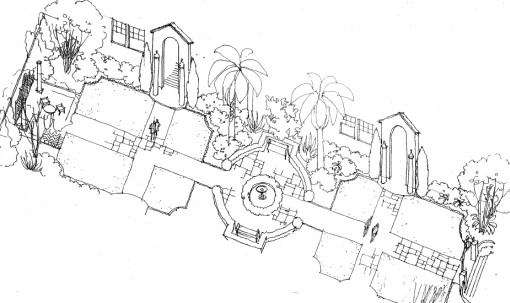

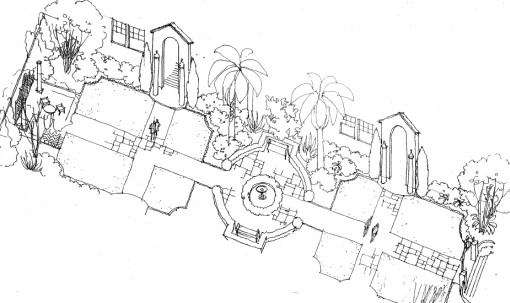

Say goodbye to the Galileo Court apartment complex at 1229 Francisco. And say hello to the Francisco Palms, a down to the studs renovation, and an ambitious seventeen unit TIC development by Maven Investments. That’s right, our own little “Melrose Place” down in the Marina, complete with four palm trees and a fountain (but no swimming pool).

According to the developer, the first four units (2 two bedrooms and 2 three bedrooms) will hit the market after Labor Day (9/10/06) and are currently slated to be priced from $950,000 to $1,050,000 (~$750/sqft). The Bank of Marin will be offering individual financing (6.95% fixed for 5 years, interest only with a ten year term, and 1 point up front) for up to 75% of the purchase price, and the developer will be offering to carry a second mortgage (8% fixed with a five year term) for another 5% (i.e., 20% down payments).

We had a chance to take a sneak peek a couple weeks back and were relatively impressed by the quality and thoroughness of the renovation. (Our major quibble was the decision to configure a few of the three bedroom units with only one bathroom.) The big question, however, is how the market will respond to million dollar TICs that are priced in-line with condos, but will never have the opportunity to convert (residential buildings over six units aren’t eligible).

And while it’s true that the individual financing will mitigate at least one of the major drawbacks associated with TICs (i.e., shared risk of loan default or delinquency), it doesn’t adequately address another: liquidity (more on this later). That being said, one could make the argument that the demand for these units will be a fantastic indicator of how the market is truly valuing the traditional benefits of home ownership (versus a speculative investment in real estate) in San Francisco these days. We’ll keep you posted.

∙ Maven Investments [maveninvestments.com]

∙ The Francisco Palms (coming Soon) [1229 Francisco]

Hi SocketSite-

I’m a little confused. Isnt this how coop apartments are in NYC? They’re not condos and everyone owns a share in a building, just the same way i thought TICs were handled. If I’m totally off base, whats the difference between TIC and coop?

confused reader – yes (in terms of “shares”) and no (in terms of being the same).

A co-op building is owned by a corporation which is responsible for paying the operating expenses on the building (including the underlying mortgage and taxes). When you purchase a unit within a co-op you are actually purchasing shares in the corporation which entitle you to a “proprietary lease” in the building. Shareholders pay a monthly maintenance fee to cover the building expenses (again, including the underlying mortgage payments), and obtain individual loans (akin to a traditional mortgage) to finance the purchase of their shares.

In contrast, a TIC is owned by a group of individuals, each member of which holds an individual interest (or percentage share) in the undivided property. A TIC agreement defines their exclusive right to use and occupy specific areas of the property and the group typically shares a single common mortgage on the property. Individual (or fractional) loan programs do allow owners to obtain separate mortgages, but as far as we know, all borrowers are locked-in to the same lender (and rates) for the entire term of the loan (after which all owners will either have to payoff their remaining loan balances or collectively refinance).

We are at the beginning of the fractional loan market. It’s only a matter of time before more and more lenders start making these loans. TAt that point, the problem of everyone being locked into the same lender will have been eliminated. At that point, there won’t be any significant difference between a TIC and a condo.

IMHO, if you can buy a TIC with a fractionalized loan, do it! You will profit from the spread between TICs and condos being narrowed if not eliminated.

How did they empty the building to create the TICs? Did they buy out tenants?

To the best of our knowledge, some left voluntarily, some were “bought out,” and some are still negotiating.

Consult your real estate attorney on this issue. There are other differences such as rights of surviorship. TIC ownership may present problems in the event of a owner default, which could occur in a down market, yet fractionalized loans partially mitagate this risk. It would be imporant to understand the financial strength of your fellow owners, but this is not always possible. It’s a complicated form of ownership and why TIC units are significantly discounted over condos.

I disagree with the last post (although I realize that you’re trying to have an intelligent discussion about this). In order to obtain authorization to sell TICs from the Dept. of Real Estate, the owner must either close 80 percent of the units simultaneously and pay off the owner’s loan or obtain a partial release from the owner’s lender under which the owner’s lender is essentially subordinating its loan to the fractionalized TIC loans on the units sold.

As for risks in a down market, I think that fractionalized loans completely eliminate risk from other TIC owners defaulting (although, as with condos, a substantial number of defaulting owners would be a bad thing overall for many reasons).

I have handicapped the discount from condominium (3D paint to paint ownership w/ undivided interest in the fee) to TIC (agreement to possession and % undivided interest in fee) title as

2 units ~5%

2-6 units ~10%

>6 units ~25%

Who has responsibility for curing loan default(s) in a fractional (TIC) loan? Other borrowers or the lender? Assume bank has first right to foreclose on the % undivided interest. Does this cloud title for the others? Worse than HOA litigation? Does bank have defacto control over sale by allowing new owners on title?

Am interested in how the market prices out this property. Marina condos are ~$900PSF ? This indicates ~16%

Apologies on all the questions, Socket. The Pinot Noir is doing its job. You are doing a great job and one of my blogging heroes (or heroines as the case may be).

RE is the last bastion of insider trading and you are doing a great job of shining light into the residential marketplace.

Keep it up.

I, for one, would not consider buying into a TIC at this price point. There are too many convoluted issues with TICs to justify a purchase in this price range. It is much simpler to buy a unit recognized as a Condo – terms of loan are better, easier to acquire, refinance, and resell a Condo v TIC. But, to each their own.

Teddy,

We’re still trying to answer some of these questions ourselves. And although we have talked with a couple of the banks that are offering fractional loans, not even their loan officers seem to have all the answers.

That being said, it is the lender that has responsibility for curing loan defaults, and no other owners should be affected by the default or foreclosure (i.e., it shouldn’t cloud the title). As far as the bank having any de facto control, we really don’t know (but are looking into it).

Keep drinking the Pinot. And if it’s good, feel free to send some our way…

Pardon this potentially dumb question, but why aren’t there more co-op style arrangements like there are in New York? I’m guessing it has to do with laws regarding converting rentals to properties, but any info that would shed light would be interesting.

I’ve seen some great TIC’s but some of the arrangements one has to make and some of the stories I’ve heard from people who’ve had both good and bad experiences make me shy away a little from the concept.

The reason there aren’t more coops is that they are strictly regulated, like condos. You can’t create any more than 200 condos a year in SF, and coops are treated like condos for that purpose. SF, in its infinite wisdom, has so decreed.

Just a little insight on how the tenants were handled.

Maven has had several lawsuits filed against them in the past for how they have handled tenants.

In this case, the courtyard torn up and left in disrepair for 7 months after the old grass and shrubbery was removed.

Tenants storage and garage were taken away from them under the pretense of garage construction. Tenants were then told the building would be Ellis Acted and they were told they would have to move out eventually.

And then finally, they were offered money to move out. For those that didn’t take the money right away, they were informed that if they did stay, their rent would be increased as much as 10-15% due to building improvement costs.

There are still several tenants that have not negotiated to move out.

From the San Francisco Business Times circa Feb. 8, 2008:

Across the city, a growing number of developers are taking on large — and increasingly upscale — TIC projects. In the Marina District, Maven Investments just went into contract on the last of 17 units at its Francisco Palms TIC conversion project.

For Lipton, whose Francisco Palms development is the largest TIC conversion pulled off in the city to date, the gamble has paid off. Lipton paid $7 million for 1229-1261 Francisco St., two buildings separated by a Mediterranean style garden. Maven spent about $3 million buying out tenants and renovating the units and the outdoor common areas, which include a brick patio and a 1920s fountain. With one unit left to go, total sell-out will likely end up just shy of $15 million.

And now, possibly, the first resale in the development at http://www.1257franciscostreet.com .

Looks like another “Forever TIC” has hit the market, this time a 2bed/1.5bath unit. See http://www.1253FranciscoStreet.com

These two items caught my eye from the website:

Several attractive fractional financing options with Bank of Marin available. One of the few areas in the Marina that is not in liquefaction zone.