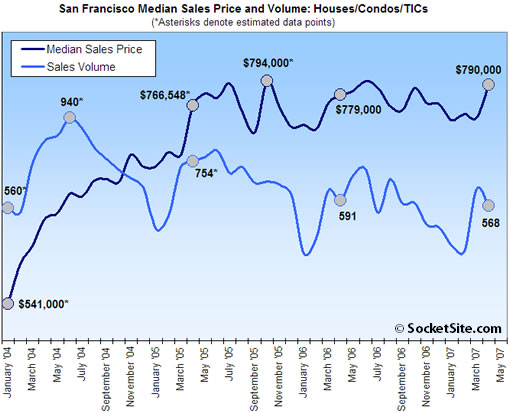

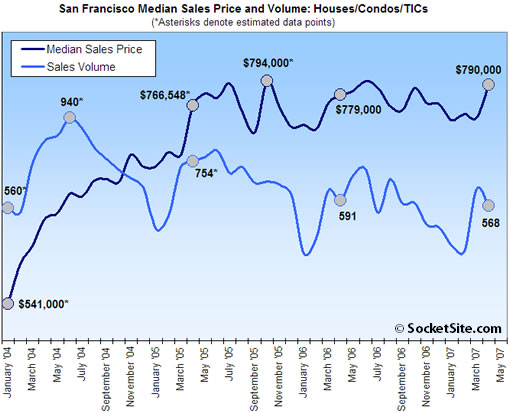

According to DataQuick, the median sales price for existing homes in San Francisco was $790,000 last month, up 1.4% compared to a revised April ’06 ($779,000), and up significantly (4.9%) compared to the month prior. Sales volume, however, was down (3.9%) year-over-year (568 sales in April ’07 versus a revised 591 sales in April ’06) and fell (11.3%) compared to the month prior (640 recorded sales in March ‘07). As we noted last month, sales volume typically builds through the first six months of the year.

For the greater Bay Area, the recorded median sales price in April was $659,000 (a revised year-over-year increase of 3.8%) and sales volume was 7,447 (down 18.4% from a revised 9,129 sales in April ’06). And at the extremes, Sonoma recorded an 8.5% year-over-year reduction in median sales price, while Marin recorded a 8.8% year-over-year gain; and year-over-year sales volume continued to plummet in both Contra Costa (down 28.2%) and Solano (down 37.2%) counties.

A quote from DataQuick’s Marshall Prentice: “With sales this slow, prices would decline if there were a huge number of motivated sellers listing their homes. That doesn’t appear to be the case. It’s likely that potential buyers are biding their time, as are sellers. It’s hard to buy a home if you think it might go down in value. Things could pick up this summer as buyers see that values are not dropping.” And of course, vice versa.

∙ Bay Area home sales drop, prices up [DQNews]

∙ San Francisco Home Sales Up, Median Sales Price Down [SocketSite]

Hmmm… it seems to me that sales volume over the last few months in SF is flattening out (low single digit declines). Also, prices really haven’t dropped much — if at all. I know there’s alot of bubble talk out there, but the numbers sure don’t seem to indicate it for places like SF and Marin.

It’s nice to see the rate of price increase going down a little– I think 2% annual growth is more sustainable than what we’ve seen in the past few years (and I say this as someone who just bought in SF!). However, w/r/t bubbles, I definitely don’t hear any popping sound coming from these numbers…

“However, w/r/t bubbles, I definitely don’t hear any popping sound coming from these numbers”

I didn’t hear any popping sound in Feb of 2000 either. Don’t worry. You’ll hear it soon enough. For now, enjoy the ride.

As tighter lending reduce the number of loans lower-income people can make (i.e. those in SF making less than $180,000/year), and as higher-income people continue buying at the current rate, the median house price will definitely climb.

Instead of housing getting more expensive, maybe this graph only means that buying and selling is moving more upscale. Case-Schiller might offer more information.

We’ll know in a few months!

Wow, when did 180k/year become “lower-income”?

Finally some data that supports what people have been saying for the past two months!

“I didn’t hear any popping sound in Feb of 2000 either. Don’t worry. You’ll hear it soon enough. For now, enjoy the ride.”

2000 was a short term hickup and the market has clearly gone up since 2000, I don’t understand your point?

“Finally some data that supports what people have been saying for the past two months!”

You mean that prices have been relatively flat for the past two years while sales volume has been falling for the past three?

Nasdaq peak in 2000: over 5000; Nasdaq close today: 2547. Not the whole market, of course, but certainly reflective of the most speculative part of it. As for the Dow, I guess it’s about kept track with inflation since then?

“2000 was a short term hickup and the market has clearly gone up since 2000”

Oh yeah. Short term hickup. Nasdaq is still 50% down from 2000 – in nominal terms. Adding in 2-3% inflation over 7 years brings it down more like 60%. A real short term hickup indeed.

Somebody else has mentioned this before…think it was Surveykid…but these things start out in the burbs and spread inwards towards major metropolitan areas.

SF market is still creaking along. Who’s buying? The truely wealthy, who can afford homes over $1.0 million regardless of market conditions, and those making a moderate income but who have parlayed for 5 years and are rolling massive equity. Who’s not buying? Everyone else.

It’ll take more time for weakness to seep in. L.A. is doing fine but the Inland Empire is weak. NYC is doing fine but Long Island is stumbling. We’re still doing OK but the East Bay and wine country are down.

Perhaps San Francisco will be the last bastion of financial absurdity and the correction won’t affect us. At this point I don’t really care anymore…another year and a 3-bedroom SFR in Walnut Creek will sell for $500K. Goodbye Muni, hello BART.

Socketsite, could you provide some stats comparing the median condo and sfr price in 2000 with today?

[Editor’s Note:

San Francisco Home/Condo Sales: Historical Context.]

In 2000, there was huge appreciation. At the beginning of the year, the Bay Area median was about 330K, the SF/Marin/San Mateo median was about 425K. By the end of the year, the Bay Area median was approaching $400K, and the SF/Marin/San Mateo median was approaching $510K.

Here are the Case/Schiller indices for the year, and the year on year change:

January 2000 100.00 17.6%

February 2000 102.70 19.5%

March 2000 106.56 21.8%

April 2000 110.97 24.4%

May 2000 115.01 26.6%

June 2000 118.45 28.0%

July 2000 119.48 26.8%

August 2000 119.95 26.1%

September 2000 120.94 25.8%

October 2000 123.08 27.3%

November 2000 125.66 28.4%

December 2000 128.58 30.0%

Comparing Condo prices from today and tomorrow might be a bit iffy since parking spaces may or may not be included in those prices …. and that’s no small bite when I understand they’re being sold for $75k a pop at Infinity in addition to the condo unit price – and that’s for valet retrieval/parking of the vehicle (better be good to those valets at Christmas time with a sweet tip!)

It is interesting to note that some folks believe the stock market increases are a symptom of a reduced number of publicly traded companies (thank you Sarbanes Oxley) in addition to the good earnings from exports and so on.

Amen Corner, I’m not sure why you’re comparing the NASDAQ to the SF housing market. For one thing, stocks are much more volatile than real estate and accordginly yield better average returns. Also, fundamentally these two things just aren’t very related. Is your point that a large portion of the people in the Bay Area work for NASDAQ listed companies? And if so, why haven’t housing prices (or any other measure of affordability for that matter)declined since that 50% drop you keep quoting. I don’t follow your logic.

Anon at 10:26, my comment was a followup to a point (“I didn’t hear any popping sound in Feb of 2000 either) and followup about the stock market. I wasn’t comparing stocks to the housing market.

Wonder if the forecasted slight decrease in mortgage interest rates in 3q/4q will buoy the market somewhat. Also I believe Bernanke mentioned the economy is now past the bottom of its (slight) down cycle and should be picking up….so that should help firm up prices as well.

to bad fewer people will be able to qualify …

“Facing criticism from members of Congress about lax regulation, ederal Reserve Chairman Ben Bernanke promised that the Fed would do everything possible to crack down on abuses that have put millions of homeowners in jeopardy of defaulting on their mortgages.”

“‘We at the Federal Reserve will do all that we can to prevent fraud and abusive lending and to ensure that lenders employ sound underwriting practices and make effective disclosures to consumers,’ Bernanke said in remarks prepared for a financial conference.”

http://biz.yahoo.com/ap/070517/bernanke_mortgages.html?.v=10

“‘Combating bad lending practices, including deliberate fraud or abuse, may require additional measures,’ said Bernanke. ‘Markets can overshoot, but, ultimately, market forces also work to rein in excesses,’ the top central banker said. ‘In the long run, markets are better than regulators at allocating credit.’”

“Banks and other lenders are tightening their standards for subprime, near-prime and even prime borrowers, a Fed survey of banks’ loan officers showed earlier this week.”

“‘Curbs on this lending are expected to be a source of some restraint on home purchases and residential investment in coming quarters,’ Bernanke said.”

http://www.marketwatch.com/news/story/bernanke-sees-limited-impact-subprime/story.aspx?guid=%7BE7E75A8C-0A89-49B7-87DB-A365A101BBD6%7D

I think that these numbers are very deceiving. I mean, we all know that SF homes are selling for these prices by looking at the MLS – there is simply nothing on the market for less than that these days! So I’m not surprised to see a higher median price. But just because the houses that DO sell these days (and obviously, that is far fewer than past years), are hanging steadfast with their million dollar pricetags, doesn’t mean that the market is strong. SB is correct – the high-end side is strong and will always be strong (just look at CEO pay these days). What will everyone think next month, when Le Petite Triaton’s price and all those other 3000 block homes sell? When the median price jumps to $5 million just because ONLY the rich are buying, is that going to justify a “strong” real estate market in SF? Does that mean that everyone with less than a 6-figure salary should overextend themselves to buy into this “super hot market”?

All that this chart shows is how out of touch SF prices are. The median San Franciscian and their salary can only afford about a $300k home max. Our salaries are not much higher here than many other metro. area in the US, where median home prices are much closer to the national average of $212k. The fact that this index keeps crawling up should not be treated like a badge of honor to live in SF, it should be a point of disgrace to all of us, even the home owners, that we have created a city for only the uber-rich.

There is another thing I noticed – most of the SFH’s in good neighborhoods on the market are flipper’s houses – they have had great (depending on your taste) remodeling, and of course demand higher prices. This was not the case in 2005.

Just read socketsite – most of the houses covered by this site have been recently remodeled. If you still have any doubt, go to redfin, and filter all houses by minimum 1 million, and you will see 90% of them are remodeled.

I highly doubt 30 year mortgage rates are going to start a downward trend …

“What will everyone think next month, when Le Petite Triaton’s price and all those other 3000 block homes sell? When the median price jumps to $5 million just because ONLY the rich are buying, is that going to justify a “strong” real estate market in SF?”

The $790,000 median price means that half of the homes in SF sold for below $790,000. The sale of a few $10 million dollar homes might skew the average price, but not the median price.

Well, 30 year-mortgage rates are in fact forecast to drop slighty. Who knows though. It surely looks like they won’t go up.

30 Year Mortgage Interest Rate Forecast

May 2007

Jun 2007

Jul 2007

Aug 2007

Sep 2007

Forecast Value 6.16 6.19 6.17 6.19 6.06

Stop comparing only SF to the rest of the nation when you’re looking at metro areas!

Compare SF to Manhattan (only Manhattan)

Compare SF to central Boston

Compare the Bay Area to the full NYC (if Brooklyn gets included with Manhattan, then Oakland should be included with SF – there is no difference except in semantics – Brooklyn started and was a separate city, in fact the third largest in America when Manhattan swallowed it up)

When comparing things this way, the PE here doesn’t look out of whack. It’s never going to be the same as suburban US cities. Period. Try buying a SFH in central Boston or Manhattan and then tell me that prices are “out of control” here.