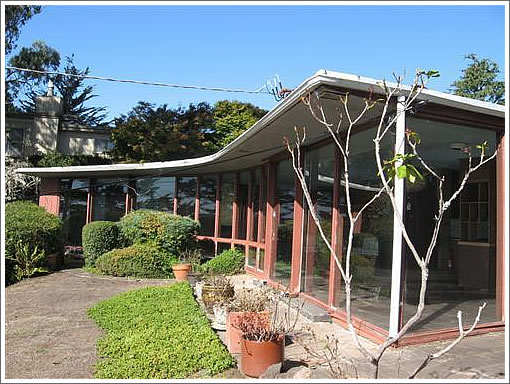

“Unique.” Check (and check out the fireplace). “In need of total fixing and updating.” Check. “Options…possibilities” and a fair price? Those three are up to you.

∙ Listing: 370 Lansdale (2/1.5) – $799,000 [realestatesf.com]

San Francisco real estate tips, trends and the local scoop: "Plug In" to SocketSite™

“Unique.” Check (and check out the fireplace). “In need of total fixing and updating.” Check. “Options…possibilities” and a fair price? Those three are up to you.

∙ Listing: 370 Lansdale (2/1.5) – $799,000 [realestatesf.com]

I like the bones believe it or not. Sure there will be some expense in a total over haul but hey.

Dwell Magazine cover story, September 2010.

“Going from Wrong to Wright. How this mid-century

modern was rescued with a little 21st century know-how.”

I walked by this street for the first time a few months ago. I love the 1950s feel of the neighborhood. Gardens are well maintained. Overall a very nice residential area. Now, about the weather…

Property Shark shows a refi in 2005 for $919,308 variable from “Financial Freedom Senior Fundi”. Maybe someone retired/went to a home and used the equity?

Not to offend anyone, but this (exact!) house could probably be purchased right now for 20% less in the east bay foothills, and your commute to downtown would be faster. Weather problem solved 😉

I love it!

Nice – but its going to be torn down. It will be upbidded yes even in this market. Rule of real estate – location location location. Build something better on that lot keeping in mind the lines of the exsisting structure.

Amazan8, it sounds like you haven’t town anything down in SF. How exactly would this fail a soundness test? How would you automatic discretionary review go?

I really like this place from the pictures – very unique indeed. And this is a great area, although a long walk to the West Portal Muni station.

Hey dub dub: where in the east bay could you find something like this? Don’t think I’ve every seen this style of home out there, but I don’t know the east bay that well.

Did anyone see 101 Lansdale? Any thoughts? Does the weather really suck up there?

Yo “sparky-the-bear” – You may want to take some remedial grammer classes or just write spend some time proof reading. What are you trying to say??? Please be clear

I cant figure out what the hell sparkbear is trying to say?

seriously, if you write here, at least slow down, take your time to actually read what you typed. this isnt some version of a 13 year old girls myspace page.

I live a block away and it’s a really nice neighborhood with some of the best views in the city. This time of year you get a clear view of the sunrise over the East Bay Hills and an even clearer view of the sun setting over the Pacific. Best time of the year to list the house since it is horribly foggy about 75% of the time up on Mt. Davidson.

I’m not sure about the price since there is so much work to do, but the properties at 101 Lansdale and 296 Cresta Vista are both listed at over $2mil. All about potential, I guess.

@Dude — montclair, oakmore, and around there. If you like mid-century modern, it’s worth a look. Streeview has most of this covered now (but poor quality), so you can check it out.

When I first saw this house, I thought it was one of the occasional and tantalizing SS east bay foothill listings 🙂

Thankyou Westwood for your candid response.

101 Lansdale is listed just a dollar short of $3mil and I love the house but am hesitant about the fog. Being asthmatic, I do better in sunnier spots which I guess your neighborhood will not quite work for me!

Thanks, I’ll have to do some exploring next time I’m out that way.

torn and not town, and your instead of you.

Sorry, my post should say;

“it sounds like you haven’t torn anything down in SF. How would your DR review go?”

Amazan8, you cap on me by saying “…or just write spend some time proofreading”. Is my grammar any worse than yours?

I will be as clear as possible in the future and point out everyone else’s grammar as well. Weeee

sparky-the-bear – you must be having a bad hair day? haha. Have a good weekend all

I am curious why you think the commute from say, Montclair Village would be faster, dub dub.

Google maps says that via transit 1980 Mountain Blvd., Oakland, ca -> 101 California is 55 minutes, while is is 370 Lansdale Ave is 43 Minutes. Via car is is 23 minutes from Montclair (or 30 minutes in traffic) vs. 20 from 1980 Mountain (or 30 minutes in traffic).

I drive from pretty much this exact location to Union Square every day, just heading straight down Portola/Market and, depending on traffic, it’s 15-30 minutes at the worst.

If you walk down to West Portal and take MUNI, it’s only about 25 minutes (unless you get stuck in a tunnel).

Not trying to minimize the cost savings by moving to the East Bay, just informing on accurate commute times.

I should have said the commute downtown takes “about the same time, depending on where/when you are leaving from and where you are going to, and how you choose to get there, assuming there are no issues with tunnels, bridges, traffic, weather, or muni”. Apologies!

Also, you wouldn’t get this “exact” house; it would be a different one — I’m surprised I wasn’t called out on that whopper 🙂

Forget the commute times and think of the carbon foot prints you would be making if you lived in the Eastbay and commuted into the City . Bottom line the place is a fixer no matter how you look at it and it’s going to be a long permit process with the City to get anything worthwhile passed.

This place sold for $713,700.

Wow. That’s a lot of money for that place. We were up there trying to figure out how to soften the lower portion of the view. It hideously looks due south at the City College parking lots. Two thirds of those windows are facing brown sludgy nastiness in the lower portion of one’s views. (The views from the windows to the left of the picture face the Bay.) If this property were angled 15% west it would have went for a lot more money.

I believe a couple of days ago someone was doubtful of my estimate that this area is 15% or so off.

You might want to divide 713 by 919 and see what you get my dear anonn.

if this was to the upside you would say total fixers don’t count though wouldn’t you diemos?

Good, bad or indifferent doesn’t make any difference as long as it’s the same house some bank thought was worth 919 back in 2005.

And if it had sold for more I’m sure I would be wailing about the madness (the madness!!!) of SF real estate buyers but I wouldn’t deny it as a data point.

I bring up Noe fixers that change hands higher and they are denied as data point, but not by you apparantly. The truth is the $714K is madness! All those windows have to go, all new foundation, new kitchen, new everything.

edumacate me sparky-C. Which houses? But the previous sale/re-fi has to be in the 2005-08 period.

It doesn’t tell me anything about the current direction of the market if something sells for more than what was paid back in 95, or even 04. 😉

“I believe a couple of days ago someone was doubtful of my estimate that this area is 15% or so off.

You might want to divide 713 by 919 and see what you get my dear anonn.”

LOL. You’ve neither visited the property, nor do you have any grasp whatsoever of the fixer market. I have. But I think I know what you’re trying to say. You’re slapping some metric on one house that’s all potential? You’re clueless here. The point you’re trying to make is precisely the problem. The fixer has NOT dropped as much as the finished product. My point regarding the view is the most salient point here. This is a view neighborhood, pure and simple.

Too many of you guys stretch yourselves. Whether you agree with what I have to say or not I don’t do that. You sir, are not in your arena.

diemos, I’m not sitting on a compiled list of them, I’ll bring it up again next time I see one.

Where do you get this 919 figure from, anyway? And why should I be doing any dividing using 919? They started at 799, homesource.

I wrote 15% but meant 15 degrees, clearly. As in, orientation? As in, 15 degrees westward would produce Pacific views instead of City College parking lot and reservoir views?

Nice stand, diemos. Great one. One of your best. Keep ’em coming.

(For the record, we fleshed this one out. We sort of liked it for ~600K or so. But that view. View neighborhood, crap view = pass. Then again we’re “arrogant flippers” TM.)

So? Seriously, diemos. So what? Why is that your stance? That’s not the market. Do you think someone did a 100% 919K cash out or something? Do you know how cash outs work? Do you know where this property is located? If so, is it any wonder that a high valuation was granted during the lax former era? Do you suppose that a ~700K sale was not a huge gain?

What? Seriously, what is your point?

“So? Seriously, diemos. So what? Why is that your stance? That’s not the market.”

Some bank thought the place was worth at least 919K in 2005.

“Do you think someone did a 100% 919K cash out or something?”

Yeah.

“Do you know how cash outs work?”

Um, you sign up for a new loan for more than your old loan, pay off the old loan and keep the difference? It really doesn’t strike me as rocket science.

“Do you know where this property is located?”

San Francisco? 370 Lansdale?

“If so, is it any wonder that a high valuation was granted during the lax former era?”

Not at all. Just like every other property in SF.

“Do you suppose that a ~700K sale was not a huge gain?”

I’m certain the 919K refi in 2005 was an enormous gain for the property owner. And the ~700K sale in 2009 was a 200K loss which, thankfully, they were willing and able to absorb instead of walking away and dumping it on the bank/taxpayer.

That’s the point.

“I’m certain the 919K refi in 2005 was an enormous gain for the property owner. And the ~700K sale in 2009 was a 200K loss which …”

But it wasn’t tho. Even in those days, checks and balances were in place. There was no such thing as a 100 percent cashout.

You, and others like you, need to get it straight. Too many of you guys spout off on here without repercussions. You are ruining this website.

Am I the only one who remembers 2005?

When unlocking your equity was all the rage?

When mortgage brokers roamed the earth?

When wall street would buy anything?

When Standard and Poors would give a AAA rating to anything?

When appraisers would either “hit the numbers” or be blacklisted?

919K refi. What part of that don’t you understand? The bank handed the owners 919K in exchange for a lien against the property. Whether they reported that to the securitizers as 100% cashout or whether they “appraised” the property at 1.838M and reported it as a 50% cashout I have no idea. But in the end they handed the owners 919K as shown in the public records.

anonn is right here. It was not possible to get a 100% cash out refi back then from what I coul tell. A family member of mine (at my insistence) got a cash out refi for the max possible – 80% in late 2005 or early 2006. Of course, the way around this was just to get a “friendly” appraiser – not too difficult since all the banks were competing, so in effect he cashed out about 95% of the FMV. Best move that family member ever made, as the house is now well underwater to the loan, and he can now pick and choose among the government cheese handouts that are coming down the pike courtesy of the foolish taxpayer.

I’m not sure you’re arguing against diemos’ point, though, anonn. If $919K was not 100% of the appraised value, that means that the appraiser thought it was worth even MORE than $919K back then. Appraisers of course are basically functionaries, and can only go off comps (perhaps massage them a bit). That implies that the value of this house is down substantially MORE than the 22% decline implied by the $919K valuation. Say, the $919K cash out represented 80% of the appraised value (the situation faced by my family member). That would imply that the appraisal came in at $1.148M! If it was at 90%, then the appraised value was $1.021M. LOL, whatever it was, this turkey is down at least 30% from what some “expert” appraiser thought it was worth.

Dude, you’re lying. You have never done it.

You see 919 and you assume.

I’m not going to ask you to trust me. It would be silly to do so. But in 2004 I actually was in a position where I had spent 500K turning a decrepit Noe Valley house plus lower rooms into a spectacular two unit. When it came time to re-fi, and cash out, I knew that my limits were 75 percent loan to value. At best.

You really need to not talk about this stuff, man. You, and others like you, are killing this site.

Challenge away. I’m down for it. It’s informative for both me and you. But Redfin reportage/valuations as monies paid? Step off son. You are a rookie. Period.

anonn, exactly who are you schooling here. read the posts. NOBODY ever said that anyone took 100% equity out of this place or that one could do so — except YOU: “Do you think someone did a 100% 919K cash out or something?” So you’re not a “rookie.” Fine.

Examine what was said, “anon.”

Done?

Yer boy thinks that 919k = some sort of market indiator. It begs the question, doy YOU know how it works?

Have fun storming the castle, as always.

What exactly is your point, anonn? I took this data point as another indication that the market is moving significantly downward from the high water mark. The fact that someone did a less-than-100% refinance at 919k means that the loss was probably even bigger than it looks at first blush. Do you have some other interpretation?

If Sparky is correct and all this work has to be done, then we’ll assume the buyer estimates this property to be well over 1M. As I said earlier, a pretty nice neighborhood. I hope there will be more of these gems and at an even lower price in the future. Many people still think 15-20% is the peak-to-trough range.

Apparently not the opinion of some experts:

http://finance.yahoo.com/tech-ticker/article/190712/Shiller-House-Prices-Still-Way-Too-High?tickers=^gspc,^dji,hd,kbh,tol,ctx,xhb