loan in 2007 (I’m not, I’m under the 4x figure).

Rillion, thanks for the precision.

Yes, thanks for that graphic and the explanation. It’s a pretty good indication of how screwed the housing market is, and will be for some time.

Does that mean we need to look at the properties sold in April 2002 in a given neighborhood to determine a fair price for a property in that neighborhood? I understand that there is no good scientific way to price a property other than what someone is willing to pay for it but it’s important to consider conditions in the broader economy.

Does that mean we need to look at the properties sold in April 2002 in a given neighborhood to determine a fair price for a property in that neighborhood?

I’d target 1999-type prices, but then I’m a little grizzler than the average bear. Prices IMO will continue to fall even from those levels for some time, but I bet the low interest rates available will make a 1999 price purchase a good bet over a 10+ year horizon. I wouldn’t even dream of buying something in SF (even at 1999 prices) if you don’t see yourself living there for 7-10 years.