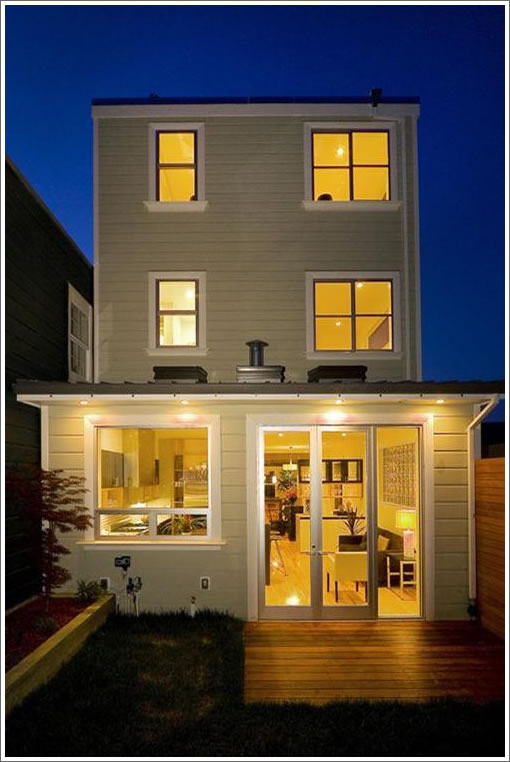

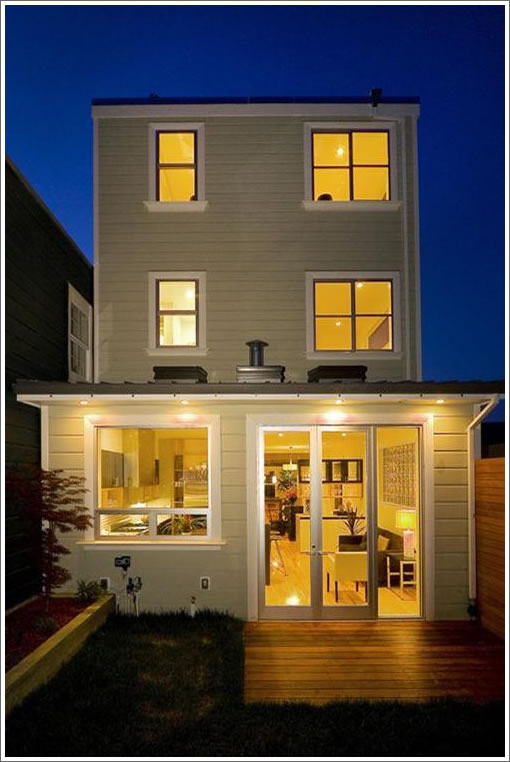

As previously noted, 4419 19th Street returned to the market last week with the same list price of three months before. And after just five days back, said price has now been reduced $187,000 (7.4%). We remain drawn to the decks (and kitchen).

Over at Heritage on Fillmore (1310 Fillmore), while the listing for 1310 Fillmore #PH1E still notes, “Last opportunity! Only one left at the low price of $690,000,” on Thursday the price was reduced another $40,000 (5.8%). And the next day #1104 hit the MLS with a price $650,000 as well (so make that at least two).

In terms of two-bedrooms (of which at least four remain available), the list price on 1310 Fillmore #PH2A has been reduced another $130,000 (11.6%), now asking $995,000 or $230,000 (18.8%) below its original list price of $1,225,000 last year.

∙ Listing: 4419 19th Street (3/3.5) – $2,348,000 [MLS]

∙ Drawn To The Decks (But Perhaps Not The Best For Entertaining) [SocketSite]

∙ Listing: 1310 Fillmore #PH1E (1/1) – $650,000 [MLS]

∙ Listing: 1310 Fillmore #PH2A (2/2) – $995,000 [MLS]

∙ Heritage On Fillmore Update: 90% Sold, Reductions And Incentives [SocketSite]

4419 19th Street is a gorgeous house. I would have considered buying it, but I’m very happy with my condo.

Very nice location, home and even the price…

I am really surprised that the 19th street property was lowered as much as it was. At this point, at ~$2.35M you aren’t going to find much around there that’s nicer or larger. How big did we think it was in the previous thread, around 2700 feet or so? That would put it at 875 $psqft or so, pretty much right at the 5-K average I posted for the past six months. Naah, nothing behind these numbers.

IIRC, we never got a straight answer on square footage, despite having the ear of the architect who performed the work.

The best we got was a “you’re close” to someone who estimated it at “a little over” 2000 sf. That would be approx. $1100/sf.

fluj,

“That would put it at 875 $psqft or so, pretty much right at the 5-K AVERAGE [emphasis added] I posted for the past six months. Naah, nothing behind these numbers.”

Let’s leave aside the venom from our previous “slugfest” – and no, I’m not trying to start another.

But think about what you are saying. “AVERAGE”. This looks like an absolutely beautiful place. Completely redone with really high end stuff. Shouldn’t this sell for much MORE than average? I mean, were just about ALL the sales that flow into that $875 psf number completely redone “stunners”? Because that is what you have to have for this one to trade at the “average”. Don’t you agree?

The alternative explanation, assuming that the $875 psf is accurate, is that the market has weakened, and that now a showpiece property trades at what the average of yesterday did.

Showpiece, yes. But very vertical, separate bedroom levels, little yard etc. not ideal in those regards.

Prices have for the most part come down. I don’t think you’ll get much argument from anyone, fluj included. Plus fluj has it at 2700. You said a little over 2000. Big swing there. Still well over $1000 if it’s low 2000’s

Zillow lists this as 2600 square feet. The home has been “claimed” by owner, and in fact listing information will have been submitted to Zillow by the agent or owner. That’s probably pretty close. Funny that the square footage is submitted there, but not on the MLS listing. Does anyone have any insight as to why this might be?

Yeah, this house is not AVERAGE. It gets much higher marks than that.

But if you want my opinion, dropping pricing down to near the neighborhood average in $psqft is very effective. One example I can point to is the Ashbury street property recently featured on this site. They got into contract about two weeks after they dropped the pricepoint down to around the average $psqft.

So the rationale is probably to create a buzz again. It is buzz worthy. This is way to nice of a home to be sitting on the market unsold.

I’ve been inside the home a couple of times. It’s a really nice house and I am surprised it hasn’t sold yet. Yes, its pretty vertical, but its the best they could do with the given lot size constraints. At this price point, I hope it moves soon for them.

Great house. Plain facade, which I like. The Noe house hunters don’t realize that there’s another side to the hill.

I think the reason the 19th street place is not selling, and won’t sell, at these prices is they are targeting the superficial buyer who no longer exists. They tout “Sub Zero and 6 burner dual oven Viking stove. Home also comes w/radiant htd flrs, surround sound, video intercom, central vac system, built-ins and a perfect back yard for the bbq.”

The Subzero refrigerator and Viking stove are only a few thousand dollars. They are pretty but add no significant value at all. In fact, subzero refrigerators are crap. They are pretty until they inevitably break down and leak within a couple years.

Surround sound. Also essentially worthless as this can be added to any place for an insignificant sum. Same with “video intercom” which is also absolutely unnecessary unless you have about 10,000 square feet.

“central vac.” Certain to break within a few years and ridiculously expensive to fix. And really no more convenient than switching the plug for the vacuum in each room.

“a perfect back yard for the bbq.” Yes, but ONLY for the bbq as nothing else will fit there.

If this place had worthwhile, valuable features, one would think the seller would tout them. By highlighting superficial crap, it tells me the place was done on the cheap with the emphasis only on initial eye-candy appeal, and should not see anything close to this asking price.

The talk here about homes being well-priced is beginning to sound anachronistic. Home prices are in decline – there is no doubt about it. Looking at current per sq ft averages is difficult: do we look at values a year ago? six months ago? three months ago? expected values in the next twelve months?

Comps become difficult in a declining market – especially one with as little visibility as we have now. There are a number of non-market cycle (exogenous) issues at play: the break down in confidence in our capital markets, the inability of banks to package and sell off jumbo loans, tightening of lending standards.

I think sellers should start thinking about carrying paper. Perhaps up to 30% of the value – with a five year term. That should give the market enough time to stabilize and should help buyers who are having difficult time with getting jumbos. Banks simply don’t want to take risk. Many banks are now net buyers of balance sheet instead of net sellers.

I suspect the market needs to rethink liquidity and credit. Sellers and buyers need to think of nontraditional means to get deals done. Otherwise, I suspect many homes will remain on the market for a very long time.

“If this place had worthwhile, valuable features, one would think the seller would tout them. By highlighting superficial crap, it tells me the place was done on the cheap with the emphasis only on initial eye-candy appeal, and should not see anything close to this asking price.”

Have you even seen this house or are you another armchair observer who seems to know everything?

“If this place had worthwhile, valuable features, one would think the seller would tout them. By highlighting superficial crap, it tells me the place was done on the cheap with the emphasis only on initial eye-candy appeal, and should not see anything close to this asking price.”

Clearly you haven’t seen the property in person. But I disagree. The seller does tout them. “Each bedroom has its own full bath,” “Walk out decks on the upper 2 levels giving the owner incredible views of the Bay area” and “open mn flr lvl.”

I did see it last time around. The views and decks are extremely pretty. While it does have an open layout that many will find nice, it felt like a vacation rental to me. And even the cheerleaders must admit the ceilings are too low which makes it nevertheless feel more cramped than a $2.2 million house should ever feel. Maybe someone will pay it, but there are far superior places on the market right now at this price level.

Come to think of it, this house would be a great vacation rental no doubt about it. The location is perfect for vacation rental. I wonder what a larger Eureka Valley SFR vacation rental price would be.

In fact this came up recently. Anyone know where to gauge that market? VRBO?

This is another great home. Great layout (OK, maybe the dining room isn’t separate enough, but the finishes look top notch and look at photo 14 in the listing: just the perfect family layout. You couldn’t ask for a better one. Decks and views a smashing. Kitchen is top of the line, even if we all know that some top of the line appliances have more going for them on appearance than utility. This is just the perfect home for a young family. Architect, builder, realtor, all did great jobs.

The only issue is the market. It just isn’t there at this price point. It was, but those days seem to be slipping away. The 28 year olds who could put a nickel down and get the home of their dreams as their starter home just isn’t happening.

The cash market has slowed as well. There aren’t tons of people who bought with cash, but there were enough. Most valley stocks have been stagnant at best for years. Goog hasn’t gone anywhere – it’s been stuck around 500. A new hire with a couple of thousand shares (or equivalent stock units – Google just pays you as if you had stock) just isn’t going to go buy this place with tens of thousands of dollars from options on a 90K starting salary. DNA, supposedly a sure thing headed to 126 where everybody vests, is mired under $100 and doesn’t look like anyone is going to vest. Aapl is doing about as well as anyone can and it’s under last year’s 3rd quarter.

The free flowing money is gone, at least for now. The stock option money might come back, but that just brings us to 2000 prices. The bank money is gone for good. Great places like this are getting to be more and more common, and so they are sitting. There isn’t a single person in the prior thread on this house thinking this place is overpriced. But that was three months ago.

regarding the fillmore place, it is still priced at $750/sq ft for the Western addition. I think at $600/sq ft or $810K, they might get a buyer

Well first off I don’t see how you can gauge how much money people you have never met possess, or how many such people exist. We have all been suprised so far. Who are you to say that the well is dry?

Then you say:

“Great places like this are getting to be more and more common,”

If you look at all the area 5 SFRs between 2 and 3M, there are only 14. Of those, how many are actually great? I happen to really like 1901 Diamond of that bunch, this one, and the Caselli house. That’s about it.

I spent most of the weekends this spring looking at district 5 and district 9 property in the 1.5 to 2M range. Places I liked continued to set records and I suspended my search. From threads the past several days, it seems that upward march in prices may be slowing, but are Noe prices actually down for a $1.8M SFH? Have things really changed in the last 2 months?

regarding the fillmore, saw it in person awhile ago, the material used is more an appartment standard than a $1. smth million penthouse, or now $995K…………..

Or just me being picky…..

Tipster, I love reading your comments, but a counter-argument. I’ve been shopping around this price point in 5-K. I wasn’t impressed by 4419. The photos looked great, but it fell short in person. Off the top of my head:

– You had to walk through a bedroom to get to the main front deck, ostensibly an entertaining space. That was weird. I kept imagining how I’d get cocktails from the kitchen up there without spilling them.

– The media room felt completely isolated from the rest of the house.

– Too little closet space across all the bedrooms. Is it unreasonable to assume potential buyers might have a lot of clothes? And then there are shoes…

– Only one bathroom large enough for a tub, IIRC

Granted, I could be freakishly different from the rest of the potential buyer pool.

For the ask, you could have bought 3911 19th and spent 250K on cosmetic upgrades. Just my two cents…

“Have things really changed in the last 2 months?”

Yes. Meltdown of Fannie Freddie. JPMorgan/Chase announced they are out of the jumbo market. Nonconforming mortgages are becoming very difficult to get. Average rate for 30-year fixed jumbo is around 8% (see bankrate.com) assuming you can get one. Greenspan, Paulson and others have announced the housing market downturn is far from over. Consumer sentiment is lousy. Stock prices for peninsula industries are flat overall.

No cash – no buy.

The 1 – 1.5M Noe SFH market has not gone down at all, if anything it has probably gone up a little bit. I don’t know about other price points.

Here are some places that just went into contract:

858 clayton, $2.3M

719 ashbury, $2.4M

656 Douglass, $2.3M

4121 Cesar condo, $2.15M

943 A Church condo, $2.2M

All cash on the “No cash-no buy” state of the market, doubt it. Either way these peop’s could have pulled the trigger on caselli or 19th.

@sparky:

Do you think those places will actually sell anywhere near the asking prices you’ve listed? For example, looks to me like 656 Douglass (which is actually 656-660 Douglass) shows a DOM of 172 days.

Sparky,

People will continue to buy at all price points in any market. Clearly the market is not dead, nor is it falling off a cliff. But I am noticing that pricing in prime areas is starting to trend down. We get surprised more and more frequently by a top notch property in a good location that isn’t selling at what once was a reasonable price point.

That used to happen only on “busy streets”. Now it’s happening everywhere, and it’s not hard to see why. Will people still buy with cash, credit or whatever? Yup. But pricing appears to be heading down. Maybe not yet in super premium A+ areas, but in very, very A- good ones. 3 months ago, it was only trending down in District 10 and on “Busy Streets”.

I’m seeing stuff just sit in Pac Heights that would have flown off the market 6 month ago. Pricing isn’t down there, but stuff isn’t flying like it used to. I’m sure pricing will sit steady for a while, but when the A- stuff is dropping like we’ve seen it, the A+ won’t be able to hold its ground.

Good news for buyers, especially those who can wait.

What you describe there, Tipster, is all of 2008 so far. A+ selling rapidly, A- sitting a while and then selling after w few months. We’ve all been saying that for a while, bears and bulls alike.

The cesar and church condos will sell very near those prices. And those are over $1000 per foot. Church street isn’t A+. Besides all I did was spend 1 minute on the new contracts in good D5. My point was that there are people with money saved, good jobs, and ready to buy who are not all cash, as was described.

I think prices across the board have, are and will come down. But let’s not pretend everyone thought 19th was A+ before and are backtracking. Nobodies picking it up with a bag of gold, especially after the beating gold took today.

Even Olivia Hsu Decker has admitted that the luxury market has slowed….

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/08/09/REIA126K4A.DTL

No cash – no buy: Even those getting jumbos are paying very high rates and often can only get the loan if they already have liquid assets to pay for the home.

See: http://globaleconomicanalysis.blogspot.com/2008/08/chase-suspends-non-conforming-mortgages.html

or:

http://www.bloomberg.com/apps/news?pid=20601087&sid=alebCtUJbRXc&refer=home

or http://www.bankrate.com – go to rates available in San Francisco

I’m not making this stuff up. The lending environment is very grim.

That’s not what I said, fluj, the A+ stuff is starting to sit, not all of it, but stuff I’ve NEVER seen sit is now sitting in Pac Heights, even stuff I think is priced right. The A- is dropping, the A+ is sitting.

6 months ago, the only thing dropping was the Cs and Ds.

Remember when LA DQ numbers dropped like a rock – 20 to 30% down. It wouldn’t surprise me to see that here.

Call me a perma bear, it’s true, but I know when stuff is priced right it sells, and I’m the first to admit it -I’m the first post in this thread:

https://socketsite.com/archives/2008/03/through_and_through_and_throughout_on_a_sunny_saturday.html

That thing sold in days. But stuff is now sitting that is priced right. Not dropping, mind you, but sitting. NOT selling quickly. Sitting. At least in Pac Heights.

^ The district 7 market is kind of schizophrenic right now. You have a lot of properties flying instantly into contract, while a couple of properties are indeed sitting that would’ve sold rapidly last year. 3525 Clay is pending in a week. 1889 Green is in contract in a week. Ditto for 2512 Octavia and 3962 Clay. 2881 Vallejo looks like it’ll close 8% higher than it sold for last year. I’m really surprised though that the Victorians on Washington and Sacramento are sitting.

As for condos, about 40% of listed inventory in district 7 is in contract, but there have been a ton of reductions, which is good news. You can now buy a 1 bedroom on a very prime Pac Heights block for probably what you’d rent it for…

Why is a lending environment that requires large downpayments, verified income and charges an interest rate that is commensurate with the banks’ expectation of long-term inflation/interest-rates/whatever over the next 30 years considered “grim”?

That all sounds “normal” and “reasonable” to my young and un-informed self.

Who, exactly, is this “grim” for? Definitely not high-income earners waiting for the end of irrational markets around the country.

Jimmy: It’s hard to save enough to have assets equal to 100% of the value of a home – even for high wage earners. Our housing market has for years been driven by credit. I contend that the $1m+ market is increasingly becoming a very high net worth market – with deals being all cash or with large down payments combined with substantial investment portfolios on the side (required to get decent jumbos).

That does not bode well for property values.

marketwatcher,

that’s just not true. High income, yes. Good credit, yes. 100% assets, nope. 25% assets, yep.

Tipster,

You are mistaken. Six months ago was not 2006. I had an A/A- listing six months ago. I witnessed that one, and I saw others like it, languish a little longer than they should have. What you are observing in Pacific Heights might have a lot to do with exorbitant list price. Just a guess. The example you give is for a $2M condo on Alta Plaza. That’s very goood. But A+? For Pacific Heights Alta Plaza is clearly not A+. The Scott street condo has got to be well north of 1000 a foot, no? Is it even top floor?

Marketwatcher,

I have a buyer client in escrow on a property right now. The purchase price is slightly north of $1M. He’s putting 30 percent down. He has excellent credit, makes very high six figures, is not over-extended in any way although he does own other property, and the lenders want to see 25 % assets, varying by lender. If he wasn’t an out of state investment buyer there are lenders who would be content with 20%. I do not know where you get your information but it’s wrong, and you are not being helpful. A lot of people come on here to suss out the state of the market.

Maybe it’s just the places or areas I’m looking at, but it seems like anything above $1M just sits or gets withdrawn.

Thanks for the real estate porn, really made my day. Great house, and great location.

Fluj,

Sleepiguy and I are both watching the same properties sit. Those properties are not priced inappropriately, and at least the asking prices are not too far out of line with 2006 prices. They are all in the $3-4M range, so maybe it’s just that range, but six months ago, those properties would have been G-O-N-E.

Foolio,

anything above $1M sits? That’s just not true.

@sparky: In terms of the places/nabes I’m seeing, it is. YMMV.

Pick a neighborhood.

Tipster,

Working as I do usually in the nicer southern neighborhoods I don’t deal with 3 to 4M too often. The example you gave for 2311 Scott st #1 was not that, tho.

And now that I look at it, it sold? For 2.17M in April? For almost 1100 a foot? And it spent only two weeks on the market. Was that a mistake?

Anyone else see today’s Chronicle? There’s an article specifically about the effect that tipster has alluded to:

http://www.sfgate.com/cgi-bin/article.cgi?f=/c/a/2008/08/12/BULK1293VV.DTL

The neighborhoods which seemed immune a few months ago are starting to show weakness.

The specific example Tipster gave as a languishing property did anything but languish. It actually sold for over asking in a relatively short time.

@ Dude,

By the way, that article talks about the region being down due to overbuilding and not SF County. (It quotes a Zillow guy so take that with a grain of salt.) When you look at the chart, it shows much of the city to be up in value. In essence, Dude, the article you site is saying the exact opposite of what you’re saying. The neighborhoods Tipster talked about are in yellow. Yellow is up in value. Look at it.

^ No…

What tipster was saying is that a few months ago, the Alta Plaza apt sold immediately, but, this summer, a couple of well priced Victorians located on Washington St. (2506) and Sacramento St.(2922) aren’t selling. There are rarely decent Victorians available (in such great locations!) and last year we saw similar properties sell in a week or so OVER 4 million. I haven’t seen the properties so I don’t know if there are a lot of negatives associated with either. The 3+ million buyer pool may have shrunk somewhat, but my guess is that the craptastic economy has people sitting on the sidelines.

@sparky:

You’re still not getting it. In your rush to try to “prove me wrong” or sling some stats on the health of the market (ex. D10), you’ve misread my post.

The places that Mrs. Foolio and I are looking at these days (not “trophy” properties and perhaps not even “semi-trophy” properties–we’re value shoppers), are not selling. They’re sitting for months and then usually getting withdrawn.

This isn’t about a particular neighborhood. It is about the fact that it seems to me from our anecdotal open housing that there are a number of $1M+ places that just seem to sit around now.

Up front, I acknowledged that this may be a symptom of the types of places that interest us. In case it isn’t clear, I also acknowledged that this may not necessarily be anyone else’s experience (i.e., YMMV). That said, $1M+ stuff that (to my untrained eye) seemed to fly off the shelves in the past now sits…

You’re right. Sorry about that Tipster. If you look up I was confused as to why that one was an example. I somehow glossed over your last sentence. And again, 3 to 4M is not what I’m looking at too frequently. I did notice a Green st. house got right into contract today at $2.8M or so.

Now as to that SFGate article being bandied about as a sign of declining central SF values ….

Foolio,

Can you tell us where you’re looking? and the precise range? amenities?

This is the sort of SS information that I find most useful. Thanks in advance.

@fluj:

From the map, which is a little tough to read, it appears that a number of SF areas, including Sunset, Inner Richmond, and Noe Valley are down (light green).

I wasn’t in a rush to prove you wrong, nor did I say “prove you wrong” so I don’t know why you have it in quotes. But anything over $1M just sits is not true that’s all I was saying. There are places selling, and lots of those are over $1M so everything isn’t sitting or getting withdrawn.

You did say maybe it’s just what your looking at, and this time around you are talking about the value shopping near $1M that you are doing. I think that is very different than nothing is selling at $1M and up.

Also, I admittedly have no idea what YMMV means. So appologies there.

I could get into that if I wanted. The Inner Richmond? Do tell. Noe? hmmm. That’s running counter to what we see on here daily. The Sunset? OK, perhaps. Which part tho? Not Inner Parkside. Not Parkside. Not the Inner Sunset either.

I don’t need to tho. Dude specifically attempted to corroborate neighborhoods Tipster mentioned. North of California hoods. They’re plainly yellow.

@sparky: YMMV = your mileage may vary. Google is your friend…I never claimed to speak for the whole BA, just my experiences…

Oh, and since this has come up before–maybe it is an agent thing–quotation marks can signify something other than strict attribution, like in the sentence, “Real estate agents are “experts” on pricing and valuation in the Bay Area.”

@fluj: Re what we see, it’s mostly ad hoc, just walking into whatever open houses cross our paths in whatever area we happen to be in on that day. In general, we tend to stick to the same nabes, though, if that’s helpful…Sunset, Richmond (inner for both), HV, Potrero, SOMA…

Are you talking condos? houses? at least 2 br? 1.5 bas?

1M to 1.5, languishing? In the Inner Sunset, Inner Richmond, Noe, Potrero and SOMA? mate — that isn’t what I’m seeing. And it isn’t in keeping with the Inner Richmond figures I sent your way like two months ago either?

I dunno, eight homes sold for over $1M in Noe Valley in the last 30 days and there are another eleven in escrow.

4148 23rd St has been sitting on the market for a while though.

From the map, which is a little tough to read, it appears that a number of SF areas, including Sunset, Inner Richmond, and Noe Valley are down (light green).

Zip Codes 94131 and 94114 are yellow on that map. Sunset and Richmond – 94116, 94122 and 94118 are green, though Outer Richmond/Seacliff is yellow (94121). Noe Valley is basically right at the “C” in San Francisco on that map.

@fluj: Again. I’m not claiming that everyone is seeing this or that my experience is somehow illustrative or representative of the broader market. But yes, I’m seeing stuff–houses, condos, you name it–languish on the market in those nabes. (Go back and re-read my comment, you mistakenly included Noe.)

I do recall the data you sent a few months back, but–no offense–it’s not exactly very credible to me after the diary a few days back. Too dirty and too many holes. Plus, I’m not quibbling with your data, FWIW. I’m just offering my experiences. I suspect plenty of value-oriented folks who are looking at the same places I am are seeing the same thing.

@NVJ: My bad, looks like I misread the map. Zip code 94114 does appear to be in yellow.

NVJ,

I would say that a good part of 94116 is yellow as well. Inner parkside, inner richmond.

@sparky: That seems unlikely, as the map appears to hew to zip code boundaries.

Boy, we all sure care an awful lot about a map that “doesn’t matter,” don’t we? 😉

So you are retroactively deciding my YoY sales data is not valid. OK.

I thought HV was a typo for NV. What is HV?

Why the quotes? That’s odd to me too. You are the only individual to say “doesn’t matter” in the thread. IMO this map does matter. It is very interesting how little comment it has generated. It’s easy to see why, but I find it rather telling.

Foolio, then what is the area unde the A-N. That looks like a line at 19th, so the stuff right of 19th is yellow (inner parkside, inner richmond)

But your right, it is a map of median so I am fully behind you on the “doesn’t matter”.

I just like it because it’s contrary to cw. These guys ignore it ‘cuz it’s contrary to cw. Yes, median indeed sucks. To quote the classic movie “Meatballs” : “It just doesn’t matter!” So yes. Median sucks. Zillow sucks. Zillow’s PR department tho? Certainly that is a force to be reckoned with!

The latest listing for 4419 19th Street has been withdrawn from the MLS, but not before raising the list price to $2,250,000.

4148 23rd Street now shows as asking 1.579M. It had been sitting at 1.8M for a while.

That’s less than 600/sf. No garage though which could explain the low-ish $/sf.

Too bad 4148 23rd Street wasn’t in a hot neighborhood like Miraloma Park. Then they’d be looking at $600+ psf, easy 🙂

4148 23rd just lowered a tad to $1.537..I just love the false precision