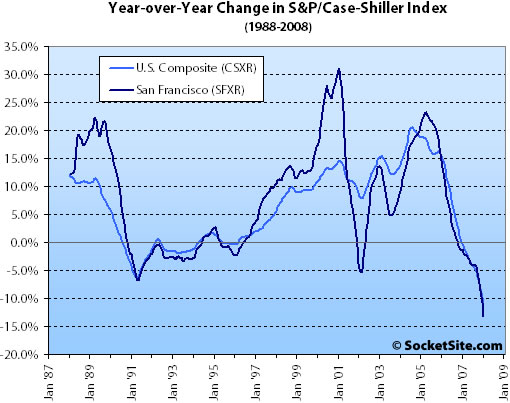

According to the January 2008 S&P/Case-Shiller Home Price Index (pdf), single-family home prices in the San Francisco MSA fell 2.9% from December ’07 to January ’08 and are down 13.2% year-over-year. For the broader 10-City composite (CSXR), year-over-year price growth is down 11.4% (having fallen 2.3% from December).

Las Vegas and Miami share the dubious title of the weakest markets in January, reporting double-digit annual declines of 19.3%, followed by Phoenix at -18.2%. In January, Washington and Minneapolis slipped into negative double-digit territory with annual returns of -10.9% and -10.0%, respectively.

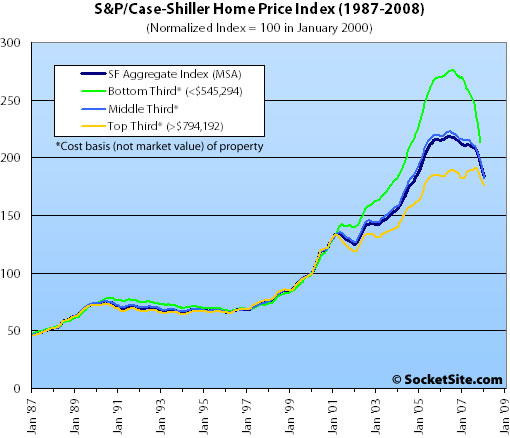

Prices fell across all three price tiers for the San Francisco MSA with the rate of decline easing slightly for both the lower and upper third of homes.

The bottom third (under $545,294 at the time of acquisition) fell 4.4% from December to January (down 28.8% YOY); the middle third fell 4.2% from December to January (down 15.9% YOY); and the top third (over $794,192 at the time of acquisition) fell 1.7% from December to January (down 3.5% YOY).

And according to the Index, home values for the bottom third of the market in the San Francisco MSA have returned to March 2004 levels, the middle third to August 2004 levels, and the top third to April 2005 levels.

The standard SocketSite S&P/Case-Shiller footnote: The HPI only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ Record Declines in Home Prices Continued in 2008 [Standard&Poor’s]

∙ December S&P/Case-Shiller: San Francisco MSA Hits Double-Digit Dip [SocketSite]

fluj: all those lines are pointing down very steeply but there are supposedly bidding wars erupting all over the city. How should we bitter renters reconcile the two conflicting perspectives?

I would trust the realtors. After all, they are “in the trenches” everyday, and they have no incentive to try to instill confidence. I mean, after all, it’s not like their livelihood is dependant on sales activity or anything….

anon: apparently the people participating in the bidding wars can’t read the charts either… otherwise they wouldn’t overbid. Assuming rationality prevailed (bad assumption).

We are still looking at three tiers meeting at 160 to 165.

John: what happens after the three tiers meet? Everyone goes down in concert or the decline just suddenly stops and levels out?

Those charts look like a system that has a bit of ‘inertia’ to it — trends don’t just stop on a dime.

I can vouch for the fact that some people are still participating in bidding wars. Two properties I looked at last month (both listed in the 900k range) closed for more than $150k over asking.

2003 here we come.

Does the graph look anything like this?

http://bp3.blogger.com/_C_udvemSTqQ/R8g4OEU574I/AAAAAAAAARw/a7hVwz4-es8/s1600/image003.gif

Jimmy,

Don’t forget that pets.com stock was in a bidding war every day of its existence.

I have an almost perfect apples to apples buy vs. rental comparison based on an open house I went to this weekend.

2201 sacramento #101 2bdr 2ba $1,069,000

From MLS

“Gracious Pacific Hts 2BR, 2BA condo meticulously remodeled so as to pair 2008 conveniences with classically elegant architecture of 1928. Situated across from Lafayette Park and just 3 blocks to Fillmore, this home provides updated kitchen w/ maple cabinets, granite counters & stainless steel appliances…baths finished in limestone & granite…details include arched windows, hardwood floors, fireplace & highly functional floorplan. 1 car garage parking”

I went to look at this place yesterday as it is about half a block away from my apt. the price really struck me.

The apt is strikingly similar to the one I currently rent. Mine is 1300 sq ft vs. 1265 here. both 2bd, 2ba and both have garaged parking. they are similar styles and in similar condition(although, their kitchen appliances are nicer). Mine is on the 3rd floor and i have a balcony. this is on the ground floor with no balcony, although it does have a view of lafayette park. Mine has a view of southern hills

I pay $2150/mo in rent. I got this place in mid 2006, so no long term rent control

If I were to put 10% down and buy this place with a standard 30 yr fixed, my cost would be as follows

Monthly payment: 30 Years

Interest rate: 7.500%

Loan amount: $ 962,000.00

$ 6,726.44 a month

+ 400/mo HOA

= 7126.44/mo

so in apples to apples, i could either continue to rent for $2150/mo or plop down $100+K and pay $7125/mo to own for roughly the same apt in the same location.

The history of this place.

Sales History

Historical home sale price (1): $840,000

Prior sale date: Apr 23, 2004

Change since this sale (1): +27%

Historical home sale price (2): $620,000

Prior sale date: Apr 18, 2000

Change since this sale (2): +72%

Since the case schiller just showed that we are back to 2004 prices, does anyone see this selling for the 27% apprciation since then.

PS. This is a nice condo, jsut vastly overpriced IMHO.

So Tipster, how long until real estate goes completely out of business and is delisted? I see we have gone from 20% predicted declines to 50% declines to SF housing = pets.com

I guess at that point the rent to buy is favorable, hmm…I can rent it for 0 or I can buy it for 0.

The most notable aspect of the data is how the freefall in prices has accelerated so strongly in recent months. SF prices are down more than 10% just since August ’07, and most of that was just since November. That directly corresponds with the credit/lending freeze that has endured and continued to worsen. SF sales and prices were driven by cheap, funny money loans. Those are gone, and the result on sales volume and prices was (and is) quite predictable. Demand has dried up and supply has dramatically increased. That means lower prices unless the basic laws of economics have ceased to apply. If anybody can put forth any reasonable basis why this downward trend would reverse itself anytime soon, I’m interest in hearing it — I don’t see it.

And I’m sure there will be anecdotal “bidding wars” and “over asking” sales throughout this downturn, just as there were in the mid-90s. That does not change this stark trend.

spencer,

as a landlord i have to say that you have an undermarket rent. as proof you may go on craigslist and look for a pac hgts 2br/2ba. it is possible to find smaller/darker/damper/uglier apts. for less than the going rents but IMO its not easy to find a good rental for anywhere near this rent. in the past you have said that you were offered another place (tele hill?) for a similarly cheap rent; i would contend that these places are not available

publicly but only available on blog comment boards…

of course you can post some examples from CL to prove me wrong-or not.

“How should we bitter renters reconcile the two conflicting perspectives?”

Because C-S reflects what is happening in the SF MSA, not SF proper. Most of the homes used in the measure are in the suburbs. The numbers for the top third come closer than those for the bottom third, though, in reflecting the SF market. Prices in SF are down, but to a lesser degree than in the East Bay.

“Since the case schiller just showed that we are back to 2004 prices”

Spencer is comparing a Pacific Heights condo with a measure of suburban single family homes. I do think that this downturn is affecting most housing, in the city and in the suburbs, but to varying degrees.

We will probably see a pull back, and a few months of increases. Everyone with skin in the game will breathe a sigh of relief, and then it will plummet further.

As for the convergence – who cares? That will be a n arbitrary point in time when that occurs, and will not effect consumer psychology/consumer willingness to buy, or even consumer ability to buy.

Rillion – I believe the reference to pets.com was to illustrate the naivety of believing these things can’t go down much further, or that anything is a sure bet. San Francisco is special, but not when it comes to a bubble that is so grossly over inflated. In fact, the slight resistance SF has shown thus far just means it has a longer way (percentage wise) to drop than most places that have already begun a hard drop. I get that there are differing opinions out there on “what” is going to happen, and no 1 opinion is more right than another right now, but for every 1 reason you could give for the housing market coming back (or not dropping), I can give you 4 to the opposite.

Remember, this is for the San Francisco MSA,(not the city of San Francisco), which includes Contra Costa and Alameda County. The numbers for these areas (especially Contra Costa) are bringing the overall numbers down significantly.

What are the boundaries of the SF MSA?

Looks to me like single famiily will hit about 150 this summer…then stabilize with a slow decline to 120 to 130 or so…If it goes below 115 I’d be surprised. The big thing tho is what happens when you include Condos..especially in Soma. I’d say 30% decline overall with 40% decline if you include condos. That’s really quite amazing.

[paco] –

Spencer’s rent is pretty darn low. Spencer – I want in!! That’s a steal. How in the world did you find that?!?!?

His point is still valid though Even if he were paying $4000/mo (which would be overpriced, though only slightly) his analysis still holds. And he doesn’t even factor in insurance.

There is no analysis (that doesn’t speculate future prices) where buying makes sense in this market. Since homes we would want to live in are >800k, I have to assume the buyers are smart people to even come close to affording such a home. Once they do the rent/buy analysis… well I can’t see how someone would choose to buy.

Oh boy. This is starting to get ugly….

I’m waiting until January 2003 to get in. Anybody know what a nice 2 BR was going for in those days?

Apples to apples, prices are down more than 13.3% yoy out here in the nice parts of District 4 that I watch.

Here is a fun example that all the “locals” are talking about: 261 San Fernando Way (in Balboa Heights/St. Francis Wood).

Sales history (from Propertyshark, also SF Chronicle for the last sale):

12/08/2003 – $1,398,000

01/07/2007 – $2,475,000

10/09/2007 – $1,710,711 (lender bought at auction)

02/27/2008 – $1,500,000

BTW, the latest buyer overpaid a little IMO, but close enough. Note the almost complete absence of appreciation since 12/2003. The $2.475M sale looks a little suspect to me – probably a cash back scam or a clueless recent arrival from Asia – but $1.7-2.0M would have been about right in 2006/07. No major renovations since 2002 (I know the house), and the 2003 price of $1.4M was about right IMO for the time. BTW, houses like this were available to rent for about $3-4K up until last year (and I bet we’ll be there again soon, as the recession takes hold). I know, because I rent one of them (mine is actually slightly nicer because it was a tremendous view and nicer kitchen).

There are a number of others out here – apples to apples – that show that appreciation has been wiped out back to end 2003/early 2004 now.

Also, a number of flipper properties are getting squished. I went to two open houses last weekend, pointed out to the realtors that both were in distress, and had apparently stopped paying taxes, etc. Both realtors expressed shock (sure, like they didn’t do a little checking before they took the listing?), and denied it. The best part of it was that one of the realtors was the owner/flipper (I didn’t let on that I knew)!! I’m *sure* he didn’t realize that he had stopped paying his taxes, heheheheh. Yeah, really ethical profession.

Anyway, out of some misplaced sense of fairness, I’ll refrain from posting the addresses to those two failed flips until they either sell or (more likely) go into foreclosure.

Jimmy (Bitter Renter),

When the three tiers meet, that’s the bottom. (of course, some of the extreme bears would like to see the index dropping to 80)

Using 2002 or 2003 as the “fair” price level, factor in the “fair appreciation”, which is (IMHO) inflation + population growth – new development, the index SHOULD be around 160 in later 2009. So, that’s what I am predicting.

treeman,

you make a good point when you say that homes you would want to live in are >800k. that implies many things in regards to location and condition. the point being that you can not find this kind of quality for rent; rather, you find rental quality.

this goes back to what i was saying about spencer’s hollow boast. RE bears want to paint a picture that includes beautiful rentals for cheap and crappy sales offerings for too much money. in this world smart renters are laughing at dumb buyers. and little tatoo welcomes us to the island…

In comment number one Jimmy (bitter renter) asks what I believe to be a serious question tinged with a bit of good humored irony. I was getting ready to respond. But then I read the second comment. In comment number two Satchel posts a snide dismissal of my peers as a whole. You know, I don’t feel like being negative so early in the morning folks! So I won’t.

As you all know I mostly follow SFRs and 2-4 units. Many of you SS posters tend to follow condos more closely. What I am seeing in the neighborhoods I typically monitor is the following. (I’m gonna keep it SFRs for the sake of ease only, OK? I can look up other stats later if you like.)

Since January 1 of this year to today in Bernal Heights, and YoY:

2008: 20 sales 863K 680 a foot 27 DOM

2007: 24 sales 854K 593 a foot 46 DOM

Potrero Hill:

2008: 5 sales 895K 657$psqft 24 DOM

2007: 9 sales 1.265M 701$psqft 46 DOM

Noe Valley:

2008: 24 sales $1.741N 873$pft 46 DOM

2007: 23 sales $1.38M 767$pft 41 DOM

——-

What do these MLS numbers mean? Well, looking at Potrero Hill and parsing through what’s on the market versus what’s sold, I would say there is a pent up demand for North Slope Potrero homes. There are a good amount of homes on the market, but they aren’t the blocks people want the most.

As for Bernal and Noe I think you can pretty clearly see that there remains significant demand. Bernal seems to keep with my theory that because it is the last semi-central piece of mostly gentrified high ground where one can buy somethign for under $1M. Noe has only gotten more expensive as its reputation has grown. Maybe blogs are adding fuel to this fire, even?

So how can I spin Case Shiller numbers? I can’t. But I don’t care to. It doesn’t really represent what I’m seeing, so why bother?

Sorry paco, flawed argument. There are several places listed on craigslist for sale OR rent. Additionally, several Soma condos for sale that come with a tenant in place. SocketSite has featured a few, like that place in the Marina with all the realtor acronyms in the headline. Run a rent vs. buy on any of these properties, and the conclusion is unchanged. I agree that for-sale inventory, in general, is nicer than rental stock. But not nice enough to justify the huge buy vs. rent delta.

I’m not bullish on the market but I always like to inject something into these discussions. What I always find lacking in the extremely polar banter around here is some much-needed perspective on these numbers.

I read this site frequently and, to the best of my knowledge, it has never once featured a property in Alameda or Contra Costa. And while it may occasionally feature a bottom-barrel property, most of the “real estate porn” featured here is pretty high end. I don’t see a lot of discussion about how to get in early on that “Bayview-thing”… Plus, I think the demographic survey of readers skews toward the upper end of income? (Ed. please correct me if I’m wrong on any of the above.)

If these characterizations are accurate, then what can one really glean from these charts and figures? We know that the low end (of SF, Alameda, San Mateo, Marin, and Contra Costa) is dragging down the market significantly at ~30% YOY. What does that mean in SF? Well, I found roughly 15% of the SFR inventory today IN SAN FRANCISCO (about 75 homes) resides in that sub-$550K list price bucket. Where are they? Ocean View, Bayview, Mission Terrace, Silver Terrace, Ingleside, Visiticion Valley, etc.

Conversely, lets look at what’s happening in SFRs above $800K? Down 3.5% YOY. This currently represents 228 SFRs (43% of SAN FRANCISCO inventory). You can guess which neighborhoods are represented in this category.

All of this is not to say that prices aren’t going down. They are, slowly, and that’s a positive thing. If you could assume that the average $800K place that you wanted last year is now on sale at $778K (a 3.5% discount), that’s not insignificant to most of us on the top line. Apply that same back-of-the-envelope math to the mortgage payment and it’s roughly $4,500 last year vs. $4,343 this year.

Try not to attack the math or bring opportunity cost into the equation. (I don’t care if you rode up the wheat commodity boom while day trading from your rental unit. This post is meant for people who are thinking about buying real estate, not permabulls or permabears…) I’m just trying to point out to the primary readership of this site that the sky is not falling.

There is definitely a slow hissing noise in San Francisco that’s bound to be persistent for years. But unless you are chomping at the bit to buy a Hunter’s Point house at a $200K discount, I don’t see too much to get too excited about here in this report. And I don’t think any readers here care about that segment. Alternatively, if your strategy is to wait for five years and see the losses compound in the better neighborhoods, that could definitely pay off. Time will tell. But if you’re happy to rent for five more years, one has to wonder what you’re doing on this site… 🙂

“If anybody can put forth any reasonable basis why this downward trend would reverse itself anytime soon, I’m interest in hearing it — I don’t see it.”

I have 2 reasonable reasons

1) government intervention. the govt has intervened significantly, and this MAY open up lending a bit, which might allow more people to buy again. It will not lead to rapid super-appreciation, but it may lead to a small turnaround

2) seasonal factors. We may see a spring bounce again, many call this a “dead cat bounce”. It may or may not be sustained. RE downturns take a long time, and you will often see some headfakes here and there.

notice I am not saying that i think that SF has a high probabilty of significant sustained appreciation… but it does have a possibility of some positive months here and there, especially the later spring due to the above factors.

I do not have access to the MLS, but what I see from Altos Research on listings (as opposed to just focusing solely on what actually sold), paints a very different picture of the market from what fluj presents. Altos Research breaks down “Potrero Hill/Central Waterfront” and shows 8 SFRs listed with a median list of $994k, $563/sf, and avg DOM of 63 days. For condos it is 118 units listed, $737k price, $748/sf, and avg DOM of 57 days.

Citywide, the $/sf have trended steadily downward from $600/sf in May ’07 to $530/sf today. Condos $/sf have actually held pretty steady at about $700/sf. And, of course, sales volume is way down from last year and inventory is way up. One can certainly point to isolated neighborhoods or sales and say “doesn’t look too bad there,” but there is simply no way one can reasonably deny the strong (and accelerating) downturn in SF or its neighboring counties. CSI futures are traded on the Chicago Merc for a reason — it is widely respected as an accurate and consistent market gauge.

My pets.com reference was misconstrued so I’ll clear it up.

Jimmy implied that with prices falling, you can’t have (or haven’t had) bidding wars. Pets.com shows that you can. People were bidding for it all the way until its last day. Doesn’t mean the stock is going back up, it just means people were bidding for it. I did not mean to imply anything other than people can be wrong! They bought millions of shares of pets.com right before it went out of business.

I interpreted Jimmy’s comment to imply that bidding wars would soon be over (not true if someone wants to underprice a home) or that fluj could not be telling the truth (also not true: he tells us what he sees and he’s been pretty darn honest). I’d use him in a heartbeat.

However, let me be clear: bubbles are characterized by an inflated demand. The reason they take so long to pop is that there is one way to pop them: the supply has to EXCEED the inflated demand. That’s when they finally pop and it takes a long time to create that much supply.

There’s just one problem, when the supply exceeds the INFLATED demand, the supply GROSSLY exceeds the REAL demand. So when the bubble pops, you’re in big trouble on the supply side.

The country is awash in houses. Maybe not everywhere, maybe not even here (though I’ve lived here for a long time and I’ve never seen that many cranes in SF). But in a capitalist system, the workforce can do something magical: it can MOVE. And it will.

If I were in my twenties, I’d think about moving to some place where homes are practically free, but jobs are plentiful. Phoenix would probably be on my list in about a year if I were younger. That will improve my standard of living immensely. I could buy a home, and have tons of dollars left over to do what I want. Don’t like the restaurants? If homes are cheap enough, you can hire your own chef.

Will it take a while for jobs to spring up to take advantage of the lower wages that will be required to provide the same standard of living? Of course. But the jobs will come. And people will move from high cost areas to lower cost areas to take advantage of them. And when that happens, even the supply constrained areas will fall dramatically.

It was only a matter of time before home prices fell, and dramatically: we’ve been building them to supply a bubble, not to supply normal demand.

The US is awash in houses. Prices are heading way down. There isn’t any way to stop it. We built too many of them.

dude, duuuude.

i had a quick perusal of craigslist and confirmed that the rental offerings in pac hgts are expensive and crappy and often both.

and of course that makes sense.

so are you saying (like spencer) that people are just dumb to go buy when they could just rent?

more importantly, are you saying that you think the buy/rent equation has ever been in line in pac hgts? or ever will be?

now i agree that it is possible to rent single family houses in the suburbs for much less that you can buy them, but i question how nice these houses (and fixtures and finishes) are. and of course that means you are far from pac hgts and not getting any closer. so yes, cheap rent in Ross and access to great public schools is a good idea-but that does not translate to living in the best part of a great city.

Not only CAN one look to certain neighborhoods, but one MUST do so. Yeah, there are eight Potrero SFRs on the market. I alluded to that in my post. Look at them closely, however.

54 Blair Terrace — Under 1000 feet, townhome, south slope.

73 Littlefield Terrace — Also smallish, also south slope.

1459 Rhode Island — South slope, under 800 feet.

2136 18th street — C-minus level North slope loaction. 740 feet.

2104 24th street — south slope. No parking. Protected tenants.

447 Vermont — A stone’s throw from 101N.

619 San Bruno — Also parallel to 101N.

969 De Haro — No parking. Probably C level location, a bit far from the village but still nice. More in keeping with what I perceive people would like. But challenged.

Contrast these with any of the pending or active contingency properties. They include 1136 Rhode Island, 519 Arkansas, 237 Texas, 773 Rhode Island, and 752 Carolina. (In fact everybody should look at 752 Carolina just for fun. wow. talk about RE pornography.) Each of those properties spent scant weeks on the market at most.

When you’re talking Potrero Hill you MUST talk north slope versus south slope. That is not debatable.

Tipster is onto something. Jobs can move out of SF. At a certain income-to-housing price point, people will pick up and move.

See below:

http://www.bizjournals.com/sanfrancisco/stories/2007/12/17/story1.html

Charles Schwab Corp. will move jobs out of San Francisco over the next few years, seeking to reduce its office space here and boost its presence in less expensive places.

@Spencer

A few notes from someone who has gone to see many many rentals. First, you are getting a good deal. No doubt about that, so for you rent vs. buy is an easy decision, but you have a below market rent. Second, when you factor in buying affordability, don’t only use 30 year fixed as the cost basis, run the numbers with a 5/1 or 7/1 IO ARM. Then you will see how people are affording it and why some chose to go down that path and come up with different numbers on rent vs buy. Those numbers would come to much closer to a market rate rent than you would think. That is how virtually everyone I know has bought their house or condo.

I have been amazed at how people have been able to justify buying in this environment, but one thing is for sure, not a lot of first time buyers are anymore, because we are priced out of the market. That will take some time to ripple through, but eventually it will catch up and really hurt prices.

Satchel also has a great rental deal, as do I, but with that comes market exposure. If we get kicked out, or the landlord jacks up our rent, then we may have to move, and might find it difficult to land the same deal we now have. There are a lot of variables in rentals that you don’t think about when you have a good, secure deal.

Anyway, for you, this is an easy decision, but for other people it may not be as easy. People look on shirt time horizons these days, and 5-7 years seem like a long time to live anywhere, so that is why you see so many ARM’s in use, plus short term money is way cheaper than long term money these days.

@ paco: you’re still not getting it. Skim through craigslist listings and notice how many properties are both for sale OR rent. Same property. This Fliparite Investments guy is always advertising them:

http://sfbay.craigslist.org/sfc/rfs/618129233.html

But here’s a specific example:

http://sfbay.craigslist.org/sfc/rfs/617263070.html

I can buy unit 366 at the Beacon for $895K. If I put 20% down and get a 30-year loan at 8%, my monthly nut is $5,250. This excludes HOA fees and property taxes. And it assumes I want to dump $180K into a depreciating asset.

Alternatively, I can rent the SAME UNIT at the Beacon for $4,500 per month.

http://sfbay.craigslist.org/sfc/apa/618055596.html

It doesn’t get more apples to apples, does it? Who would buy here for $1,000 more a month than it costs to rent the SAME UNIT? The asking prices for both rent and buy here are way too high, IMO. And maybe the Beacon isn’t “prime.” But the anecdote illustrates the relationship you find throughout San Francisco: home prices are still largely disconnected from fundamentals, and have a long way to go to be at (or near) parity with rents and incomes.

BTW, I’ve always wondered how the savvy real estate investors get rich on trades like this? Let me guess….volume!

I think the dingo ate my comment….

Satchel brings up a good point about worker portability.

if too expensive, many people will move away. but it’s not just individuals it can also be firms.

I have a friend with a large stake in Wells Fargo. Wells was bought a while back by a MN company called Norwest. Norwest bought Wells (but kept the Wells name) and then moved a lot of operations to SF.

now many are questioning this move (including my shareholder friend) because it is raising costs compared with Minneapolis and he feels impacting profits.

so there is some groundswell (not from the executives) to think about relocating the headquarters to Minneapolis again.

this is what happened with BofA. When BofA was bought by NationsBank (A Charlotte company) NationsBank decided to move BofA headquarters to Charlotte, due partly to costs.

(also, there is very little in terms of employees that can be had in SF that can’t be had in Charlotte or Minneapolis, at least in terms of Banking sector)

i don’t know what the market is going to do next, but i know this: i sold a house in SF in 2002 higher than what i’d paid in 1999. all the dot-coms were dead and SF’s population declined by almost 10% in that time. but you know what? the market never went down. never. and hasn’t gone down since. (well, until recently, i guess!) all i’m saying is that was one of the 5 most-obvious trades of my life, & i couldn’t have been more wrong. just when you think you’ve got it all figured out…

All this debate about MLS numbers and other avenues just goes to show how opaque the RE market tends to be.

Realtors spout MLS data as gospel as if no houses are privately listed on their own website. The MLS doesn’t give a complete picture of the RE landscape.

So people tend to look at other streams of data. So it is basically very difficult to get an accurate measure of the market.

The case shiller index helps as do the MLS, Altos Research, DataQuest etc.

The apples to apples comparisons and foreclosures or rather the accelerating rate of increase in the number of those properties is a more reliable ndicator of the SF market, IMO.

2006 and early 2007 you would have been hard pressed to come up with so many examples of distressed properties in SF.

So Fluj…did I not say two weeks ago we’d see some data that would show SINGLE Family down substantially when you were saying the data would show no change or modest decline. You mocked me!!! and what do we see now? How do you explain this? Do you think the data is flawed?

BTW here is a good link to a story by Barry Ritholtz on seeking alpha entitled–Is realtor spin counterproductive. Basically an argument would be by encouraging buyers with false data it ends up making corrections much much worse then they otherwise would be.

http://seekingalpha.com/article/69852-how-counter-productive-is-realtor-association-spin?source=i_email

My previous comment got eaten, probably because of the links. But here’s another attempt at countering the fallacy that for-sale properties are in better condition than rentals, hence the premium.

Go to craiglist and search for “unit 366” under rentals and real estate for sale. It’s a 2-bedroom at the Beacon that is for sale at $895K or for rent at $4,500 per month. SAME PROPERTY. A simple buy vs. rent analysis will show you that it costs $1,000 more per month to buy than to rent it. And that’s with 20% down, 8% on a jumbo. It doesn’t get more apples to apples. So why would anyone plop down $180K to buy it? Even with the tax write-off of buying, you don’t break even. Sure, the Beacon may not be “prime” SF, but the same relationship holds for most properties/areas throughout the city.

So the points made by Treeman and Spencer are valid: prices are still disconnected from fundamentals such as rents and incomes, and will keep falling until an equilibrium is approached. Or until the Fed takes over insolvent Fannie and Freddie and gives us all 0% mortgages. 50/50 bet at this point.

Dude

8% on a jumbo?

If you take a 8% jumbo (even though the cost of mortgage has increased significantly since six months ago), you will be ripped off whether you buy, rent, or buy a TV from BestBuy.

Back to the case shiller index …

Does anyone know of an updated inflation adjust graph? I found one as of 07/2007 but nothing more recent. The Paper Economy blog has an excellent CSI graphing tool (that includes CME Futures data) but it is not adjuste for inflation.

Cooper’s seekingalpha post raises a point over which I’ve been scratching my head for months. Local real estate professionals as a whole are getting killed by the dramatic reduction in sales volume. Yet the industry, locally and nationally, continues to push the myth that the market will go back up soon so now is the time to buy — seeing quite plainly that people are not that stupid and they are not going to buy such sloganeering and jump in.

The best thing for the profession would be an immediate and steep reduction in prices (say 20%) rather than having it slowly play out over years, which is what we’re seeing. That way all the excess inventory might start to sell and realtors could return to earning commissions (emphasis on “might” — hard to tell if buyers could get financing to jump in even with 20% price declines). I just don’t get the self-defeating party line that has resulted in a stalemate, with very little moving and realtors consequently losing bigger than anyone.

Dude, you’ve got some bad math going on. You said:

“Go to craiglist and search for “unit 366” under rentals and real estate for sale. It’s a 2-bedroom at the Beacon that is for sale at $895K or for rent at $4,500 per month. SAME PROPERTY. A simple buy vs. rent analysis will show you that it costs $1,000 more per month to buy than to rent it. And that’s with 20% down, 8% on a jumbo. It doesn’t get more apples to apples. So why would anyone plop down $180K to buy it? Even with the tax write-off of buying, you don’t break even. Sure, the Beacon may not be “prime” SF, but the same relationship holds for most properties/areas throughout the city.”

Try this out for a much better calcualtion:

http://www.nytimes.com/2007/04/10/business/2007_BUYRENT_GRAPHIC.html#

First, one should be getting a loan for more like 6-7 percent on a 30 year and maybe 5.5% on a 5/1 (I just got a 5?1 for 5.325 a few weeks ago on the condo about the same price). Also, what about the tax benefits. Even with your math I think you will find it better to buy that unit. I did the rent buy calcualtions (correctly) and found I was better buying a place for about $900 then renting for just below $4k.

Finally, even though your data point is counter to your point, you can never make or refute an opinion about the market with one data point.

Spencer,

There is a spread between renting versus buying, but I think your math exaggerates the extent of it, for a couple of reasons.

1) While I don’t know rents in Pac Heights very well, I assume Treeman’s number of $4000 is closer to the norm for the property of the calibre that you described. Before we bought we were renting a high floor [with Bay Bridge view] 2/2 at the Metropolitan [in SOMA] for about $4k, including parking.

2) In terms of the 7.5% interest, that is likely the prevailing rate on jumbos. However, one can structure it differently to reduce the rate. We have two mortgages, each about $417K .. the first one conforming even before the limits were recently raised. We got both in February at 5.125% and 6.125% respectively, before mortgage rates rose recently despite lower fed. funds rates … although we expect that anomaly to reverse fairly shortly. Accordingly our monthly payments are about $4,300 … I know your principle amount would be slightly higher, so your payments would be too … but not that much. Property taxes and condo fees are additional, but there are the interest and property tax write offs.

Just yesterday I had someone from one of the bigger banks offer me a loan that was quite different from what I had seen before. While one does need 20% down [maybe one could get away with 15%] this would be a jumbo mortgage tied to Libor … with a 1.375% premium to either 3 to 6 month Libor. While the ‘introductory rate’ would be 4.625%, after six months it would tie into prevailing Libor rates, plus the premium. Based on current Libor rates, that rate would today be around 3.9%. The glaring issue is that this is a floating rate with a 6 month reset, so it’s definitely for those with a certain amount of risk aversion. However, an instrument like this would make the buying vs. renting comparison far more compelling.

“Local real estate professionals as a whole are getting killed by the dramatic reduction in sales volume.”

I’m not sure why the NAR and CAR continue to push propaganda that is almost certain to impact the realtor industry (tough to call it a “profession” – have you seen the broker’s exam in CA for instance?). I suspect it is because it is basically a sales industry, and so most people involved in it are “optimists” by inclination.

But about it killing the local industry here, I have an anecdote that seems on point. A good friend of mine is a small time angel investor (sold a piece of software to a startup in 2000, cashed in what he could immediately and the rest as soon as the lockup expired, and has been laughing ever since the company blew up a few months after he got out). He has an interest in a portfolio company, and recently they advertised for a clerical/admin position that was going to pay $15-25 hour. He told me that within days they had received more than 200 resumes, and at least “half” were former realtors, mortgage brokers or had some connection to real estate lending. True story – this was in southern Marin.

duuude,

you wrote ” Sure, the Beacon may not be “prime” SF, but the same relationship holds for most properties/areas throughout the city.

So the points made by Treeman and Spencer are valid: prices are still disconnected from fundamentals such as rents and incomes, and will keep falling until an equilibrium is approached.”

i’m talking about pac hgts (spencer’s example) and you’re comparing that to a newly built, large unit building in a area of many others just like it. now i would venture that they built more units in the beacon than perhaps all of pac hgts over the last few years! these are not two apples.

as for your contention that prices will fall to an equilibrium in pac hgts, i say “show me”. when was the last time that happened?

paco-

Are you telling me there will never be more houses for sale than buyers in pac heights? That’s a bold statement.

Here are some Case/Shiller Home Index data points for price depreciation to put into the buy vs. rent calculators for the SF Bay Area. Yes, the futures are very thinly traded (and I’m sure most of the depreciation will be “contained” in Antioch).

Jan 08: 183.81 (current)

Nov 08: 154.80 (approx. Feb. 04)

Nov 12: 153.40 (approx. Nov. 03)

Good luck to those with 5/1 ARMs.

Paco-

To take your argument to the logical extreme where price will never fall in a given area – then the value of a home in Pac Heights should be valued as a perpetuity. That tells me that a $2MM home is really worth $40MM – assuming a 5% yearly increase forever. Why do we see any homes listed for $2MM today if the value only goes up from there? They should list those homes for $40MM since it’s such a sure thing. In fact, all of the “nice” beighborhoods in San Francisco should just price at their perpetuity value since prices never go down in those neighborhoods.

I would be curious to know what people really think is going to happen to housing prices in the “prime” locations in SF – people who are not realtors, or current sellers, or soon to be sellers.

Treeman,

Need to look at net present value. House might be worth 40 million in 100 years but a dollar will be worth less also.

My forecast: prices moderating, not tanking.

“Need to look at net present value.”

Ummm, isn’t that the perpetuity thingie……

Treeman – not a realtor nor do I have any interest in selling anytime soon, but my guess is that the “nice” areas of SF will hold their own in this market…. from what I’ve seen, that seems to be the case so far in Pac Heights as I continue to see stuff come on the market, get multiple offers, and sell including a recent 2.5 million transaction my building last month.

Good point cooper. You can see from the graph of home sales that home sales always go way up in February. For anyone to tout that home sales are up 2.9% this year and that is somehow evidence of a correction was ludicrous.

This year, they only went up 2.9% but this is seen as the end of the downward trend? Doubt it. You can see this year’s February rise was tiny compared with 2006 (the long solid vertical lines define the start of a year). And the trend is clear. But that didn’t stop the NAR from spinning away, as usual.

http://online.wsj.com/article/SB120636579684859225.html?mod=Economy

Dave, I think your comments are spot on and well-said. It’s a nice perspective on some of the numbers from the latest CS report. Also, there was another interesting relationship here that either didn’t get noticed or was just plain skipped over. The 3% drop in prices for the upper tier (presumably the best indicator for SF) is shockingly similar to the declines for San Francisco that Dataquick has been reporting recently. The editors and many others are quick to say that Dataquick is understating the housing drop due to mix changes, but now Case-shiller (the “superior” survey) is suggesting essential the same drop. A 3% correction is a lot different than a 30% nosedive, and I think you’ll continue to see things pan out that way. We’ll get slight decreases for the next couple of years, which is similar to the pattern that we saw in the late 80’s and early 90’s. As a reminder, prices dropped then by around 10% from the peak. Yes, I know about the random 40% drops during that timeframe (per some other posts on here), but that was obviously offset by appreciation somewhere else in the city.

Spencer – I’ve said this before, but I think you must have below market rent. Either that or your perception of your unit’s value relative to available purchases is not accurate. Everyone has their own rent vs. buy numbers based on where they live, but this is what they look like for my condo building. You can buy a 2BR unit for around $800K or rent one for $3200. After factoring in HOA dues, taxes, and tax deductions – the difference in renting and buying would be around $500 monthly. This assumes a 6.5% interest rate and 10% down…and I’m not taking into account opportunity costs on the 10%. I’m also not factoring in the big increases in rents that have been happening over the last few years. My point is that $500 alone wouldn’t make me decide what to do one way or another. If other factors suggested that I should rent (e.g. – no down payment, expecting to move in 3 years, job stability), then I’d rent and not think twice about it. I wouldn’t however rent with the primary assumption being that prices are going to drop on SF units by 30%. That’s where our opinions are different.

“A 3% correction is a lot different than a 30% nosedive, and I think you’ll continue to see things pan out that way. We’ll get slight decreases for the next couple of years, which is similar to the pattern that we saw in the late 80’s and early 90’s.”

A minor 3% drop on a $800K condo is a loss of $24K a year/$2K a month. You are factoring that into your rent/buy calculation right?

Regarding the rent vs. buy, somebody does seem to have inaccurate assumptions. But I’m not convinced it’s me.

30 years jumbos have crossed the 8% threshold, folks. Here’s a link to Wells Fargo’s daily quotes page. Note the 30-year jumbo at an APR of 8.2%. And this is still low by historical standards.

https://www.wellsfargo.com/mortgage/rates/

Even the veritable 5/1 ARM, the loan of choice for pretend millionaires here in SF, is now over 7% coupon. I’ve always argued that if you can’t afford a 30-year fixed, you can’t afford the property. But I may be overly conservative.

And my previous example isn’t contained to Soma. What about 2243 Greenwich? That Marina treasure was for sale for $2.2MM or rent for $11K a month. Now a short sale:

https://socketsite.com/archives/2008/02/a_little_extra_perspective_on_the_listing_2243_greenwic.html

Dude,

I guess you buy your cars at MSRP?

Come on, the mortgage rate one take is NOT the one you conviniently picked, it is the best one he can find.

Just do a little bit research. I can easily give you a example of 5.35% for 5/5 ARM, or 6.375% 30-year fixed, both with 0 point.

Wanna bet?

“Figures don’t lie, but liars figure,” as they say. Not to call people on either side of the argument liars, but there’s a relative dearth of granular data on real estate (which is my main issue) and it’s easy to pick out a comp that sold for more than listing and had multiple bids and say the market is hot– or to point to other data to say the market is tanking. It’s not easy to refute that activity has been steadily declining for more than two years to very low levels and that prices in many areas have fallen. The argument here seems to stem around the sale of shiny new condos or pac heights SFH’s- nice places in nice neighborhoods. Is that market still intact because of . . . foreign buying or the no new supply story or those buyers have cash and don’t need financing, etc.

Obviously no one knows the future. I have a view which may or may not come into fruition. I think it’s going to be a slow drawn out contraction that is deeply unsatisfying for both sellers and buyers. Buyers see the fundamentals collapse and the activity collapse and expect prices to rapidly follow. Sellers see prices very slowly leak and activity dry up and hold on to the belief that there is no end to the- “no new supply in sf/real estate can only go up” story; they are sold a story that there is only a temporary cutoff in financing and if they don’t sell now, r/e will be back to “normal” in a year. I think the most likely scenario is a long protracted sideways/ lower market. R/E is auto-correlating. A lot of times it goes up, because.. .well, because it’s going up. And it’s a slow and inefficient market to correct as a result. I feel strongly that the primary drivers for the boom of the last decade (financing trends (the ’03/’04 secular low in rates followed by the proliferation of a series of sequentially more leveraged affordability products)) were unsustainable and that even if the market doesn’t collapse, risk/reward tells you to be very patient here.

I think the contentiousness in this discussion comes from the fact that a lot of us have had bad experience with realtors. It doesn’t mean that there aren’t very knowledgeable and ethical realtors out there. But I certainly have had personal experiences as well as casual third person experiences with realtors who were neither ethical nor informed. But this does not condemn an individual. i.e. I don’t agree with fluj in many posts but he certainly seems a lot smarter in his viewpoint than many other realtors I have dealt with. But Fluj has to understand that a lot of us have had direct experiences that have left a bad taste or cursory experiences– going to an open house and having the realtor tell you that it is just on the market and sure to sell soon if you’re interested– when you know it’s been on the market for a while. I’ve literally been told that the market is heating up and then while I am upstairs have the two realtors talk about how bad things are thinking that I am out of earshot.

It’s amazing that the single largest purchase/investment people will ever make is also the one with the least amount of data and regulation. It’s not illegal for someone to say that real estate can only go up and you can’t lose whereas you can’t say that about any security. I am not a big believer in regulation as an abstract concept, but wow it does amaze me what goes on in r/e. Without the internet, the NAR would be fighting tooth and nail to prevent more data and information to the consumer. It would be simple for them to have readily available data by zipcode and zone for monthly sales, price per square foot, average square footage, etc. I know this info is out there but it should be easily available that anyone can chart any time period, any zipcode, by all of the basic measures. The fact that we argue about Case-Shiller and data quick and NAR or homebuilders numbers, show how most of us dont’ have easy access to very basic granular data about the market. I firmly believe that if there were no internet and no outside pressure, the NAR would keep it that way for as long as possible.

What’s at stake here is not only the real estate market collapsing or maintaining, but how houses are bought and sold. 5-6% commission– frequently for little data and little value added is not a problem if the market is up dramatically. But if we do end up with a sideways lower market for five years and people are losing money, there will be a much greater call for reform of the NAR, and it’s likely that commissions will drop significantly or go to a fee-based system. It’s happened in every market and every business– margin compression from competition and more readily available information and price discovery through the internet. Whether you are selling cars, airplane tickets, or stocks, this has happened. I have a strong belief that the way houses are bought and sold, the amount of data available, and the fee structure will be dramatically different ten years from now. Whether or not it happens soon depends on how bad the market gets, how politicized the issue becomes, and how successful the NAR is at lobbying against this. . ..

“I guess you buy your cars at MSRP?”

Nope. Don’t buy my real estate at sticker, either. That’s why I’m excited that the “Going out of business” sales are starting. May finally get that long-overdue 20% reduction I’ve been waiting for.

Seriously, though, if you’ve seen 30-year jumbos under 6.5% with no points, do post a link. Because I haven’t seen anything close in a while. I’ve even heard rumors that some banks (Citi) are no longer offering ARMs or I/Os in California – amortizing loans or nothing. But I may be wrong.

“I’ve always argued that if you can’t afford a 30-year fixed, you can’t afford the property. But I may be overly conservative.”

True. But, for most people, if you choose a 30 year fixed, you don’t know how to manage your money. The I/O’s ARMS etc are the tools for the wealthy to use their money smart and the less wealthy to get in over their head . . . sometime also in a smart way.

just a counterpoint to all the lemons that satchel likes to pick out from the st francis wood area. 276 states. purchased for 850k in july 07. completely gutted and if i had to give a best guess had 450-600k put into it given the quality of the finish work. just closed for 2.15mm. now, it listed for 2.179mm, so it came in 29k below asking, so i’m sure the bears will latch onto that.

Cooper I take it you didn’t read my posts that show the opposite of what you say.

About realtors and the NAR, anon’s call for reform makes sense, and I do think it will gain traction in the years ahead. This housing bust will be a debacle on the order of the leveraged equity debacle in the 1930s, from the wreckage of which arose the SEC, FDIC, state regulation of securities sales, the 1933 and 1934 Securities and Securities Exchange Acts, Glass-Steagal, etc. (It took Wall Street about 60 years more or less to figure out how to get around these regulations starting in the late 1980s, and not complete until the fall of Glass-Steagall in the late 1990s.)

About whether individual reators are ethical, hard-working, etc., of course that is true in the abstract. Nevertheless, the “fish rots from the head”, as they say. Take a read of this, direct from the pages of the official Realtor magazine, published by the NAR. For those of us who understand investing and the nature of equity returns, leverage, etc., the exhortations contained in these “recommedations” to realtors is nothing less than outright fraud. Considering the unsophistication of the average homebuyer on financial matters, IMO it is UNCONSCIONABLE. Add this to anon’s call for reform, and note the date of the attached article.

http://www.realtor.org/rmomag.nsf/pages/BlancheEvans200802

https://www.penfed.org/productsAndRates/mortgages/mortgageCenter.asp

30-year fixed, 6.375%

5/1 or 5/5, 5.375%

http://www.ingdirect.com/google/

5/1, 5.25%

Paco, In my comparison i was simply stating the facts of the case as I see them.

I do ahve a 2bd 2ba on corner of Sac and Buchanan with parking, W/D balcony and in good condition for $2150/mo. I attained this place in Apr 06 and from craigslist. I never stated that it was going for this price now. I’m sure there hase been some rental apprecitation in the last 2 yrs.

I also never stated that there are oodles of good cheap rentals in Pac Heights. However, I seem to have what I ahve and that’s all ui stated . I was also offered a large 2bdr recently for the same price in telgraph hill with a GGB view, but they wouldn’t allow my cat, so i turned it down. this was offered to me througha friend, so not CL.

I stated my case and never inferred any of those sentiments that you seemed to make for me. But in my case, the cost to buy is 3.5x as much in this scenario as it is to rent a comparable place in the same location.

Someone else made the comment that i should have used a 5 or 7 yr ARM to figure out my monthly mortgage. I wholeheartedly disagreee with that and it is why we are in the mess we are in now. Unless you are superflush with cash, I don’t think anyone should be getting these types of loans. That is exactly why we are in the mess we are in now as a country. If you can’t afford the payments on a 30yr fixed, then you can’t afford the house.

regarding rental prices: I don’t think places are actually renting for the prices that they are listed for on CL. Everyone negotiates. My Apt. was listed for 2450 at the time and i got it for 2150. A simliar apt is probably listed for $3500 now, but you could get it for $3000 or less.

It has been my experience that every landlord negotiates if you are a good tenant. And pretty soon, i think so will most of those selling homeowners.

Although y case my bee slightly out of the ordinary, I think the cost to buy vs rent in Pac Heights for a similar place is roughly 2-2.5/1

If you can up your down payment, I have seen as recently as last week a bank offering 6.25% on jumbo money, but you have to go to 70% LTV. There have been some decent rates out there, but most come with an additional 5% to 10% of LTV to secure those rates.

I agree with Tom, if you can borrow cheap in an ARM or IO ARM, then you can save money that can work for you in more productive ways, then it is not a bad idea.

“The I/O’s ARMS etc are the tools for the wealthy to use their money smart and the less wealthy to get in over their head . . . sometime also in a smart way.”

If you say so. But I’m not buying it. The fact that our nation is facing a severe recession driven by record foreclosures by such esteemed “money managers” should be hint enough that these programs are flawed. I still believe that people get these loans to squeeze into properties they couldn’t otherwise afford. If someone wants to demonstrate how good they are at managing their finances, they should be able to save for a 20% downpayment.

treeman,

you wrote “Are you telling me there will never be more houses for sale than buyers in pac heights? That’s a bold statement.”

that’s not what i said but rather that the 500+/- units built at the beacon represent more units than were built in pac hgts in many years. in other words pac hgts will never be inundated by large condo towers. so comparing soma to pac hgts is not apples/apples.

dude,

you wrote “And my previous example isn’t contained to Soma. What about 2243 Greenwich? That Marina treasure was for sale for $2.2MM or rent for $11K a month. ”

this does not bolster your point.

Posted by: Recent ORH buyer at March 25, 2008 12:16 PM

“There is a spread between renting versus buying, but I think your math exaggerates the extent of it, for a couple of reasons.”

Actually recent ORH buyer, i think your “creative mortgage” math exaggerates the benefits to buying, and mine more accurately reflects the true cost of buying. The 5/1 loans don’t give you the true cost of owning .

Having bought and sold 2 residences in the past, I can honestly say I walked away from both the transactions wondering what the true value of the services my RE agents provided was. The experience was neither bad nor good, but I think within those 4 transactions I would have done better to just hire a RE attorney in the end. That being said, had any of the agents I dealt with tried to push that garbage on me from the Realtor magazine link that Satchel posted, I would have filed a complaint (however I don’t which consumer protection agency you would file with). Is it really legal for RE agents to make such claims and give market advice without being subject to at least some sort of civil action?

Dude,

John is absolutely right – 5/1 are available in the low to mid 5% range and 30 year fixed are available in the low to mid 6% range. Both Tom and I obtained those within the past two months and while I can’t speak for Tom, my wife and I aren’t millionaires that receive some sort of special treatment. Both of the aforementioned were with no points with a 10% downpayment.

I have to agree that it’s harder to find PUBLISHED rates at the levels that we obtained, but they are available.

276 states,

Ummm, try again. 276 States is not even in the same District as St. Francis.

Anyway, about the example. Seems like a good profit for the developer who brought his skills and expertise to the market (it looks like it was a company from Prop shark). There are still many foolish buyers with money who are willing to pay through the nose for that “turn-key” lifestyle or “new condo” smell. Take a look at th recent thread on the condos at 41 Federal, and think of the owners who are about to get a nice wakeup call from the market, as one of the original unit failed to sell at more than 10% below its sale price last year and is now going to be “auctioned”. Fortunately, out here in District 4, the number of people who are falling for these flips seems to be fading, and the flips are flopping. It is hit or miss, though. The trend is down, that’s what is important. Out here, at least. Not in the neighborhood of 276 States I guess. Yet.

@ Trip, the best thing is for the NAR to push an agressive 20% markdown policy, huh? Number one, try telling that to an individual seller. Number two, and more importantly, a lot of areas are still seeing the same activity that they were for the first quarter last year. See my posts regarding Noe, Bernal, and Potrero. I just did one for Glen Park and Eureka Vally/Dolores Heights. Same thing. Sunset? Volume down from 66 to 89 but average price and $psqft nearly the same. The Richmond? Nearly the exact same as last year’s first quarter. 29 sales this year to 30 last year, 1.6m last year, 1.5m this year.

These are not manipulations. The Richmond, Sunset, Noe, Bernal, Potrero, Castro/Dolores, and Glen Park are central areas where SFR properties can be found for $1M – $1.5M. They are, in SF terms, relatively central and safe and affordable. Demand remains high for all. Only the Sunset has seen a real change. And like we constantly point out, the good ones get snapped up out there too.

Fluj, I agree that it may be difficult to convince individual sellers to drop their prices to levels where the place will sell. Perhaps that is why sales volume has fallen so dramatically. But perhaps it is also the result of the RE industry continuing to pronounce to the world that prices are “just about” to go back up. Either way, realtors would be far better off with lower listing prices and higher volumes, which was my point.

And I also agree that if you strip out all the districts where sales have plummeted and look solely at those few areas where sales volume has not changed — you can conclude that for those select areas the sales volume has not changed. Can’t argue with that logic.

paco, just getting through all the nast comments that you wrote to me based on my real life example

“i would contend that these places are not available publicly but only available on blog comment boards…

of course you can post some examples from CL to prove me wrong-or not.”

I did get my place off CL in Apr 06. However, contrary to your inference above, the rental market is not 100% covered by CL. And the prices that are offered on there are not what people actually end up paying. The landlord posts what they would like to get. This is the top of the price range and negotations go down from there.

I would argue that real rental prices end up somewhere between 10-25% lower than advertised.

jsut took a quick peek and there are a slew of 2bdr with parking in Pacific Heights on CL for less than $3000

Trip,

Looking at desirable central areas that are relatively affordable is not cherry picking. From my experience, these are the areas most San Francisco folks would prefer to live in. Let’s be reasonable. Richmond, Sunset, Glen Park, Bernal, Dolores Heights, Noe, Potrero: that is not cherry picking. That is a broad freaking swath.

I’ll have to agree with Spencer. I have multiple family members who are landlords, and they do not like to use craigslist. They have had a lot of less than serious applicants for their rentals. And yes, sometimes rent can be negotiable.

Spencer,

you wrote;

“I pay $2150/mo in rent. I got this place in mid 2006, so no long term rent control”

and then later

“I never stated that it was going for this price now. I’m sure there hase been some rental apprecitation in the last 2 yrs.”

so which is it? BTW do you live in the tall modern building on the corner? with carpet, eight foot ceilings with popcorn and textured walls?

Spencer is right about what rentals actually go for vs. what they are listed for. Two recent arrivals in my office have rented in the city for about $750 less than what was being asked on Craigslist. One 2br in Cow Hollow on Pierce street near Union was rented for $2400 a month, and one on Scott St with Parking which was a 1br in the Marina rented for $1900 a month. I am amazed at what Hipsters pay for rent in other hoods such as the Mission and the lower Haight, which in both cases can be more expensive than the 94123 depending on what landlords can get away with. If you have perfect credit and are responsible, landlords would rather cut the price than see their units loaded up with potential problems.

Fluj, I never said anything about cherry-picking. But you can’t really deny that sales volume is way down SF-wide and that as a result so are the commissions industry-wide. That is not good for the realtors out there (as a whole — as has been said many times, you appear to be far above average and I suspect you are doing fine in any market). Comparing the single month of 2/08 to the single month of 2/07 for those sub-districts where those two isolated numbers have not changed much really does not change the point.

The top, middle and bottom tiers are approximately 8%, 18% and 30% off respective peaks now.

8% isnt that different to numbers for SF that are coming through Dataquick.

I’m not sure from that I can see 30% drops in SF itself which some predict -as the current pace that would mean drops of around 90% for bottom/65% off middle.

There may be a time when the declines for the bottom two thirds cease or slow down while those at the top accelerate but at the moment the opposite is actually true.

For declines in SF to hit 30% this shift will have to happen though – and I’m not sure I see it coming.

I just looked at CL and didn’t see anything under 3K for 2 beds and parking in Pacific Heights. Except one in the western addition…Am I missing something?

peanut,

You missed all the listings from surrounding areas which use pacific height to catch spencer’s attention.

spencer and satchfan,

as a long term landlord in the city i associate with many other local landlords and we constantly compare notes. so i can only speak from my continuously updated experience, which may be different from yours. in reality (where i live), landlords hold the cards. 10-25% discounts on asking rents in pac hgts? when? where?

spencer, you wrote

“jsut took a quick peek and there are a slew of 2bdr with parking in Pacific Heights on CL for less than $3000”

i’m having difficulty finding this “slew” you speak of.

2br/2ba w/parking? if you input pac hgts 2br into craigslist the screen is flooded with rents ABOVE $3k. to characterize this as a slew for less than $3k is a sloppy reach not supported by the facts. now i will admit that it may be possible to find a crappy 1bedroom w/living room being used as 2nd bedroom apartment that is near pac hgts (on a busy street, w/no light and shag carpets), and i admit that it will be falsely advertised on CL as a 2bd pac hgts apt. but that does not support your assertions…

“I just looked at CL and didn’t see anything under 3K for 2 beds and parking in Pacific Heights. Except one in the western addition…Am I missing something?”

The know-how to use Craigslist?

http://sfbay.craigslist.org/search/apa/sfc?query=&minAsk=min&maxAsk=3000&bedrooms=2&neighborhood=23

badlydrawn: go to calculated risk. He just did a new inflation adjusted case shiller graph today. Not all the MSAs, but enough to see the trend…

“8% isnt that different to numbers for SF that are coming through Dataquick.

I’m not sure from that I can see 30% drops in SF itself which some predict -as the current pace that would mean drops of around 90% for bottom/65% off middle.”

So an 8% drop to date isn’t that bad because it’s less than 30%? Am I the only one who is floored by that reasoning? Forget the differential in monthly payments an 8% loss on an $800K condo is a $64K loss of principal!

276 States Street is interesting. Purchased in June 07 for $850K (sf listed at 1,650). Just sold for $2.15M after 52DOM. Listed square footage is now up to 2,606 so price psf is $825.

What’s interesting about this sale? It is the most expensive sale in District 5G (Corona Hts) since June 2005 when a much larger 3800sf house sold for $2.22M. In fact, aside from one other sale in 2002 of a much larger house at $2.275M, it is the most expensive listed sale in the 15 years of available history (300 sales). Also, we hear so much about renovation costs in the $300 – $400 psf range. This renovation added 1000sf plus apparently rebuilt the existing 1650sf. Well if 276states is correct and the contractor(s) came in at $450K – $600K, then this project cost only $170 – $230 per sf. The new sale price of $825 psf is higher than the current District 5G average of around $750 psf (and that’s for houses that average 1600sf).

So did the buyer overpay? Does the market tend to overvalue these turnkey renovations as Satchel suggested? Did anyone see this place? The current listing pictures look OK (but perhaps not doing justice to a “record-setting” property).

“Does the market tend to overvalue these turnkey renovations as Satchel suggested?”

10,000 flippers would say “yes”. Otherwise why would anyone renovate to sell if the market’s perceived value of a remodel was equal to or less than the cost of the remodel ?

Yes, but I know that 30% seems to be the majority (or at least a significant minority view) on here as to as far prices will fall in SF.

So I was just pointing out that based on the way things are developing with the price tier differential, I dont see it happening.

Actually, I think the 8% from peak does overstate the decline for SF SFHs, given that Dataquick posted the YOY SF SFHs up 0.1% YOY, as opposed to the top tier MSA which is down 3.5% YOY. Condos do appear to be a different story, though.

I guess my point is, if people do predict a 30% drop in SF prices, then I would be interested if they have a prediction for how far prices in the bottom and middle Case Shiller tiers will drop consistent with the 30%.

dude – I think your comments are generally worthwhile when I read the litany of things written on this site, but come on 8% 30 year fixed? We may be headed there, I have no idea really, but I know for a fact we aren’t there right now.

You saw the links posted above with regard to rates. I’ve mentioned elsewhere that I just refi’d my loan to a 30yr fixed jumbo at 5.75%, and though I’m not sure rates will head there again anytime soon, they were there just two weeks ago yet again.

Just like you shouldn’t buy sticker price on a home (unless you think it is worth it), you should never believe the garbage rate sheets that WF and other major lenders publish on the web. I’ve called them directly and been told that the real rates (on which they have serious wiggle room) for those with good credit and reasonable LTV, are significantly lower.

Right now I would state that 6.5% for a 30 yr fixed jumbo is about the going rate. You can find cheaper, but for most folks this will be about the rate at present. If you are even contemplating an 8% standard 30yr fixed you need to have your head examined.

pg2,

craigslist currently has 60 offerings for 2bd in pac hgts;

16 are under $3k

44 are over $3k

of that 16 slew of listings i’m guessing that more than half are either not in pac hgts, not true 2bdr and not desirable.

so spencer’s original comment about how his apt. rent has not gone up much is false. it looks more like rents are at least 40% higher in 2years.

“Volume down” is bad for realtors, true.

Is volume down in the areas I posted? No, only in the Sunset. Sixty-six SFR sales so far this year for the Sunset is higher than many would have guessed.

And again, I did not provide YoY single month numbers. I provided basically an entire quarter (1-1 through today) last year versus the same time period this year.

paco,

peanut gallery’s comment was “didn’t see anything under 3K for 2 beds and parking in Pacific Heights” not “didn’t see anything i liked”.

i provided a link to 16 possible apartments. only one has to be real to prove peanut gallery’s comment false.

Milkshake of Despair – obviously with a good renovation project there should be a component in the final price that values time, skill, management effort, and some return on investment. This should provide the appropriate incentive to quality renovators. By “overvaluing”, I was wondering if people are then also adding an unnecessary premium to the construction and raw material costs.

FSBO,

Speaking about flips that (may have) flopped out here in St. Francis, can you find a price for 190 San Pablo?

https://socketsite.com/archives/2007/12/on_friday_it_was_faux_bois_but_today_its_real_wood_that.html

It did sell, after the list price was reduced from $3.8M to $3.65M. Can’t imagine that the flipper made any money there. It was gut renovated – it looked like they had a crew there working 24/7 for about 6 months (I’m local to the neighborhood so I saw it all) – and at least 1000 square feet added (the house was extended). Total square footage was 5000 square feet (including the extension/new construction), and gut renovating all that didn’t come cheap! The house was purchased (in poor condition) for $2.05M a little less than two years before it was resold.

I’m curious to know what they got for it in the end, but the price doesn’t show on property shark, and of course the tax assessment bill hasn’t been updated yet. Anyway, that house and 135 Fernwood (bought to flip at $3M and flopped at $3.9M, and so rented….) show the sort of craziness out here in 2005/2006. That’s gone now, …. I think.

@ enonymous et al:

I didn’t realize the 8% would cause such a stir! Look, I realize you can get jumbo rates under 8% if you have a large down payment. Prior to doing that quick analysis, I checked the most recent published rate. It was 8%, was it not? Have some faith…I don’t pull this stuff out of thin air.

satchel said: “Ummm, try again. 276 States is not even in the same District as St. Francis.”

umm, either is 41 federal. that’s not the point. the whole market isn’t moving in some generalized downward slope as you seem to continually suggest from every post and individual property you chose to highlight (and appeared to have visited and made a low ball cash offer on). there are areas in the city that are doing just fine and a multitude of sellers that aren’t selling short. just providing a counterpoint to the doom and gloom on this board. it’s getting ridiculous.

PG2,

That was funny, I am clearly no expert at this online thingy…I think I just searched “pac heights” assuming it would pic up “pacific heights”. I clicked your link and there are a few that look to fit the sub 3K bill. One is open tonight, if someone is in the hood would be interesting to hear about it. I am surprised that those deals are out there.

IMO, If you are renting a nice place (2 beds, workable kithcen/bath) with parking in an area you enjoy for under $2,400 that is a great situation. Bonus for outdoor space, view. I certainly would not be lining up to purchase a comparable unit with that rent.

Location: 2336 B Webster

Open house Tuesday, March 25 at 6:15pm.

2 Bedroom, 1 Bath, Pacific Heights, Carpets, Miniblinds, One car garge, No laundry in bldg, Gas heat

Terms: Rent $, 2095, Sec Dep $2,600, 1 Year lease, No pets, All utilities included

REpornaddict –

I’m not necessarily expecting 30% declines in the nice areas (more like 20%). But it’s misleading to compare the median numbers for Dataquick (heavily dependent on mix) to the CSI numbers (relatively independent of mix).

Even our biggest RE booster, fluj, has gone on the record saying that SFH volume is steady in the better (i.e. more expensive) areas while falling in the less desirable (i.e. cheaper) areas. That NECESSARILY implies that median YOY change overstates appreciation, because last year’s sample contained houses that were nicer, on average, than this year’s sample. Again, this conclusion is based on facts coming straight from fluj.

How much is the median YOY change overstating appreciation? We don’t know. But given that it’s 0%, the one thing we do know is that SFH prices are going down. The question is how much. (Again, I’m not in the “prices in nice areas will eventually fall by 30% or more” camp…maybe in real terms, but not in nominal terms).

It’s called a Housing Crash. And, the liquidation phase has begun.

But this housing crash conform to what’s called a Triple Waterfall Decline. There will be three big legs down, with two ledges. We should wash out in August of 2010.

SF Bay is about to reach its first ledge, as this first leg down bottoms this Summer.

Lots and lots and lots of supply is about to hit the market.

re: the 276 listing. based on my sources, wholesale construction costs for a construction company (vs. a homeowner) are in the $200-250 range these days. this was a complete gut as well, down to the studs, so costs were lower than trying to remodel around existing interior space.

it was well done, but not extravagant. they spent money well on the things that were important to buyers – lots of bathrooms, nice kitchen, etc. saved money by not going over the top on a lot of the finish work. every open house was mobbed. was it worth it? somebody thought so. in terms of cost for the neighborhood, it’s definitely on the high side, but it’s only about 300 ft from the line of ashbury heights, where those prices are pretty common.

Satchel – regarding 190 San Pablo Avenue, MLS shows sale date of 2/12/2008 with a selling price of $3,650,000(*). The (*) indicates that the actual selling price has been masked (at the request of buyer or seller) so the number is set to the list price.

Apologies for this one more time…but…from the data here

http://www.blackstone-sanfrancisco.com/198.html

there has been very little change in mix between 08 07. Districts 5 and 10, for example, being two of the biggest, are a pretty stable share of total sales in both years. (08 is probably for jan & Feb so far as I see it. This was surprising to me, bit that’s what the numbers show.

There may be SOME mix factors going on within areas of course, but this would be hard to quantify and overall I dont think the mix argument is as significant as many make out – based on these figures at least..

276 States is in my neighborhood, here are a couple other listings that are pretty far apart on price around here:

230 Roosevelt – $1.055MM – 2171 Sq Feet – looks newly remodled

4588 and 4590 17th Street – $1.4 and $1.35MM- each about 1800 Sq Feet. Brand new construction (these were featured in SS a couple months ago as they were being built)

These are basically in the same neighborhood, and are all on busy streets, the 17th St. properties are on the corner of Clayton, it is really busy there.

So, here are two data points that tell very different stories. 230 Roosevelt is very well priced, the other two are pretty high. Seem listing agents going in two different directions on pricing in this area.

Any insight?

“I pay $2150/mo in rent. I got this place in mid 2006, so no long term rent control”

and then later

“I never stated that it was going for this price now. I’m sure there hase been some rental apprecitation in the last 2 yrs.”

Paco, I really don’t see any conflicting message here. I am sure there has been some rental appreciation but it is not a long term severly underpriced rent controlled apt.

FSBO,

Thanks. So we’ll have to await the tax assessment to figure out what 190 San Pablo went for.

All this talk of renovation is interesting. 276 states brings up “wholesale” costs for a developer company. Well, that’s GREAT if you happen to be a developer company. The question is what can the individual OWNER expect, and how should the individual purchaser evaluate the risks versus rewards?