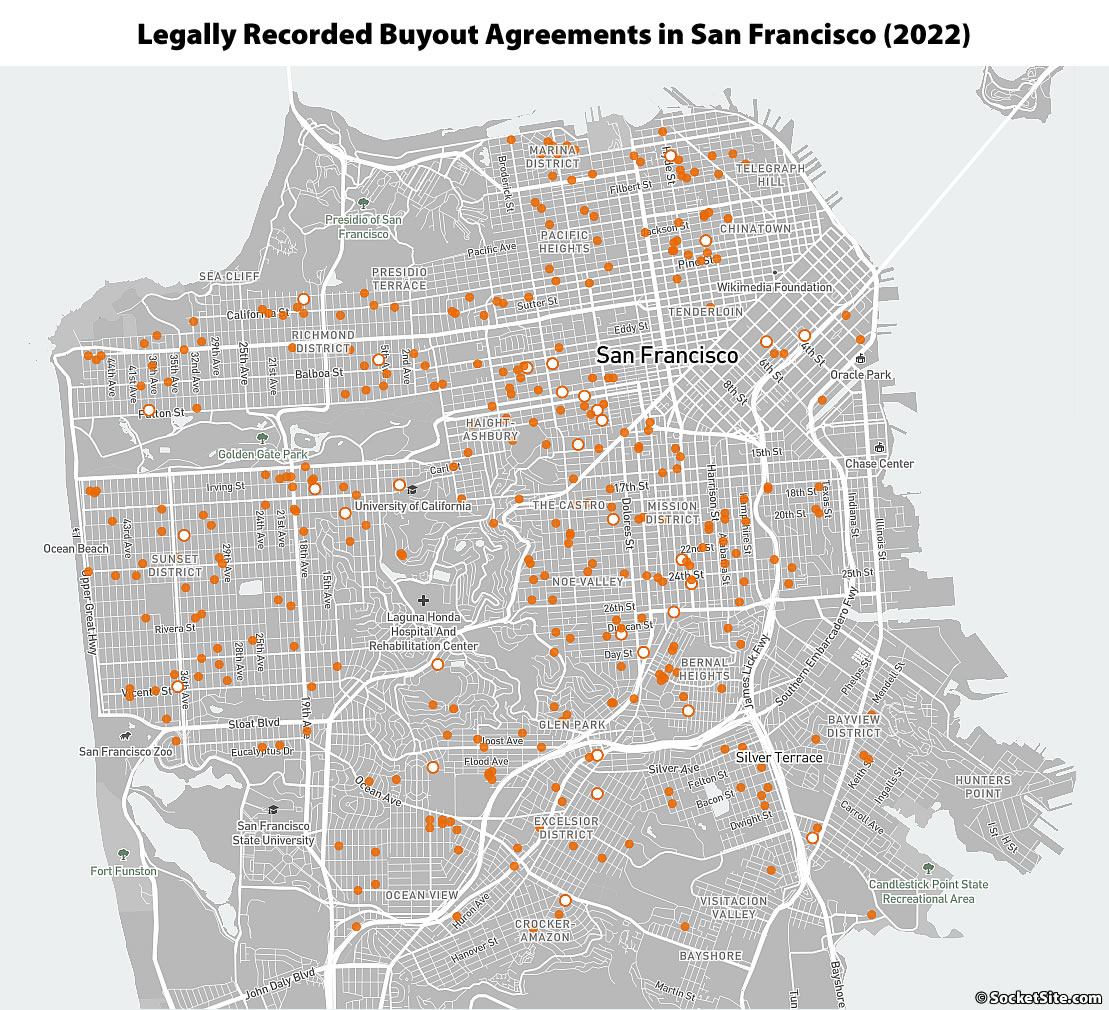

Landlords in San Francisco inked 389 legally recorded tenant buyout agreements last year, as mapped above, effectively equal to the 391 agreements inked in 2021 but with 618 “pre-buyout negotiation” forms having been newly disclosed as well.

The highest reported buyout agreement totaled $460,000 last year, according to our queries of the City’s database, a total which was split between two holdout tenants in a six-unit building in Pacific Heights, with the largest payout per tenant totaling $300,000 for one of two units in a Pacific Heights duplex that was acquired with the tenant in early 2021.

The average reported buyout agreement in San Francisco totaled $53,828 last year, according to our queries, with an average payout of $35,720 per tenant, which was up from an average agreement of $46,676 and $29,270 per tenant in 2021, which was up from an average agreement of $44,714 and $29,216 per tenant in 2020.

And for the fifth year in a row, the Mission was the San Francisco neighborhood with the most inked buyout agreements (49), followed by the Sunset (42) for the second year in a row and now trailed by Ingleside (33), Haight-Ashbury (29), the Inner Richmond (26), Eureka Valley (25) and Parkside (22).

We’ll keep you posted and plugged-in.

I was offered $60,000

In 2010 when average was $100,000 for whole house not per tenant,a woman next to me took $90,000 in 2007

I did not take the buyout

As after you pay about 35% tax you would have little left,,I worked in public housing and the non profits were offing people $5,000 to move out of the city, i told a few of them that would barely pay the moving cost it probably was illegal as well as they have to house them as they took over the city housing

$100,000 is a cheap price as you get an extra $500,000 when you sell

35%? I’m in a buyout right now and not paying 35% of the settlement. It’s regular taxable income at 15%. Why did you pay so much?

Yes, hypercapitalism broke our society. No other outcome possible really when the goal is for every aspect of life to be monetized or a short term gain investment. Now 20% of urban adults are unavailable for the workforce due to opiate use disorder, and we have the highest homeless and incarceration rates worldwide.

You’re right.

“Hypercapitalism” also made our society. This system provides us with an extraordinary standard of living. Alternatives either involve state inefficiency and corruption (along with a lack of personal freedom), or these countries cannot exist without us (because they rely on us militarily and economically).

And, if one finds it so distasteful here it is easy to leave or donate one’s ill gotten capitalistic gains to the less fortunate in other countries.

“Hypercapitalism” also made our society. due to under pricing of labor and resources in relative dollar terms. A de-dollarization gains pace expect once in a generation correction.

We have one of the world’s most competitive and efficient economies. This makes labor and resources more correctly priced than elsewhere. However, government intervention (and unions) skew this in favor of workers.

People (labor) from all over the would come here to take part in our economic miracle and enjoy unparalleled opportunity. Most Americans would fail to succeed, if we emigrated elsewhere. This is why we stay, but like to complain.

If we really do have the world’s most competitive and efficient economies as you say, why does it keep needing stimulus by way of debt funding?

People (labor) from all over the would come here to take part in our economic miracle and enjoy unparalleled opportunity. A small percentage – and especially those who do not have the burden of high cost of college education such that they are in a better bargaining position against those who do. US needs immigrants (and off-shored production) to tamp down inflation in labor costs. And US can afford to mis-price labor and goods to its benefit for as long it holds the dollar supremacy.

To answer the below questions: our country does not need that much debt service stimulus. This is simply done by irresponsible politicians who buy votes today by borrowing funds from future generations.

2.76 million illegal immigrants entered the U.S. during just 2022. It is a falsehood to refer to that as a “small percentage”. Furthermore, multiples of that amount would arrive if offered safe and free passage. They come here for a reason, which is the same one why we stay (there is no better place).

Admittedly, labor costs are lower because of immigrants, but everyone benefits. Dollar supremacy exists for a number of reasons. These include our relatively open, free and competitive economy.

Unless one wants to live in a corrupt dictatorship (such as China or Russia etc), or another country that only enjoys freedom and comfort only because of us (everyone else), hating one’s own country is to dislike and feel badly about oneself. And, there is an easy way to fix that problem—if one has the fortitude and personal honor to act on it (instead of just complaining).

Global population is minus ~500M of US+Canada = ~ 7B

“If we really do have the world’s most competitive and efficient economies as you say, why does it keep needing stimulus by way of debt funding?”

But did we really need all that debt funding? And if it was a giant mistake to provide all that debt fueled stimulus, was that a mistake made by the free market or by the government? Did all that stimulus encourage useful economic activity or just economic busywork?

Look at Elon reducing Twitter headcount by 80% and yet the site still hums along. COVID forced a muti year experiment of forced Work From Home and our tech economy and infrastructure kept humming along. Probably 80% of workers don’t really need to be in person in the Bay Area. Probably 80% of immigration does not substantially benefit the US economy. But in all three of the above situations the remaining 20% of those groups are critically important.

The market economy tends to be better (but not perfect) at separating out the 20% from the 80% in the above situations. But what about the 80%? It’s a big country and a big world. What really matters for lifestyle is if someone can produce more than they consume. On average people need to settle somewhere that their skills allow them to build a life and/or up skill to live a more expensive lifestyle.

Sure, on a small basis you can subsidize unproductive activities. But this doesn’t scale. Can you house everyone in the world who wants to live in SF regardless of their skills & abilities? Can you prop up all unproductive businesses with unlimited amounts of cash and/or cheap credit?

@wilson – US is a science & technology based capitalism, this is the basic premise. For science and technological development to progress at a certain rate enough to maintain global economic and offense capable military dominance, it requires a relatively large amount of consumption across various sectors. But real-productivity cannot fund this level of consumption – hence debt funding is used to prop up consumption to continue this development. In the process those closest to government generated capital also benefit handsomely to the disadvantage of many.

As to why global dominance and as to why allow wealth concentration in a few hands – that is an interesting question.

Many people play the game of time arbitrage – that is borrow at the possibly earliest phases of government generated capital and cash out at later phases when price of money falls in relation to demand for kind. In San Francisco (and perhaps most of the western world) this kind is RE. In my opinion, this is actually a dangerous thing at a system level as it makes housing expensive and can (has) set off a ever growing debt spiral. There is other interesting questions within – why RE? why RE in SF? why not production activity?

Debt makes production expensive. The market “knows” arbitraging between two points in a QE cycle is a safer bet than any other search for yield option. Greenspan knew exactly what he was doing in 2001. If he claimed otherwise – I wonder if he fell asleep in Milton Freidmans class!!

Anyone have any idea when should we expect that once in a generation correction due to de-dollarization to arrive? Or even begin?

It’s worth noting her that if you’d taken cave_dweller seriously when he began going on about de-dollarization here a few months back, interpreted that as his bearishness on the U.S. dollar vs…say…the Chinese Yuan, and taken the other side by betting on the U.S. dollar vs that currency, as of today you’d be up by almost 3.5 percent.

To be fair, he didn’t say that he was long the Chinese Yuan as a way to substantiate his implicit investment thesis (he said “…days of 3rd world eating the U$D may be close to over if not over”). The notional BRICS currency that was and is being discussed to weaken the greenback’s status as a global reserve currency hasn’t happened yet, AFAIK, but if it were available betting against that would be a better way to execute the counter-cave_dweller thesis. That is why I am asking about a time frame.

I don’t remember exactly what I said and I am not one to be bothered with searching my posting history – but “days of 3rd world eating the U$D may be close to over if not over” .. should really be “day of 3rd world eating the inflation as a result of accepting U$D IOUs in exchange for goods and services may fast be approaching to a close if not already over

Raising the debt ceiling also negatively affected the current USD holders and hasn’t been received well around the globe.

And (this is not a joke) – US should really consider annexing Canada & Greenland.

And share some of the wealth to stabilize the south of border region from Mexico to Panama – effectively making the region a protectorate of US.

Sooner the better.

A counter trade – go long on U$D and short on commodities/resources. I am real curious which magic hat these payments will be pulled out from in terms of real productivity and without offensive military engagements.

The Congressional Budget Office (CBO) projects that interest payments will total $663 billion in fiscal year 2023 and rise rapidly throughout the next decade — climbing from $745 billion in 2024 to $1.4 trillion in 2033. In total, net interest payments will total nearly $10.6 trillion over the next decade.

And finally, there it is:

Treasury Secretary Says to Expect a Slow Decline in US Dollar as Reserve Currency

The Annual Testimony of the Secretary of the Treasury on the State of the International Financial System

Here it is, latest (as of early today) from the Treasury Secretary Ms Yellen herself, responding to questions about threats to dollar supremacy: “It is true that when we impose sanctions, countries that are afraid they can be the subject of those sanctions are motivated to look for other tools other than the dollar to engage in transactions.”

She continued over time, we should expect countries to diversify and hold more assets other than the dollar.

Thanks for the pointer. I don’t see any way we can, as a democracy and a country that cares about freedom around the world, avoid using sanctions against aggressors like Russia when they invade neighboring countries just to keep the U.S. Dollar as the world’s reserve currency. So you’re right, in the long term we’re going to have to adjust to a world where other countries don’t have to use U.S. Dollars.

It would be nice if other countries gave up imperialism so we didn’t have to do this, but it seems to go hand-in-hand when countries are ruled by authoritarian single-party dictatorships.

I don’t see any way we can, as a democracy and a country that cares about freedom around the world, avoid using sanctions against aggressors like Russia when they invade neighboring countries just to keep the U.S. Dollar as the world’s reserve currency.

A number of people believe this – but a critical analysis would establish – this is historically, factually and contemporarily false. Please understand “reserve currency” is a potent weapon which serves to establish domineering will (both economically and militarily) of the nation that possess it.

If as you say US is a democracy that truly cares in platitudinous terms above – it would not have inherited the imperialistic impulse from its erstwhile colonizer. Also, I might suggest a thorough analysis of historical events and America’s role in them – between Russian Revolution of 1917, Dissolution of USSR in 1991, Vladimir Putin’s milestone Munich speech in 2007, Color Revolutions in Africa/Asia/Eurasia through 2000s, NATO invasions of Yugoslavia, Iraq, Afghanistan, Syria & Libya, Maidan Revolution in 2014 and the regional war that has been going on since and which has graduated to a European War in ’22.

There is a distinct relationship between events after fall of USSR and rise of valuations in non-productive assets since mid-90s in the West – which also translated to handsome gains for SF RE. As the world reverts to multi-polarity the monetary forces that propped up valuations will also retrench. You are free to completely ignore this comment or study it. Studying it could make you a better student of history and/or perhaps present several profitable investment opportunities.

At a minimum try to analyze your thinking biases which had you insisting de-dollarization is unlikely.

“between Russian Revolution of 1917, Dissolution of USSR in 1991, Vladimir Putin’s milestone Munich speech in 2007, Color Revolutions in Africa/Asia/Eurasia through 2000s, NATO invasions of Yugoslavia, Iraq, Afghanistan, Syria & Libya, Maidan Revolution in 2014 and the regional war that has been going on since and which has graduated to a European War in ’22.”

Get out of here. You slid so many unrelated topics into one blather it’s laughable. But the Maidan revolution, to stay on topic? no. Yankovych betrayed the will of his people. That’s why the Maidan Revolution took place.

Well, just to be clear, I don’t think that “de-dollarization is unlikely”. I think that in the long term, the dominance of the U.S. dollar in international trade will certainly decline significantly from the point it’s at now. I think our (that us, the U.S. Gov’t) response to the current War in Ukraine just accelerated what was likely to happen at some point anyway given the number of authoritarian governments around the world.

I will, however, insist that de-dollarization will not be the impactful sea change that you’re making it out to be in the near term. And I don’t think at any time in the near future (let’s say the next decade) you or I will be able to make a significant return by betting against the U.S. dollar vs any BRICS currency, any amalgamation of BRICS currencies, or the Russian Ruble (barring that country getting a new ruler or another revolution).

That’s not to say that foreign countries won’t reduce their holdings of U.S. Treasury Securities. They probably will, even in the near term.

As a recently evicted tenant due to an Owner Move In Eviction (OMI), I can tell you that not everyone is eligible for these large payouts.

We got the City Rent Board dictated 7K and change per person to leave our home of over a decade. This didn’t even cover the moving costs. We weren’t a member of a protected class (Over 60, Disabled, School Age Children). For many, this kind of eviction means having to leave the Bay Area permanently.

While I realize this is all about the money, I know there are many landlords who use the OMI to re-rent a unit at full market after 3 years or less.

It may have been your home for a time, but it was someone else’s property; probably their life savings went into buying it. It’s simply unreasonable to expect that by renting some home, you gain the right to live there for the rest of your life. If you want that kind of guarantee, you need to buy.

If you dont like the tenant laws in SF, then dont buy here. period.

To say its “simply unreasonable” is ignoring the actual laws on the books and why some of those laws, including tenant buy-outs are there.

I can turn your last sentence back to you, if you want the type of guarantee you can move into the house whenever you want, then dont rent in SF.

Interesting response. If there are no buyers for rental properties, who will renters rent from?

As a small landlord in SF, I recently came up against the landlord’s side of the eviction issue. I had a tenant who refused access to his unit — access I needed to make structural repairs to the building that were actually ordered by the building department.

After issuing the usual sequence of warnings, etc… — all drafted by a known landlord-tenant lawyer in SF — and getting no cooperation from the tenant, I finally asked the lawyer if we had a case to evict the tenant. The lawyer said we had a ‘slam-dunk’ case but that it would go to jury trial. Then I asked how much such trials cost and the answer was around 100K. The tenant was violating his lease and just laughing at me. Eventually he asked for a substantial amount of money to ‘settle’.

The 50K ‘buy-out’ price quoted here appears to be anchored by the real legal cost to process an eviction, regardless of the merits of the case.

As for your own experierience, ‘Marin Dweller’, I am guessing that you didn’t want an eviction case on your tenant record and a landlord who would decline to offer you a glowing reference — something that these ‘buy-out’ tenants might have to face (at least, future landlords would learn of the amount required to buy them out).