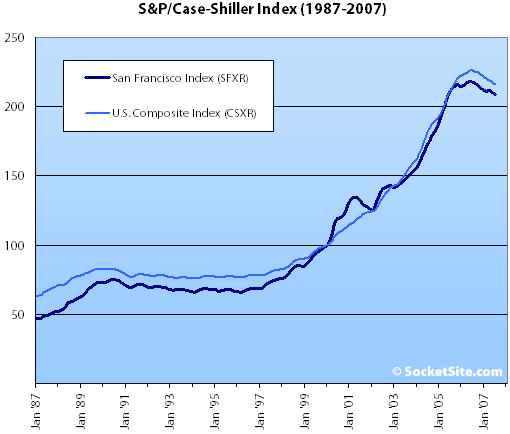

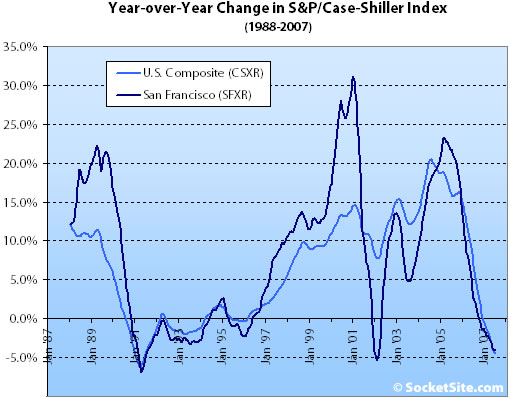

And speaking of the S&P/Case-Shiller index (and no, that wasn’t a coincidence), according to the July 2007 index (pdf), single-family home prices in the San Francisco MSA slipped 4.1% year-over-year and fell 0.4% from June ’07 to July ’07. For the broader 10-City composite (CSXR), year-over-year price growth is down 4.5% (down 0.5% from May).

The standard SocketSite footnote: The S&P/Case-Shiller index only tracks single-family homes (not condominiums which represent half the transactions in San Francisco), is imperfect in factoring out changes in property values due to improvements versus actual market appreciation (although they try their best), and includes San Francisco, San Mateo, Marin, Contra Costa, and Alameda in the “San Francisco” index (i.e., the greater MSA).

∙ They’re Betting Against San Francisco On The CME [SocketSite]

∙ Summer Swoon Evident in the S&P/Case-Shiller® Home Price Indices (pdf) [S&P]

∙ June S&P/Case-Shiller Index: San Francisco MSA Mimics U.S. Decline [SocketSite]

here is my question. If i bought at the infinity 9 months ago for 1 mil, and 6 months from now when i close they have not lowered prices, has the value of my home avoided this downturn? I think it has, although there is a risk of a large correction if they fail to sell.

For all those who think real estate always appreciates (and are probably not on this board), look at that gap from 91 to 97 when appreciation was well below 5%, and often negative. Ouch. I think we’re heading for a similar time as the P/E ratio rights itself again.

I do not know if PDXbuyer lived in San Francisco between 1991 – 1997, but that was when it was thought that San Jose was going to take San Francisco’s place as the crown jewel of The Bay Area.

That never happened, and probably never will, regardless of the 49ers!

Also, there was absolutely no job growth then either like there is now.

Also, Notice of Defaults are down 16% from August 2006 to 2007, and Notice of Trustee Sales are down a dramatic 68% in the same time period.

97 was a very interesting time. if you bought that year, you had to be a fool not to double your money in the next 24 months.

Is there any way to get a longer term view of the CSI.

I would like to see this sam chart for the past 50 years to look for trends. 20 yrs is too short IMHO.

[Editor’s Note: Sorry, the index only tracks back to 1987.]

“here is my question. If i bought at the infinity 9 months ago for 1 mil, and 6 months from now when i close they have not lowered prices, has the value of my home avoided this downturn? I think it has, although there is a risk of a large correction if they fail to sell.”

The value of your unit will depend on the comps.

Yes, it’s true that prices at Infinity has risen around 10% since last year (even more if you bought in July/Aug,06).

If the majority of units close at the contract price, then yes your unit will reflect those prices as those prices will be your comps.

If Infinity starts lowering prices, well that’s a different story and your unit may reflect those prices. So far, there’s no evidence that will happen. The first tower is hovering around 90+% under contract. The 2nd tower will come online next year with even higher prices (and a waiting list for the prime view units).

“Yes, it’s true that prices at Infinity has risen around 10% since last year (even more if you bought in July/Aug,06).”

That’s exactly what boosters have been saying about One Rincon but this would seem to suggest otherwise:

https://socketsite.com/archives/2007/09/not_exactly_a_flip_but_possibly_a_push_over_at_one_rinc.html

Day one pricing today in the secondary market.

“That’s exactly what boosters have been saying about One Rincon but this would seem to suggest otherwise:

https://socketsite.com/archives/2007/09/not_exactly_a_flip_but_possibly_a_push_over_at_one_rinc.html

Day one pricing today in the secondary market.”

Yes, that’s why I said:

“If the majority of units close at the contract price, then yes your unit will reflect those prices as those prices will be your comps.”

The big IF is the billion dollar question (and we’ll find out in 08)….

Also, you can’t make an assumption on the health of the market based on one single case. That would be foolish and dangerous 🙂

Agree with MissionBay Res, with Case-Shiller having about a three month lag it will be interesting to see where we are when December’s data is available (roughly Mar ’08), my gut or best guess says we relive the 91-97 period.