An anecdotal quote that runs somewhat antithetical to the “foreclosures aren’t comps” argument:

“Our experience is the bank has a number (the asking price); they will hold that for a while,” [Re/Max Realtor-broker Joe Metz] said. “If they don’t get that number for three or four weeks, they will lower the price a little more. Banks are very smart about how they do this. They move them very quickly and for about as much as anybody could get.“

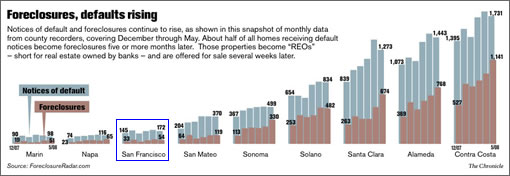

Granted, it’s from an East Bay broker where foreclosure activity continues to be significantly more meaningful than in San Francisco, but the trend is up across the board.

Also up, the ratio of properties that receive a notice of default (NOD) that eventually become bank owned (REO). A sign of dropping values, not only financial duress.

∙ How to buy a foreclosed home [SFGate]

From that quote it seems as if the bank’s approach to pricing is an accurate and expeditious determination of the fair market value of a property. They’re not exactly dumping properties onto the market and definitely not in SF with the low volumes of foreclosures.

I can see excluding foreclosures from appraisal comps if there were a large volume hitting the market at once, but not the trickle that we’ve seen so far.

Move them very quickly? Whatever. I’ve seen several places sit on the market for months before the bank cut the prices enough (all by about 30%) before they sold.

Banks are retarded. Maybe recently they’ve gotten a bit more aggressive on pricing, but they’re still behind.