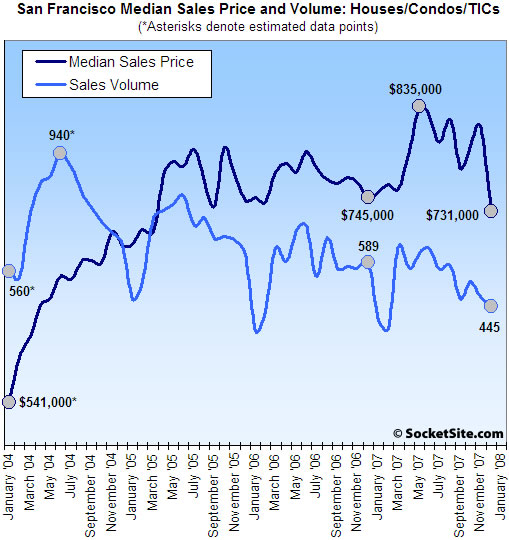

According to DataQuick, sales volume for existing homes in San Francisco fell 24.4% on a year-over-year basis last month (445 sales in December ’07 versus a revised 589 sales in December ’06) and fell 7.1% compared to the month prior (479 recorded sales in November ‘07). And as we’ve noted over the past two months, the data once again suggests that October’s uptick in reported sales activity was at least partially driven by a delay in September closings rather than a significant rebound in buyer activity.

The median sales price in December was $731,000, down 1.9% compared to a revised December ’06 ($745,000) and down 10.3% compared to the month prior. That being said, we continue to believe that mix is playing a significant role in supporting the median.

For the greater Bay Area, sales volume in November was down 39.5% on a year-over-year basis and fell 1.2% from the month prior (5,065 recorded sales in December ’07 versus a revised 8,372 in December ’06 and 5,127 this past November). The recorded median sales price fell 4.9% on a revised year-over-year basis and was down 6.6% compared to the month prior.

Last month was the slowest December is DataQuick’s statistics, which go back to 1988. Sales have decreased on a year-over-year basis for 35 consecutive months. Until last month, the slowest December was in 1990, when 5,458 homes sold. The strongest December, in 2003, saw 12,349 sales. The average for the month is 8,903.

At the extremes, Sonoma recorded a 48.5% year-over-year reduction in sales volume and a 21.9% drop in median sales price, while Napa was the best performing Bay Area county with no change (0.0%) in it’s Median Sales Price (but a 43.3% drop in sales volume).

∙ Bay Area home sales drag along bottom, median price back to 2005 [DataQuick]

∙ San Francisco Sales Activity In November: Back Down (-15.7% YOY) [SocketSite]

Why do you refuse to acknowledge that September’s lesser volume was due to August’s scare? Go ask any title company about that. October’s uptick wasn’t about delay. It was about loan programs evaporating and deals completely falling through for September. In October, the new guidelines came into effect. People adjusted, and still bought. And 7.1% November to December is normal.

That said, yes, there’s something happening. What is is, exactly, we don’t know.

[Editor’s Note: Perhaps we’re saying the same thing (and yes, we talk with escrow officers almost every day). The point is that a fair number of buyers who would have likely closed in September under “normal” circumstances ended up closing in October (due to either a delayed closing or purchase). And while a drop in volume from November to December is indeed normal and entirely expected, a 24% year-over-year drop in volume is neither.]

Oops… Is this more anecdotal evidence or is a trend emerging?

REOs and reductions were apparently “anecdotes”. Sales volumes dropping might also just be anecdotal, no?

Are you talking to me? About October’s uptick? Everyone in town who is in R.E. know what the hell happened.

I know sales volume is dropping. Something is going on. When it translates to lower prices please do let me know. I have several buyers waiting to pounce.

“When it translates to lower prices…”

Uh oh, fluj. I detect a chink in your armour. No more if? 😛

Just a little humor for the day. Those Sonoma numbers. Wow.

“That said, yes, there’s something happening. What is is, exactly, we don’t know.”

Great one. No one knows. Hmmmmmmmmmmm, what could it possibly be? I have no clue……….

I don’t see how one can read the plummeting sales numbers as anything but a dire indication of the accelerating downturn in the market (and catastrophic for RE agents), but I must say that realtor web sites/blogs all over town are already cleverly spinning it. Here are some:

The low volume is the result of nothing good being offered for sale — the buyers are out in droves but there is nothing to buy

This indicates pent-up demand, so better buy now

This means we’re at the bottom, so better buy now

With interest rates falling, sales prices won’t fall any further, so better buy now

I’m not sure how any of those pitches square with the fact that median sales prices have dropped, median list prices have plummeted, and DOM stats are heading further up. But I give a solid B+ to the industry’s creativity (it would be an A if the desperation were not so palpable). Volume will pick up when prices have fallen back to realistic levels, and not before. One would think the RE industry would be pushing for that day to come, not going all out to try to delay it.

“What is is, exactly, we don’t know.”

Talk to the buyers you mentioned who are waiting for prices to drop, Fluj. They probably know. 🙂

Wow, and that was December.

Meanwhile, in January, the great savior of SF real estate, Google stock, has now dropped 100 points in the last 30 days (and is sinking fast), and Wall Street, the other great savior of real estate on both coasts, is hemorrhaging money and handing out mountains of pink slips.

Something is going on?

No. Something is popping.

Hope those buyers ready to pounce have their down payment in cash, because they are ~2% less wealthy than they were this morning (in terms of their equity holdings).

Who we kidding… it’s never a bad time to buy in SF.

Actually, I know better than many if not all of you. So please stop it if you don’t know of which you speak. To the guy who asked me to talk to my buyers, wtf? I talk to them daily. Prices really aren’t dropping around town folks. Not yet. Will they? Maybe. But stop acting like you know something. You really don’t.

@ Trip “the fact that median sales prices have dropped, median list prices have plummeted”

That was patently false, Trip. No ifs, ands or buts about it.

“But stop acting like you know something. You really don’t.”

Thanks fluj. I really needed that hearty laugh I just had.

The GOOG let holding up prices in SF is about to be kicked out. When tech layoffs start -> lookout below.

You’re welcome, akrosdabay. If and when prices drop please let me know. If and when any of you armchair economist blowhards know something that I don’t know about the current state of the real estate market in San Francisco, not the greater Bay Area, not nationwide, not some fabricated Parkside neighborhood of your imaginings, SAN FRANISCO RIGHT NOW, please do tell me.

Just so all the relevant news isn’t overlooked, also from the Data Quick release, “Foreclosure activity is at record levels.”

Fluj, if that was false, then give us the figures (I notice you don’t seem to question the fact that DOM is rising). I’m just relaying what I can glean from various sites that make public what the MLS does not want the public to know. I’m principally looking at Altos research here:

http://www.altosresearch.com/paragon/latest/paragon_market_update_zip_based_cmid_55_zipd_94103.html

If you have different, more complete, or better numbers, please share them.

No body that is bearish about SF real estate is talking about the “current” state. Your profession only cares about the “current” state. Investors, prospective buyers and even sellers should be worried about the “future” state.

So there is no disconnect just difference in semantics.

“But stop acting like you know something. You really don’t.”

Oh, we know a thing or two.

“If and when any of you armchair economist blowhards know something that I don’t know about the current state of the real estate market in San Francisco …”

I utterly defer to your knowledge of the current state of the SF market. But I don’t drive by looking in the rear-view mirror.

Trip, this site has been publishing generally rising median statistics for six months. How on earth you come off saying otherwise is unknown. Now, those median numbers can be interpreted in a myriad of ways. The details of that have also been examined. But to flatly come out and say median sales prices are falling, as are median list prices have “plummeted”? That’s just baloney, my friend. And everyone who reads Socketsite knows that.

Don’t switch this to DOM. Don’t switch this to the MLS having some conspiracy (LOL, if they did, do you really think they’d let S.S. use it for free all the time?). Admit error.

“Actually, I know better than many if not all of you.”

This guy is beyond hope. Too bad we’ll probably see him again at the Seven Eleven cash register when his R.E. job has run its inevitable course.

You might want to read up on retail for your next career move Fluj!

Anon, you clearly don’t know anything about anything. I’m not even sure you want to get into an Internet cutdown battle with me. I know more about that — your only real skill — than you do.

Fluj wrote: “If and when any of you armchair economist blowhards know something that I don’t …”

I think you just insulted 90% of the posters on this site, but thanks for tilting at windmills anyway.

The chicken little attitude of this board is hard to take sometimes. Folks, SF real estate may be headed south, but if you’re waiting on a 20% correction, you really need to take off the tinfoil hats.

According to the fashion mavens I know, tinfoil is “in” this year.

The fact of the matter is that it is sheer folly to buy – right now.

For instance, we’d be paying 3 times our rent to buy in the area where we live. What sense does that make ? You don’t need a calculator or ‘DataQuick’ or knowledge of economic theory or whatever other crap to figure this out.

Fluj, I understand your point. I was not making the sweeping comment about median sales prices in recent months that you read into it. I was referring to the data in this very thread — the December ’07 median is down YOY from December ’06. That is why I said median sales prices have just “dropped” while median list prices have plummetted (I stand by that unless you show me contrary stats). And the real point I was making was that it is all but economically impossible to have — as certain RE spin doctors would have it — lower sales volume being driven by constricted supply rather than lower demand unless you had rising sales prices, not lower prices as we see here.

But we’re not seeing lower sale prices dude!!!!!!!

That’s it for today. LOL. Seriously. Yall make me chuckle. Good luck rockin the foil.

This Fluj character might be a socketsite creation and doesn’t really exist. You need some clown to keep the discussion going….

Actually, one last point. @ Anon.

Say something real for a change. Have an opinion. Sheesh.

Fluj, my gosh, I was trying to keep it civil. But just scroll up to the top — The median sales price in December was down 1.9% compared to a revised December ’06 and down 10.3% compared to the month prior.

I understand that medians are only one small piece. But all I said was “median sales prices have dropped” . . .

Fluj aka Kenny on thefrontsteps – I believe he is real.

Fluj,

I’m curious what business plan your clients have where they will “pounce” on SF RE on just a few points of depreciation. I understand that some people can make money in a declining market. Are the costs of adding value so cheap now that you can pick up a property, add value, and make a lot of money flipping it or renting it out? Even in a declining market? Or are you and your clients the Warren Buffetts of SF RE? Is your strategy to simply buy and hold SF RE over the long term and a few points off the high is a good time to buy?

20% correction is a given for SF. We’ll be lucky if we escape with just 20%.

The polyannas who cling to the ever shrinking liferaft of SF real estate values crack me up. Now that the whole country is plunging, the state of California is about to massively pull back on spending, the stock market is tanking, somehow we are going to keep going up in price here in SF. Yup, gotta love those rose-colored glasses.

Of course, realtors are handed a pair of those glasses along with their license.

Doggone it. I really do have things to do. I’m trying to negotiate a short sale right now. You wouldn’t believe how ridiculously prohibitive it is to wade through all the red tape.

My clients’ plan is to live in a nice place that they can afford. Prices have been quite expensive for some time now.

Trip, you said median “plummeted!” Please! I just looked at the MLS. THe average sales price for ’07 SFRs is over 200K higher than the average sales price for December ’06. Is the median really less? No way.

yippeee. A misinformed pan-realtor smear at long last! And it took 32 whole posts to get to it! “We are going to keep going up in price” he says that we say!

Can it be that some of you guys are growing to like me?

“I’m trying to negotiate a short sale right now.”

And yet you claim the market is fine.

Damn. Are those prescription rose colored glasses?

December numbers are pretty much meaningless…so are January numbers…No one is really going to know trajectories until we approach the end of 1Q08.

I don’t have access to full MLS data. All I can tell you is Altos Research shows the median SFR listing price right now to be $777k whereas the average is $1,330k. A couple of those $25 million places out there really, really distort the average . . . It looks like median list price a year ago was just under $850k.

Another interesting tidbit — in December the median selling price was lower than the median list price. That says something about the “mix” but I’m sure there are an infinite number of opinions as to what that is. (I have no idea).

Diemos, what you don’t know about this one anecdote could fill volumes. Briefly, it barely falls (think under 2%) in the realm of short sale and it is in a much worse state than when purchased. But feel free to post broad based assumptions on a singular anecdote you know nothing about. Who am I to stop you?

“December numbers are pretty much meaningless…so are January numbers…No one is really going to know trajectories until we approach the end of 1Q08.”

Uh, I can tell you the trajectory now. It’s down. I said 6 months ago prices here would be down 15-20% and I got yelled at. Now this looking to be on the low side. For the markets like Soma–I can see 30% price declines by the end of the year. On the plus side I do think we’ll put in a bottom around summer time because rates are going to be dropping pretty dramatically by then. But I bet prices will be relatively flat for the next 3-4 years–if we are lucky. So its not like you need to rush in and buy as the deals will only get better every year for a while.

Techs have cracked. Look for massive layoffs by the end of the summer.

The GOOGLE layoff will be the toughest and should finally put some fear in the SF real estate market.

The GOOGLE layoff will be the toughest and should finally put some fear in the SF real estate market.

This makes no sense whatsover. First, Google is rolling in cash. Could they have layoffs? Of course. Will they be massive? No.

Whoever thinks Google is/was/will ever be a big factor in SF real estate doesn’t know what they are talking about.

Don’t get too excited by a 1.9% median price decline YOY for December 07. SF median sales prices were UP yoy for 10 of 12 months in 2007. And inventories are not rising significantly in most districts. I’m with Fluj, here – too soon to say there is a city-wide real estate downtown in these numbers.

Thousands of instant millionaires, mostly in their 20s, former renters, has not been a big factor in SF real estate? Funny.

And Google could easily have massive layoffs once the cash stops rolling in. They don’t have longterm advertising contracts and if/when the economy contracts in a substantial way, advertising can be pulled from Google quickly.

Meanwhile, Google has been driving up their fixed costs by a large margin these past few years so if tough times come, say goodbye to 1000s of jobs.

For listed sales in Dec 07, the count is now at 357. I know that we’ve wondered about this before, but DQ reported 445 sales for Dec. This is about 90 more than MLS. So the implication is that these are “unlisted” sales or new construction units or some other source that DQ taps.

As for the listed sales:

Dec 07: 357 sales, $756K median selling price, $759K median list price.

Dec 06: 503 sales, $760K median selling price, $759K median list price.

So the median selling price in Dec 07 was slightly less than the median list price – not by much, but that’s certainly a change from the recent norm. At the high water mark of May 07, the median selling price was $840K versus a median asking price of $799K.

For those who want to check out the 2007 vs. 2006 numbers for just San Francisco (as opposed to DQ’s bay area numbers), check out this web site: http://www.rereport.com/sf/index_a.html

Accounting for all 2007 sales, it shows a 6% increase in median prices for SFH’s and a 14% increase in median prices for condos. Number of sales are way down for the year. And DOM are about the same as 2006.

anon: I’m going to respectfully disagree.

In any case, we aren’t talking about google’s survivial, but the survival of its stock price. To see what can happen, check out Sun: They’ve always had a fantastic balance sheet (they just plunked down 1B dollars for a company yesterday), but the stock lost 80% of its value aound 2001, then another 50% the year after that. The whole while, a fantastic balance sheet. And they’ve only been bleeding employees slowly…

Google’s capital costs are enormous — cloud computing/server farm build-outs everywhere. If the faucet is slowed, it will cause a rip in the bay area space-time/tech-zeitgeist continuum the enormity of which can not be underestimated or ignored !!11! 🙂

Google’s stock price is actually a very good, lazy-person’s proxy for the health of “better” SF real-estate prices. It hasn’t cracked yet…

Why not table this endlessly repetitive, tiresome discussion until, say, June ’09? None of the bears on this board will be buying in the next 18 months, and all of the bulls can get on with making their next million on a fix/flip deal, or whatever it is they do when not arguing on the internet. Anyway, one or two data points do not make a trend …. and you can never unequivocably call a peak until long after it’s happened.

That, Jimmy, is a (good) question for the SS editors.

folks — given this post’s subject, what exactly should we be talking about on this thread? “I like how the bottom plot is blue, and the top plot is black”!

Thank you Jimmy.

I am a bull and yet I believe the bottom is end of 09/early 2010, and I have said that since 06. The topic for potential buyers is not “this and that seller lost money”, but “when should I get in?”.

This market is not yet a buyer’s market. It is no longer a seller’s market, but given the extremely limited inventory, difficulty to obtain credit, and higher mortgage rate, it costs buyer significantly more to buy today than one year ago, even if the “price” is lower.

Google’s stock price is actually a very good, lazy-person’s proxy for the health of “better” SF real-estate prices. It hasn’t cracked yet…

you have got to be kidding with this sort of stuff

Thousands of instant millionaires, mostly in their 20s, former renters, has not been a big factor in SF real estate? Funny.

Do you have any facts to support this, or even anecdotes? Google had about 2000 employees when they IPO’d, they’ve added thousands since, and the latecomers to the party aren’t nearly as rich as those who got in early. Many buy in the peninsula (Palo Alto, Atherton, Mountain View, etc.)

How many times did you “google” today? For goodness sakes, the company’s not going anywhere.

C’mon, sanfrantim, I don’t profess to have any real insight on this, but that’s not the relevant inquiry. It’s still trading at a p/e of 47. How many Cisco routers did each of those google searches cross? Yet Cisco is still off about 70% from its peak in 2000 despite dominating the industry and consistent high profits and margins.

I agree with many that one month of data in isolation doesn’t demonstrate a trend or speak to the broad market (contrapuntally, neither does some spoiled millionaire overpaying for a trophy in Noe Valley). But I don’t think we’ll need to wait until June of ’09 to be sure.

Let’s wait until the new towers in SOMA go to close units. Or to see if that fabled “spring bounce” happens this year. I’m betting the trend will become self evident this year.

Is San Francisco “special” or “different?” Sure we are. But we’re not immune. If some of you are growing tired of these debates, don’t worry: soon the only remaining debates will be 1) how long will prices fall; and 2) how low will they go?

This “Get Fluj to admit real estate is tanking” thread reminds me of my uncle’s mens clothing store in the late 70s.

My uncle bought way too many leisure suits. He had an inventory of thousands of them when fashion so thankfully turned against him.

He sold to a retiree crowd who shall we say, was not exactly up to date with the latest fashion. And leisure suits were very cheap and very low maintenance: those people he sold to WANTED to believe that they were still in fashion.

LONG after the leisure suit fad tanked, anyone who asked my uncle whether leisure suits were on their way out was met with 1000 reasons why, not only they were NOT going out of style, they would NEVER go out of style.

I learned an important lesson: don’t ever ask a businessman to admit something that, if admitted, would be bad for his business.

When did my uncle finally admit that leisure suits had gone out of style? When he sold the last one he had, and admitting it was no longer bad for business. And that was YEARS after everyone but retirees had stopped wearing them.

Stop asking Fluj to admit it’s looking like curtains for real estate. It’s bad for his business.

And in case he starts thinking like we do, he has a whole sales machinery in place behind him to make sure he BELIEVES that real estate always goes up. This is the same crowd who thought running ads that said “It’s a good time to buy and sell real estate” would have any effect at all. They drink the real estate cool aid all day long. Because the brokerage makes more money if they can convince fluj, and every other realtor, to be more enthusiastic, they invest heavily into keeping him on point. So he might even believe it, because his management barrages him with messages that this is “but a flesh wound” to quote a character who just had his arms and legs hacked off in a Monty Python movie.

Trying to get any realtor to admit defeat just isn’t going to happen. His job is not to be honest to the public: a realtor’s job is to sell. He’s just doing his job.

Leave the poor guy alone.

“How many times did you “google” today? For goodness sakes, the company’s not going anywhere.”

The question should be how many times did you click on an ad on gooqle’s page today? That’s how they make money not by people using the site.

sanfrantim – we could always use Vivisimo or Ask.com (thank god Jeeves is gone). GOOG is obviously not going anywhere, but their stock is still kinda priced for perfection (as they used to say back in 1999). SUNW (er JAVA) didn’t go anywhere either – but I bet their employees reduced their housing expectations.

I’m not sure if that was an honest, yet twisted, defense of what you believe to be my raison d’etre, Tipster. Or whether it was in fact a backhanded and thinly veiled slap at me and my profession. Either way, you’re off base. I work for a very small company and there’s no pressure from anywhere, nor propaganda. I have my eyes wide open. I do not need a rising, flat, or falling market. I need people who buy and sell property to hire me.

You guys just go out on a limb for each other, all the time. I don’t know how many ridiculous statements I’ve seen on here today. It may be a new record. None of you honestly looks at what’s happening. You want it to be tanking. You want it to be tanking so badly. There were 10 offers on a doghouse in Noe today, OK? Give it a rest.

It’s not necessary for it to tank, for me. If it tanks, I’l probably get more than a few sales. It’s all good. Yall are too funny.

dub dub checker — nope! Remember, it’s a lazy indicator, so it won’t get me a PhD in anything.

remember that google’s stock is not only a proxy for not only google wealth, but also all ad/software companies feeding off of its valuation. That’s a larger group than you can think, and it includes many startups, and induces much investment (e.g., microsoft investing in facebook). It also affects psychology, a huge factor whenever you buy a house at > 2.5 times rent.

And I bet it has more predictive power than a 200-line rent/buy spreadsheet (slow as molasses, and hosted on google, by the way, for free).

This issue isn’t whether google’s stock price will go down (it’s already down $100 from its peak). Who knows? The issue is whether it’s a good proxy for the SF housing market. I say it’s absurd to think so. If you’re talking about the market in general, maybe. But looking at a single stock to try to guess the direction of the housing market is foolish.

anon — what part of “lazy person’s proxy” don’t you understand? You spreadsheet pedants are so literal! In the immortal words of Tyler Durden, “how’s that working out for you?” 😉

anon, the Google effect on SF real estate was/is mainly confined to Noe Valley and the Mission, but it was VERY pronounced there. Every Noe open house was like an offsite meeting of Google employees.

being locked in on a good rental rate might prohibit you from ever moving. thus, one may always be negative about buying a place but great if it works out for you. that might someday catch up to you, though.

for me, i’ve been away from SF for a few years now and i’m in the process of moving back. as some of you know, rents are even crazier than ever and the places i’ve seen are skank (that’s pretty normal, though). from what i’ve seen lately, it’s cheaper and better quality for me just to buy a place (one bedroom condo) than rent some (one bedroom) gross hole somewhere.

thus, i’ll be buying a condo relatively soon. i’m actually quite happy about it, that fairly simple market forces are creating the decision for me. now i don’t have to wonder what to do and if i’m making the right decision.

“There were 10 offers on a doghouse in Noe today, OK?”

“fluj”/kenneth – was it 806 douglass which you called the “the best deal in Noe Valley”?

https://socketsite.com/archives/2007/11/weekend_wrapup_and_reader_recommendations_525_jersey_no.html#comments

did that place ever sell? if so for how much? if not your “I honestly do not know why it hasn’t been snapped up.” and “Actually, I know better than many if not all of you. So please stop it if you don’t know of which you speak.” comments are priceless.

“Let’s wait until the new towers in SOMA go to close units. Or to see if that fabled “spring bounce” happens this year. I’m betting the trend will become self evident this year.”

HEY! That’s what I say with every one of these posts! now that you’ve stolen my line, I have nothing to say. 🙂

Leave fluj alone… I don’t see why we can’t disagree but be civil. That goes for you too fluj with the “I know way more than all of you” lines…

I disagree with tipster… a RE agent doesn’t necessarily have to talk the “prices only go up” book. in fact, smart agents would start talking the “RE is falling” book.

A realtor isn’t paid just if the market goes up or down… they get paid by SALES. If they sell, they get paid. if not, they don’t. This was the mistake the NAR made the last year nation wide. They preached the ‘prices will go up” mantra too long. So sellers listed high and refused to deal, and buyers stayed home.

SO a smart NAR would start saying, “prices are going down in a controlled way”. Thus you’d get sellers to lower listing price bringing more buyers back to the table.

I know some standup agents who are making a killing right now… BECAUSE of the down market.

googlehas little to no efect on SF RE prices.

There are 18000 employyes, of which maybe 10,000 are in a position to buy real estate, spead across the whole bay area.

it’s a ridiculous conversation. i heard the same argument about the Genentech effect 3 yrs ago. google or google related buyer’s reepresent less than <3% of the SF market.

[Removed by Editor]

OT: Batten Down The Hatches (JMHO)

“…there are indications that the severest phase of the recession is over…”

– Harvard Economic Society (HES) Jan 18, 1930

“… the outlook continues favorable…”

– HES Mar 29, 1930

“… the outlook is favorable…”

– HES Apr 19, 1930

“…by May or June the spring recovery forecast in our letters of last December and November should clearly be apparent…”

– HES May 17, 1930

“… irregular and conflicting movements of business should soon give way to a sustained recovery…”

– HES June 28, 1930

“… the present depression has about spent its force…”

– HES, Aug 30, 1930

“We are now near the end of the declining phase of the depression.”

– HES Nov 15, 1930

“Stabilization at [present] levels is clearly possible.”

– HES Oct 31, 1931

anon2, I wasn’t talking to you. And no, that wasn’t the one. That property, which I’m certain you never saw yet still see fit to pass judgement upon, will be going back onto the market shortly. You’ll see.

What’s funny is that all of you “sky is fallers” are actually detached from reality. The market, right now, is quite active, and quite expensive. I just don’t understand how you supprot your perspectives. Your LOUD perspectives. It isn’t happening at the moment, yet you take it for granted that it WILL, and further, that it ALREADY HAS. That’s not credible.

I guess the main thing is that, yes, volume is down. Yes, there has been a shift in buyer perspective. But many of you need to put a much finer point on it than you do! Not any old property in every ‘hood is going gangbusters any more. But if it’s good, and in a good area, it’s likely to merit a lot of attention and sell in relatively short order. Does that mean the sky is falling? Far from it. Far, far from it.

Is that a return to balanced? Maybe. A harbinger of worse things down the road? Maybe. A story of two San Franciscos? Maybe.

What it isn’t is “a precipitous collapse has already occurred.”

fluj is right- if its a good property (fixer or not) in a good area it sells fast. if its not, it will sit. that is a big change from what we’ve become used to. its like what ‘usually a renter’ said above; high prices/rents on skanky places was the norm and now those units may go unrented-but if the unit is nice you had better get it before someone else does.

IOW the buyers are still out there, waiting in the wings; they can wait for the right product (not just any product like before) and when it comes they pounce.

This discussion makes me realize that the frustration of trying to buy in 2005-07 may actually have a silver lining. Bidding against people who were snapping up anything and everything at 20-80% greater than my concept of value was disheartening. The side effect is that now much of that crazy money is safely sequestered in overpriced properties. Competition on the buyers side won’t be quite so insane (yeah – there will still be some insane overbids, just not as frequent)

Its kind of like the way that all-you-can eat buffets are laid out. The cheap stuff : jello, macroni salads, and bread appear at the front of the line. When the crowd is big and the lines long, the hungry snap them up the low value stuff first leaving little room on their plates for the good stuff at the end of the line.

Now that the crowds are fading, it is easier to go directly to that crab and lobster at the end of the line.

OK, I admit that that’s a weak analogy but I’m just trying to say that the dude carving up the prime rib is still carving and will likely be the last one to go on break when the crowd fades. Meanwhile there are a lot of sated customers stuck at their tables, loosening their belts and rubbing their bellies full of pasta and rubber chicken.

@Milkshake — it’s a reasonable analogy, but I think the crab/lobster were taken as well.

The question is whether you have the courage to nibble at the good stuff when half the restaurant comes down with food poisoning, even if you may be very hungry and first in line? 🙂

Um, hello folks – places are still selling, people are still out looking and buying – and I seriously doubt Fluj will end up working at a 7-11 somewhere. Sure, a lot of people that wandered into the real estate business during the boom years will most likely wander on to other things – but like ex SF-er said, plenty of them will still be working and I a sure making a very decent living at it. Sure, things are changing. The market is not collapsing, nor will it come to a grinding halt – life will go on. And I’m sure Fluj will be just fine. A lot of you people are just downright mean. You need to get a life!

At the risk of having someone tell me I’m a moron or that what I don’t know fills volumes, here’s my personal (yes, anecdotal) view on the whole “pouncing” theory:

I’m arguably one of the potential “pouncers,” but there’s little chance I’m going to “pounce” into the market on a slight drop. It’s like I said yesterday, don’t try to time the bottom. If you do, you’ll probably end up catching the proverbial falling knife. Wait for the bottom (as long as it takes), then wait for the run-up to start.

And frankly, to those who might say that *their* clients are more “ready to pounce” than I, I’ll just say that my agent probably thinks that about me, too.

I reserve barbs for those who deserve them. Lambasting me about an unknowable anecdote, predicting a future convenience store employment aptitude etc. And who said slight drop? I’m not even sure I did.

Most of the people on here don’t talk slight drop. They talk cataclysm. Shoot. If a cataclysm happens then I got buyers galore. (Just kidding, sort of. I do have buyers hoping for slight drops because they are slightly priced out. They are writing offers, so I know they mean business. If that’s different than you, then OK. Good luck to you.)