Forget that rogue sea lion, it’s the shark that captures all of our attention today. PropertyShark added free foreclosure listings for San Francisco to its site this afternoon (fourteen currently listed).

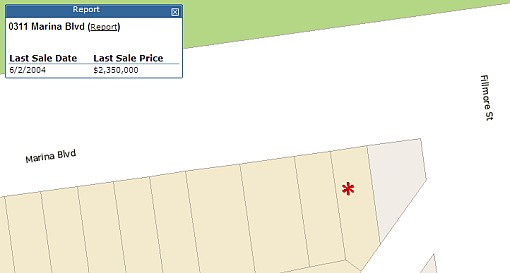

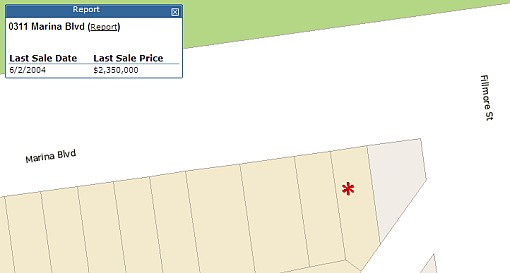

For example, according to PropertyShark, 311 Marina Blvd last changed hands on 6/2/2004 for $2,350,000 and the property was refinanced on 6/14/2005 using two variable rate loans (one for $1,950,000 and another for $530,000). The property is currently in foreclosure (with an estimated unpaid balance of $327,573.97) and will be auctioned off on 11/27/2006 at City Hall.

At the other end of the spectrum is 3018 Casto Street which was purchased on 11/09/2005 with a $569,000 variable rate mortgage. A year later, the current unpaid balance on the loan is now $609,014.48 and the property is scheduled to be auctioned off on 12/04/2006 (once again, at City Hall).

If you’re not familiar with PropertyShark you’ll probably be a bit shocked by the depth and breadth of information that’s available for the vast majority of residential and commercial properties in San Francisco (not just foreclosures). Also added to the PropertyShark site today, a number of San Francisco property maps including land use and property outlines.

∙ Rogue sea lion in S.F. menaces swimmers [SFGate]

∙ Circling The Waters [SocketSite]

∙ PropertyShark: San Francisco Foreclosures [propertyshark.com]

∙ PropertyShark: San Francisco Maps [propertyshark.com]

It will be interesting to see what that property sells for (marina) at auction.

propertyshark is awesome! I especially like the building permit information.

Wow. You really weren’t kidding about the “depth and breadth” – sales history, owner info, and even mortgage info? That’s pretty amazing (and perhaps a bit frightening).

The best part of Property Shark is the maps; they are incredible!

You guys, do you really not know why The Marina place is in foreclosure? Hellllllo. If they can sell it for $2.4 mil, or just 400K, wouldn’t they just do it since they only owe 330K? Jesus.. i can’t believe how slow some people are. The seller is going to make BANK!

Talk about a little knowledge being a dangerous thing!! It is a junior lien that is foreclosing on the Marina BL prop. Anyone buying at the Trustee sale is buying subject to all senior liens. The property is most likely over encumbered.

Neg Am loan less than 2 years old. The shape of things to come. At all price points: even 2.4M.

Oh, now I understand these bizarre comments. They are from a guy known as “Prime Property” for his endless unsupported postings on how the Marina is Prime. He attempts to distort the facts to show that property in the Marina does nothing but go up. In this case, he is talking about the median going up due to almost no sales in the district, while comparables are dropping like a rock.

Thus, he pretends that a home in foreclosure must be some sort of scam: that no one could owe more than the price of a home, etc. Ignore him.

The fact is that prices for the same place are down about 20% in the Marina, and the person who bought in the last few years won’t be able to sell for their loan balance, even if it wasn’t a neg am loan.

Was it just me, or did anyone else smile at the “rouge sea lion” reference. It’s a cute little typo Socketman.

[Editor’s Note: Damn it, sometimes the fingers are faster than the brain…]

In case it gets lost in the noise, this really was an amazing find, and this just reinforces my belief that Socketsite is the best real estate related site out there.

yeah but they police the forum nazi style. why not let the topics flow as they wish, to some extent. this comment will probably get pulled too.

[Editor’s Note: If you want a free-for-all, head on over to the craigslist housing forum. Otherwise…simply add value, stay on topic, and avoid the personal attacks to ensure that your comments will stand the test of time.]

It’s funny how people think the Marina is down 20%. If you guys would just look at the listings, they are actually about about 5-8% in 2006, after being up more than 15% in 2005. The examples are all over the place.

Jesus, this place was finally listed as a short sale yesterday. Talk about the slow pace of foreclosures.

Someone bought it for almost 3.7 in June and now has it listed as a short sale for 1.8, about 25% under its 2004 price. Is it possible that a lender bought it and has it listed as a short sale?

tipster,

According to inclinejj on this thread the scheduled auction was canceled. I’m guessing the lender wants to try the short sale route to avoid a foreclosure fire sale and associated headaches. I documented the current owner here. He is the defendant in a lawsuit on the property next door to the Odeon (165 O’Farrell) which alleges $8.5 million has not been accounted for.