Another $600,000 (10%) has been cut from the list price for the staged penthouse shell resale atop San Francisco’s Ritz-Carlton Residences, now asking $5,395,000. That’s $1,105,000 less than was being asked this past June, and $25,000 less than was being sought by the sales office at the end of 2006 (we’re not privy to the actual contract price).

UPDATE: Assuming a plugged-in reader is right, the current “asking price, minus commission, would still be above the original purchase price.” By just how much will still don’t know.

∙ Listing: 690 Market #2401 (3,595 square foot shell) – $5,395,000 [MLS]

∙ The Staging (And Reduction) Of That Ritz-Carlton Penthouse Shell [SocketSite]

∙ Ritz-Carlton Residences (690 Market): Listed [SocketSite]

Still too high.

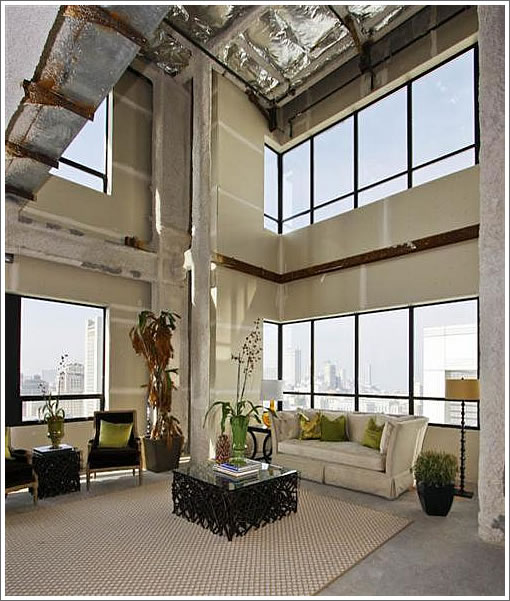

That picture is hilarious! Staging a shell with cheap Levitt’s furniture, AND a dead plant.

Classy!

When I saw the dead plant in the corner, I laughed out loud!! Talk about cheapskates … who are these jokers who buy a $5.XX million dollar property then try (and fail) to flip it while dressing it up with some used motel furniture?

that pic/staging attempt is pretty darn funny. shoot, why even market this place as a luxury unit, it looks more like a live/work loft in a luxury building—it’s done as far as i’m concerned. shell, schmell… 😉

Agreed. Looks terrible.

It’s just such a mediocre Penthouse. Look at the other wonderful Penthouses San Francisco has to offer. This one just screams blah, no matter how much you put into it to make it original.

The staging seems like a pretty pointless effort to show scale. I would think they would do better to have some potential floor plans drawn up and do 3D renderings with different architectural styles to show buyers the potential.

Re. high-end marketing — Inman had an interesting article about marketing to the very high end segment. The interviewees laughed at typical real estate sales techniques in the high net worth millieu. They said that when you buy a personal jet, you get a coffee table book about your jet. They joked about yacht buyers getting wowed by cookies during yacht showings (“open yacht”?).

keep your panties on, it’s still above water from purchase price.

ditch the cheap staging already and get some 3d renderings.

Litter the place with dead plants and knock $1,000,000 off the price and it should sell.

“it’s still above water from purchase price. ”

Exactly how is something “above water” when it hasn’t sold? It’s one thing to say something that’s highly liquid with a consensus price (like a share of stock in Google, say) is “above water” without having to sell it. It’s very different when the asset in question has been sitting on the market for 17 months without a buyer, despite dropping the ask by over a million bucks. If they relisted it at $20MM would that make it “way above water”…?

It’s just too edgy for you guys.

Oops – make that five months on the market (not 17). Nonetheless, not sold – and therefore not “above” anything (other than, perhaps, the market-setting price).

Also – even if it could sell at the new asking price, we don’t know if it would turn out to be “above water,” because we don’t know what the purchase price was … all we know is that the current asking price is BELOW the asking price when the property last sold..

And they are stuck with a Wachovia bank branch (soon to be Wells Fargo) on the ground floor instead of the chic restaurant buyers were promised.

grimwood, what exactly does your post add? my post is pretty straight forward, and I believe adds value to this thread as there was a question as to what the original purchase price was, of which I have knowledge. The asking price, minus commission, would still be above the original purchase price. That is my point. you appear to be fussing over semantics.

Auden,

Care to theorize what the carrying cost would be on that previous purchase price? How about opportunity costs?

Let’s say they bought it for $5M (which must have seemed like quite a bargain buying at an 8% discount off of list at the height of the bubble).

They have been sitting on it for two years, and clearly not living in it. So there are substantial carrying/opportunity costs involved, and they should be large enough at this point to declare this property officially underwater, even if they get their asking price, which I don’t think is likely to happen, at least not anytime soon. Not that we will ever find out.

That plant is not dead, it’s sleeping…

Life is better at the top.

Well, at least they didn’t go with the bamboo “time share” style furniture…

🙂

Levitz furniture or not, this place has massive potential. It may not go this month, but it will certainly get bites in Jan. I’m lovin’ it!

In my opinion the real problem isn’t the location or the space or the lack of finishings. The core issue are the fees and the Ritz-Carlton lifestyle that are part of the deal. This unit is intended to appeal to people who want to be as pampered as possible, and for whom the large ongoing bills are, if anything, more of a bragging point than a nuisance. Unfortunately for the sellers, this extreme high point of luxury is a hard sell. Luxuries are popular in boom times, and the very rich are often value conscious. Including completion and upkeep this is more of a ten million dollar unit, and the air up there is extremely thin.

“it’s still above water from purchase price. ”

And the plant’s beyond water!

Well, at least they didn’t go with the bamboo “time share” style furniture…

Speaking of the Ritz timeshares… err, fractionals… I updated the Ritz thread with the latest offering from Craigslist (hint: the prices are trending down — around 20% off the developer’s price).

What a joke.

They ended up selling this shell 7 years later for a $2M loss.

Whoever bought it, built it out, and put it on the market last May for $9.9M, just in time for those newly minted 10,000 millionaires.

And yesterday, they gave up and dropped the price by $1.4M.