An evenly balanced follow-up from the Chronicle with regard to the their coverage of the most recent DataQuick report:

This spring, Bay Area homeowners are likely to know whether the housing market has merely paused before resuming its upward climb or has truly downshifted to the slow lane and, if so, how dramatically.

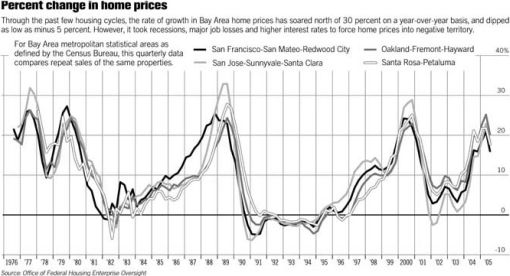

Last month, the number of homes sold declined for the 10th month in a row and hit its lowest level since 2001, and price gains slowed markedly as well.

Now, the question is, will the market simply cool or will it dive into negative territory?

Each housing cycle in the past has had its own set of twists and turns in which a multitude of factors comes in to play.

As the current housing frenzy exhausts itself, variables ranging from interest rates and employment growth to affordability, new home supply and sellers’ willingness to part with their No. 1 asset will help determine the swiftness and magnitude of any downshift.

“Making this cycle more unique … is that there’s been a big increase in homeownership since the early 1990s,” said Celia Chen, director of housing economics at Moody’s Economy.com. “We’ve brought a lot more people into the market, and it’s uncertain how these people will react in a down cycle.”

Here’s where we definitely agree with Sir Issac: “I can calculate the motions of heavenly bodies, but not the madness of people.” (Sir Issac Newton having lost his shirt in the South Sea bubble, 1721)

∙ HOUSING — JUST COOL OR GOING COLD? [SFGate]

∙ Rates Cheap. Houses Not Cheap. [SocketSite]

∙ Real Estate Vs. Real Behavior [SocketSite]