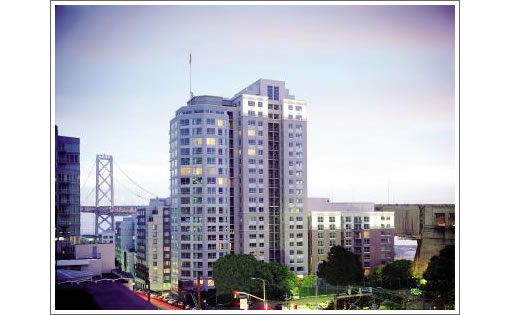

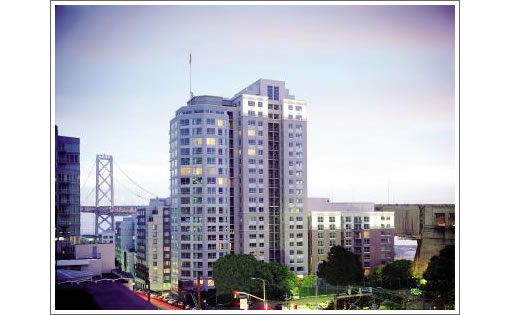

400 Beale #1501 has been on the market for a little over a month. Advertising the largest 2 bedroom, 2 bath floor plan at the Bridgeview and a “huge final price reduction” of $24,000 (2.4%), it’s currently listed at $975,000.

Enter 400 Beale #1201. It’s the same largest floor plan as #1501 (albeit three floors below). It’s another bank owned (REO) condo in the Bridgeview (no, not Bayview). And it’s now on the market for $825,000.

And while it appears that #1201 might be tenant occupied (which could affect the price), and those three floors do make a difference on the Bay (but not necessarily bridge) views, we’re still calling it a concerning comp (but not quite a troubling trend).

∙ Listing: 400 Beale #1201 (2/2) – $825,000 [MLS]

∙ Listing: 400 Beale #1501 (2/2) – $975,000 [MLS]

∙ The SocketSite Scoop On That Short Sale In Rincon Hill [SocketSite]

Well, I wouldn’t agree that this is entirely the same view. When you are looking out towards the bay from #1501, you have an unobstructed view. From #1201, you have Baycrest partially blocking the view (it is 14 stories tall). Now, whether this should command an additional $150,000 is debatable, but there definitely is a difference.

[Editor’s Note: We never should have said “same,” and the three floors do make a difference, but we’re not so sure about “unobstructed” views from either (see the listing photos for #1501).]

How would tenant occupied effect the price? Cause they can’t show it? Perhaps the owner who’s being foreclosed on lives in it? Do they normally tear it apart in a short sale like people do in regular foreclosures?

The views from #1501 are surpringly not very good, especially the bay views

How can tenant occupied property affect the price? Let me count the ways! They do not have to be slobs to obliterate the effects of your kind offer to send in a housekeeper for them on Saturdays. First impressions are important, but the tenant does not have any skin in the game.

No economic motivation to go Martha Stewart on the place. If you have a less then perfect relationship with your tenant, this is where payback comes into play. They may feel put out and threatened that the are losing their home and sabotage your efforts to sell.

Owner occupied homes have occupants who are motivated to put their best foot forward, even it if it at an extreme incovience, (TV and Tivo and boys electronic toys all go to storageland) (all thd wedding/baby/family pix off the wall and into boxes) No evidence of arts and craps.

Tenants can actually be slobs, and since most buyers make up there mind about a home in 10 seconds, if you are looking at a pile of mountain bikes in the bathtub and tiremarks on the wall, or a linen closet full of semi automatic rifles that could turn off the potential buyer.

Then there is the food debris, dishes in the sink, towels left in n normal places, but still used towels in a bathroom, or cheerios on the shag carpet. This normal signs of living can real turn offs to buyers, especially in high-rise living, where the home next door can be staged and fabulous. Tenants can also be uncooperative to showings, making it more difficult to show.

Then there are the tenants whose view or art crosses into other people’s definition of pornography. If it weren’t for two very angry tenants, I never would have been able to afford my first home. They even painted their kitchen a truly ugly blue, grew cobwebs, and refused money to move out. I keep them in my prayers every day.

the listings you linked this morning didn’t show a single photo from inside the unit. isn’t that a rather large concern when dealing with reo’s since they tend to be neglected by their imminent foreclosure owners?

Why is everyone assuming the place is trashed? First off, I believe it’s usually foreclosed owners that trash property before the bank kicks them out. This place is tenant-occupied. What possible incentive would a tenant have for trashing an apartment just because their landlord was being foreclosed on? Just not sure why everyone is suddenly generalizing here. From what I’ve seen, tenant-occupied properties are usually shown by appointment.

I saw 1501. Views are great from just about every room. Not unobstructed, but I thought they were fantastic. Very, very pretty. The layout is superb and the building amenities are remarkable.

And now with 1201 at $674 psf, waaayyyy down from about $850 or so last year, that building is certainly the one to watch. Unit 711 (with much worse views, if any) sold for $706 psf in 2004 (!) and now prices for higher floors are below that. Unit 1108 sold for 750psf in 2004 (!), and now we’re at 674 for a higher floor?

Prices are UNDER 2004? And falling!!

Down 10-20% in one year! That’s about a downpayment. Or two.

While maintenance can be a problem with tenants, the real issue with tenants are (1) the possibility that they will fight the owner move in eviction; and (2) the required payment to tenants in an owner move in (OMI) situation. First off, if a tenant fights an eviction, even an OMI where the outcome is assured, it can add months to the time you can occupy a property and cost you the mortgage and some legal fees during this time. This option will completely screw the tenants credit history and rental history as they have no legal right to stay in an owner move in situation, so most prudent renters won’t do this. However, sometimes when an owner/seller if having financial difficulties they are not getting the best tenants in there in the first place and hence someone would be willing to screw their credit/rental status for 6 months of free rent during the eviction process. You basically have to go through some legal processes which end with the Sheriff coming out and encouraging or forcefully removing the tenant. So a contested eviction is kind of the worst case scenario and is pretty infrequent. The real issue though is the mandated eviction payment of I believe $4,500 per tenant, even if you are owner occupying a condo unit. So, if there are three legal tenants there, you have to pay nearly $15,000 in eviction fees to the tenants and give them a month or two to leave. And the maintenance thing goes back to the creditworthiness of the tenant – if they care about renting again in town and using you as a reference, they are not going to trash the place as you could sue them in small claims court to recover any significant damage beyond bad house-keeping. So mainly, it’s the eviction payment of $4,500 per tenant and the slight occupancy delay, but occasionally it can be worse if you have problem tenants.

The description above says ‘might be tenant occupied’. I called about this unit over the weekend, and the man I spoke to was vauge about the unit being occupied. I was left thinking it was still owner occupied.

But I guess that doesn’t make sense with a short sale? The owner would want to help sell it, right?

“Troubling trend” or not (Wayne previously accused me of gloating), I can’t help but feel like a vulture waiting to feast upon the carrion of victims of creative financing.

*blush* Gee, that doesn’t sound very sexy … or ladylike, does it? 😉

I thought condos are not rent controled, so the new owner can easily get the tenant out.

I believe rent control depends on the date of build, right? But this building is too new to be affected, I think.

Miles – what if the new owner just lets the tenant ride out the lease and then not offer to resign? Does this still count as an eviction?

Buildings constructed after June of 1979 are not subject to rent control.

John – that is what the real estate agents will lead you to believe.

California state law: people who rent condos and single family homes after 1997, do not have rent control. But these tenants do have eviction control. Some tenants, over a certain age or with a chronic health condition, can not be evicted ever.

Most tenants do not know the law and may leave voluntarily. But, remember tenants can get free legal advice in the city and may fight you.

I am not a lawyer but there are the standard reasons that allow an owner to evict the tenant: failure to pay rent on time, etc.

An owner move-in eviction is expensive and tough to do. Plus there is a restriction on the number of OME in a building.

The easiest way to get rid of a tenant if the tenant is not paying market rate rent is to raise the rent to market rate. If the rent will be raised more than 10%, the owner must give the tenant about 65 days notice of the new rent.

Of course if you are thinking about buying a place with a tenant it is best to consult with a lawyer specilizing in these issues. For me an hour with a lawyer was money well spent.

[Editor’s Note: Rent Control In San Francisco: The Real Rules (and we’ll second that part about legal advice).]

If there is no rent control, but eviction is still tuff, why not just raise the rent to $10K/mo or more?

Regardless of rent control, I think landlords are limited to the amount of increase per lease (some set % amount per year) but am not an expert here.

“Down 10-20% in one year!”

Not quite, because prices aren’t falling in San Francisco….it’s just more “instant equity” for the next buyer!

Mostly correct here. Yes, buildings constructed after 1979 are not subject to rent control and you can raise the rent as much as you want when the original lease runs out (sounds like a way to get a tenant out actually). Units built before 1979 are subject to rent control which limits the increase in rent to 60% of CPI, or a little less than 2% per year. Yes, all units that are rented regardless of their date of construction – condos/house/apartments/illegal in law units – are subject to the eviction rules of SF which basically say that you can only evict a tenant for non-payment of rent or an owner move in (well, there are a few other ways, but those are the main two). No, the tenancy does not run out after the initial lease, all units in the city are converted to month to month rental agreements after the initial lease expires – and they are still protected by rent control (if applicable) and the eviction limits. Yes, excellent point about “protected” tenants – elderly or chronically sick tenants who have a long term occupancy of 5-10 years in your unit – once they are in, they cannot be evicted even with an owner move in and are probably there for life – major, major issue there. But I’d have to disagree that an owner move-in eviction is difficult – it’s actually fairly straightforward from my information. Most people get a lawyer and pay a couple of thousand in legal fees, but the majority of the time with a condo or house, it’s not that complicated and the outcome is pretty certain and fast. The higher tenant eviction fees of $4,500 per tenant are a new aspect to it, but generally these costs are pretty minor in relation to the whole purchase price. However, when you are talking about an OMI eviction on an apartment or TIC building, then you run into quite a few more issues with this, so then it becomes complicated.

“Unit 1108 sold for 750psf in 2004 (!), and now we’re at 674 for a higher floor?

Prices are UNDER 2004? And falling!!

Down 10-20% in one year! That’s about a downpayment. Or two.”

Unit 1108 is a 694 sq.ft 1 bedroom. But you know that already, don’t you? To make a really meaningful comparison with this 2bd unit and support your point, you should pick a 400 sq.ft studio and then compare them on a psf basis.

blahhh, notice how tipster was largely ignored until your post calling him/her out on this (likely deliberate) “mistake”.

So, there is eviction control…..what prevent the owner from raising the rent to $4500/month or whatever amount to cover the mortgage?

When I rented, I always added a line in the leasing to limit the per year rent increase. Unless the tenant has that, I don’t see how they are really protected.

Units 1402, 2404, and 1405 are also for sale at wishing prices well above $675/sq. ft. Wonder what this short sale does for comps?

http://sfbay.craigslist.org/sfc/rfs/444406994.html

http://sfbay.craigslist.org/sfc/rfs/444397892.html

http://sfbay.craigslist.org/sfc/rfs/444401787.html

same realtor too. probably reo’s as well. how sad.

I think the situation here is that these are no longer the new buildings, many other new buildings were built in better locations, better floor plans. The location is pretty loud with the bridge right there. I bought a new place a short time back and did not even consider this building, regardless of price.

how’s the noise in these units if 1) facing the bridge and 2) facing to the side (parallel) to the bridge? i was in one of the Portside units and it was very loud from what appeared to the one and only openable window from the whole unit, and those units are asking about 500k for a studio.

Turned out my first search overlooked a few units….#2002 and #1308 are also listed (different realtors). But that’s not a lot of units for a 245-unit building.

But I did find one of the 2-bedrooms for rent for $4,100. So if there are any investors looking at this short sale, they’ll still need to put about $200K down just to make this investment cash flow neutral…will be interesting to see what happens to this unit.

I just visited a friend on the 24th floor of the Bridgeview. The unit was not noisy. Even out on the unit’s patio overlooking the bridge, the noise wasn’t bad. Great views, BTW, from the 24th floor.

Condoshopper — FYI — there is no reason to open the windows at Portside. The building has Z vents in the exterior walls. The occupants have a slide control for a variable speed fan which pulls filtered outside air through the vent and exhausts it through a duct that exits the roof. The acoustic windows are designed to remain closed at all times for noise abatement. Additionally, Bridgeview has air conditioning if my memory serves me correctly.

To everyone who asked why not raise the rent substainally in order to force the tenant to leave, you maybe provoking a battle with the tenant. The advice I recieved from my lawyer was to survey the surrounding compariable units and raise the rent to market rates. That way the tenant has little evidence to challenge the rent increase as a way to evict the tenant.

Miles: about buildings built before 1979, rent control depends on when the lease was signed. If signed after 01/01/97, the tenant does not have rent control. See the socket site link at the bottom of my last post.

Thanks for the clarification CA (namely that leases for SFRs and condos signed after 1/1/96 are not subject to rent control regardless of the date of the building’s construction).

Sorry, no conspiracy to commit a mistake by listing those units, which *are* smaller, but are also on lower floors. I only picked them because they were on nearby, but lower floors and sold in 2004.

The only similarly sized two bedroom unit on a nearby floor that sold in 2004 or early 2005 was unit 1907, 4 floors above, that sold for about $900 psf, even higher than the two examples I cited. I omitted this one because it likely has a better view, but it was the only other data point. No intentional mistake: the lower floor should have helped, at least in part, to cancel out the size differential. So I was being quite conservative: I did not list the 900psf sale.

The issue with the city eviction control laws is that you can’t skirt their intent by arbitrarily raising the rent to some preposterously high level, because then you are in effect, evicting the tenant and that is strictly prohibited. You can raise the rent to market, but if you go over, expect a lawsuit for wrongful eviction: you evicted for a reason that wasn’t one the legal reasons for doing so. The elimination of rent control on buildings built after 1979 was to promote people to keep building new buildings and insure that they could always collect market rents without fear of getting stuck in rent control. It was *not* to allow owners to skirt the remaining laws, one of which is eviction control.

On the other hand, a tenant paying market rents is not a difficult tenant to induce to move. The costs or packers and movers for such a place would be about $1500. Add in half a week’s wages to the tenant for unpacking, changing addresses, and toss in $5K for inconvenience and just about any tenant at market rates will walk away. $10K-15K. A below market tenant will not take that deal, but for at market tenants, it never ceases to amaze me how a seller will NEVER PAY A PENNY- WHY SHOULD I? IT’S MY CONDO and yet the new owner will drop his offer price by twice that much and give half of it to the tenant every time and everyone is happy, including the seller who took in in the shorts for $2 on every dollar he could have just paid to the tenant.

As for noise in these Bridgeview units, when I was in unit 1501, the windows were wide open and I didn’t hear anything unpleasant.

And as for newer buildings crowding this one out, this building was built 5 years ago. Are you telling me that the buildings in this area don’t even have a 5 year life before they are considered old? There will *always* be some newer building. No building would be safe from a decline 5 years down the road.

AnonN, thanks for the insightful info regarding vents.

This has always been one of the least desirable buildings in the area. Not really deserving much attention…the best thing you can say is that the prices are lower than other highrises. That’s about it.

Heya Tipster – your calculations are about right to induce market rate tenants to leave in apartment buildings, but we’re talking about SFR’s and condo’s with only one unit. The only time you would pay in excess of the required $4,500 per tenant eviction payment is if you wanted to rent one of these units as an investment and not occupy it. Most people who are buying these units are going to occupy them and as such can invoke the owner move in eviction just cause. Most tenants find out real quick they have no legal recourse in such a situation and now take the $4,500 per tenant and go without a fuss. Your buyout strategy can work in multiple unit apartment buildings (assuming every single one of the tenants takes the buyout), but the owner move in route is what most people use for SFRs and condos.

Miles,

I’ve been bought out before and I can assure you the $10-15K over the required relocation payouts is the cheaper solution for the new owner. First, the legal fees for doing an OMI are not cheap: at least 10K if the tenant doesn’t fight, up to $50K if he does. Walk up to the tenant and offer $15K over the relocation – probably no fight.

Second,you get closure: when the buyout agreement is written, you get a covenant not to sue. No wrongful eviction worries hanging over your head, for years.

Finally, you get a clear title. If you get into a bind and need to rerent down the road, you can, without a wrongful eviction suit,which would be sure to follow.

As for condos, I think the one OMI per building rule could stop you cold, but I don’t know if a condo would be considered its own building.

Note that this doesn’t include the tax effects – if the tenant is in a higher tax bracket, you’ll have to account for that and offer more. And if the tenant is under market, the amount required to make the tenant leave could be much more.

But if you can get out of a bad situation for no more than $10-20K over the relocation fees, it’s a better deal for the owner to buy the tenant out. The old owner will never give the tenant a nickel. The new owner always pays and everyone is happy.

BTW: your lawyer will come up with 100 reasons why you shouldn’t do a buyout. The only real reason is that the lawyer won’t make as much money, and OMI is a lot of easy money for a lawyer.

“First, the legal fees for doing an OMI are not cheap: at least 10K if the tenant doesn’t fight, up to $50K if he does.”

Not true. OMI legal fees for a tenant who does not fight will be between $1k – $2k. Only in the most extreme cases where the owner didn’t adhere to the specific procedures for filing an OMI will the legal fees approach anything near $50k, and that’s only if the owner wrongfully tried to evict versus making a simple error following the procedures, which would be more in the $10k neighborhood. Don’t believe me, call Sirkin’s office.

have the folks with bay facing units had their sweeping view turned into a peekaboo view now that the infinity and watermark are in front of them?

this is a nightmare for anyone buying a place with a view, imo

When I was negotiating my buyout, I called a different firm, and they quoted me $10K. The new owners were also quoted the $10K figure, but they may have figured a small amount of opposition. So we came to agreement pretty quickly.

It doesn’t apply here, nor did it apply to me, but a lot of buildings have illegal units that the tenant can call the department of building inspection and they will issue a notice of violation and have it removed, and make sure it does not get rebuilt (they make you cement the sewer lines from that unit and the plumbing to it).

If you have one of those and you force a tenant out using an OMI or an Ellis eviction, you can pretty much kiss that illegal unit goodbye. The investment in those units is frequently not more than $50K or so, but still, it’s $50K down the tubes, and the rental stream is gone forever. Another consideration when deciding whether to buy out a tenant or not.

From the higher-floor bay facing unit I was in, neither the Infinity nor the Watermark blocked bay views. With the bridge and the bay in the center of the view, the Infinity was on the far left of the view, and the Watermark on the far right.

Does any one have the comp for the 12th floor unit that sold in this building in a matter of days back in June, or was it in fact 1201?

i dont know observer but i just found the penthouse for sale for 2.4mm:

http://www.mcguire.com/(twrlmtmg4lbjhcvx5szjg3ix)/property/property_details.aspx?CN=110-14716

Sorry, I agree with KK here – the legal costs for most OMI’s are going to be a few grand at most in the vast majority of situations – and if you really want to go thrifty, you can do it out of one of the NOLO Press law books, though most lawyers would not recommend you do that. Again – we are talking about condos and SFRs that are treated very differently from apartment units for OMI’s (and yes, a condo is treated as its own unit, so someone doing an OMI in another part of the building will not affect your ability to OMI). And truthfully, if someone is going to fight the eviction – they are kissing their credit rating and rental potential goodbye as there is a paper trail a mile wide when this happens. There are really no legal grounds to fight an OMI eviction out of a house/condo other than the “protected tenant” status (so double check to see if the tenant has been in there for more than 5 years first thing and then check if they are a senior or are ill). Seriously, if someone is going to fight you, they are going to try to bend you over for more than $15K anyways. BTW – you also need to spend those same legal fees to prepare the buyout documents that you speak of as well. And yeah, it gives you some piece of mind that the tenant won’t sue you (which is rare if you follow the rules) and yes, it gives you the option that you can rent it within the 3 year period if you need too, but ultimately I still think buying out a tenant in a house or a condo for much more than the $4,500 eviction fee is a waste of money.

And yes, it is a whole ‘nother ball of wax if you are talking about OMI’ing an in-law unit, but we’re not, we’re talking about OMI’ing a probably fairly well off tenant in a fairly new luxury condo who wouldn’t want to ruin their credit rating and rental history.

My understanding is that the ‘former owner’ is occupying the unit. It was not being shown as of last weekend. They have two offers on the property– both subject to inspection. Neither offer had been reviewed as of last weekend. Don’t know what current status is.

1201 is back on the market at $895k. Investor purchased the unit following the foreclosure, and made a few upgrades: new carpet, new paint, and refinished floors.