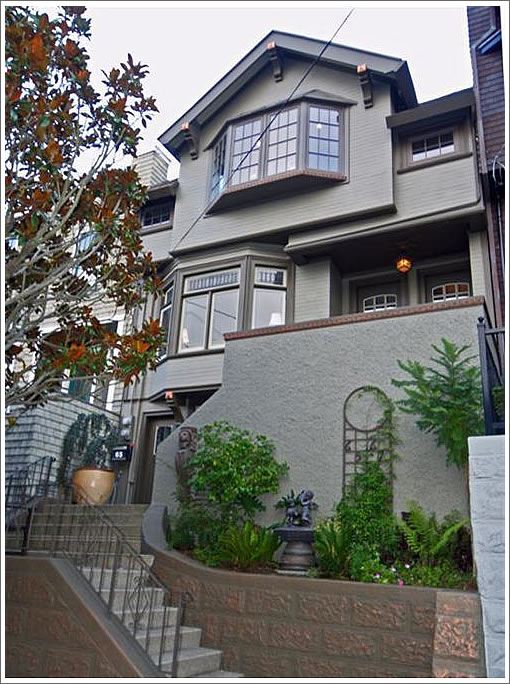

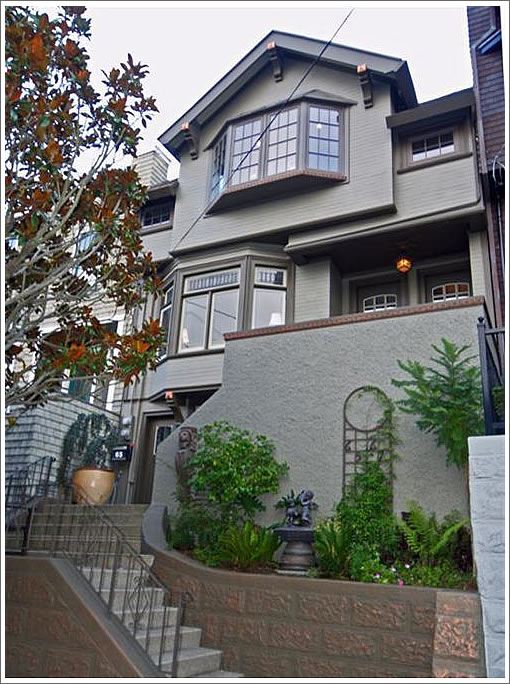

While the sinks in this single-family home on Caselli Avenue (65) weren’t all that warmly received two months ago (at least in terms of practicality), the overall house, location and price reduction ($295,001 or 12.9%) were. Or as “movingback” commented at the time, “this is a great house – should sell now that the price has been adjusted.”

And while it hasn’t yet sold, the price has been reduced another $300,999 ($200,999 three weeks ago and then by $100,000 yesterday). And yes, the seller remains “motivated!”

∙ Listing: 65 Caselli Avenue (3/4) – $1,699,000 [MLS]

∙ And Sometimes It’s Simply The Sinks (65 Caselli Avenue) [SocketSite]

With local companies like VMWare stock going from 130 to 55 in the course of 2 months (it dropped another 30%(!) yesterday), I think the glory days are coming to an end.

Nice place, but some rationality appears to be returning. At 1.995, if they get it, this seller will still come out OK. They put a lot of time and money into the place and they’re still in positive territory. They just won’t make the killing they’d hoped for.

“At 1.995, if they get it, this seller will still come out OK.”

Agreed, tipster. But they won’t get it – especially because the listing is now at $1.699MM 🙂 (Note to editor – the link referencing the MLS listing wrongly has the old price.)

At $1.699MM, that’s about a 25% decline from the original listing price (about $2.3MM).

About the tech wreck, couldn’t agree more. It’s wonderful to see the market starting to act more rationally. The large run-up in tech following July 2007 is now starting to get unwound. Tech is a relatively small portion of the US economy, and its profit share (as a % of GDP, or as a % of overall corporate profitability) is also small. And, it’s largely a commoditized business (with some notable exceptions, of course). Companies like Intel, for instance, in the mid-1990s traded at multiples comparable to car companies or homebuilders. We’ll probably see that again…

This is in my neighborhood and I’ve seen it. It’s a very nice place on a good block (although a steep hike up from Muni). But the layout is funny — really a 2-BR with a separate unit that has all been sort-of joined into a single SFR. Also no yard. It just wouldn’t work for most buyers looking at houses in this price range. I think this is a good example of how really perfect places might still sell quickly enough but if there is anything odd or imperfect then prices will see a noticeable discount from a year or two ago and it will take longer to sell (or won’t sell at all). My guess is the buyers who are out there now are only looking for places to live long-term, so it has to be just right.

Yow. As someone who is holding on to their home in this neighborhood…I suddenly feel a lot poorer! This is a great house on a great street….a great example of what’s really happening out there.

First off, they should stop marketing this as a single family dwelling. It is two units. Note the two front doors. Differnt buyer. Different loan.

Okay, do you know I never realized it was not a single family dwelling until someone pointed out the (obvious) more than one front door?

Let’s see if the newest price adjustment brings in a buyer. It’s a great location, and a very nice place.

Does this have three doors in the front? I haven’t seen the house, but these multiple unit remodels (in guise of SFRs) always have confusing layouts… Random fire rated doors, odd hallways and incongruous stairwells don’t exactly make for comfortable living.

been in it, also smells strongly of dog.

Oh goodness, I didn’t see the price problem. They paid 1.420 in 2005 and I’m guessing they spent about 200K fixing it up. Add in $80K in realtor fees and they are at nominal break even. But that forgets about the points they may have spent on loans, the premium they paid to own vs. rent. etc.

And when you bought in 2005, you had to buy without contingencies. A place like this had to have $20-30K in repairs, that they would have to make on their own now. They may have to pay the buyers closing costs.

So they spent a ton of time and effort redoing this place and now they will lose a bit of money on the deal. Probably about $50-75K.

All that hard work that goes into this kind of remodel, down the tubes. That’s a real shame. It’s a pretty place and selecting the finishes and supervising all that work takes a lot of time and energy. And what’s more, the location is very good. They did everything right and still lost money.

I’m guessing they are marketing this as a SFR because they took out the kitchen. After losing money on the remodel, I can only imagine their lack of enthusiasm for putting a kitchen back in. I suppose that’s how they ended up with more baths than bedrooms: the kitchen got turned into a bath and now they are stuck.

Guys, relax. Fluj’s pouncing clients are going to bid up this puppy above $2 Mill. Always pays to have a great realtor who knows the market.

@ anon – it’s been on the market for awhile now – and the price has been reduced a few times – I doubt anyone will ‘pounce’ on it now and bid the price back up – but you never know in this market. At 2500+ sq ft, it is rather large, even though it’s not truly a single-family home.

Good point about it likely being two units with the two entry doors being a tip off. Public records show the address as 65-67 Caselli and it is listed as “residential miscellaneous” rather than a single family home, so it’s probably two units. If you’re looking to buy this, make sure the 3-R report clarifies that it’s a two unit or a single family building or even take a trip down to the planning department to get a ruling. Very different loans available for duplexes compared to houses that generally require much larger downpayments. There’s a possibility that the place was legally converted to a single family house, but this requites more than just removing the kitchen, you have to go through a planning process to “remove the unit from rental market.” Generally, the city doesn’t want to convert duplexes to single family homes in order to keep the rental stock in place. And anyone else notice the owner’s refi’d 4 times in the last 2.5 years – motivated indeed.

Miles,

Is there a publicly-available way of seeing that refi activity? I checked propertyshark, but they only show the original loan at time of purchase ($550K – variable). So, I was guessing this was an “investor” group purchase. But the refi activity that you mentioned has me thinking “distressed”.

550,000 first loan

150,000 credit line

40,000 private money from the broker at Herth

100,500 private money 4th

Can’t see the loan amounts on my paid subscription data source so the high amount of refi activity looked suspicious at first. However, when you add up all the loan amounts shown above, it’s not even 60% LTV so that wouldn’t be that distressed or motivated at all. Can I ask where you found the refi loan amounts yikes!? Thanks.

Based on that info from yikes!, the low CLTV and the quick pace of price reductions (25% over a few months – quite a drop!), I’m guessing my original supposition is more likely: an “investor” group. I get pitched by them all the time (referrals from a friend who is involved in two of them). Anecdotally, the “real” cash in these groups are often HELOC money.

My wife and I know a couple – NOT high earners (my wife was the wife’s boss for a while) – and they “own” 6 properties, two of which are with investor-friends: SFH in San Jose (purchased 2001), SFH in Bakersfield (2005-OUCH!!), land in Shasta County (2003/4), a new $1.3MM McMansion in Livermore (2006-OUCH!!), SFH in Daly City (2005) and another somewhere in San Mateo (last two are with investor groups). Yeah, this bubble is going to end well!!

I think everyone is missing the biggest problem:

The open house is during the Super Bowl.

@ Trip 8:03AM – excellent point in your post. I completely agree with what you said about this property – too much of a imperfection or quirkiness for most buyers in this price point. We drive or walk by the house often and it certainly is beautiful from the street.

I have no idea who owns the place, but my s.o. and I checked out an open house there. Like Trip we found the layout strange, and the master had a small fraction of our current closet space.

And then there were the sinks in the master bath.

There was an “old” (land yacht – 1970s?) car in the garage.

This listing seems to have disappeared off the MLS. Does anyone know what happened to it? Did it sell?

Anyone? This one seems to have generated so many comments and now it seems to have disappeared. Did it sell?

The listing for 65 Caselli expired without generating a sale (as far as we know). If the seller is in fact “motivated” to sell, we wouldn’t be surprised to see the properties return under a new broker. (And perhaps another new price…)

I live in this neighborhood and saw this place when it was on the market a few years ago. It was 2 units then but it felt like it had been a single family that was once split into 2 units. There was an in-law down so maybe they were able to convert this to the second unit? Who knows.

The owner is/was a single man and he did the remodel himself. Another guy lived there and he drove the old (big) car. They had 2 big dogs, hence the smell? I havn’t seen them in a while. I have no idea what the loan info above was or why Herth was involved in it, other than they had the listing when it was 2 Million?