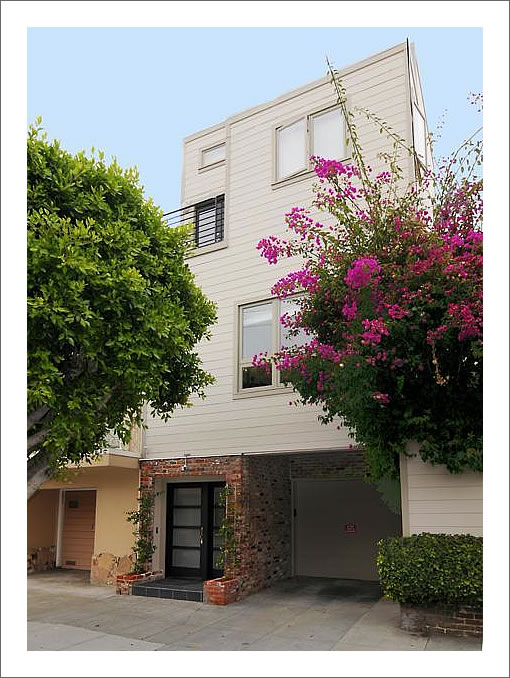

What plugged-in people have known for a week, all agents on the MLS now know as well: 1968 Greenwich officially closed escrow on 11/21/08 with a reported contract price of $1,750,000.

Purchased for $2,100,000 in May of 2005, in addition to $350,000 in acquisition cost our plugged-in buyer will be saving (and the City will be losing) approximately $4,000 a year in property taxes as compared to the party who sold.

The sale of this property was considered a legitimate neighborhood “comp” (comparable sale) in 2005. The implications for today?

∙ A Plugged-In Reader Picks An Apple For Himself (1968 Greenwich) [SocketSite]

∙ A Renovated Cow Hollow Apple On The Tree: 1968 Greenwich Street [SocketSite]

Ouch! About 400K lost in 3 years! That is gotta hurt.

Still seems overpriced, though. A 3 bed CONDO for 1.75mil? No thanks. I wouldn’t be surprised if it lost another 250K in the next few years.

It’s a condo? Looks like a SFH to me.

When is the housewarming? We were supposed to be invited. I hope the guy has good taste in beer. (Renters prefer Stella or Sierra Nevada)

Anybody know why the prior owner was selling? He/she enthusiastically overbids the May 2005 asking price of $1.9 million and then turns around and sells it in 3 years! What gives?

In any event, congratulations to Apple Picker.

$1.75 million? Sucker. Hope he’s rich, because if he’s not, then about in a year he’s going to miss the $1 million he just overpaid. Buying on the way down ain’t smart, and this downward spiral is still going strong.

“What gives?”

The market.

That’s a beautiful house on a quiet street right in between all of the fun shopping, bars and restaurants of Polk Street, Union Street and Chestnut Street. Couldn’t ask for a better location. Couldn’t ask for a nicer place. Move-in condition. I’ve been in it twice and it’s fantastic.

And almost 25% off it’s 2005 price? That is, of course, what prices have done in district 7 because this wasn’t a fire sale, it wasn’t on a busy street, there was nothing wrong with it, it’s just the new reality. I’m sure it hurts for anyone who bought a home in this area for the last three years, but that’s the way it is. We’re back to 2003-2004 in terms of pricing. And when the alt-a resets hit in earnest next year, it will probably go down further, in spite of the Japanese recipe we seem to be relying upon.

Will it be up or down when this guy sells? Who knows, but we know what happened to the last guy and I’ll bet it wasn’t the outcome he was planning. I’m very happy for the buyer. And I’m happy for the seller too: he got out before it got any worse at a time when he didn’t have any more time to ride it out.

Everybody won. A good result all around.

Your “almost 25%” is my “almost 17%”…

@ Alexei

$1.75 mm is almost 17% less than $2.1 mm — and when you include 6% agents’ commissions, the seller is taking almost 23% hit, and closer to 25% with closing costs.

My bad. 17% is right. Eyeballed it wrong. What can I say.

But this guy bought in 2005. If he had bought in 2006/2007 he’d be out 25% easy. And lots of people bought in that time frame, or refinanced for 100% LTV in 2006/2007 even though they bought earlier than he did. You think they are going to hold on to their pay option loan when it resets for more than their income, when the property is 25% down?

Gregg, you’re saying it’s worth $750k? Jeez..give me a break. Please explain that one.

gregg

“$1.75 million? Sucker. Hope he’s rich, because if he’s not, then about in a year he’s going to miss the $1 million he just overpaid. Buying on the way down ain’t smart, and this downward spiral is still going strong.”

Have you even seen the property? If so, your bet is that the house sells for $750,000 within a year?

You can’t be serious…

“But this guy bought in 2005. If he had bought in 2006/2007 he’d be out 25% easy.”

tipster – would you say we are back to 2004 prices in real sf? and if so, would the editor consider putting up some apples-in-the-making of 2003/2004 vintage?

Am I the only one freaked out by all that brick on the lower level? You literally couldn’t pay me to live in that place.

nice purchase. I think this is a good long term hold

The brick is most likely a facing for exterior looks and not structural.

I live in this area, and like many of my neighbors plan to live here for a long long time. This guy bought the place because he loves it .. I’d say he bought for the long term and all the carping about his missing the extra money he paid for it will be of little interest to him as he enjoys a great place in a great neighborhood.

^^though the same could have been said about the guy that just sold to him.

condoshopper,

Good to see people keeping the faith like this buyer. We have to encourage that. The day the market will be an ocean of red with no buyers in sight will be the official bottom and you don’t want that to happen right away, do you? The market seems to be on a 15-20% annual correction mode right now. Do you want to see this last 1, 2 or 3 years?

Plus, anyone who catches a falling knife today will NOT be competing for the cheap deals down the road.