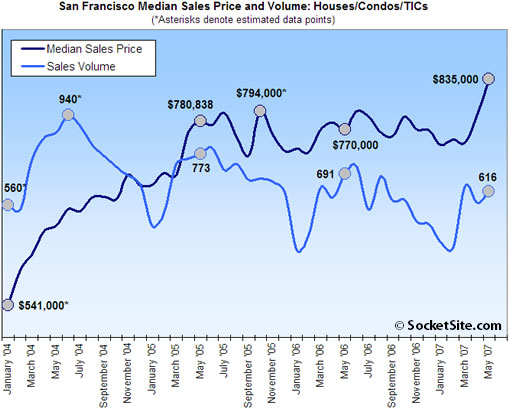

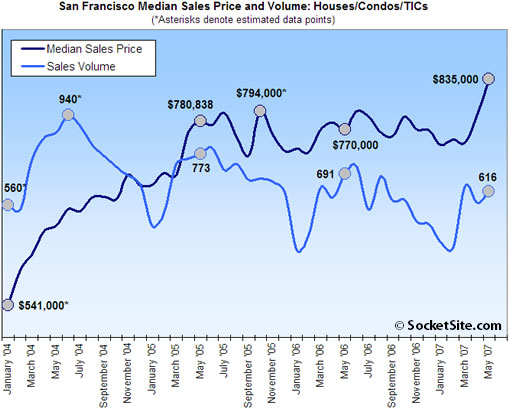

According to DataQuick, the median sales price for existing homes in San Francisco was $835,000 last month, up 8.4% compared to a revised May ’06 ($770,000) and up 5.7% compared to the month prior (think mix). Sales volume, however, was down 10.9% year-over-year (616 sales in May ’07 versus a revised 691 sales in May ’06) but rose 8.5% compared to the month prior (568 recorded sales in April ‘07).

A key sentence that finally made its way into the latest DataQuick report (and shouldn’t catch any plugged-in readers by surprise): “The median has increased the last four months, in part because sales of lower-cost homes have dropped more than sales in other categories.”

For the greater Bay Area, the recorded median sales price in May was $660,000 (a revised year-over-year increase of 3.4%) and sales volume was 8,080 (down 18.7% from a revised 9,935 sales in May ’06). And at the extremes, Sonoma recorded a 5.4% year-over-year reduction in median sales price, while Napa recorded a 13.1% year-over-year gain on significantly lower (down 35.6%) volume; and year-over-year sales volume continued to plummet in both Contra Costa (down 29.5%) and Solano (down 37.6%) counties as well.

∙ Bay Area home sales drop, prices up [DQNews]

∙ San Francisco Home Sales Drop, Median Sales Price Up [SocketSite]

One, it’s nice to see DQ finally admit that they sales mix was skewing the volume. To bad the did not calculate the adjusted mix like the did for So Cal (where the adjusted number was actually -2%)

Two, the sales volume is still dropping and we have yet to feel the impact of higher rates.

finally, what caught my eye was the signifcant decline in the use of ARM’s in the Bay Area. I find it very surprising that this has not had more impact on price, of course maybe that is what is driving the ‘low end’ decline.

It’s easy to see the shift in the mix on median price regionally, when sales decreases are much greater in the less expensive outer suburban counties like Napa and Solano than in pricier Marin, SF and San Mateo counties (or in SoCal, where sales in Riverside and San Bernadino county have decreased much more than in LA).

However, it would take more data than Dataquick is presenting to figure out if that is what is responsible for the big price increase within the city of SF. Note both the number of sales and the median price are up from the prior month.

I’ve noticed for the past few months that sales volume is flattening out in SF, and prices are increasing slightly. “Mix” could be explaining the lack of sales volume in some of the outlying areas, but within SF/Marin – it’s probably less of a driver. I’m certainly not singing happy days are here again, but this doesn’t seem like a bubble bursting to me. Just my two cents.

I agree that there’s been no bursting of any bubbles in SF and Marin. I do see evidence of slight declines in Marin on a per square foot basis. It would be great if there were a quality index as it does seem like the recent mix may be of higher quality than previous periods – particularly in SF.

It would seem that there should be a natural differential (premium) between the “special” areas (SF, Marin) and the outer suburbs. Since the outer areas are clearly declining (and will likely to continue to do so), the differential is increasing. Is that sustainable?

Fortunately, no one needs to sell their cheaper home to move up and buy another.

Because if they did, the slower sales at the bottom would start showing up at the higher end in about 3-4 more months.

Can you say “Sarcasm”?

Can you say “Credit Bubble Ending?”

Here’s my current view as at June 14 after having gone to open houses, tracking sales of properties I’ve seen and making a couple of offers as a homebuyer in SF -over the last 3 months.

Good quality condo’s in the Lower Pacific Hights to Telegraph Hill area without any negatives in the 700K range have been selling quickly, typically, it seems, over list with a couple or so competing offers. Condo’s in that area with negatives (no parking or low sq. feet or poor location or layout etc. stay on the market and sell after a price reduction.

Non-central houses in the $700 range (say, Sunset, Mission Terrace, Excelsior, the Inglesides) sell around list if priced right and after reduction if not. Non-central Condo’s (Diamond Hts, Corona) are good buys on a square foot comparison but still take many days on market to find a buyer.

My interpretation of the stats is that lower priced homes are hit hardest by the sub-prime -tighter lending standards and this leaves, as others here have recorded, sales of higher value homes to raise the median sale prices.

(The best surveys worth watching are Offeho and Case-Shiller. The latter shows a 3% property value drop from the peak during 2007. )

Based on living through previous real estate cycles, I expect the value losses in the $600K to $700K properties to become evident as they eventually sell and as is historically the case, this value reduction will work its way up the food chain to higher value properties as buyers have less net-equity available for the next move-up property.

The recent mortgage interest rate increase is another reason that the below-median homes will lose value.

The buyers’ market is about to return. Gravity exists —even in San Francisco!

Here’s a link to asking prices in SF (plus a few other localities to the south). Yes, I know these are only _asking_ prices but I still think there’s some interest in their trends. As you’ll see, there was a spike upwards a couple of months ago, which has now subsided. Also I see no overall trend of increasing asking prices over the last year, even at the 75th percentile. Two possible reasons I can think of:- firstly, it really may be that what’s actually selling – as opposed to what’s for sale – is higher end stuff, thus pushing the median sales price up while maintaining the same asking prices. Or secondly, if lower end stuff isn’t selling, the median asking price is being artificially lowered by more lower end properties flooding the market.

http://www.housingtracker.net/old_housingtracker/location/California/SanFrancisco/