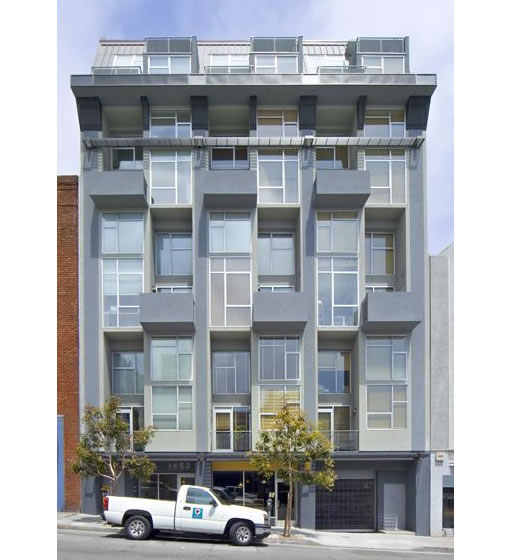

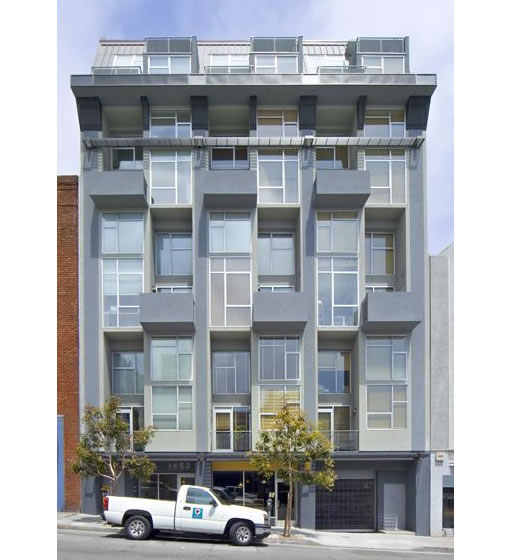

A year ago we reported on three of twenty-two condos that were on the market at Midtown (1452 Bush). At the time, unit #9 was listed for $899,990. If you missed it, don’t fret, it’s back on the market (and this time it’s listed for $824,000).

∙ Listing: 1452 Bush #9 (2/2.5) – $824,000 [MLS]

∙ Locking In Gains At The Midtown? [SocketSite]

but the chronicle told me prices are “going through the roof” and that the bay area seems to “defy gravity”!?!?!

Remember in the last downturn, condo prices fell first…

He paid 735,000 on 5/10/04

That’s great for him. I paid $100 for GOOG in 9/04. For some reason I’m not expecting the same returns over the next couple of years and I probably should have sold when it was over $500 last November. In either case that doesn’t make it a good buy today.

“He paid 735,000 on 5/10/04”

$735K to $824K over three years is an annual asset appreciation of less than 4%. Take into account transaction and carrying costs and it’s likely an effective loss.

Exactly Michael, people seem to forget things like transaction costs, taxes, insurance, hoas, maintance/upkeep and let’s not forget SF’s favorite sellers cost, staging.

Also to consider, what type of mortgage did they have? Have the paid down any of the principle or was this another 80/20 100% financing ARM?

Finally, add inflation running at 3-4% during that time.

a perfect example of ‘why your home is not the investment you think it is’

http://finance.yahoo.com/real-estate/article/102603/why-your-home-is-not-the-investment-you-think-it-is

Let’s see here. Renting is “throwing money away.” This property went up $89k in 3 years (assuming it sells at list).

$89k – $49k (6% selling costs) – $25k (3 years property tax) – $12k (3 years HOA) = $3k profit. And we didn’t figure in the interest paid on the mortgage, or any closing costs.

Let’s assume, the owner could have rented a comparable property for the same as his P + I payments on his mortgage. So, if he put 20% down on this place, that was $147k. If you put $147k in an online savings account it would be worth $170k after 3 years (5% interest rate). That is a return of $23k, or 7 times better return than this property.

I just walked by the building. Do the same and you’ll see exactly why Brad’s point may be accurate. The neighborhood is shady and I don’t believe it has changed in the past 3 years and I frankly don’t think that there are any major changes in the works.

Now, had there been any improvement in the neighbordhood then there’s no doubt that the value would have increased much more. L,L,L!

OK, the price is down, regardless of how you do the math. So who on this string is going to step in and buy (steal?) this property. Seems that there has been a lot of people on this blog in general flogging the dead horse of prices are declining. So, based to what I’ve been reading on this thread, now is the time to jump in, grab it, hold on, and ride it up over the next five years. Who’s first?

What about decreased tax returns for the home owner, is that factored in.

And you saved or earned 23K over this time period and the property went up about 100k. So, now three years later if you want to buy this property, you are applying 20k toward the 20% down payment. So, in all honesty where is the gain in not buying, or holding? Even if prices do just go up 4%. Just curious about the tax return in your model.

Over that three years you gained 22k, would you report income tax on that? Not sure. I am guessing the tax break that loft owner got each year was probably about $15k each year. I am not sure and just asking? If so, that certainly is a dent in the model.

brad, the after-tax carrying costs of this apartment (interest plus loss of interest on down payment, taxes, hoa and insurance) almost certainly far exceed the cost of renting an equivalent apartment. Thus you need a certain level of appreciation just to stay level with the cost of renting. By my (admittedly somewhat rough) calculation, I would need a little over 3% appreciation per year just to break even with renting an equivalent apartment. Obviously we don’t know the tax situation of this seller, but assuming it’s equivalent to mine and this guy sells for list, he’s up about $20k. Then you have to take away from this his cost of buying and selling. Even assuming no costs other than the commission to sell, he’s down about $30k over having rented for the past three years.

Yes, it’s always fun to see someone else loose money, especially when you are renter.

However history, especially here in SF, has always proven Real Estate to be a one-way bet. After the 1989 quake everyone said that the Marina was going to sink and that prices would never come back. Well, take a look and you will see they have tripled. My point is that yes this may not be the Taj Mahal, but the underlieing economics of home ownership remain sound, in spite of current events. There are going to be 30 Million more Californians in the next 25 years and they all have to live somewhere!

M.R.

was that owner able to deduct the interest payments, mortgage payments from his income and thus save money each year. Did he get a tax break?

Hey Mystery Realtor – not sure where you get your data, but California (and San Francisco) have both been losing people, on a net basis, for quite a while now. Here’s an excerpt from the U.S. Census (admittedly dated, but I think the trend still holds):

“California has experienced increasing rates of net domestic outmigration since 1990. Its 1993 to 1994 net domestic outmigration rate reached 1.4 percent, the highest of any State, and represented a net loss of 426,000 migrants to other States. Only its high rates of net international migration and natural increase are allowing California a modest growth rate.”

I think you both are correct (Dude and Mystery Realtor). Even though people are leaving the state, an increasing birthrate will compensate for any net migration.

“was that owner able to deduct the interest payments, mortgage payments from his income and thus save money each year. Did he get a tax break?”

The owner should have been able to deduct the interest and property tax payments.

CA estimate

http://factfinder.census.gov/servlet/GCTTable?_bm=y&-geo_id=04000US06&-_box_head_nbr=GCT-T1&-ds_name=PEP_2006_EST&-_lang=en&-format=ST-2&-_sse=on

Look at SF pop #’s from 1970-1990.

http://www.bayareacensus.ca.gov/counties/SanFranciscoCounty70.htm

http://www.bayareacensus.ca.gov/counties/SanFranciscoCounty.htm

This is entertaining reading but at the end of the day it seems that most people here have no actual clue of what they are talking about.

That’s right anonymon, nothing to see here. Real estate is always a great investment and is obviously going gangbusters (despite the pricing on this one). Carrying/maintenance/opportunity costs don’t count because you don’t see them at settlement. And the government is obviously wrong about the population of the city.

Thanks for enlightening us clueless people.

There are two different discussions happening here…

1. Homeownership versus Renting; and

2. Investing in Real Estate versus Other Investment Opportunities;.

Don’t muddle the two…there are lots of intangibles that go into the first topic and it really depends on what you value in life. Topic 2 however can be forecast with a fair degree of accuracy if you are experienced and really understand the ins and outs of RE versus other income producing ventures.

California population has been declining? What planet are you living on? We gain more in actual numbers (not that percentage BS that always makes small states look like they are growing by leaps and bounds) than any state except for Texas (some years).

When your birth rate is adding people and you’re still an international immigration magnet, you can lose 500,000 locals a year and still grow by 500,000.

No kidding, California has already increased to 38MM people and is supposed to be over 42MM people in 2015 and 50MM in 2030. Of course a bunch of these people will move to central valley suburbs, but many will want to live in the bay area and SF itself.

Isn’t this site about San Francisco and not the Central Valley? The population of San Francisco is still about 30,000 less than in the year 2000. It is just possible that everybody does not want to live here. This city has not experienced major population growth for decades, and I seriously wonder how many people truly WANT to live in S.F. when you are charging Laguna Beach prices. When you are asking 1,000 a sq. ft., many people begin to weigh other options both for the location of their business and their home. I have to admit, even Chicago looks good when you compare cost of living.

The population decline in San Francisco from 2000-2005 was a response to the dot-com crash. It merely reversed the population gains of the late 1990’s, which had resulted in a near 0% rental vacancy rate by 2000.

San Francisco had gained 100,000 people from 1980-2000, which is impressive, considering little new housing was built.

The population of SF can’t grow substantially without more building. It’s not a matter of people not wanting to live here, but that there is no place for them to live.

The “wildcard” in this discussion of the direction of the RE market is mostly overlooked.

It should be obvious to most, a major factor in the world’s huge run-up in RE prices, is the decline in interest rates. The Fed, fearing a serious recession after 911, flooded the US with cash. The US RE market was the unintentional recipient of much of the tidal wave of cash. Sub prime,interest only, and cash-outs are the result. We have been slowly absorbing this overleverage. So far, we’ve avoided a meltdown in the RE market.

I’m not skilled enough to predict where interest rates are headed. If Bill Gross is having difficulty, how could I know? But, I will say,a 1% increase in a 30 year mortgage rate means the average mortgage increases almost 11%.

When interest rates begin to rise most sellers will find a buying public with less ability to buy.

Cary

“That’s right anonymon, nothing to see here. Real estate is always a great investment and is obviously going gangbusters (despite the pricing on this one). Carrying/maintenance/opportunity costs don’t count because you don’t see them at settlement. And the government is obviously wrong about the population of the city.”

Please don’t put words in my mouth. I could have been agreeing/disagreeing with either side. You further validate my point.

“The population of SF can’t grow substantially without more building. It’s not a matter of people not wanting to live here, but that there is no place for them to live. ”

So where did the 50k that lived here in 2000 but no longer do live?

“So where did the 50k that lived here in 2000 but no longer do live?”

Somewhere else on earth.

Amen meant “where did those extra 50K people live when they lived in SF?”

The fact is, there were place in SF for those 50K people. They left for elsewhere. Those places (apartments, homes) are now vacant. Plus the new contructions, “The population of SF can’t grow substantially without more building” is simply not true.

Here is an interesting article:

http://sfaa.org/0704sheridan.html

It has some interesting figures about what we are talking about here.

[Editor’s Note: Hope you don’t mind but we shortened the URL.]

The places those extra people lived aren’t “vacant” for the most part. Did any of you people live here in 2000? Young, hopeful dot-commers were living 3-4 to a studio in some places. I knew one group of nine (nine!) people living in a one bedroom in South Beach. Now, those studios have one person living there. That one bedroom has two people. The rental market was INSANE then. It is merely tight now.

And BTW, those numbers from that report are worthless – they include too many other places.

http://www.ci.sf.ca.us/site/uploadedfiles/moh/2000_part1.htm

http://www.ci.sf.ca.us/site/uploadedfiles/moh/2000_part2.htm

historic perspective…have things changed all that much?

What it comes down to is you either drink the “kool aid” or you don’t. By that I mean, you either believe this city really is a world important vibrant affluent city, that is the envy and desire of the planet, OR, that it is a very attractive place that is now charging so much to live in, that many many people have been choosing OTHER options. Example, Studio condo in the Marina, OR, 3bd home in Palm Springs with Pool (I know it is possible as I have friends who just bought a mid-cent. home down there for 319,000), two bedroom condo in South Beach OR home in Florida on intercoastal waterway with boatdock (I have friends that made that choice too 789,000). My point is, look at the statistics of who is moving into the city , and who is moving out. S.F. is a great walkable attractive adult playground as was mentioned before, but it is not the only lifestyle option when you start weighing the costs. If we don’t get housing more affordable soon and stop justifying high costs because “everyone wants to live here” (FALSE), or because it is terribly rich here (Really? Been to Newport Beach lately where more homes above 5 million were sold last year than in ten years in San Francisco), we will drive new business and creative young grads away and become a rich second home playground with a very poor underclass prowling the streets at night.

anom, you’re looking at the city as a stand-alone entity. It’s not. Period. Even if everything happens as you describe, you’re still forgetting that there are literally millions of people surrounding the city that will still come to the city for some things here and there.

True, there may be more $5 million plus homes sold in Newport Beach lately. So what! Guess where the four highest per capita income counties are in California – Marin, San Mateo, San Francisco, and Santa Clara.

You seem to be forgetting that San Francisco is MUCH, MUCH, MUCH different from those other places you mention in one very important way – more than half of the people who live in San Francisco RENT. Even if single family homes and condos go to $2,000 per sqft, more than 400,000 people will be living here in apartments – for the exact reasons that you mentioned – it’s one of the only walkable, pleasant adult playgrounds in America. If I have the choice of renting for $2000 a month here or buying on a beach in Florida, I’m going to rent here. My salary is significantly higher here, and I make good money on my investments. Home ownership is NOT everything, regardless of the media/realtor frenzy.

anom, you think there is no vacancy in SF?

Well, take a look here:

http://tinyurl.com/2pb9kp

14% of SF housing are vacant. About 70% of SF residents are renters.

It is simply not true that the city has more population than it can handle. It had more population before. It has a lot of vacancies. Period.

John, I understand pefectly that there are many vacant units in the city. As I wrote above, I believe many condos are now purchased as second homes.

Brutus, you cannot play the surrounding county game with me. See, I agree that Marin is desirable and rich, but THAT does not justify the high cost of housing in San Francisco. We are talking about San Francisco here. My point is that San Francisco is not nearly as desirable as realtors want us to believe, in fact, it is no longer the economic or population center of the Bay Area. Don’t believe me? Look it up.

I mentioned Palm Springs and Florida because those two places also have large second home markets.

I only “played the surrounding county” game because you came out with the “it isn’t that rich here” game. The four highest per capita incomes in California are the four counties surrounding San Francisco (including SF proper). Having tens of thousands of people who make $120,000 a year has a lot more to do with OVERALL housing prices than having a few thousand who make over a million.

My point was that just because costs to BUY in San Francisco are stratospheric doesn’t mean that it is only a city for the rich. I could plenty afford to buy in 95% of places in the US (and could probably even here if I stretched), but I CHOOSE not to. More than half of the people in San Francisco also don’t buy, but rent instead. Rental prices HAVE NOT increased dramatically in the last ten years. Therefore – it isn’t becoming only a “city of the rich” as much as everyone here seems to believe.

Not all of us view our lives as failures if we don’t own some piece of property.

I don’t know how the redfin website calculates the vacancy rate but it conflicts with the information the sfaa provides. 14% seems to be too high for units that actively available for rent in SF. Could it include units that are being held off the market intentionally?

The laws of supply and demand would dictate that there is an oversupply, and rents should be going down. Is that the case?

I will agree with Brutus on his point about the rentals and regarding the surrounding counties. My parents own rentals in the city and in Palo Alto, and their units in Palo Alto now rent for much more than the units in the city. It would be hard to dispute rental or purchase prices both on the Peninsula and Marin, as both areas are truly very wealthy.

As a small note regarding pockets of wealth, those counties are rather small in population, and as I do work in Southern California as well, it is astonishing how large and vast the wealth pool is down there. (Largest number of residents worth more than a million in the country are in Los Angeles county btw.) When Herb Caen was alive, he used to enjoy writing about how San Francisco chose to just ignore the huge growth and increasing power of Southern California.

I wasn’t at all implying that there isn’t wealth in Southern California. I was just saying that the AVERAGE person in the four counties (San Mateo, Santa Clara, Marin, and San Francisco) earns more. Sure, they don’t add up to the same number of people as LA county, but seriously, if you’re throwing around things like “LA county has more millionaires than any other county BTW” – the county has 10 million people! It better have more millionaires than any other county! It’s larger than all but a few states! Does it have more millionaires per capita than any of the four counties I mentioned (separate or combined)?

And more importantly, does LA county have more people earning over $100,000 per capita than the four counties I mentioned? That’s your key to housing prices – most multimillionaires are going to only buy two, maybe three houses. If we have five people earning $150,000 for every person earning $2 million down there, prices will be higher here for the AVERAGE house.

Agreed, there are many wealthy cities in the Bay Area. My reason for writing an alternative view is not to dispute your facts, but rather to question what I call “Bay Area Exceptionalism”. This is the belief that it is “better” and “different here”, and that therefore real estate will never go down. Cities, like neighborhoods, go up and go down. Selecting certain areas as justification for “it’s different here”, could be done with the Westside of L.A., Southern Orange County, north shore Chicago, etc. Populations change, and wealth moves. As good as things have been here, I am thinking not about the next five years, but the next 25 years, and as a real estate investor myself, I have begun to question all of the long held beliefs about the future of the Bay Area. I hope that I am wrong, but in the meantime, most of my money is out of real estate and in foreign currencies. I was recently in Singapore and let me assure you, it IS different there.

Agreed about Singapore – was there last November – I’d love to live there.

I agree with your assertions as well – I’ve just seen too many people on here taking the opposite extreme – that somehow there is NO wealth here because there is more other places. Well, duh. We’re just not that big for a metro area compared to LA or New York. I get sick of people throwing around the “there are more millionaires in LA county” – when it is the biggest county in the US! Wouldn’t it be weirder if there WEREN’T more millionaires there?

I do think that the wealth is a little bit more spread out here – that’s just what I see as the reason for higher prices. You can primarily thank Silicon Valley and stock options for that – the only other cities that seems to have a similar number of upper income (instead of a fewer amount of ridiculously upper income people) are NYC and Seattle. Ten people who can afford a house up to $1 million gives more pressure on the OVERALL market than two people who can afford a $5 million house.