Redfin attempts to go analytic on the anecdotal and publishes “seven tactics for selling a home (pdf) more quickly and at a higher price”:

1. Don’t overprice your property

2. Set your price to show up in web searches

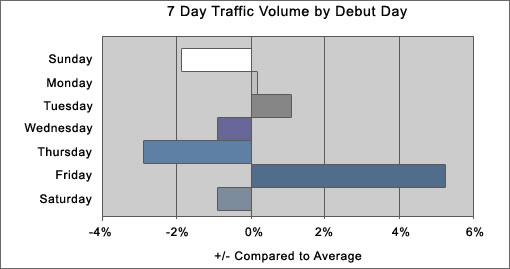

3. Debut on Friday

4. Stay engaged

5. Market the property online

6. When selling your home, stay put

7. Wait until neighboring foreclosures are off the market

And while we’ll be the first to note that the tactics/findings are anything but earth-shattering (and perhaps even common knowledge to many), they are appropriate. And we do appreciate the analytic approach.

[Full Disclosure: Redfin is a sponsor of SocketSite (but provided no consideration for this post).]

∙ Seven Tactics for Selling a Home: A Data-Driven Approach (pdf) [Redfin]

How the hell would they know? Two days ago my buyer client called me about a listing in Noe. I called the Refin agent – never a call back. I called the owner and we met. I asked him what Refin did for him. The answer – NOTHING – just take $4,000 at closing. From this procedure, they know what works? MK

exactly, MK. You get what you pay for, eh?

$4000 gets you listed on MLS. That’s about what it is worth (until someone do a open and free listing to compete against MLS).

Redfin makes no secret about it. Their listing service is just that. It is essentially FSBO.

Malcolm, no disrespect but What do you know? Your client found that property and told YOU about it. Seems like they did the work if they decide to buy it. What’s your fees? I’m sure its not $4,000.

Never bought anything from Redfin, but I would if I found a place on my own and wanted to write an offer. Looks like the seller above got their $4,000 worth. People are asking to view their property without paying hign end commish.

Again, nothing against you but since you made the comment, I had to call it out.

At the end of the day, there is a structural downward movement in commissions.

In 5 years time, 3% commissions will be the norm instead of 5%, making sellers better off. Hard to say with agents, b/c prices will probably be higher then as well.

Redfin and the internet are changing the real estate landscape for the better.

Hmmm, RT – I think I will disagree. I think with the market slowing down and changing, you will see commissions hold steady or go back up a bit, as homes take longer to sell, more to market, and agents working harder. When we were living in the DC area, during the frenzy we noticed most of our friends were able to negotiate pretty low commissions to sell their homes – not so much when the market started turning there a little over 2 years ago.

I’m seeing just what movingback is describing. The average bid on my website to represent a seller went from 4.46% (72 days on market) to 5.27% (111 days on market) between ’06 and ’07. The reason? A homeowner transfers the risk of selling his/her home to the agent in exchange for a sales commission at closing. As the market weakens and it becomes less probable a transaction will occur, the price of that risk increases.

I never understood why the seller paid all the commissions. Why not let seller and buyer pay their own agents (and allow different percentages or other payment structures if they so chose)?

When the market slows, agents become more deperate, and are willing to negotiate their commissions lower to get a sale. it’s really that simple. it’s happening all over the place.

people who don’t believe the internet, and the likes of redfin are putting downward pressure on selling commissions are not rational and do not understand the state of affairs.

From the seller’s point of view, commissions should be tiered, with increasing percentages for sales above comps. As it is now, there is much incentive for a seller’s agent to push to take the first offer, even if low, and move on the next deal, and very little incentive to wait until the seller receives a high offer.

A sale price of say, $20k higher, means only $250 more to the selling agent (they receive 25% of the 5% commission). So while this $20k is a huge deal to the seller, it is peanuts to the agent and hardly worth waiting another month or two for. I am definitely going to suggest some sizeable incentives for my agent when it becomes time to sell.

@RT

Desperate? For what, money? They’re always desperate for money. But they sure aren’t desperate for listings because there’s a glut. And that’s the problem. Excessive inventory begets longer days on market begets higher operating expenses to the agent. To avoid shrinking margins, each winner (sold listing) must offset an increasing number of losers (expired listings). Your theory just doesn’t add up.

anon@2:44 : I’ve often wondered the same thing. The problem is that comps are a little too vague to be used as a metric to base commissions on. In fact it may cause “comp fraud” much like the opposite appraisal fraud that we’ve seen in the past few years. If you’ve looked at comps on paper and then actually visited those properties, you can see that the paper comp is lacking.

I’m not aware of any financial services organization that does such comp based compensation. It seems like it would be pretty cut and dried for a financial adviser to have a variable component of their compensation based on how well their strategy compares to the S&P 500 for example. Instead they get a fixed percentage of the assets that they manage with little direct incentive to make the portfolio perform well. Why is this ? It seems like you’re better off throwing darts at the stock market than hiring a financial adviser.

anon 2:44 — it can be much simpler. I’ve had two associates in my office sell places in the last 6 months with negotiated incentives. You just spell them out. It went something like seller’s commission is 2% up to 800,000; 10% of anything between 800,000 and 1M, and 20% of anything over 1M. Makes sense, and their realtors worked hard (but I never asked what the selling prices ultimately were).

I still get about 10 unsolicited postcards/letters a week from realtors begging to sell my place, so I don’t think the glut is having the effect marc hypothesizes.

RE: Marc’s and RT’s comments. My Aunt is a 25 year broker in the upper end suburbs west of Boston, which saw a big bust in the late 1980’s, so I’ll post her honest comments about agent behavior during cycles as soon as I get them from her. In the meantime…

Marc brings up an agreeable point:

“they sure aren’t desperate for listings because there’s a glut. Excessive inventory begets longer days on market begets higher operating expenses to the agent” This is highly possible as agents are just too darn busy to manage may properties for long periods of time.

RE; RT’s comments. I also agree with the potential for an agent to take on more listings, even at a cut price. (I’m in sales in a different industry) As a slesperson, you always need to have multiple irons in the fire b/c you know some leads just won’t pan out. If you have cashflow needs or a family to feed, you do what it takes up to a point to get money in the door. A broker may take more listings in an attempt to net out a certain number of sales or certain net income.

So the need to take additional listings or cut rates might just depend on the broker’s personal situation and work ethic. Stand by for honest answers from my Aunt.

@ RT – sorry, I disagree. We sold 3 properties in the DC area during the frenzy in 2001-2004. They all sold within weeks. Agents were undercutting each other like mad to get our business. When we sold our last property in late ’06, we paid our agent a full 6%. It just makes sense if you think about it. Also, I’m not saying the Internet hasn’t changed the way Real Estate changes hands these days – but when it comes to the real movers and shakers, and those that really control the market, I just don’t think the Redfins or Zip Realty’s of the world are making that much of an inroad. Not here in San Francisco anyway. I can’t think of a single Redfin or ZipRealty sign anywhere in my neighborhood.

@Trip

Interesting idea, tiered incentives. However, it motivates the listing agent to lowball the seller. It’s hard to get away from the information imbalance between homeowner and agent. For a seller planning to go the full-service route, the traditional approach of obtaining a CMA from two or three brokers and picking one is probably still the best way.

I’d be interested in seeing the residential sales business move towards unbundled a-la-carte services with fixed fees. There could be a menu of prices for valuation/pricing services, MLS listings, perhaps a monthly retainer during the marketing period, and stated charges for services during the escrow period.

Brokers could provide a discount for a seller signing-up for a full package of services. And buyers would pay an agent for the assistance they receive. Of course, a seller could state in their listing that they would reimburse the purchaser up to $X for r.e. agent fees.

Those agents providing the best service would still make the most money. The better agents would charge higher fees but they wouldn’t be making the windfalls in a strong market (i.e. getting both sides of the commission on a sale that goes into escrow within 3 days). This idea probably won’t be popular with the Realtors but I think it would encourage greater professionalism. Most other professions operate this way.