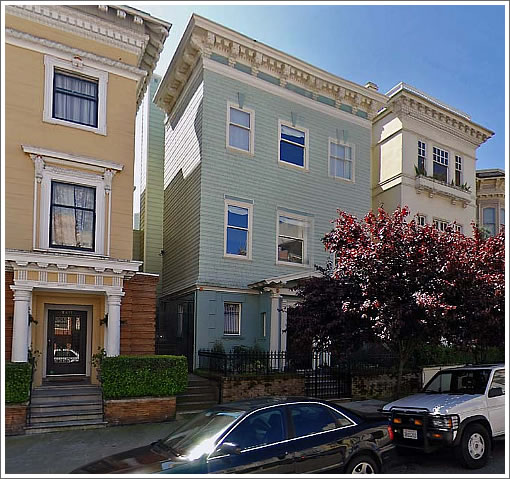

In April of 2007 the listing for 2219 Pacific Avenue touted “Beautifully remodeled and maintained Pacific Heights Edwardian…Detached 2 car garage…All bedrooms are generously sized.” It closed escrow two months later with a reported contract price of $4,250,000.

Three days ago a gutted and reframed 2219 Pacific returned to the market touting “Permits issued and complete plans available to finish this spectacular 3 story home in AAA Pac Hts…needs elect, plumbing, flrs, mechanical…will be a 4900 sq ft home…3/4 of foundation is brand new w/ all current seismic upgrades.”

Now asking $3,495,000.

UPDATE: From an always plugged-in sleepiguy: “Just all around tragic. Again, Pac Heights real estate died a sudden, painful death back in October. It’s not even on life-support; it’s just dead.”

∙ Listing: 2219 Pacific Avenue (5/4.5) – $3,495,000 [MLS]

Speaking about misallocation of resources and wealth destruction…..

Guess someone looked at the projected remodel costs and said

“AHHHHHHHHHHHHHHHHHHHHH”

I know I’m not in the right demographic for this, but gosh it would be difficult to walk into a $3.5M home that doesn’t have walls or a floor!

Obviously, the true “value” of this property is the fact that it is a shell, and already permitted.

a question: does the fact that it has permits mean that you have to renovate to the specifications of the past flipper? or do you have latitude with this? can you redesign things?

Does anyone else smell smoke?

Can someone enlighten me on why someone would buy a “Beautifully remodeled and maintained Pacific Heights Edwardian” for 4.25 Mil and then gut that place?

Really, what are the chances you would recapture the investment/carrying costs of fixing/replacing everything from the foundation up?

And on a bit of a tangent …

So now it appears that we have a home that was perfectly habitable prior to the purchase which is now nothing more then a hollowed out shell.

The idea that permits (seem to be) readily granted to gut good homes, but owners in more marginal areas have to fight tooth and nail to remodel crap homes is mind boggling to me.

Getting permits within the envelope of your home is not a challenge, so there’s not a ton of value in this being permitted. Maybe you’re saving $50K in architecture fees but the real headaches enter the picture when you try to expand the envelope, especially if you trigger a variance.

And, no, your not stuck with the previous design. You can change lots of things without messing up the permits. If you want to change the entire thing, then you’re basically starting over.

does anyone have any real information on the backstory on this?

When I saw the listing for this return, I knew it was a Socketsite post waiting to happen.

Just all around tragic. Again, Pac Heights real estate died a sudden, painful death back in October. It’s not even on life-support; it’s just dead. There are simply no buyers out there in this price range. There is even less demand (if that’s possible) for fixers, which is kind of too bad. A lot of homes in D7 remain in desperate need of some TLC.

Should we pity the rich?

Ummm…NO.

Pac Heights is in another world, mere mortals will never afford, not wish to.

One less vacation home and one less digit in their net asset value… bah humbug!

Paco???????

I don’ believe the current owner paid over $4m for this place. Can someone check?

I sympathize with the owner who is making a sacrifice dumping this back on the market. This wasn’t intended to be a flip and my sources say that it was just an ill-timed purchase. Considering the nature / location of this property and some recent comps (Fillmore remodel) this place could be a deal. Lot’s of potential.

The SFH on Green just went into contract around $3M so there are still some buyers out there in this range. That place had killer views and lots of potential. But this place has a better footprint and just plain bigger. But no views. These was also a SFH facing Alta Plaza that went into contract in October. So PH isn’t dead but the vast majority of life has been sucked out.

One thing is clear — buyers exist at the right price.

$713/sf for shell condition…good deal?

Pac Heights dead? Can’t be. I walked past a 1/1 on Filbert asking $999k just last night. Fluj, please prove us wrong… How many $3M deals were signed just last week in Pacific Heights. I’d bet there were several.

A good SFH on that block will easily command 1000/sf and the Fillmore place went for 1300? So if this could get 1200/sf than I’d say yes this is a good deal.

Also this place wasn’t in move in condition when it was last listed/sold. This was always a gut renovation. So considering you are getting it for cheaper and build ready condition. Wish I had the cash.

Median SFH prices are down in Pac Heights, but only over the short term. I ran an analysis last week and posted here: http://spedr.com/jlw2

Dead? That’s a bit of a stretch. IMHO, Pac Heights will never really “die”. Matter of fact it will survive. When the sea levels swell, it’ll be one of SF’s high-priced islands in our little archipelago for the rich. People will be rowing over to Fillmore in Maserati gondolas to have their puppies groomed. You just watch.

Socketsite disclaimer: I am joking. Sort of.

One thing is clear — buyers exist at the right price.

Also – the sky is blue. Drop this place to $500k and it probably sells…probably.

You have to like this house for $5MIL after you put $1.5 MIL into it to complete and it is 2010 and the construction is complete.

You can do better for $5 MIL right now, and over the next 6 mos, without the misery. It looks mis-priced to me.

I didn’t delve too far into it, but I did a quick search for solds, act. cont’s, and pendings for District 7 since mid November and it was like 40 something. There have been a few sales here and there recently. I seem to remember one right by this property. Mostly condos are changing hands. It isn’t hot. It’s slow, like anything else. The funny thing is that, time was, really expensive stuff traditionally ran the risk of taking a very long time to sell. Somehow that CW got reversed! Now it’s like,”Why won’t this 3.5M fixer sell? It is so wierd!”

I believe the owner paid $4.25m for this home. I believe he is looking to clear $3+m for it, too. My guess is that he lost a fortune in the market in recent months and just would like to walk away with his $3+m in cash. I don’t think this is hard to understand.

I am sure there are people who can still afford Pac Heights. But, the market has done some serious damage to the portfolios owned by people who are in this housing price range (and, lower). At this point, I think it there is a psychological game going on in people’s heads. It goes something like this: Mr. X thinks to himself, “Hum, my portfolio used to be worth $10m. Today, it is worth $6m. If I am looking at a home that has been steadily priced at $5m, shouldn’t it be valued at $3m? Why should I buy it at $5m?”

As someone who is plugged in, I’d be very interested to hear what some of Sleepiguy’s former clients are saying about the market and their psychology. From what I understand — a lot of PH owners are VERY concerned about their home prices and whether they should be on or off the market. Obviously there is barely any market so we’re only going to see those homes that have to sell.

PP — not sure about price paid, but your comment about the owners reason for selling reflects that you have bad information. Your following point about PH owners / buyers is very much on point and it is not simply generalized to PH buyers.

4.25 is the sold price listed in the MLS.

Maybe the rich don’t want to live where people will think they are rich? Just a hunch…

Pumpkin Patch said, “I believe he is looking to clear $3+m for it, too. My guess is that he lost a fortune in the market in recent months and just would like to walk away with his $3+m in cash. I don’t think this is hard to understand.”

I think this is accurate. I know some people who lost money in the market by betting the wrong way… They now have to sell safer holdings to cover their bad bets.

I don’t know if this is the case with the owners of this property, but I think it probably is (or something similar)…. I mean come on… After a year and a half no one would flip it with at least a $750k loss (we don’t know what it will eventually sell for)…. They paid for plans- got permits, an architect, everything…. now they’re selling for a loss…. I think if they had the money they would finish it and sell it. Unless the owner died and the estate just wants to get rid of the house.

I’d love to know the story.

Eddy…I never said I had any information. Maybe that was the problem. I am just looking at the market from the view of someone who actually has some money and as someone who actually knows people who have even more money. Many of the people I know look at the lump sum of what they have and, they compare it to what they had six months ago. This is real.

Now, loosing $1+m on a $4.2m house just might not be as big of a lose as some portfolios have fallen recently. But, heck, I am just speculating…

They have to be having money problems, or an unexpected job relocation. No one is ready to loose 750k on a property in this stage of the game just because they are nervous. Kudos to them for being realistic on price.

PP — thanks for clarifying. Misread your original note.

They story behind this place is unique and demonstrates that at this end of the market you simply cannot make rash judgments about seller motives / reasons. Just an ill timed purchase that needed to be liquidated.

That said, I still think this place has a lot of potential and will find a buyer. Still some life left in PH. Fluj’s post was vague on details. 3 in contract homes in D7 w/in the last 7-10 days. Green, Washington, and a 4M home in Marina. Another SFH on green sold/closed on green within 15 days recently. The SFH on Laural seems to be amazing although I haven’t been inside but the owners have lived there 42 years and have lots of room to negotiate! Can’t beat the location. The Fillmore remodel was over priced but is a comp here. At $3.5 you are getting a pretty nice footprint / address in PH and can build a dream home. There just has to be a few fools with money to throw out there.

Anyway, I’m just astounded at the market in D7 and all of SF for that matter. I’ve never seen this much opportunity / value relative to the prior 36 months. Yet at the same time it’s most likely only going to get better and better (for buyers).

People in D7 are absolutely nervous. Several high-end remodel projects have just been abandoned and contractors that specialize in this area are starting to lay off some of their workers. I’m also getting a surprising amount of questions like, “Do you know anyone who wants my house/condo/building?” All of these properties are in A+ locations, which is very scary. Still, most people I know that have started a remodel are tying to finish them in a hurry or, at the very least, scale back in scope. Meanwhile, those that want to sell are just hoping for the best, but I think there’s an acknowledgment that the boat is sinking (if not already sunk).

I really feel the buyers in the 2-4 million range have pretty much been wiped out over the last two months. Those that can still afford more want great deals or to downsize. It doesn’t help that these buyers typically own something in this neighborhood anyway and tend to make lateral moves (since it’s kind of hard to move up). They know they can’t sell, so they don’t see the point in buying.

I do think the SFH market here will likely recover first. It’ll only take a couple of high sales to tempt the wealthy back into the waters, but it may take several years. I know of a couple of ultra-prime homes that were going to hit the market and would normally be priced over 10 million, but I have no idea what’s going to happen now.

Eddy, that’s true. A handful of properties are going into contract – at closeout prices! I’m glad the see the fixer on Green finally accept an offer, but I’m still waiting to see when and if it closes. The Filbert house, for example, has been in escrow forever. As for the Laurel house… that’s a tough one. I never really liked that property. Not only does it need work, but, to paraphrase Michael Kors, the garage on that house is insane!!

The overwhelming majority of people in Pacific Heights are like people everywhere. They bought long ago or recently, and are happy to stay put, even if their portfolios have fallen.

Fire sale prices like this one reflect specific situations; the potential loss indicates distress of some sort, but not necessarily financial.

A possibility not yet mentioned is that the sellers simply got disgusted with remodeling problems and dissembling contractors, and decided to move on, at whatever dollar cost. They would not be the first.

Perhaps these guys (2219 Pacific) simply got an unbelievable “closeout” “fire sale” price on their dream home, and so just want to unload this on to move on. Psychologically, perhaps its easy to take the loss, because they perceive they are buying their dream property for, say, $3M under the price they think they would have paid last year! During the Christmas season, I prefer to think positively.

(BTW, the all in economic loss if 2219 Pacific sells at $3.5M and was purchased fo what those honest realtors put in the MLS – $4.25M – has to be well in excess of $1.25M, perhaps as high as $1.5M or more. Selling costs, taxes, architect and permit fees, demo work, 3/4 new foundation, seismic retrofitting, carting fees, and over a year of financing/opportunity cost (and I’m sure I missed plenty) can’t be chump change when you are in this rarified air in Pac Heights!)

Eddy…of course there are deals in Pac Heights. Many, many people have backed off but there is always someone with a wad of cash who can afford a home in D7 and wants to live in D7. But, I really believe what is happening on Wall St is the real driver behind the D7 market.

I will never forget the Open Houses pre-2007 in Pac Heights. There were hundreds (plural) of people attending them for homes in the $2.9-$3.5m range. I often wondered if there were really these many multi-millionaires in the area. Then, all the sudden, fall 2007 came and a lot less people were in attendance for the same priced open homes…market softened…now, it has more than softened…there are deals to be made for a person who has an enormous wad of cash ($3m has to be pocket change for these people)…because most are holding their portfolios for dear life…

2 points;

1) How is it that everyone in PH, or looking in PH, took a beating in the stock market while no savvy investor on socketsite lost much if anything. It was just yesterday where LMRiM joked about how “investing in the DJIA is the only game in town, right, he he he.”

2) The third floor addition was submitted in April of ’06. So this was purchased as a fixer in the first place.

This is`a great thread. The lateral move comment was perhaps the most insightful. Thank you.

I would imagine people are more likely to “trade up” instead of “laterally.” It doesn’t make sense to move from one $4 million dollar home to another $4 million dollar home when your cost basis is probably lower on the first house. Why not stay put and keep the lower cost basis for property tax purposes (Prop 13)? Plus, 6% commissions would be another $240K, hassle of moving, etc.

Most rich people I know are rich because they are smart with their money.

plan C-sparky…I don’t know about PH home owners, per say…but, I am hearing people talk about a recent loss of portfolio assets in the order of 40-60% pretty regularly. I have also heard light hearted comments of ‘smart’ investors loosing only 20%. I have yet to meet anyone who is up with their portfolio assets.

And, I don’t think money is gone. But, when someone just lost 40% of their portfolio assets, I just don’t see him quickly running out to buy a PH home, unless that home is really a drop in the bucket for him.

And, that is reality.

It will be interesting what Obama’s stimulus plan offers this area. He is talking about building out the Internet infrastructure, throughout this country. If this works, this softening maybe very temporary….

One more note…’smart’ investors know that this is not the time to move money around. Stocks are at a low. It is time to hold.

I think the longer Wall St stays down, the bigger dip we will see in housing prices in this area.

All eyes need to focus on the stimulus plan offered by the next administration…who is going benefit? Technology will be high on this list…

P.Patch, I agree with you that some people are losing lots of money in the stock market. But, I think that, like DataDude said, the rich are “smart with their money” and probably lost less than most poor Plan C homeowners.

I have yet to meet anyone who is up with their portfolio assets.

PP,

My portfolio is up 3% this year with 98% cash. It would have been 4% if the 4% (now 2%) I had in stocks hadn’t lost 45%!!! (ouch!)

I am all cash and safety with my European banks which just offered me 3.5+% CD-style investments for the new year. In the US I am all CDs also with multiple banks.

I moved out of stocks in late 2006. A move I regretted until earlier this year…

a portfolio with 98% cash is not really a portfolio- just cash– ???

a portfolio with 98% cash is not really a portfolio- just cash– ???

Maybe. But I’m happy with it…

RE: My lateral move comment…

I was basically referring to some of SFs uber-wealthy individuals who have been less affected by the market downturn. Eventually, if you keep upgrading houses, there comes a point were you really can’t upgrade anymore without buying a $20 million house, and not many people do that (even if they can afford to). As a result, people seem to buy similarly priced homes for reasons other than money. For example, a couple owns a big house on Green, but wants a better view; so they buy a smaller house on Filbert. Likewise, a couple has a baby and moves out of their view home on outer Broadway for a home on the same street with no view but a bigger garden. An older man trades his Pac Heights mansion for one in Sea Cliff. The bored wife of a CEO buys the house down the block to remodel. I’ve seen these and similar purchases happen over and over again. Keep in mind the carrying costs are to some extent irrelevant. However, to make these type moves, the sellers typically need someone upgrading into their old homes. Those buyers are currently on hold. As a result, you’ve essentially eliminated two pools of buyers of top tier homes.

4900 square feet is not a huge house in this neighborhood. Nice and comfortable, but not extravagant, as are many others just a few bocks to the west on Pacific.

Has anyone from the list just asked the lister why the house is on the market, since so many here are curious? They might tell us.

“The bored wife of a CEO buys the house down the block to remodel”

I thought that restoring classic cars was an expensive pastime, but this takes the prize for the most expensive hobby.

Milkshake, usually you have pretty good comments, but c’mon buddy. no need to single out the wife line. it’s a little you know…and you know their are plenty of expensive hobbies out there for the uber rich. Follow a day in the life of Tom Perkins for instance…

typo-there not their…