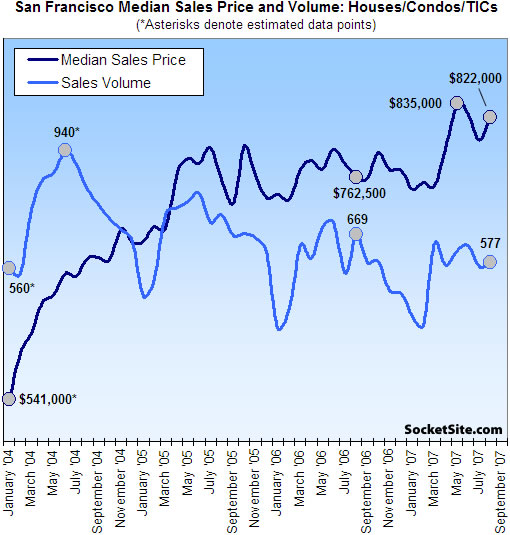

According to DataQuick, the sales volume (i.e., demand) for existing homes in San Francisco was down 13.8% year-over-year (577 sales in August ’07 versus a revised 669 sales in August ’06) but was up 2.3% compared to the month prior (564 recorded sales in July ‘07). At the same time, the median sales price in August was $822,000, up 7.8% compared to a revised August ’06 ($762,500) and up 2.9% compared to the month prior. (And yes, we’d continue to think mix.)

For the greater Bay Area, sales volume was down 24.9% year-over-year (7,299 recorded sales last month versus a revised 9,713 in August ’06) while the recorded median sales price was $655,000 (down from $665,00 the month prior but up 4.0% on a revised year-over-year basis).

Sales have decreased on a year-over-year basis the last 31 months. Sales last month were the lowest for any August since 1992 when 6,688 homes were sold. The strongest August in DataQuick’s statistics, which go back to 1988, was in 2004 when 13,940 homes were sold. The August average is 10,170.

At the extremes, Solano recorded a 9.7% year-over-year reduction in median sales price (on 42.7% fewer sales) while Marin recorded a 12.4% year-over-year gain (on 34.3% fewer sales). And sales volume continued to fall (off 35.6%) in Contra Costa county.

∙ Bay Area home sales slowest since early 1990s, flat prices [DQNews]

∙ San Francisco Sales Activity: Volume And Median Prices Up [SocketSite]

∙ JustQuotes: Apparently They’re Building More Land In Contra Costa [SocketSite]

It is a shame that the real market conditions are not reflected by DataQuick’s research and/or analysis of the residential real estate market.

In San Francisco, virtually none of the new home/condominium sales are reflected by DataQuick.

DataQuick, as well as MetroScan, the San Francisco Board of Realtors and other real estate data services do not include sales of new residential properties at the time of their actual recording at the Recorders Office.

Since the mid 1990’s, the data of new home sales has not been reported, nor has the data been revised at a later date to reflect the original sales. This includes sale activity for the majority of SOMA, Mission Bay, the Mission District, Van Ness Ave and other parts of San Francisco that has new homes/condo’s.

This sales activity may be as much as 10% of the entire market.

At some price points the new condo sales reflects over 75% of that portion of the market. The St Regis sold 102 condo’s in 2006, average price $2.4M, never reported by DataQuick nor the SFMLS;

The balance of the resale market had 49 condo’s/coops sold over $2M for 2006.

Bottom line, DataQuick’s info has been consistent, but does not reflect the real market.

Frederick

True. Sales and median price are underreported by the DQ numbers. I do think the DQ data is more useful for S.F. though than any other data out there.

I’m curious to know about the real market. Tell us how it really is,please.

It’s a decision by Dataquick to leave out new home sales, and there are very good reasons for their decision. The new home market is quite different from resales of existing homes. Developers have different motivations, different marketing techniques, more options for pricing adjustments, like new refrigerators, no HOA for two years, etc. My bet is they also don’t trust being able to get accurate info from a developer.

I can see wishing we had a full data set, but it’s not truly apples to apples, so it’s best they be kept separate in my opinion.

Even if you included new home sales this year, you’d still have to include it for the prior year. It doesnt really matter. The market is bad and going to get much much worse.

As is clear by the data, home prices are falling, no one is buying, houses will be down by 50% just as soon as the new data from this quarter is taken into account, yada, yada, yada.

As some like to say: “Just another datapoint”.

Likely response going through pessimistic minds:

“Wait a minute, this data is skewed. There must be something wrong with it. Things can’t trend UP in the SF housing market with the credit crunch and all. Let’s pick it apart and find out what specific parts don’t fit my idea of the current (declining) market and throw them out. Or maybe I will just refute the data as a whole by providing one example of a property that was sold for 5-10% under asking and extrapolate (while also ignoring five others that sold for asking or above).”

Note: Even patrick.net has given up on the idea of the SF market declining this year. Just wait till spring of ’08 he says.

We’ll see. Time will tell, not Socketsite posters and armchair economists.

Craig, what evidence do you think there is that prices (as opposed to the median price) are rising when taking into consideration what the Case Shiller index is telling us?

Anyone have data on the 91-93 decline in SF housing prices and how that tracked to the Bay Area/California/US decline?

It would be interesting to compare that to how things play out this cycle. Thank you.

“armchair economists”

Like Ken Rosen, Robert Schiller, Christopher Thornburg, Nouriel Roubini…et al?

Re Case:

“The standard SocketSite footnote: The S&P/Case-Shiller index only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).”

Apples and oranges my friend.

Also, medians are important. Not perfect, but important none the less. There is a reason you see it so widely used for representing so many different groupings of data (other than just housing).

Look at the Case Schiller data. SF correlates extremely closely with the rest of the country. We can pretend that SF is different, everyone wants to live here, etc. But the data indicate that we are not so special (although I love it here and will never leave unless my firm opens an office in Paris). Explain to me why the SFR vs. condo distinction in Case Schiller could make any difference. If anything, it would mask the true extent of the recent declines that are indicated since SFRs tend to hold up better than condos in down times.

I heard all this in the early 90s — we saw a much bigger run-up here and there will be a much bigger correction.

A real life “data point” for you all.

My family recently (late Aug) listed a 3bdr/2ba SFR. The comps in the area suggested a list price around $1.4M (give or take $10k). Our agent felt that due to a few upgrades we should list for $1.45M. We were afraid with the “current market decline” that it was better to go a little lower so we weren’t chasing the market down. We listed at $1.425M. After two weeks on the market we had 4 offers over asking and it is currently in contract for $1.55M with no financing contingency.

Some food for thought

“SF correlates extremely closely with the rest of the country.”

No.

The BAY AREA correlates extremely closely with the rest of the country.

If SF always correlated with the rest of the country, it would be the same cost to live here as the rest of the country. 3-4x difference between SF avg and the US avg indicates to me that SF has deviated (not correlated) in the past. Does the past predict the future? Citing the early 90s makes me think you believe this.

It’s not so much that Case excludes condos, but that it includes outlying areas besides S.F., which have much greater transaction numbers and thus have much greater influence on the data. I think S.F.’s portion of the SF MSA for Case is fairly small- less than 5% of the total transactions.

Karl,

People are in a hurry to use the loans they have…they are in a pinch to use it because their broker let them know what is happening today…

Q4 will show the true drop of SF.. and it will continue to Q1/2 at least

“Q4 will show the true drop of SF.. and it will continue to Q1/2 at least”

My psychic powers kicked in today too…Let’s see here…It’s getting clearer…clearer…that’s it…George Bush will be impeached by Q1/2 of 08.

Hey Karl-

If you don’t mind us asking, why did you sell?

Craig, you’re misunderstanding the term “correlate.” It does not mean that SF prices are the same as the rest of the country. It means that where prices go up or down by X% in the rest of the country, they also tend to go up or down by about the same X% in SF. The absolute dollar amount is not relevant.

Does the past predict the future? Sure — when it comes to predicting whether SF trends will run pretty much the same as broader trends. 30 years of data shows a pretty consistent match.

If anyone can show me any data that reveals that the trends in SF have nothing to do with those in the SF MSA, then you’ll convince me that Case Schiller is not relevant to SF.

Hey, if you think the go-go years are still with us, go ahead and make a pile of money. There are lots and lots of properties in SF that nobody else is making a single offer on. Buy them up and get rich — surely you can get funding for such a slam-dunk business plan.

It seems pretty obvious that the upper end is still selling but the lower end (where you need an exotic loan in order to buy) is dead. The Solano declines pretty accurately show what is happening to the “regular” bay area home buyer who is middle class. They are completely priced out and are not buying at this time.

There are a couple of thousand homeowners in pre-foreclosure right now in Contra Costa and Alameda.

The inventory of homes for sale in Solano County is really right now. I would like to know the average market time there. It must be 8 months or longer. Prices are really coming down now. You can actually buy a home (yes, probably a shack) for under $300,000. It’s been a few years since that has happened.

I’m not sure who’s misunderstanding the term “correlate” but if prices in S.F. always changed in unison with the rest of the country then prices here would be the same as the rest of the country. Obviously at some point there has been greater price growth in S.F. unless prices here started 4x higher than average.

For what it’s worth- which won’t be much to some- the Realtors historical pricing report puts S.F. at 8% annual growth vs. 5% nationally for the last 30 years or so.

“Craig, you’re misunderstanding the term “correlate.” It does not mean that SF prices are the same as the rest of the country. It means that where prices go up or down by X% in the rest of the country, they also tend to go up or down by about the same X% in SF. The absolute dollar amount is not relevant.”

No, if SF and the avg US home start at $100 and both increase 10%/year (i.e. correlate) for 100 years, they will be the same price in 100 years. Now if those % increases/decreases vary between the two groups each year (i.e. do not correlate) for 100 years, the price will be different at the end of 100 years. Maybe something like 3-4x.

Percentages have obviously not always correlated between SF and the US avg, hence the price difference. (This analysis assumes relatively equal cost at some point in the (distant or maybe not so distant) past.)

As an aside, I am not a bull on real estate anywhere in the US, including SF, just trying to bring a different view. I do not believe that SF will correct more than 5-10% though. More likely flat number-wise, but losses due to inflation for a number of years.

Correlate? I’d say the shape of the curves match – ahem, ‘correlate’ – the further back you stand.

I’d like to stand real close to the curves for 91-93 and see just where SF did and did not correlate. This has all happened before, BTW. People moved out to Stockton in the 80’s because they couldn’t afford the inner bay counties, and those outlying areas were the first to drop. And, as the recessionary years went by, the better neighborhoods dropped as well. I just don’t recall what kind of lag time – the lack of correlation – there was.

IIRC, SF dropped 15% over that period. Not quite a crash. Then essentially flat-lined for another 5-7 years. I think there is hard data to support the opinion that the better neighborhoods will be the last to fall, but I haven’t seen anyone actually offer up that data. I know it’s out there, though, I just haven’t found it.

Congrats on your sale, Karl!

You’re all almost right about correlation. Anono, if price in SF consistently went up 8% per year and prices elsewhere consistently went up 5% per year, they would indeed be correlated.

It’s not a 1:1, meaning exactly the same, correlation, but it’s still very highly correlated. Not correlated means not related, meaning it doesn’t matter what the rest of the country does, SF does it’s own thing.

That is clearly not true. If real estate is going down the tubes in all of the SF MSA, you should expect a drop in SF. It may be less, but it will be there.

If it’s going up like gangbusters, expect SF to go up, but maybe more.

Either way, there’s still a relationship. They tend to go in the same direction.

SF is not immune, but it’s probably got some better cold medicine than, say, Contra Costa.

Please god, grant me the time and the energy to start a blog in 2008 collecting, highlighting, and responding to all the SF RE bulls comments made from 2005-2007.

And by the way Craig a 5-10% correction is a monumental disaster in a city like SF. Leverage in reverse is a bitch, and if you bought anytime recently a 5% correction could mean your hundred thousand dollar deposit (and life savings) just went down the tubes. A 10% correction means that not only did you lose your life savings you are now upside down, and will need to cut a sizable check before moving. And of course you can forget about refinancing, so approx 70% of homeowners who bought in the past five years with ARMS are going to be enjoying sizable increases in their mortgage payments right around the same time the economy is going into contractions. With all the exits blocked off it will be an interesting time to be a homeowner to say the least.

Craig, you’re getting close to comprehending this point. You say: “No, if SF and the avg US home start at $100 and both increase 10%/year (i.e. correlate) for 100 years, they will be the same price in 100 years.”

But SF and US averages did not start out at $100. Since at least the 70s, SF home prices have been much higher than the average US price. So if the average SF price was $200 vs. $100 for the rest of the U.S., and they both increase the exact same percentage — say 10X (i.e. perfect 1:1 correlation), the SF average will be $2000 and the US Average will be $1000. For at least the last 20 years, SF and the U.S. price curves — ups and downs — have been pretty close to right in line (certainly with some variations over certain small periods).

I do agree with you that SF prices likely won’t crash like, say, Stockton. But that’s because the recent bubble run-up was not nearly as pronounced in SF as in other areas (hard to believe, but true. We saw pretty close to average appreciation for the U.S.) For example, OFHEO numbers (I know — imperfect data source) indicate that Stockton housing saw a 113% run-up from 2001-2006 while SF only saw 58% appreciation. So Stockton will likely bust much harder than SF because it boomed much bigger. But one huge wrinkle is that SF is much more dependent on jumbo loans than most other places, which are no longer available at all to most and more expensive for those who can get them. And all buyers will now need to come up with very large downpayments (given that SF prices are higher). If there are far fewer buyers, prices fall. So I wouldn’t be surprised if we see your 10% drop by the end of this year, and more declines in 2008. It was just a few months ago that the debate was whether prices would keep going up here. Now, the only debate is how far they will drop.

Missionite, first, too many assumptions in your argument; second, not everyone bought a $2M property; third, refinancing may very well be possible again for ARM holders in the not-so-distant future (who really knows?).

In this market, it’s all about perception. Take for example, my last seller. His house would have fetched 1.7m last year. I wanted him to list for 1.45M, because I didn’t think it would sell for more than 90% of last year’s price.

So what do I do, I convince him that comps are 1.4, but that I’m going to suggest we list for 1.45, because everyone is a little greedy, right? Well, this guy’s smart: he splits the difference, and we list at 1.42.

We get four offers, all over asking and the high bid is 1.55, almost exactly where I thought it would be – 10% off last year’s price.

The buyer thinks he stole it, the seller thinks he ripped the buyer off, and I didn’t spend too much time on it.

It’s all about perceptions. Man, I just hope it closes…

“But one huge wrinkle is that SF is much more dependent on jumbo loans than most other places, which are no longer available at all to most and more expensive for those who can get them. And all buyers will now need to come up with very large downpayments (given that SF prices are higher).”

Trip, this is not such a huge wrinkle and not really accurate. If you just read the news, you would think this was true. But go shop for a jumbo loan right now. There are lots of options at very good rates. Stated income are available w/ rates in mid 6’s w/ good credit for 3/5/7/10 yr fixed. IF you have bad credit and no down payment, then your not going to get a jumbo loan, but this has never been the typical jumbo buyer in the SF market. The jumbo 30 yr fixed is around 7% which is about .5% higher than “pre-explosion” days, and granted this has some effect, i would argue that its not going to stop very many jumbo buyers from getting what they want.

According to Bloomberg, increased difficulty in getting jumbo loans does pose a significant wrinkle to the SF area. But maybe they are only reporting the bad news? http://www.bloomberg.com/apps/news?pid=20601087&sid=arXc3wRc35Pg&refer=home

I went to e-loan and entered 1.1M value, 1M loan. 750 FICO score, not an interest only loan. E-loan says I need to put 22.5% down or they won’t take it.

The lowest rate on a ten year fixed is 8.625% with 1.606 points, no points at 9.125. 7 year fixed are in fact in the range of 6-7% with points, but only if I cough up 225K as a down payment.

I think the issue that most of us have is that people were able to buy with nothing down and now they need $225K for a 1.1M purchase. It may take a few years for people to save that kind of coin, given what passes for savings these days.

Missionite, first, too many assumptions in your argument; second, not everyone bought a $2M property; third, refinancing may very well be possible again for ARM holders in the not-so-distant future (who really knows?).

Huh? Where do you get $2M? I’m talking about the median home. If anything I’m being conservative. Let’s take a look:

Price of house: $822,000

10% Down payment: $82,000

Closing costs: $5,000

Ok so now you have 82k in equity.

You pay roughly $4,700 a month in mortgage for a year, earning an additional $8k in equity over the course of a year (bankrate.com calculator, at 6.55% which is being generous.) but you’ve also spent $48k in interest (I’m leaving out the tax benefits, but I’m also leaving out maintenance costs and property tax so I’m giving you the benefit of the doubt). So after one year of living in your house you are up to $90k in equity, and you’ve put up $143k (down payment plus mortgage payments) to get there.

Now let’s say at this point you get a divorce, lose your job or something else happens and you have to sell the house.

During the year the market took 5% off the value of your house lopping $41k in equity. That hurts but the house is still worth 781,000. Oh, but wait you have to pay commissions (buyer and sellers) on that sale price. Let’s call it 5%. That’s another $39k. Oh, and if you want to sell it reasonably quickly you are going to stage it, and theres another $5k (If you do it cheaply). And then there’s the transfer fee so you got another $5400 bill. I’m leaving out any early payment fees, the moving truck, and all the other costs associated with moving.

There’s a whole lot of other crap to consider, but the bottom line is that 5% depreciation resulted in $90k in expenses. That’s more then you put down as a down payment. In the meantime you paid $4700 a month in mortgage for a house that might cost $3k a month at most to rent. $1700 a month wasted.

So, adding it all up, in a single year you managed to blow through your life savings and then some: $110,000 in total.

And that’s just a 5% deduction. A 10% deduction means you need to bring a check to your house closing, or convince the bank to take a short sale.

This isn’t a hypthetical scenario either: in some neighborhoods of San Francisco it’s happening right now (all of these people bought their homes within the past year or so and are selling it now for more then 5% less then what they paid then):

http://www.redfin.com/stingray/do/printable-listing?listing-id=743209

http://www.redfin.com/stingray/do/printable-listing?listing-id=752522

http://www.redfin.com/stingray/do/printable-listing?listing-id=877727

I lived in Manhattan in the early 1990s. Can distinctly remember my boss coming back from the closing when he sold his place simply because he had to write a check to the bank for the difference between what he owed and what the buyer paid. And at the time you did not get a loan with just 5-10% down.

If it can happen there…

“Stated income are available w/ rates in mid 6’s w/ good credit for 3/5/7/10 yr fixed”

Rincon:

are you sure those are really available?

One of the problems is that the mortgage sites put erroneous data (i.e. blatant lies) in their advertising spiel… in order to get people to walk in the door. Then they hit them with the true mortgage rates.

The Federal Trade Commission just started cracking down on deceptive advertising.

http://www.usatoday.com/money/economy/housing/2007-09-12-mortgage-ads_N.htm

I haven’t heard of anybody doing a stated income Jumbo ARM in the 6’s… I’d like info as to who is doing them so that I can short their stock. unless perhaps you’re talking about lenders offering them to borrowers with very high down payments? (like 30%+ downpayment?)

also, who calls these “3/5/7/10 yr fixed”??? They are ARMs.

there are plenty of good jumbo loan options- at least for refi- if you call some local banks directly. I’m not really sure I’d go by what E-loan says. Call Wamu or Wells or Union Bank etc…

Also, a mortgage that has a fixed rate for 7 or 10 years- while technically an ARM- serves the same purpose as a 30 yr. fixed for someone who will only be in the place for 5 years and they probably get a lower rate.

Relax everybody. Lawrence Yun at the National Association of Realtors says everything is going to be fine. . .

Jumbo loans are certainly available, but the rates are nearly a point higher than for conforming loans. But the bigger issue is the new need for a hefty down payment. As tipster points out, the pool of buyers who have $100,000 or $200,000 cash to put down is far smaller than the pool of buyers who have $0, which is what it took to buy a $1M place a few months ago. Add in the fact that you now also need documented high income and a high FICO (unless you want to pay about 9% if you could get any loan at all), and the pool of buyers is even smaller. These factors just came into play a few weeks ago — I wouldn’t be surprised if properties on the higher end (needing bigger loans) actually see bigger declines than those at the lower end.

Waaaa, prices continue to rise. Comon crybabies, tell us how your friends Steve Jobs and Bill Gates are renters and they’re not buying until prices collapse to $100/foot.

Can all the naysayers agree to just be silent if their predictions don’t come true by a certain date? This is getting tiresome.

Anono,

Re: “Also, a mortgage that has a fixed rate for 7 or 10 years- while technically an ARM- serves the same purpose as a 30 yr. fixed for someone who will only be in the place for 5 years and they probably get a lower rate.”

I believe this thinking is what contributed to the housing mess we are currently in. If, in five years, one is sure of moving, but mortgage rates are substantially higher or defaults are high, the value of the property will almost certainly suffer.

Why do you assume, in five years, housing values will be higher? How do you know interest rates will be lower in five years? What if they increase?

If one thinks of an ARM, indeed any mortgage, as a tool for fixing the cost of living in one’s home, (you could equate it with rent), how can it not have a strong relationship to income?

Cary

Anyone who goes to eloan gets exactly what they deserve.

ExSFer – yes, I am sure they are available and not impossible to qualify for – requires 20% down – 1mm pp for stated income, up to 1.25mm pp for full doc – higher $$ w/ 25% down.

Anono at 6:58 AM is correct – and you can do even better by calling an experienced and qualified mortgage broker (Disclosure – Yes, i am one, but i am not soliciting business, just providing an opinion).

Many posters seem to assume that all the 1mm plus buyers have 0 down, or are scraping to come up w/ 10% down. I don’t see that. These are not first time buyers with no savings or equity. That would be Stockton, East Bay, and many other areas, but not the city. I don’t know of any statistics that show specifics on new loans for the city, but in my little world, I have done exactly 0 no down purchases in the 1mm and up range. Several that were 10% down and the rest were 20% or more, many significantly more.

rincon – as a broker, could you provide any insights on ARM resets? Just wondering if you’re seeing folks in trouble from loans adjusting or not. Most of the published stats are national or state-wide, so was just curious what it looks like on the front lines?

It is kind of meaningless to argue about what’s on paper (whether it is harder to get jumbo loans).

How about let’s hear someone who recently purchased (or sold) a house which requires jumbo loan? How easy/difficult is it?

It seems among the 40+ posts, Only one person sold recently (Karl). Since there was no financial contingency, I will guess it was either a cash offer, or the buyer had no problem obtaining loans.

Any other real stories?

“The credit panic appeared to stabilize on Wednesday, interest rates rising a bit, but the crunch found new legs today on news of sinking retail sales. At week’s end conforming mortgages are a hair under 6.5 percent, the gap to vanilla jumbos closing to roughly a 0.5 percent premium, half of the worst in August. Everything else — even high-quality off-brand loans — is as-was: pricey or gone.”

From an article just posted from Lou Barnes at Inmann news.

Just one source showing the gap is closing between the Jumbo and conforming, and conforming rates are more like 6.25 @ 0 pts.

Dude – I am seeing lots of folks in trouble due to resets, but almost all of them put no money down, and are in the 250-500k range (I work the whole state, none of these are in the city of SF)

The majority of resets coming from Alt A 3/5/7/10 yr arms are still far off into the future. And most of these borrowers had bigger down payments, better credit etc. It will be interesting to continue to follow how the problems from the subprime spill into other areas and how great of an impact this will have overall.

Thanks – the effects of the “reset tsunami” on SF have been widely debated here, but I haven’t heard any specific anecdotes or stories yet. Although I do have friends who are getting scared and have been cancelling vacations…

cary-

much of your post makes no sense to me. Too many people on this site assume that everyone who used a mortgage product other than a 30 year fixed loan with 20% down made a stupid financial decision. However, for people with high income and savings the flexibility in mortgage products is a great finance tool. I don’t think of a mortgage as a tool for fixing the cost of living in one’s home. It is but one piece of a big a financial puzzle.

you asked how I know rates will be lower in five years. This is not a relevant question for me. I don’t care whether rates will be lower or not. If my rate is fixed for 10 years, and I’m selling in 5 (or 4 or 6 or whatever), what difference does it make? I would not use an ARM without taking into account that I could afford the maximum possible reset if for some reason I am still in the home and couldn’t refi to a lower rate or new term with a similar rate.

I’ll give you that I don’t know what housing values will be in 5 years. If I knew where interest rates and prices would be five years from now I would be plotting my path to riches.

DQ News stats for August are very indicative of the market at hand: bifurcation. Prices in SF and Marina continuing to go up, other areas not so much. I think the +7.8% YoY number understimates how much prices have truly increased in 2007, especially the more desirable neighborhoods.

It is VERY difficult to buy anything remotely decent now, without a lot of competition, and rents are reaching or breaching levels not seen since 2000.

Scary times for those looking to buy.

anono 3:43

I think cary’s point was if rates are significantly higher when you decide to sell your home (despite the fact you might have locked in for 10 years) the next pool of potentially buyers will be smaller as they have less purchasing power (i.e. translation: possible lower selling price).