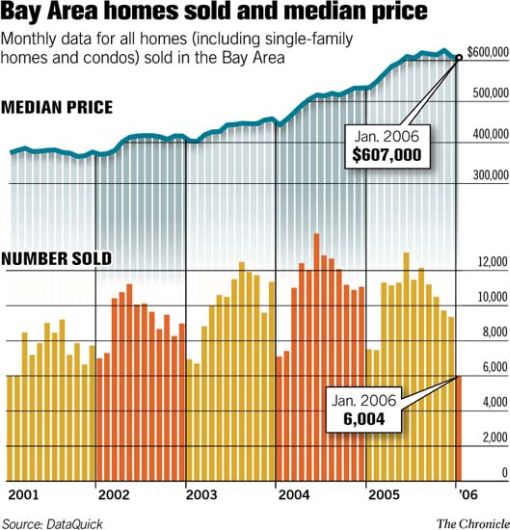

According to the most recent DataQuick report, Bay Area home sales plunged last month while prices held steady. From the Chronicle:

Bay Area home sales tumbled to their lowest level in five years last month, and prices hovered well below record territory, further evidence that the region’s seemingly unstoppable housing boom may have peaked with the blistering market of 2005.

What remains to be seen is whether the new figures amount to a hiccup or the beginning of prolonged slowdown.

Rising interest rates, and tighter lender standards, seem to be taking a lot of the blame. A quote from the director of the Center for the Continuing Study of the California Economy in Palo Alto: “People chose to bet on future appreciation by choosing loans where they knew payments would go up by a lot — but they got in cheap…There are no cheap loans now.”

The scariest thing? Current mortgage rates are still well below historical averages (second to last graph).

∙ Home sales falter, hinting at slowdown [SFGate]

∙ Interest Rate Trends [Mortgage-X]