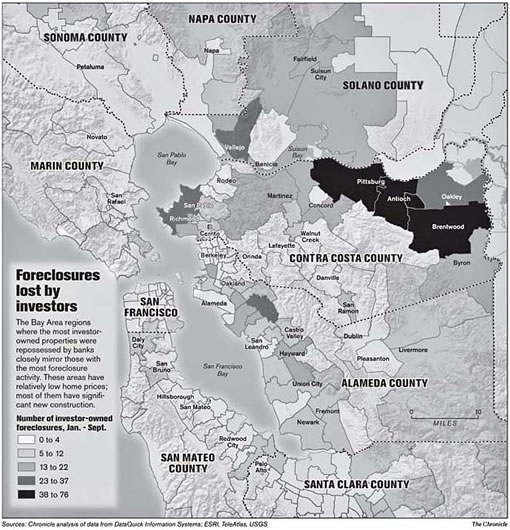

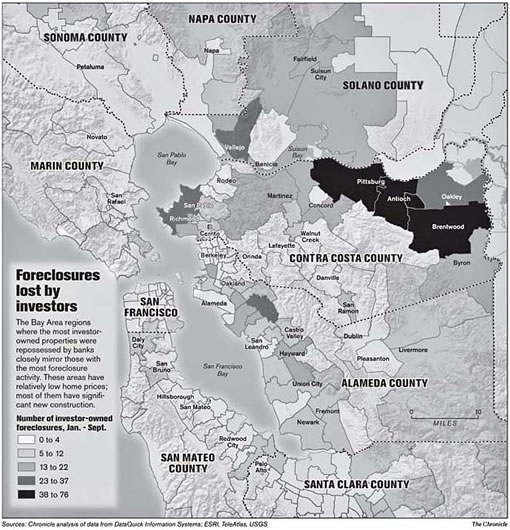

“The Chronicle analyzed ownership information for 6,557 Bay Area homes and condos repossessed by lenders in the first nine months of this year. Those represented 94 percent of all Bay Area foreclosures during the time period; full records of past ownership were not available for the remaining foreclosures.

Of these, just under 1,000 were owned by 439 people who had multiple properties foreclosed upon from January to September. An additional 349 foreclosures were owned by people who listed mailing ZIP codes different from their property’s address at the time of purchase – suggesting the properties were an investment, not a primary residence.

The vast majority of these properties were bought with little or no money down, according to an analysis of DataQuick’s loan information. About 69 percent of the investors got 100 percent financing, meaning they did not put down a dime of their own money toward the purchase prices. An additional 12 percent made down payments that were less than 5 percent of the purchase price. Only 10 percent of investors put down the standard 20 percent.

Some 80 percent of the investor-owned Bay Area foreclosures were purchased at the height of the real estate market in 2005 and 2006, public records show.”

[Editor’s Note: “Investment” properties are often undercounted due to buyers self identifying their purchases as being owner-occupied in order to benefit from more favorable mortgage rates/terms.]

∙ Investors own about one-fifth of Bay Area homes in foreclosure [SFGate]

Is that some shading I see on the Tiburon/Belvedere peninsula? Small, I know, but “the fish rots from the head down” as they say….

Location, location, location.

Do people actually live in Antioch/Pits etc? If you’re a foreigener, you’re looking in SF not elsewhere.

RT, maybe you should get out a bit more and work out the answer to your question for yourself? Yes, there is a world beyond SF, surprising though that may be to some.

I do agree, though, that it’s location location location. I was playing around with Redfin yesterday after reading this article, and was stunned at the farms of REOs in, for example, east Oakland. Properties whose last sale was in the $500k to $600k range, have been foreclosed, and now are on sale for $200k less.

RT, hold on to your hat, some who live in the east bay moved there to be CLOSER to their jobs. The tenants in the office next door to mine moved to Oakland, and a lot of their staff went from being renters in the city to owners in the east East Bay. I am becoming more bullish on Oakland myself as a future investment opportunity after the “dust settles” and prices have dropped back to historic norms.

Another good reason NOT to bail these people out. If foreclosures are on “investment” properties–I say, let ’em foreclose. Good riddance to bad rubbish. Take the speculators out of the market so prices will be more in line with reality and true supply/demand. Seems like foreclosure rules should be different for owner owned (especially if that’s the *only* residence) properties vs. investment properties.

The concentration of foreclosures on the eastern fringe of the bay area in Contra Costa County are in line with the RE investment adage “buy in the path of growth”.

But I thought that applied to raw dirt, not developed properties. I guess these investors were interested in easy flips (as in do nothing more than hand over the keys) and not earning via developing properties.

Milkshake, this is where there were wads of new houses that “investors” could buy with little deposit with the expectation that prices would have increased by the time construction was complete. This minimizes the length of time the flipper has holding costs and maximizes potential profit… until the market retreats.

does this mean that a bailout will include all those folks who paid their money for one of those “carlton sheets no money down” get rich quick schemes?

make it stop make it stop

What is with the bailout talk? There is no bailout, nor is there going to be. The rate and refi games that borked lenders and borrowers are playing with each other will only reduce some of the pain that they now have to share with each other. The whole game is still collapsing hard. Anyone tormenting themselves over imagined bailout scenarios should do themselves a favor and read Nouriel Roubini’s take on all of this. Make it stop, indeed.

It is interesting to watch the change in the mainstream press coverage of housing since the credit crunch got rolling in July. There are fewer and fewer housing bulls and more and more dire predictions (see Paul Krugman’s Friday NYT column for a good example ). While I’ve always been critical of the flippers and real estate agents, the financial services industry is turning out to be the real villain in this story and once again the financial pain will be inflicted on the average American in the form of a weakened economy while Hank Paulson and Co. try to minimize the damage to his friends in the investment banking community.

mktwatcher,

Don’t forget to assign the blame (perhaps the lion’s share) squarely at the feet of Alan Greenspan and all the other “market socialists” (in Japan and Europe) who believe that by literally stuffing money (as credit) into a world that has no productive use for it they can avoid the necessary pain of economic contractions. I fear that the foolish attempt to avoid recessions since the mid-1980s is setting us up for something really bad.

Satchel – George W Bush’s ownership society means that building thousands of McMansions was a perfectly legitimate reason to pump cash into the economy. More homeowners means more good American family values in George’s world. Never mind the condition of US infrastructure or the billions in tax breaks that never “trickled down”. Every time I am certain that we will see the payment for these sins, somebody finds a new way to defer the pain. I keep telling friends I feel like I live in Russia.

George W. Bush’s ownership society has worked perfectly.

The banks own you.