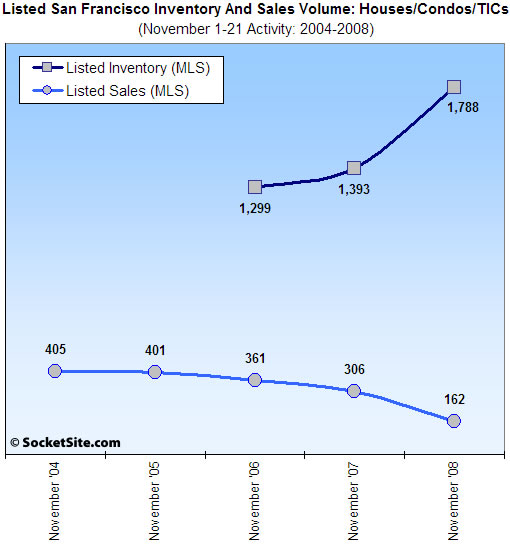

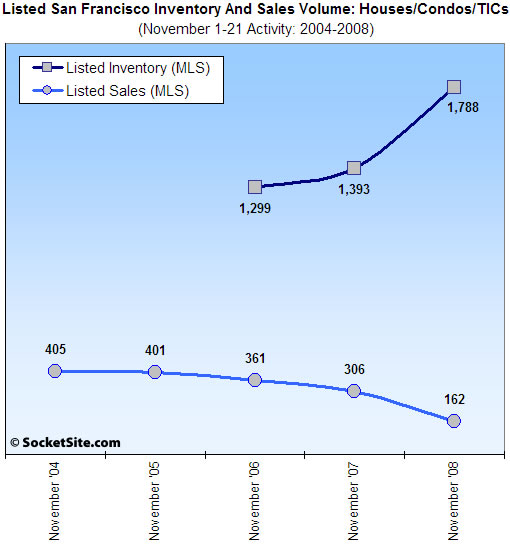

Last week we calculated a 38% single week decline in San Francisco listed sales volume with inventories up 28.4% year-over-year. And now according to a plugged-in reader, listed sales volume in San Francisco for the month of November is currently running 47% lower on a year-over-year basis based on early counts for the first three weeks of the month, while the median sales price has fallen 15% (now in line with 2004).

∙ SocketSite’s San Francisco Listed Housing Update: 11/17/08 [SocketSite]

I think the editor is a little premature. November isn’t over yet. There should be a lot of activity over the Thanksgiving holiday to boost sales back up to normal.

Oh wait…

great graphic. if this holds steady, we are at 11 months of inventory, if the trend continues, more than 1 yr of inventory very soon.

Editor, How many months of inventory do you see when you look at the Complete inventory index (CII)?

This doesn’t include the effect of all the units that are being pulled off the market and turned into rentals while the owner “waits out the market”. That may defer some of the downward pressure on prices but also lengthen the bottoming process. Hmmmm…but maybe declining rents will create cash flow issues that will force some of these back onto the market.

09 is bound to be an interesting year.

These two lines are pretty stunning — they would explain the Case Shiller graph below.

I’m curious how this downturn is affecting the different price levels. How about posting the same lines for quartiles? It looks like just about 50% of the units asking $1M or higher have seen price reductions (not a few featured on SS). My prediction is that the high end will now see steeper declines than the low end — the opposite of the last 2 years — because of the financing difficulties and the evaporation of down payments held in the stock markets. But I admit it is very difficult to find any hard numbers to tell one way or the other.

When these two lines converge we’ll be at the bottom!

Oh wait, what?

Spencer – There probably won’t be many sales during Thanksgiving week, but late reporting could still increase the numbers. Total sales could hit the low 200s, which might imply ~8 months inventory. To put that in context, here are the analogous numbers for Contra Costa County:

Nov 05: ~3 months inventory

Nov 06: ~4.5 months inventory

Nov 07: ~9 months inventory

Oct 08: ~5.5 months inventory

So this is what i’m curious about? How long before unsold inventory turns into rentals that put downward pressure on the rents? (What with layoffs and all added into the picture) And then what happens to the unfortunate owner who is not pulling enough profit from the unit to begin to cover the costs? More downward pressure on prices? Oh goodness!

In San Francisco, there are two types of sellers: ones who must sell, and ones who might sell but only at a “make me move” price.

Sellers who must sell–due to foreclosure, job loss, underwater options, divorce, developer over-extension, etc–will be forced to lower prices.

But the other group of sellers are wishful thinkers. They’d consider moving, but only if properly compensated for their inconvenience. A handful of homes have been on the market for a year or more, with no meaningful price declines. These aren’t motivated sellers.

Only a market with motivated sellers will experience meaningful price decline. There are buyers out there, but not at these prices.

The question for San Francisco is how many of the houses for sale represent true motivated sellers vs. wishful thinkers?

Actually, when the 2 lines do converge, it may signal the bottom. You heard it here first.

The trend is clearly going the opposite way however….

The bottom will be when our Current Account deficit goes to 0.

Having said all that – and I know I was laughed at for saying it before, but San Francisco will drop harder than most other places.

Why? Because home buying fundamentals have not changed since the 40s. They just got out of whack recently. What do I mean by that?

Well, people can’t – I repeat – can’t spend more than 33% of their gross on a home. You can’t feed your family otherwise.

So even if you make 200k, a level significantly above the median income range, even out here – your yearly mortgage payments you can *maybe* afford is $67k. That’s slightly above $1M on a loan (assuming 5.25% interest rate).

So a median house should be in the range of $1M-$1.2M, we’re not even close to that level. And a median home should be 3br, 2ba, 1500sq ft. SFH. It would take a drop of another 25-25% to get there. So we’ve dropped 30% already (15% conservatively, depending how you want to slice the neighborhoods)… How long until we drop 25-35% from where we are at now?

I concur with gmh. Total sales for the month should will probably hit about 225(+/-) – so that’s about 8 months of active listed inventory. Anecdotally, we know there are a lot of other homes waiting out the market plus new inventory coming on line (at least that which isn’t being converted to rentals). We’re coming into a seasonally slower period and all of the other factors should continue to depress sales volume. If there is ever going to be pressure put on sellers in our market (at least the non-discretionary seller), it should really be evident in the next few months.

Also, as gmh noted, months of supply numbers have actually dropped elsewhere around the state. But some of the drop resulted from the huge number of REO and short sales and massive price reductions. The median price of a single family home sale in Sacramento County this month is down to $183K (coincidentally right at the national average) – this is down by 50% from 2006. It works out to $110 per square foot for the median house (plus you get the land).

Meanwhile in District 5C (Noe), there have been 6 sales of SFH’s this month at an average price psf of $863 (based on the 4 transactions that reported square footage – 625 Duncan at $5.8M showed no sf and was excluded). In 2006, the Sacramento-Noe square footage exchange rate was 4:1. So now it’s 8:1. Back in the 1990’s, it was less than 3:1. But, who cares – all markets are local, right?

Where the two charts converge is where we have one month’s inventory (and prices rise hugely), not where the market bottoms out.

2006 = 3.6 months inventory

2007 = 4.6 months inventory

2008 = TBD

All this chart says is months of inventory is increasing. And that realtors in San Francisco are making about 50% less this year than last year.

How long will realtors be willing to take a 50% pay cut before they start pressuring their sellers to get realistic and lower price?

It’s called sarcasm. I’m taking 2 things that are completely unrelated and relating them. There’s some funny history on this site making weird proclamations like that.

The genesis of it is the Case-Shiller 3 tiers, and someone calling out that the bottom is signaled by the tiers meeting, as if that means anything other than the 3 tiers having inflated to the same levels over time. There was some long and misguided explanation about it all.

if the two graphs cross, doesn’t it mean that available inventory is the same as the number of sales in a month? how is that a signal of the bottom? sounds like a super hot mode.

Welcome to the deleveraging nightmare.

Call me when it’s over!

I’ll be at home tucked in my bed, with the shades drawn and my tub of chunkey monkey.

DataDude,

I think the hit to the Realtor’s pockets is more than 50%. You have to account for the decrease in sale prices and others.

Say a Realtor was making 10 sales at $1M in 2007. Today he’s making 5 sales at $850K. That’s 4.25M instead of 10M, or a 57.5% decrease.

And that’s assuming they are not lowering their commissions under the current pressure. 0.5% on a seller-side Realtor is 17-20% of his 2.5/3% cut.

But I am sure they saved a bundle during the fat years and can easily wait it out. Except of course for those who put their cash into the game by trying a flip…

@ San FronziScheme — you are probably right, that 50% pay cut for SF realtors is on the low end, and the actual pocketbook hit is probably greater. The magnitude of this salary shock is now understood with Novembers poor performance.

In the East Bay, where prices are down 50% but sales are up 50% (or at least were pre-October crash), assuming a constant number of realtors and no commission cuts, their salaries haven’t suffered as much.

It will be interesting to see whether realtors, feeling the pay pinch, will be able to pressure sellers in to lowering prices so that things start to sell. No sale = no commission. My sense is some sellers don’t need to sell, or think they can wait it out till the market recovers. How long will they wait: 10 years? 15 years?

The next few months will be interesting.

Classic stare-down, game theory style. Who will blink first, sellers or buyers?

Must…not…blink…

“It will be interesting to see whether realtors, feeling the pay pinch, will be able to pressure sellers in to lowering prices…”

I’d think that no pressure is required at all for serious sellers. The listing agent need only present the reality of the market and their advice. If a seller still holds on to an unrealistic price point then I’d say that they are not really serious about selling, more of a “make be move” type of owner.

A listing agent who holds a contract with a stubborn seller seems to be in an awkward situation. Perhaps a little heart-to-heart talk would help : “It doesn’t make financial sense for me to represent a property priced too high to sell so you should consider finding another agent.” Breaking up is hard to do.