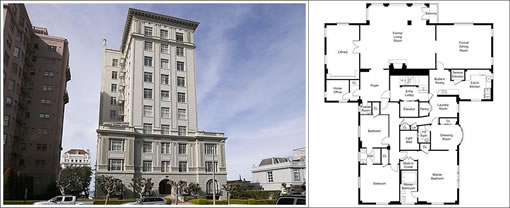

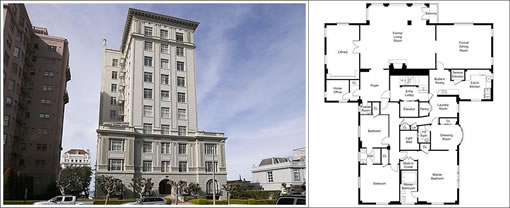

1940 Broadway #6 hit the MLS (and SocketSite) on February 8 with an official list price of $4,350,000. Five days later it went into contract. And twenty days after that (today) it closed escrow with a reported contract price of $4,911,000. That’s 12.9% over asking and an official 26 days on the market.

That’s a mighty quick turn. Then again, according to a plugged-in reader the property had “unofficially” been on the market (and the agent’s website) for a few months prior.

∙ A Few Of Our Favorite Things: Big Windows, Views, And A Floor Plan [SocketSite]

There you go, folks. See? Not all real estate in San Francisco is going down.

Great property. Lucky buyers!

Why lucky buyers? It seems that they could have had it cheaper for months and then when they finally decided to move on it, got caught in a bidding war . . .

It’s a gorgeous property. And yes, bidding wars are still going on in some parts of San Francisco.

Movingback,

You are right, and those that can see the forest from the trees [like yourself] realize that even in an overall R.E. bear market, there are desirable segments that will still rise. Good to see tangible proof of that, even though this stratosphere is way out of my league 🙂

So the market for $5M coops is strong? Good to know. But the fact that something expensive sells for over asking doesn’t mean the market isn’t “going down”. Maybe it would have sold for $5M last year. Remember that place on Masonic?

Let’s be somewhat positive. This is a great property and it was priced right for what it was and thus it sold quick – looks like cash with such a quick wrap up.

Don’t any of you realtors understand Callan’s clever pocket listing strategy? If you do, you’ll understand why it sold so quick, and why it sold for this ridiculous price.

There is nothing to understand, really, other than the fact that it did sell, and it sold for over asking price. The rest is irrelevant. Ridiculous price to you, perhaps, but not to everyone else.

“There is nothing to understand, really, other than the fact that it did sell, and it sold for over asking price. The rest is irrelevant.”

if you’re not a realtor you certainly play one online. it’s selling for “over asking” that’s irrelevant not the rest. it was on the market for months but recorded as one? no wonder dom is down in sf.

movingback…then I suggest you use her strategy and then you might be able to afford a property like that.

Strategy or not, whatever you want to call it – it sold and it sold for over asking price. It’s a beautiful property. You guys are very silly.

“”Don’t any of you realtors understand Callan’s clever pocket listing strategy? If you do, you’ll understand why it sold so quick, and why it sold for this ridiculous price.”

Please elaborate on this strategy — you don’t know what you are talking about.

Why would I elaborate her strategy on this website for those realtors who can’t figure it out when I am a buyer and I don’t support these activities?

Seriously, what is it exactly that you don’t support? The concept of pocket listings isn’t new nor is the listing to MLS pre-sale?

Honestly, folks – who cares what the agents strategy was? Who cares how long it was on the market? The point I am trying to make is amid all of the doom and gloom that circles over this blog like a heavy black storm cloud, there are still plenty of beautiful places in San Francisco – and people that have money – and people that are buying places – even in the Millions – and even for over asking price. Life will go on. San Francisco is not going to get sucked into a mysterious black hole anytime soon.

Afford a place like this? Perhaps. As I mentioned before, it’s a beautiful piece of property – but not really my cup of tea.

Noone disagrees with you ‘movingback’. The over $4M market is a totally different and separate market altogether — and clearly there is competition at the stratosphere levels. The market for RE below $4M does appear to be softening quite a bit for anything that isn’t near-Perfect.

Above $6M you still have to have a perfect place. There is a reason 1071 Vallejo, 3400 Clay, 1230 Sacramento, 898 Francisco are still on the market. And no one is fighting over 2505 Divis either. I’m not sure that even a $1M reduction would sell any of these places.

No of these listing agents wants to be the first one to take a 15% drop in price, and I’m sure the home owners wouldn’t be any happier either… but clearly these owners don’t NEED to sell or CAN’T sell for much less than they are asking.

So let’s not pretend that cause some totally mint/cherry coop with killer views sells for over asking that the SF market is HOT.

Personally, I still think the Pencil building was a better value. Did we ever get an update on the sale of that CoOp?

Callan sure ain’t #1 for nothing!

Maybe we should get a thread going on the tactics of all the high end realtors in SF and expose them for who they really are!